PharmaSources/Chen ShipengFebruary 19, 2021

Tag: Gelatin , Export Market , Derivatives

Foreword

Gelatin is a product made from animal bones, skins, muscles, tendons and scales after moderate hydrolysis (acid process, alkaline process, acid/alkaline process or enzymic method) and purification. In China, gelatin is divided into gelatin, capsule gelatin, and food additive gelatin. Among them, gelatin is included in the Pharmacopoeia of the People’s Republic of China (2020 Edition), Volume II, its category is “absorbable hemostatic agents”, and its formulation is “absorbable gelatin sponge”; capsule gelatin is included in the Pharmacopoeia of the People’s Republic of China (2020 Edition), Volume IV, and its category is “pharmaceutical excipients, used in hard capsules, etc.”; the standard for food additive gelatin is the National Food Safety Standard Food Additive - Gelatin GB 6783-2013. The National Food Safety Standard Food Additive Usage Standard GB 2760-2014 clearly defines the uses of gelatin as food additives: when used as a “thickener”, food additive gelatin can be used in all kinds of food in appropriate amounts according to production needs; when used as a “clarifier”, food additive gelatin can be used in the processing of fruit wine and wine.

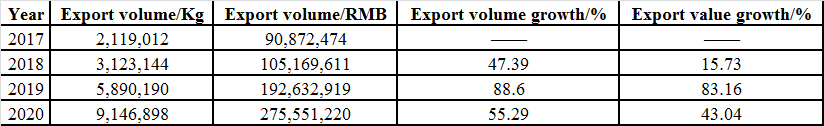

China’s economy and export business was affected by COVID-19 in 2020, however, China’s export of gelatin and its derivatives grew considerably, which was because gelatin and its derivatives, as good animal proteins, can be widely used in biological pharma and food industries. According to statistics, the export volume of gelatin and its derivatives in China in 2020 was 9,146,898 kg, and the export value was RMB275,551,220, both of which grew greatly compared with the past. See Table 1 for the relevant data of China’s export of gelatin and its derivatives from 2017 to 2020.

Table 1 China’s Export Volume and Value of Gelatin and Its Derivatives in Recent Four Years

We can see from the above table that China’s export volume of gelatin and its derivatives has increased year by year since 2017, with annual growth of more than 45%. At the same time, China’s export value of gelatin and its derivatives has also increased year by year since 2017, with annual growth of more than 15%.

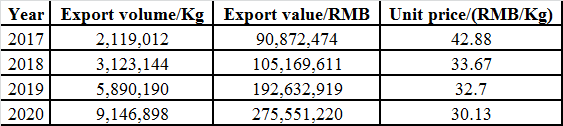

Statistical analysis shows that both the export volume and value of gelatin and its derivatives have increased year by year since 2017, but the unit price has decreased year by year. See Table 2 for the relevant data of the export unit price of gelatin and its derivatives from 2017 to 2020.

Table 2 China’s Export Unit Price of Gelatin and Its Derivatives in Recent Four Years

We can see from the above table that China’s export volume and value of gelatin and its derivatives have increased year by year since 2017, but the unit price has decreased year by year because: firstly, the technology of manufacturers of gelatin and its derivatives in China has developed significantly over time and their operating costs have been effectively controlled and reduced so that gelatin and its derivatives have room for price reduction, with their price reduced year by year; secondly, gelatin and its derivatives were in short supply for a period after the “toxic capsule incident” in 2012, and the price of gelatin and its derivatives rose rapidly, which attracted a large amount of capital to enter the industry, and a group of new gelatin manufacturers were built in China; in the meantime, the original gelatin manufacturers expanded their capacity, resulting in the overcapacity of gelatin and its derivatives and oversupply in recent years, causing the price of gelatin and its derivatives to reduce year by year; thirdly, China’s export of gelatin and its derivatives was affected by the fluctuations of the international market of gelatin and its derivatives, and the price was adjusted in China, and both the gelatin and its derivatives industry in China and in the world expanded production; fourthly, the export unit price of gelatin and its derivatives was contracted in USD for one year or half a year, and with the continued appreciation of RMB from 2017 to 2020, and with RMB as the statistical indicator, the result was that the unit price of gelatin and its derivatives decreased year by year; fifthly, the price of gelatin was also affected by the specification of the exported products: the prices of different specifications (bloom) were different, with the higher the bloom, the higher the price and the lower the bloom, the lower the price .

