David Orchard-WebbMay 12, 2022

Tag: Oncology , biosimilars , Approval

Biologics and biosimilars are large and generally complex therapeutics produced from living organisms. A biosimilar is comparable to a biologic reference medical product already endorsed by the Food and Drug Administration (FDA) or equivalent regulatory agency. The main comparisons include structure, function, purity, and bioactivity. (FDA, 2022) Successful companies submit studies that demonstrate safety and effectiveness equivalent to the reference biologic. These studies include pharmacokinetics, possibly pharmacodynamics, immunogenicity assays, and any additional clinical studies needed. Biosimilars have the same quality standards as biologics. They are tracked post-marketing by pharmacovigilance to ensure continued safety.

Biosimilars are biologics, but they typically have a shortened developmental timeframe. They are by definition equivalent to a biologic already on the market. This regulatory pathway is similar to that used for medical device approval. Europe and North America led the way by developing the concept of biosimilars, but the Asia-Pacific (APAC) has taken the production lead.

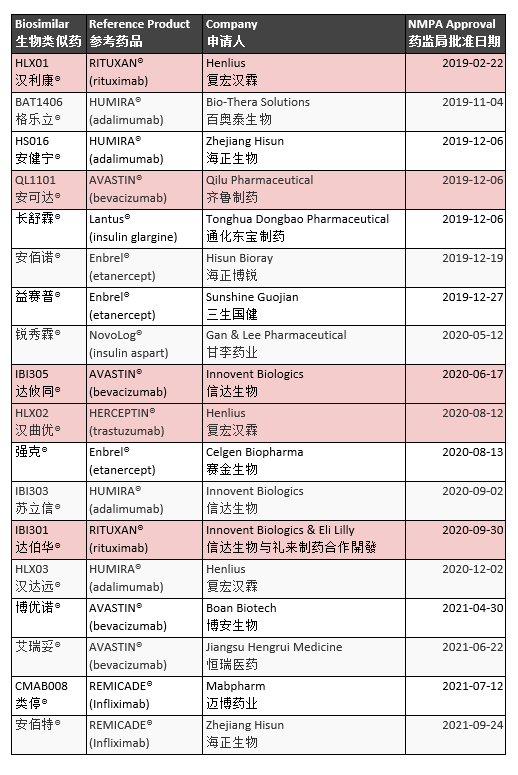

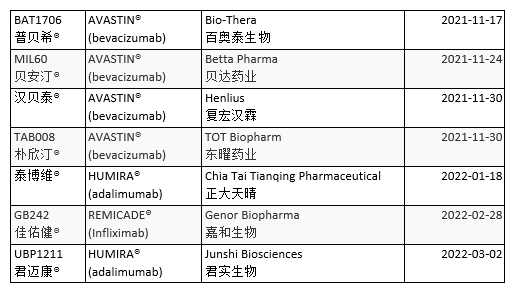

The Chinese National Medical Products Administration (NMPA) released its first guidelines for biosimilars in 2015. China has subsequently rapidly expanded biosimilar production. The EU created the first biosimilar pathway in 2006, while South Korea and Japan implemented their frameworks in 2009.

Oncology is a major application of biosimilars. From $4.19 billion in 2022 to $11.35 billion in 2026, the global market of oncology biosimilars will grow at a CAGR of 28.3%. The Asia-Pacific (APAC) region leads the way with approximately 55% of the biosimilar market, Europe holds 30%, the USA captures 14%, and the rest of the world has around 1%. (Yahoo!, 2022)

The APAC region is cost-sensitive, but generics are a cost-effective alternative to brand-name drugs, so biosimilars are particularly strong here. China and India together have at least a 77% share of the APAC biosimilar market. The breakdown is mainland China; 41%, India; 26%, South Korea; 15%, Taiwan; 8%, Japan; 4%, and Hong Kong; 4%. (Hagen, 2021)

That said, the European biosimilar market is the most mature. Europe produced 84 biosimilars since the first in 2006, more than any other region or trading block. Unfortunately, 15 were withdrawn after approval, leaving a total of 70 biosimilars currently approved in Europe. Of these 70 biosimilars, 30 directly treat cancer (Table 1).

