PharmaSources/zhulikou431November 15, 2021

Tag: ADC , PDC , Innovative drugs

With the sustained investment in China's pharmaceutical industry and the growing attraction of China's pharmaceutical market to global innovative drugs, more projects of innovative drugs have added the listing in China as a necessary part. Among these innovative drugs, ADC is favored by innovative pharmaceutical companies and attracting increasing attention from investors because of their combined therapeutic effect. As the first article in this series, the author analyzes the current progress of the R&D of ADC based on the latest industry information collected, hoping to provide help for the industry.

In recent years, ADC has become the priority for enhancing the R&D capability of antitumor drug as well as the R&D hotspot in biomedical field, which are called "intelligent biological missile" and "magic bullet". ADC (antibody drug conjugates) consists of monoclonal antibody (mAb), linker and cytotoxic/payload. It is a powerful anti-cancer drug which combines the cytotoxicity of small molecule drugs and antibody targeting. By combining the monoclonal antibodies with specific antigens on the surface of tumor cells, it can deliver cytotoxic drugs to the complete cytoreduction with the specificity of antigens and antibodies and has the great killing effect targeting the tumor.

PDC (peptide-drug conjugate) is a new conjugate, which has become a fascinating area of drug R&D and medical product suppliers.

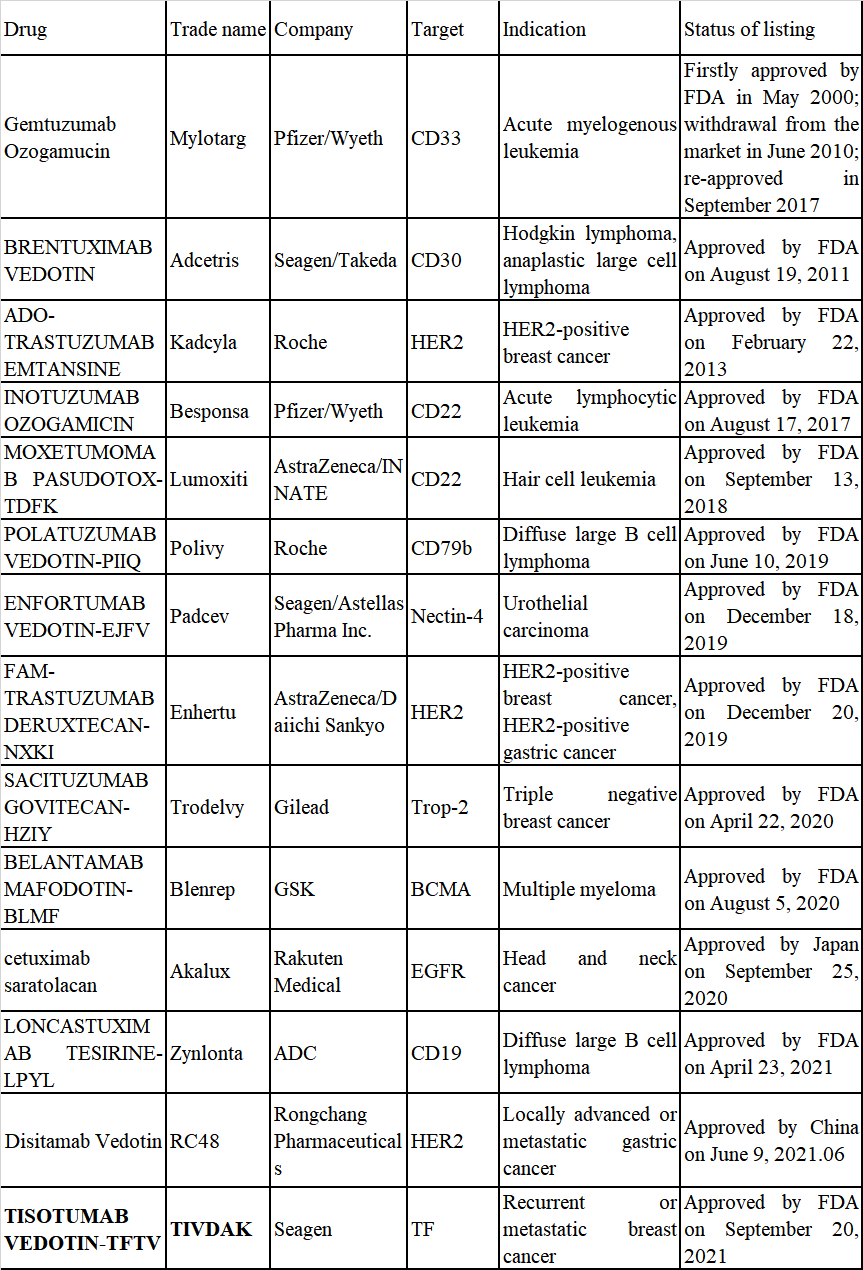

Pfizer's first ADC Mylotarg was launched in 2000. Since then, 14 kinds of ADC have been approved worldwide (see Table 1 for details). The R&D of ADC mainly focuses on solid tumors and hematological malignancy. With the development of antibody screening technology and genetic engineering, the specificity and stability of ADC have increased, and the indications have gradually expanded from tumor treatment to infection, autoimmune and metabolic diseases. Among the ADC on the market at present, the indications of six targets such as CD22, CD30, CD33, CD79b, BCMA and CD19 are hematological malignancy. The indications of HER2, Nectin-4, Trop-2, EGFR and TF are solid tumors. In addition, many other targets of ADCs under development around the world are also progressing rapidly, such as CD74, CD138, CD56, CD70, CD180, GPNMB, PSMA, CA6, Mesothelin, FRα, 5T4, ROR1, cMET, etc.

Table 1 ADCs Approved Worldwide

The R&D technology of ADC drug has been developing since it entered into the market. From the perspective of drug composition and development technology, the ADCs on the market have undergone three generations of technological changes. The first generation of ADC has low antigen specificity, insufficient toxicity load and unstable connector. Among them, Pfizer's Mylotarg is the representative one. The second generation of ADC, represented by Adcetris jointly developed by Seagen/Takeda and Kadcyla from Roche, generally adopted small molecules with stronger toxicity, which overcame the shortcoming of insufficient toxicity load of the first generation. However, the traditional chemical coupling method was still adopted, and the joint stability was not good. It was easy to crack in blood, causing serious toxic and side effects. The third generation of ADC solved the problem of poor uniformity of antibody coupling of the previous generation. The use of site-specific coupling makes the distribution, metabolism and excretion of antibodies easier in human body. The representative drugs include Lumoxiti of AstraZeneca, Polivy of Roche, Blenrep of GSK, etc.