Summary

China’s export of gelatin and its derivatives has grown considerably from 2017 to 2020. Its export volume cumulatively grew by 331.66% and export value cumulatively grew by 203.23% from 2017 to 2020 because gelatin and its derivatives are good proteins of animal origin and can be widely used in the food industry and pharmaceutical industry. Food additive gelatin can be used to produce compound food additives, meat products, dairy products, wine, candy, ice cream, etc. Capsule gelatin can be used to produce soft and hard capsule shells, and eventually capsules. Gelatin can also be used for absorbable gelatin sponge.

The unit price in China’s export of gelatin and its derivatives decreased year by year from RMB 42.88/kg in 2017 to RMB 30.13/kg in 2020, with a decrease of 29.75%, which manufacturers of gelatin and its derivatives must pay attention to. To continue to operate, those manufacturers should not only pay attention to the industry development context in China and the world but also their internal environment, continue to save energy and reduce consumption, and reduce operating cost. Gelatin manufacturers are big users of water resources, thus they should continue to improve to reduce the water consumption and sewage discharge per unit of gelatin. Gelatin manufacturers are also big users of electricity and steam, thus they should upgrade technology and equipment to eliminate equipment with excessive electricity and steam consumption and effectively implement energy saving and consumption reduction.

Gelatin and its derivatives are resource-based products and their capacity is affected by the raw materials. Both the animal skins used for producing skin gelatin or animal bones used for producing bone gelatin have been in short supply, and the prices of these raw materials have been rising year by year, however, their quantity has not been able to meet the needs of manufacturers of gelatin and its derivatives. Chinese manufacturers of gelatin and its derivatives have been purchasing raw materials from countries in Africa, Oceania, and Asia. Regardless of the countries from which they purchase raw materials, these raw materials shall meet the laws, regulations and standard requirements of the exporting countries, importing countries and related countries (countries where gelatin and its derivatives are exported, etc.).

The export volume of gelatin and its derivatives will continue to grow because firstly, the usage of capsules has been increasing year by year because of their excellent edible properties and applicability, which will promote the increase of gelatin use; secondly, the usage of food additive gelatin will increase year by year because it has a wide range of uses and excellent performance; thirdly, the demand for collagen will continue to increase as people’s health care and beauty awareness increases, which will promote the increase in the use of gelatin.

References

1. National Food Safety Standard Food Additive - Gelatin GB 6783-2013

2. Pharmacopoeia of the People’s Republic of China (2020 Edition), Volume II, Gelatin

3. Pharmacopoeia of the People’s Republic of China (2020 Edition), Volume IV, Capsule Gelatin

4. National Food Safety Standard Food Additive Usage Standard GB 2760-2014

5. Statistical data of gelatin and its derivatives of the Customs of the People’s Republic of China

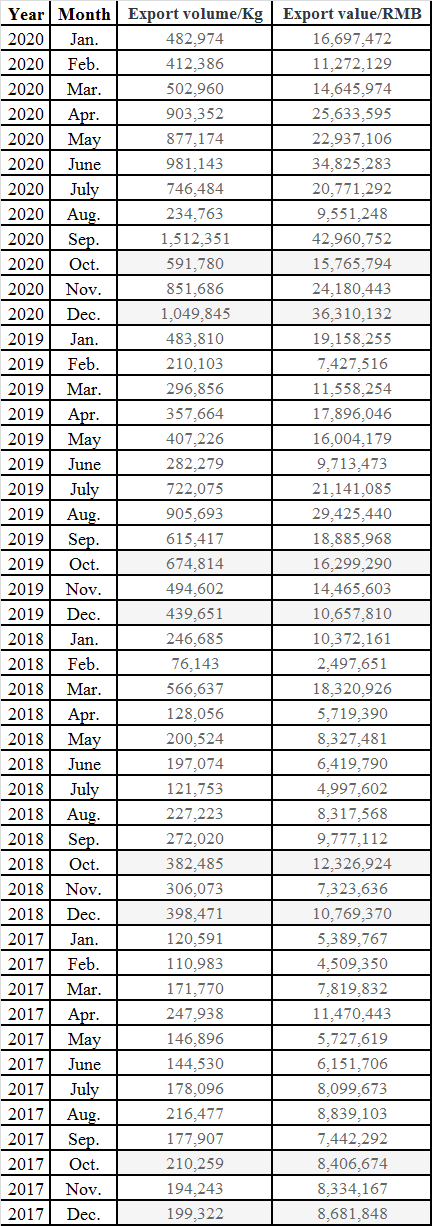

Attachment: Export volume and value of gelatin and its derivatives in the past 4 years

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025