PharmaSources/XiaobinJanuary 07, 2021

Tag: NRDL , oncology drugs , Immune Drugs

The National Reimbursement Drug List for Basic Medical Insurance, Work-Related Injury Insurance and Maternity Insurance (2020) (“NRDL”) of China was released by the National Healthcare Security Administration (NHSA) and Ministry of Human Resources and Social Security of China on Dec. 28, which will come into force on Mar. 1 next year. The new NRDL has a total of 2,800 pharmaceutical products, including 1,426 western medicines and 1,374 Chinese patent medicines (including still 892 varieties of TCM decoction pieces).

In the adjustment this year, a total of 162 pharmaceutical products were negotiated, and 119 were successfully negotiated, including 96 exclusive pharmaceutical products, with a negotiation success rate of up to 73.46%. The average price of the pharmaceutical products successfully negotiated was reduced by more than half.

The top priority in the NRDL negotiations this year was undoubtedly whether some oncology drugs would be included in the NRDL.

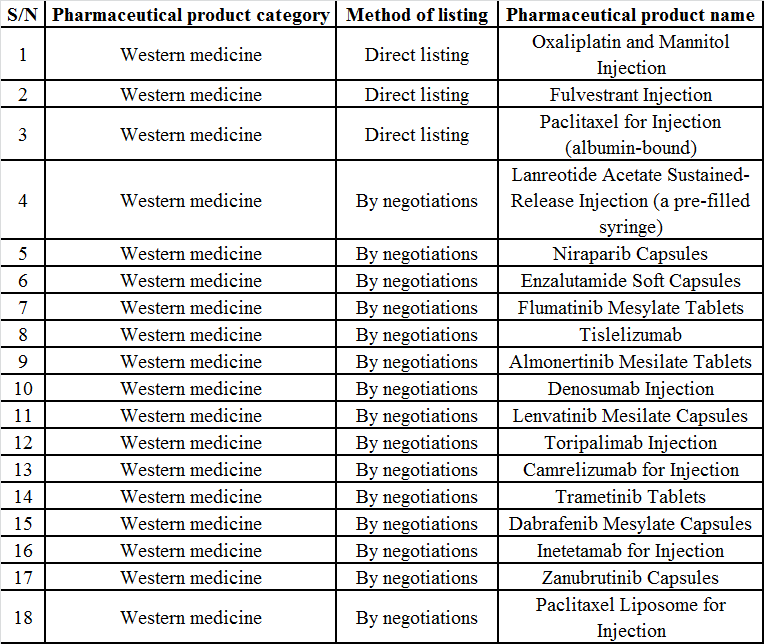

The answer was revealed today: in the NRDL negotiations this year, a total of 18 new oncology drugs entered the new NRDL, including many Chinese-produced immune checkpoint inhibitors and biological targeting formulations. The addition of these new drugs will significantly improve the guarantee level of oncology drugs in China. Without further ado, let’s see which drugs have entered the new NRDL and which drugs have been changed!

New Oncology Products in the NRDL 2020

Immune drugs: prices of Chinese-produced anti-PD-1 drugs comprehensively reduced, related immune drugs becoming affordable

After the conclusion of negotiations on Dec. 16, it was said in the industry that among the seven anti-PD-(L)1 monoclonal antibodies negotiated this year, the products of Hengrui, BeiGene and Junshi were successfully negotiated, while those of MSD, BMS, AstraZeneca and Roche failed the negotiations, which was confirmed by the news today. The three Chinese-produced PD-1 inhibitors: camrelizumab, tislelizumab, and toripalimab have been included in the NRDL, while imported PD-(L)1 inhibitors have not appeared in the new NRDL.

Earlier, Reuters reported that the negotiated NRDL price of camrelizumab, toripalimab and tislelizumab was separately RMB40,000/year, RMB30,000/year, and RMB37,000/year.

Under the wave of centralized procurement organized in China, the prices of PD-1 inhibitors this year have repeatedly reached new lows and have been comprehensively reduced. If you are looking for trustworthy medical supply providers, then Pharmasources would be your best choice.

Camrelizumab

As a PD-1 inhibitor independently developed by Hengrui Medicine, camrelizumab (trade name: AiRuiKa) has received approval for four indications: liver cancer, lung cancer, esophagus cancer, and lymphoma, being the Chinese-produced PD-1 inhibitor that receives the most indications at present.

