PharmaSources/CaicaiMarch 16, 2022

Tag: BTK Inhibitor , Ibrutinib , hematologic tumors

In today's new drug world, BTK inhibitor stands out as a member of chemical drugs in a context where biologics yield unusually brilliant results. In the TOP 100 of global drug sales volume in 2020, Ibrutinib of AbbVie/Johnson & Johnson ranks fourth with the sales volume of USD 9.442 billion. In 2021, it is expected to be listed in TOP 5 with the global sales volume of USD 9.683 billion.

With such factors as large indications, huge market potential and relatively small market competition, BTK inhibitors have certainly become the favorite of pharmaceutical titans.

At the moment, there are 5 BTK inhibitors approved for marketing worldwide.

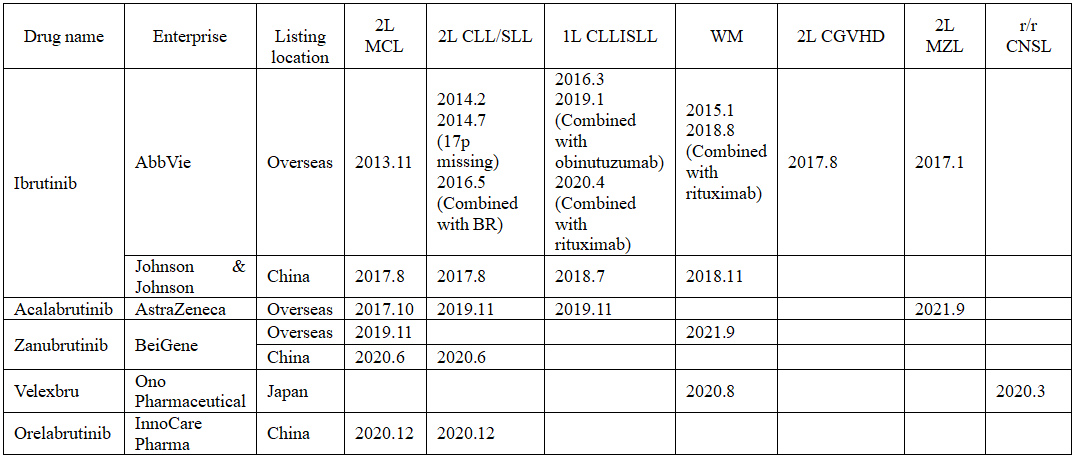

Ibrutinib was the first BTK inhibitor approved, which has been approved for the treatment of blood diseases and autoimmune related diseases, such as stem cell transplantation, immune resistance after transplantation and arthritis. Later, Acalabrutinib from AstraZeneca, Zanubrutinib from BeiGene, Velexbru from Ono Pharmaceutical and Orelabrutinib from InnoCare Pharma have been approved for marketing successively, mainly in hematologic tumors and autoimmune diseases.

BTK inhibitors approved worldwide

(Source: Research Department of CITIC Securities)

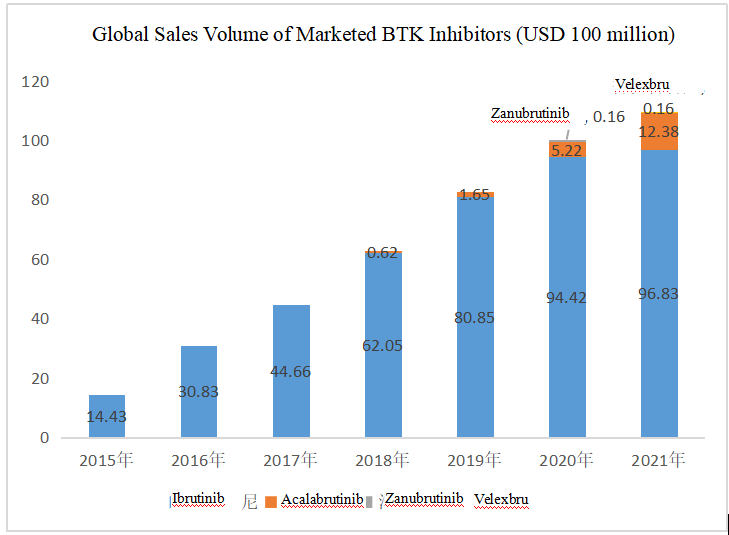

The sales volume of BTK inhibitors has been growing since their launch.

