PharmaSources/CaicaiNovember 16, 2020

Tag: First generic , Hansoh , ranking

China’s pharmaceutical industry has started to shift from “sales-driven” to “R&D-driven” since the drug review reform in 2015. Generic drug consistency evaluation, “4+7” and other supporting policies have promoted the great reshuffle of the generic drug market in China. Under the above background, pharmaceutical enterprises have significantly increased their investment in R&D and regarded first generics as the best strategy to develop generic drugs in addition to investing heavily in the R&D of Class 1 new drugs.

First generics have higher technical barriers and provide first-mover advantages compared with common generic drugs. Major players of first generics in China’s pharmaceutical industry at present include Chiatai Tianqing, Hansoh, and Hengrui, etc. Wherein, Hansoh, which was founded in 1995, began with generic drugs (mainly first generics) and has many first generics that are the best-selling drugs in their respective field, with the number of first generics ranking second in the industry in China, second only to Chiatai Tianqing.

How many first generics does Hansoh have?

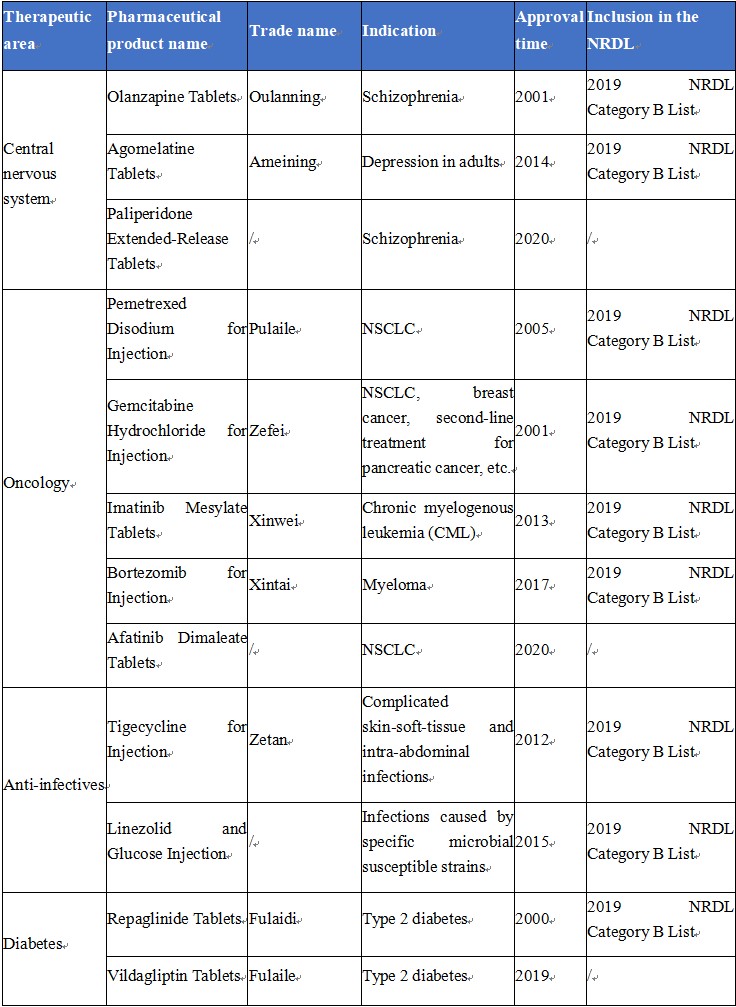

To date, Hansoh has a total of 18 first generics, with up to 9 approved in 2017-2020. Several of these first generics are revenue pillars for Hansoh, such as Olanzapine Tablets, Pemetrexed Disodium for Injection, and Gemcitabine Hydrochloride for Injection.

First Generics of Hansoh

(Source: Company website and annual report, by June 28, 2020. Any supplementation will be much appreciated.)

Which first generics have passed the consistency evaluation?

Consistency evaluation is an essential condition for the centralized procurement of generic drugs in China. If you are looking for medical supplies suppliers who manufacture generics, then Pharmasources would be your best choice.