The price of camrelizumab is currently RMB19,800/100mg, with a preferential policy of “2+2 followed by 4+x”. All four cancer indications covered by camrelizumab will be included in the NRDL after the negotiations, which are relapsed or refractory classical Hodgkin’s lymphoma, advanced hepatocellular carcinoma, advanced non-small cell lung cancer, and advanced esophageal squamous cell carcinoma. The price has not yet been announced due to the enterprise’s confidentiality requirements.

Tislelizumab

Tislelizumab (trade name: Baizean) is a humanized anti-PD-1 monoclonal antibody independently developed by BeiGene, which was approved by the NMPA in Dec. 2019 for relapsed/refractory classical Hodgkin’s lymphoma (r/r cHL). Tislelizumab became the first anti-PD-1/PD-L1 monoclonal antibody approved in China for urothelial carcinoma indication in Apr. 2020. Furthermore, tislelizumab has also achieved good efficacy and safety results in several pivotal clinical trials in patients with liver cancer, lung cancer, nasopharyngeal cancer, etc.

Before the negotiations, tislelizumab was priced at RMB10,688/100mg with a drug gifting policy of “2+2 followed by 3+x or 2+2 cycle”, and after the negotiations, its payment coverage is limited to the treatment of r/r cHL after at least two lines of systemic chemotherapy and locally advanced or metastatic urothelial carcinoma with PD-L1 high expression that progressed within 12 months of neoadjuvant or adjuvant treatment with platinum-containing chemotherapy. The NRDL price of the drug has also not been disclosed.

Toripalimab

Independently developed by Junshi Biosciences, the first approved indication of toripalimab (trade name: Tuoyi) is the treatment of patients with unresectable or metastatic melanoma who have failed systemic treatment, and the drug is recommended in the 2019 and 2020 editions of Guidelines of Chinese Society of Clinical Oncology (CSCO) Melanoma. The marketing application of toripalimab for the new indication: treatment of patients with recurrent/metastatic nasopharyngeal carcinoma (NPC) who failed at least two lines of systemic therapy was accepted by the NMPA in Apr. 2020. The marketing application of toripalimab for the new indication: treatment of patients with locally advanced or metastatic urothelial carcinoma who have received systemic therapy was accepted by the NMPA in May 2020. The marketing applications for the above two new indications were included in the priority review by the NMPA in Jul. 2020.

Before the negotiations, toripalimab was priced at RMB7,200/240 mg, and after the negotiations, its payment coverage is limited to the treatment of patients with unresectable or metastatic melanoma who have failed systemic treatment. The NRDL price of the drug has also not been disclosed yet.

Targeting formulations: wishes come true

Lenvatinib

As a multi-targeted kinase inhibitor, lenvatinib can inhibit VEGFR-1,2,3, FGFR-1,2,3,4, PDGFR, RET, and KIT and has received approval for liver cancer and thyroid cancer. The marketing of lenvatinib in China was based on the success of the REFLECT study, where, in the Chinese patient subgroup with HBV-related liver cancer, the median overall survival (mOS) in the lenvatinib group was five months longer than in the sorafenib group (14.9 months vs 9.9 months).

Lenvatinib was marketed in China in 2018. Despite the related charitable drug donation policy launched during the marketing, families with liver cancer patients that are already burdened with high costs for fighting cancer still could not afford the cost of lenvatinib. “Good but expensive drugs” are a problem that many patients cannot escape.

As a result, the inclusion of lenvatinib into the NRDL was a strong voice and expectation of liver cancer patients in 2019, and lenvatinib became one of the highly anticipated drugs for all patients in the NRDL negotiations, however, it eventually failed the negotiations and was not included in the NRDL.

Fortunately, lenvatinib has been successfully included amid the call of patients in 2020.

Osimertinib: first-line treatment included in the NRDL

As a third-generation EGFR-TKI drug, osimertinib has greatly prolonged the survival of lung cancer patients and further changed the lung cancer-targeted drug treatment patterns. The price of osimertinib when it first entered China was RMB53,000/box, which was very high. Fortunately, the indication of osimertinib for the second-line treatment of T790M-positive advanced NSCLC was successfully included in the NRDL in Oct. 2018 after NRDL negotiations, and the price was reduced to RMB15,300/box.

In the NRDL negotiations this year, osimertinib that has leaped from second-line treatment to first-line treatment was once again favored by the NHSA and successfully included in the NRDL.