The sales volume of Ibrutinib rose from USD 1.443 billion in 2015 to USD 9.683 billion in 2021, with a CAGR of approximately 46%. Acalabrutinib and Zanubrutinib have also achieved doubled sales volume growth since their launch, with the sales volume of the latter reaching USD 160 million in 2020 and USD 450 million in the first three quarters of 2021.

The total global sales volume of BTK inhibitors was more than USD 10 billion in 2020, and in 2021, the figure is estimated conservatively to be around USD 11 billion.

According to the Frost & Sullivan sub-report, in the future, the global BTK inhibitor market is expected to grow rapidly as the number of people with the disease increases and new indications are approved. The market size is expected to reach USD 20 billion by 2025 at a CAGR of 22.7% and to USD 26.1 billion by 2030 at a CAGR of 5.5%.

(Source: Annual reports of the companies. The sales volume of Velexbru in 2021 is from launch to March 2021)

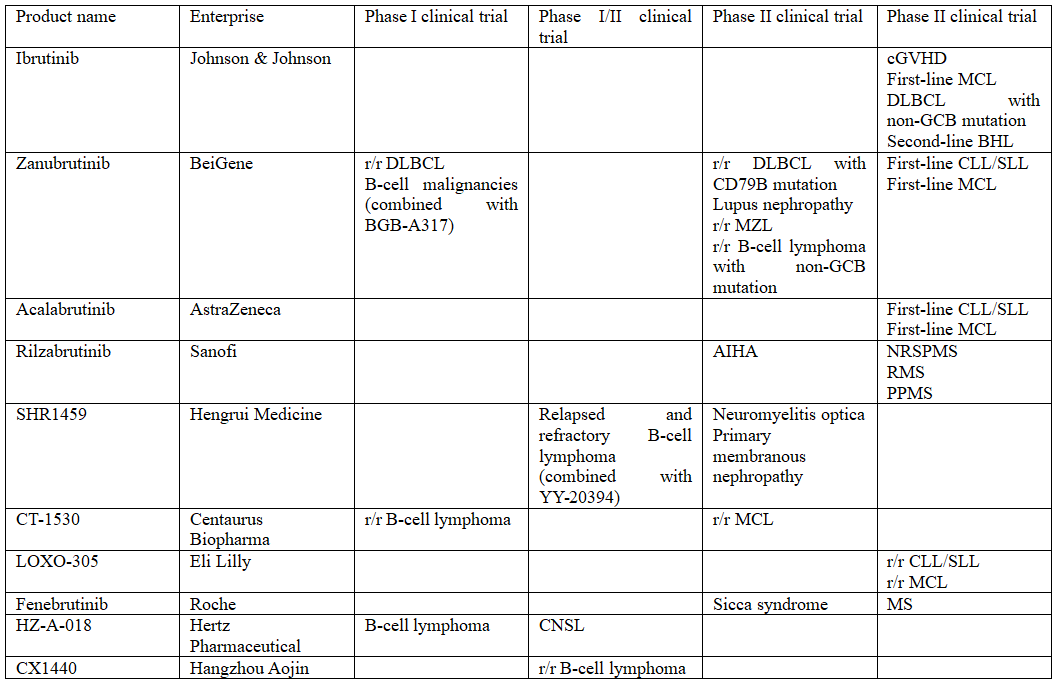

At this moment, several Chinese pharmaceutical companies and healthcare supply companies are also advancing BTK inhibitors.

Three BTK inhibitors currently available in China cover only two indications of hematologic tumors, CLL/SLL and MCL, and most of pharmaceutical companies in the pipeline also focus on hematologic tumors, with B-cell lymphoma being the most prevalent.

Chinese BTK Inhibitors in Phase II or above

(Source: Research Department of CITIC Securities)

Reference: Newcomer in Biotech, High-growth Innovative Pharmaceutical Company in Oncology and Autoimmunity

Caicai, a Master of Pharmacy from Shanghai Jiaotong University, used to work in the Institute of Science and Technical Information. Currently as a practitioner in the drug surveillance system, she is good at interpreting industry regulations, pharmaceutical research developments, etc.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025