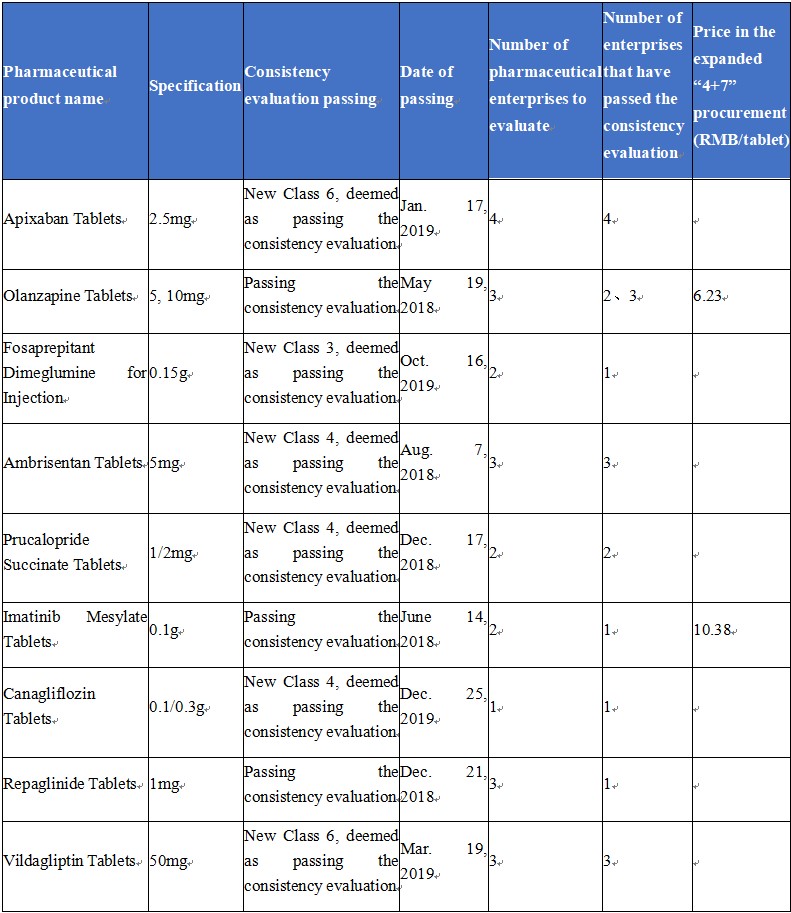

Currently, Hansoh has 9 first generics that have passed the consistency evaluation. Wherein, Olanzapine Tablets (trade name: Oulanning), Imatinib Mesylate Tablets (trade name: Xinwei), and Repaglinide Tablets (trade name: Fulaidi) were among the first batch of first generics that passed the consistency evaluation in 2018.

In the centralized procurement, Oulanning and Xinwei selected in the first round of “4+7” were separately reduced the price by about 27.2% and about 26%; in the second round, the expanded “4+7” centralized procurement, Oulanning was reduced the price again by 35.37% due to the poor competition pattern, while, Xinwei that enjoyed a good competition pattern and won the bid with another company’s product was reduced the price only by 0.19%.

Consistency Evaluation Passing of Hansoh’s First Generics

(Source: db.yaozh.com, by June 28, 2020)

Which first generics sell best?