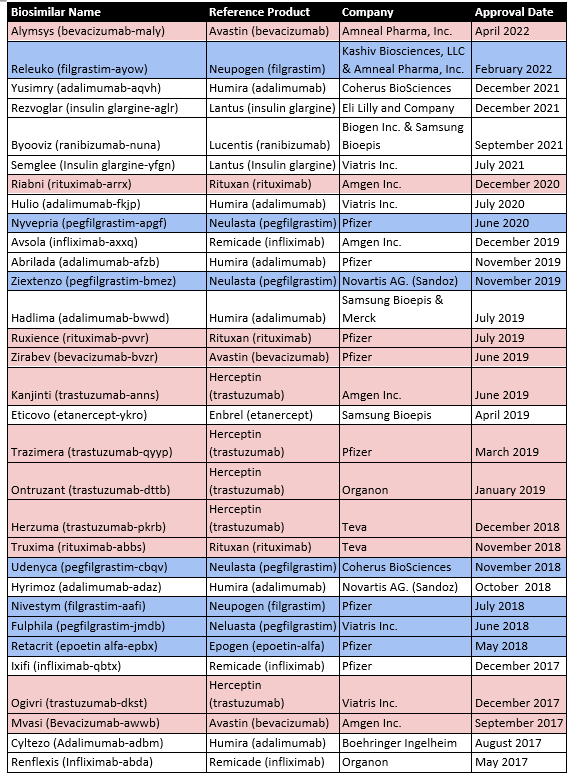

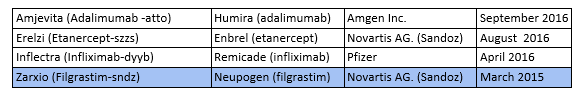

The first product approved via a biosimilar regulatory pathway in the USA was Zarxio (Filgrastim-sndz) in March 2015. The biologic Neupogen (filgrastim), a synthetic G-CSF, was the reference standard. As of May 2022, there are now 35 FDA-approved biosimilars, 19 of which have applications in oncology (Table 2).

In the case of biosimilars, FDA approval does not necessarily allow marketing approval. Biosimilar suppliers must ensure the expiration of all patent claims on the reference branded drug. For this reason, some 30% of approved biosimilars are still awaiting marketing and represent latent sales for the developers who will reap the benefits only after patent expiry.

Until such patents finally expire, biosimilars risk the branded drug supplier will find creative ways to extend the patents or establish new ones. Deals mitigate patent risk. For example, Coherus BioSciences plans to launch Yusimry in the US on or after July 1, 2023, under an agreement with AbbVie, which involves paying sales royalties (Product Profile).

The market share of medicine sold in China is 90% generic. China approved the first official biosimilar in February 2019. Developed by Shanghai Henlius Biopharmaceutical to treat Non-Hodgkin’s Lymphoma (NHL), HLX01 is a rituximab biosimilar. The National Medical Products Administration (NMPA) has approved at least 25 biosimilars. Five directly treat cancer (Table 3).

Neutrophil counts can be low due to chemotherapy. The best-selling biosimilar in the USA and Europe is Filgrastim, a synthetic version of G-CSF used to promote neutrophil expansion. The growth volume has increased by 78% since the first quarter of 2015. A Filgrastim biosimilar has yet to reach the market in China.

Trastuzumab and Bevacizumab are cancer therapy monoclonal antibody biosimilars. They rapidly grew sales by volume by 70% in the USA, Europe, and China, since their launch in 2019 (Biosimilar Trends, 2021).

Rituximab is sold in all three regions and has gained 55% sales growth by volume since its initial launch in 2019.

Once patents have expired, biosimilars have instigated price competition in the oncology drug market. Genentech’s HER2 targeting biologic PERJETA (Pertuzumab) has patents that begin to expire in 2022 and on through to 2026, making this oncology biologic potentially vulnerable to biosimilar development in the near term. In 2021 Genentech’s PERJETA sales were US $4.73 billion. PERJETA sales will erode if biosimilars that reference the biologic become available. (PERJETA, 2022)

Erbitux (cetuximab) patents expired in the US in February 2016 and in Europe in June 2014. Despite this, there are no cetuximab biosimilars on the market. Multiple drug makers, including Amgen, BioXPress, Celltrion, and MabTech-Sorrento, are developing biosimilar candidates to challenge brand-name Erbitux sales. (DiGrande, 2020)

Chinese and Indian markets are full of generics and may not need more biosimilars. What unmet medical needs are not served by generics in these countries? These will require drug innovation.

David Orchard-Webb, Ph.D., is a technical writer with broad interests including health & technology writing, plus extensive training and knowledge of biomedicine and microbiology. My Ph.D. and postdoc were in oncology and developing cancer medicines. I provide technical medical and other writing services for projects ranging from “knowledge automation” to pure pharma, to food safety, to the history of science, and everything in between. I also provide white papers, ebooks, meta-analysis reviews, editing, consulting, business, and market research-related activities in biomedicine, technology, and health. In addition to its well-known role in the development of medicines, I am a big believer in biotechnology’s ability to revolutionize industries such as food-tech, agtech, textiles & fashion.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025