According to the market data, the sales volume of ADC is amounting year by year because of the good therapeutic effect. Among them, Roche's Kadcyla (ado-trastuzumab emtansine) is the best seller of ADC at present, with global sales of 1.745 billion Swiss francs (about 1.946 billion US dollars) in 2020, which is the first kind of ADC entering the top 100 global sales list for the first time.

At present, there are 3 kinds of ADC listed in China. In January 2020, Roche's Kadcyla (ado-trastuzumab emtansine (trade name: Kadcyla)) was approved for listing in China. In May 2020, Adcetris (Brentuximab vedotin (trade name: Adcetris)), a product of Takeda Pharmaceutical, was approved in China. In June 2021, Remegen's Disitamab Vedotin was approved for marketing, which is the third approved ADC antibody drug in China and the first domestic ADC.

In addition, in January 2021, Pfizer submitted a listing application for Besponsa (Inotuzumab Ozogamicin) in China, and was then included in the scope of priority review by CDE. In May 2021, Everest Medicines also submitted the listing application for Sacituzumab Govitecan (targeting Trop2) in China.

It is worth mentioning that in August 2021, Remegen and Seagen (SGEN) reached a global exclusive license agreement for the development and commercialization of Disitamab Vedotin, and Seagen will pay a down payment of 200 million US dollars and a milestone payment of up to 2.4 billion US dollars, setting a new record for overseas licensing transactions of single drug of Chinese pharmaceutical companies.

Remegen is the pioneer of developing ADC in China, and it started the preparation for the R&D of ACD drugs more than ten years ago. From the R&D pipeline of Remegen, we can see that the company has laid out a variety of ADCs (Figure 3). In August 2014, Remegen completed the application for RC48 clinical trial; In August 2015, Remegen obtained the clinical approval issued by the National Medical Products Administration, and its new anti-tumor drug RC48 with independent intellectual property rights became the first ADC to enter human clinical trials in China. In June 2021, Remegen's Disitamab Vedotin (RC48) was approved for marketing, becoming the first domestic ADC.

Although the R&D of ADC in China started late, the market competition is fierce. At present, many domestic enterprises have laid out ADC, such as Hengrui Medicine, CSPC, Kelun, Junshi Biosciences, Zhejiang Medicine, Fudan-Zhangjiang, Lepu Biopharma, Hansoh Pharma, Bio-Thera, Tot Biopharm, Dac Biotech and Miracogen. Domestic enterprises mainly take HER2 and TROP2 targets in the layout of ADC, which leads more fierce competition. In addition, ADCs of many domestic enterprises are "license-in". For example, Trodlevy of Everest Medicines was authorized by Immunomedics, EpCAM immunotoxin of Qilu Pharmaceutical was authorized by Sesen Bio, Lonca of Overland Pharmaceuticals was authorized by ADC Therapeutics, FRα ADC of Huadong Medicine was authorized by Immunogen, and ARX788 of NovoCodex Biopharmaceuticals, a subsidiary of Zhejiang Medicine, was jointly developed with Ambrx.