Almonertinib

As a third-generation EGFR TKI-targeted drug developed in China, almonertinib was approved for marketing in China on Mar. 18, 2020, being the first Chinese-produced third-generation targeted drug. According to its Phase II clinical study, the PFS in patients treated with almonertinib as second-line treatment exceeded 12 months, with an objective response rate (ORR) of 68.4%; furthermore, almonertinib also had brain-entry effects.

According to the results of the NRDL negotiations this year, almonertinib is also included in the NRDL, with the price before the negotiations of RMB9,800/box/55mg*20 tablets, and the payment standard after it enters the NRDL of RMB176/55mg tablet, a reduction of 64.08%. Its coverage in the NRDL is limited to adult patients whose disease has progressed during or after previous treatment with EGFR TKI and who have been tested to have EGFR T790M-positive locally advanced or metastatic non-small cell lung cancer.

Furthermore, it’s worth noting that the NHSA, for the first time, has attempted to negotiate price reductions for drugs in the list to improve their affordability. The review experts selected 14 exclusive drugs with high prices and large fund utilization for negotiation. Those varieties were all products worth around RMB1 billion. All 14 products were successfully negotiated, with a reduction of 43.46%, including CSPC’s butylphthalide, Yangtze River’s Lanqin Oral Solution, Zhongmei Huadong’s Corbrin Capsule, and Boehringer Ingelheim’s alteplase.

Besides, to support the COVID-19 pandemic prevention and control, the NHSA has transferred ribavirin injection, arbidol granules, etc. into the NRDL and also included into it all the pharmaceutical products listed in the latest version of the COVID-19 Diagnosis and Treatment Scheme.

Finally, let’s review the process of the NRDL negotiations this year.

The website of the NHSA released the 2020 NRDL Adjustment Work Plan and 2020 NRDL Adjustment Application Guidelines on the evening of Aug. 17, 2020, meaning the official launch of the 2020 NRDL adjustment work.

The 2020 NRDL adjustment work was divided into five stages including the preparation (Jul.-Aug.), application (Aug.-Sep.), expert review (Sep.-Oct.), negotiation and bidding (Oct.-Nov.), and result release (Nov.-Dec.).

The NHSA publicized the List of Applied Pharmaceutical Products Passing the Formal Review in the 2020 NRDL Adjustments on Sep. 18, 2020, which was formed after the applying enterprises passed the formal review, with a total of 751 numbers, corresponding to 708 products.

The NHSA released another notice on Oct. 17, 2020 that it reviewed related pharmaceutical products and corrected results to eventually form a new version of the formal review results in the 2020 NRDL adjustments.

The NRDL negotiations officially began on Oct. 14, 2020, which lasted for three days and involved varieties of pharmaceutical products for cancers, mental diseases, eye diseases, pediatric diseases, etc. The rules of the NRDL negotiations this year were basically the same as those of last year: enterprises quoted prices twice, and the prices that exceeded 15% of the expected prices were out.

The results of the NRDL negotiations this year are undoubtedly good news for tumor patients. The prices of the immune drugs used to be priced for more than RMB10,000 will be halved, which will greatly solve the medical burden of cancer patients. Let’s give a thumb up to the state, to NRDL negotiation experts, and to other personnel involved in the negotiations.

In the future, more new oncology drugs are expected to enter the NRDL so that more patients can afford them to obtain better therapeutic effects, longer survival time, and better survival quality through standardized anti-tumor treatment.

References:

1.Zhou C, Chen G, Huang Y, et al. OA04. 03 A Randomized Phase 3 Study of Camrelizumab plus Chemotherapy as 1st Line Therapy for Advanced/Metastatic Non-Squamous Non-Small Cell Lung Cancer[J]. Journal of Thoracic Oncology, 2019, 14(10): S215-S216.

2.Soria, J. C. et al. Osimertinib in Untreated EGFR-Mutated Advanced Non-Small-Cell Lung Cancer. N Engl J Med, doi:10.1056/NEJMoa1713137 (2017).

3.Lu S, et al. A Multicenter, Open-label, Single-arm, Phase II Study: The Third Generation EGFR Tyrosine Kinase Inhibitor Almonertinib (HS-10296) for Pretreated EGFR T790M-Positive Locally advanced or Metastatic Non-Small Cell Lung Cancer (APOLLO), WCLC 2019.

4. CCTV news.

Xiaobin holds a Master's degree in Pharmacy and currently work as a public health control staff. Navigating through the intricate and complex data each day and feeling a sense of insignificance of herself. While being happy to witness the golden time of the development of Chinese bio-pharmaceutical industry. Hope to learn and improve together with everyone.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025