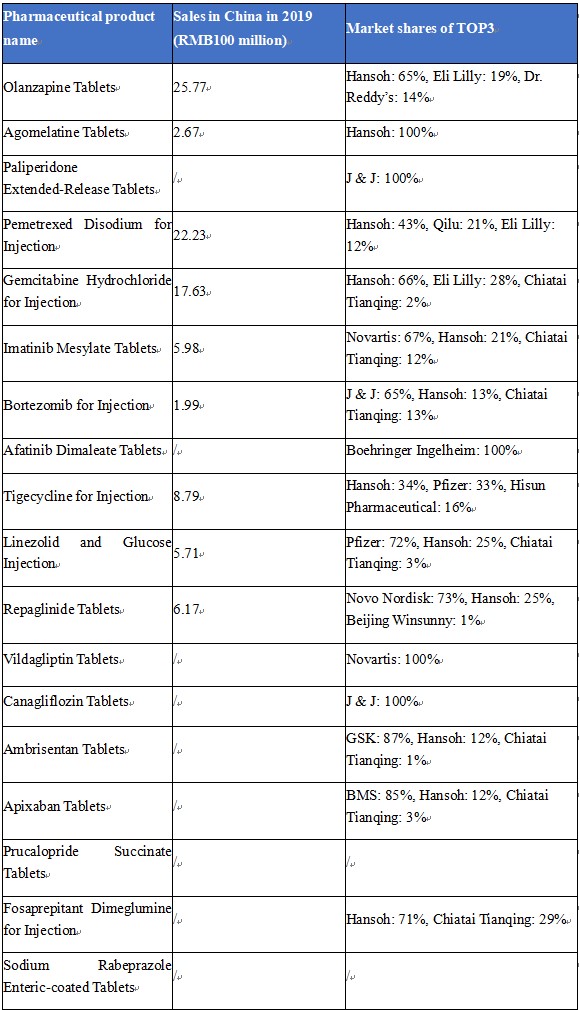

The income from the 3 first generics: Olanzapine Tablets (trade name: Oulanning), Pemetrexed Disodium for Injection (trade name: Pulaile), and Gemcitabine Hydrochloride for Injection (trade name: Zefei) accounts for more than 50% of the total income of Hansoh.

In particular, in terms of olanzapine and gemcitabine, since 2012, Hansoh’s share of the olanzapine market in China has developed from a half with Eli Lilly in the early years to a dominant position in recent years, reaching as high as 65% in 2019; Hansoh has maintained the highest share of the gemcitabine market in China, with the share growing year by year and reaching as high as 66% in 2019.

Oulanning is the variety that accounts for the highest proportion of Hansoh’s income, which exceeds 20%. Oulanning accounts for a share of about 65% of the olanzapine market in China in 2019, calculated by sales. It is the first olanzapine tablet generic passing the consistency evaluation in China. Qilu Pharmaceutical, Dr. Reddy’s, and Hansoh won the bid for olanzapine tablets in the expanded “4+7” centralized procurement with a price of separately RMB2.48/tablet, RMB6.19/tablet, and RMB6.23/tablet, while the original drug company: Eli Lilly was knocked out with a price of RMB6.74/tablet. Oulaining’s bid-winning price in this expanded procurement was largely lower than that of RMB9.64/tablet in the “4+7” centralized procurement, and its sales may be under some pressure from the centralized procurement in the future.

Pemetrexed disodium is the variety with the second-highest sales in the non-small cell lung cancer (NSCLC) drug market in China, and Pulaile is the best-selling variety of pemetrexed disodium. The sales of Pemetrexed Disodium for Injection reached RMB2.223 billion in China in 2019, and Hansoh had a market share of 43%. However, the future sales of Hansoh’s Pemetrexed Disodium for Injection are expected to be impacted because it has not passed the consistency evaluation and thus not been included in the centralized procurement.

Hansoh’s Gemcitabine Hydrochloride for Injection (trade name: Zefei) has the highest share of the gemcitabine hydrochloride market in China. Gemcitabine hydrochloride is indicated for middle-stage and advanced NSCLC, breast cancer, and pancreatic cancer. The sales of Hansoh’s gemcitabine hydrochloride reached RMB1.763 billion in China in 2019, with a market share of 66%.

Sales of Hansoh’s First Generics

(Source: db.yaozh.com, by June 28, 2020)

Articles about the first generics of more enterprises will be written if readers are interested.

Caicai, a Master of Pharmacy from Shanghai Jiaotong University, used to work in the Institute of Science and Technical Information. Currently as a practitioner in the drug surveillance system, she is good at interpreting industry regulations, pharmaceutical research developments, etc.

-----------------------------------------------------------------------

Editor's Note:

To become a freelance writer of PharmaSources.com,

welcome to send your CV and sample works to us,

Email: Julia.Zhang@imsinoexpo.com.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025