In addition, we should also pay attention to the R&D risks of innovative drugs. Bio-Thera has being the leader of R&D process of ADC, and its drug BAT8001 under research has entered clinical phase III. In February 2021, however, Bio-Thera announced the termination of the R&D of HER2 ADC (BAT8001) because the clinical phase III results did not reach the preset excellent effect target. In March 2021, Bio-Thera once again disclosed the termination of the R&D of Trop2 ADC (BAT8003). It is reported that the total R&D investments on BAT8001 and BAT8003 reached 226 million yuan and 61.565 million yuan respectively.

PDC (peptide-drug conjugate) is a new type of conjugates, and its structure mainly includes three elements -- linker, homing peptide and payload with cytotoxicity. The homing peptide can specifically target protein receptors over-expressed on the surface of tumor cells, thus delivering cytotoxic drugs to induce apoptosis of tumor cells. PDCs are similar in structure to ADCs, and PDC integrates the advantages of polypeptide. Compared with ADC, PDCs have smaller molecular weight, strong tumor penetration and lower immunogenicity. In addition, compared with the complex technological process of antibody production, PDC is easier to synthesize and purify with power production cost. Besides ADC, PDC is expected to become the most promising conjugate and make new breakthroughs.

Currently, there are only two PDCs have been approved for market. One is Lutathera of Advanced Accelerator Applications S.A., a subsidiary of Novartis, which is the first peptide receptor radionuclide therapy (PRRT) drug and was approved by FDA on January 26, 2018. The other is Pepaxto (melphalan flufenamide) of Oncopeptides AB, which was approved by FDA on February 27, 2021.

On October 22, Oncopeptides announced that it had withdrawn its peptide-conjugated drug Pepaxto (melphalan flufenamide) for the treatment of relapsed and refractory multiple myeloma in the US market, mainly because of Pepaxto's failure to reduce the mortality of ITT population in the confirmatory phase III OCEAN study (HR=1.104). Pepaxto has been on the market for less than eight months from its accelerated approval by FDA in February this year to its withdrawal.

In February, 2021, Pepaxto was approved by FDA for marketing, and was used in combination with dexamethasone to treat patients with triple refractory/recurrent multiple myeloma. FDA has accelerated the approval of Pepaxto combined with dexamethasone for the treatment of patients with relapsed and refractory multiple myeloma (RRMM), which is based on the results of the key phase II clinical trial (HORIZON). These patients have previously received at least four previous therapies, including protein enzyme inhibitors, immunomodulators and monoclonal antibody targeting CD38. Similarly, as a requirement to accelerate listing approval, Oncopeptides needs to perform post-listing phase III clinical trial (OCEAN).

In May 2021, Oncopeptides published the preliminary results of the head-to-head phase III clinical trial (OCEAN) of Pepaxto combined with dexamethasone and pomalidomide combined with dexamethasone in the treatment of relapsed and refractory MM patients, which showed that Pepaxto combined with dexamethasone could better improve PFS and ORR of patients. However, when the results were updated again in July this year, the OS data of the pomalidomide combined with dexamethasone control group were better.

In July 2021, FDA issued a security warning against Pepaxto. According to the warning, the analysis of phase III clinical trial (OCEAN, Study OP-103) of Pepaxto shows that the treatment of relapsed and refractory multiple myeloma (RRMM) with Pepaxto combined with dexamethasone increases the risk of death. FDA has suggested that medical personnel should review and analyze the situation of patients after taking Pepaxto, and then discuss with patients the risk of changing other treatment schemes to continue treatment. At the same time, patients taking Pepaxto should discuss the risks and benefits of taking Pepaxto with the attending doctors. At the same time, FDA requested to suspend the recruitment of patients for OCEAN and other clinical trials of Pepaxto.

Ultimatly, Oncopeptides chose to withdraw Pepaxto from the US market. This failure case should make more companies dedicated to the R&D of such drugs begin to think deeply about the safety of drugs.

According to the above information and data, it can be seen that ADCs have attracted the most attention of this field. The continuous efforts in the field of drug R&D also make the R&D technology and evaluation standards of ADCs clearer. It can be predicted that this field will continue to attract R&D investment, and more excellent products will appear, providing more choices for patients.

However, although there are not many varieties of PDC drugs on the market at present, there have been cases of withdrawal from the market due to serious safety problems recently. However, the author believes that with the solution of related technical problems and the breakthrough of supporting technologies, PDC drugs will also become a R&D hotspot and a crowded track for investment in the next decade.

1-The oncology market for antibody–drug conjugates

2-Official website of FDA

3-Official website of NMPA

4-Official website of major pharmaceutical companies

5-Information on the official website of Oncopeptides

Zhulikou431, as a senior engineer, PDA member, ISPE member, ECA member, PQRI member, senior aseptic GMP expert, has deep knowledge in aseptic process development and verification, drug development and registration, CTD document writing and review, regulatory audit, international certification, international registration , quality system construction and maintenance, as well as sterile inspection, environmental monitoring and other fields. In recent years, he has focused on the analysis of trends in the macro pharmaceutical field and the risk management of pharmaceutical enterprise mergers and acquisitions projects.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025