PharmaSources/CaicaiApril 21, 2020

Tag: Marketing , Class 1 new drugs , Chinese-produced

According to statistics, the NMPA approved the marketing of 13 Class 1 new drugs and 17 biological products in the 17 years from 2001 to 2017. The number of innovative drugs approved was pitifully small.

The State Council of China issued the important document the Opinions on the Reform of Review and Approval System for Drugs and Medical Devices (No. 44) in Aug. 2015 to accelerate innovative drug review and approval and conduct the pilot program of Marketing Authorization Holder (MAH) System and other policy reforms, which officially began the era of Chinese innovative drugs.

The drug regulator reform and capital catalysis revolutionized the marketing situation of Chinese-produced new drugs in 2018 where the NMPA approved the marketing of 9 Chinese-produced Class 1 new drugs. As a result, 2018 is called the first year of the era of Chinese innovative drugs.

A total of 20 Chinese-produced Class 1 new drugs have been marketed since 2018, involving hot areas such as oncology, liver disease, and diabetes.

Then, what are the specific proportions of chemical drugs and biological drugs in those 20 new drugs? What are the areas of their indications? Which pharmaceutical enterprise has the largest number? How are their performances after marketing? Which drugs have entered the national reimbursement drug list (NRDL) of China? What are the future trends?

Chinese-produced Class 1 New Drugs Marketed Since 2018

S/N | Pharmaceutical product name | Trade name | Registration class | Developed by | Target | Indication | Time of first approval |

1 | Recombinant Cytokine Gene-derived Protein Injection | Novaferon | Therapeutic biological products 1 | Genova Inc. | / | HBeAg-positive chronic hepatitis B | Apr. 2018 |

2 | Anlotinib Hydrochloride Capsules | FOCUS V | Chemical drugs 1 | Chia Tai Tianqing | Tyrosine kinase inhibitor of multi-targets | NSCLC 3L, SCLC 3L, soft tissue sarcoma 2L | May 2018 |

3 | Albuvirtide for Injection | Aikening | Chemical drugs 1 | Frontier Biotechnologies | HIV-1 | HIV-1 infection with HIV-1 virus replication after the treatment with other multiple antiretroviral drugs | May 2018 |

4 | Danoprevir Sodium Tablets | Ganovo | Chemical drugs 1 | Ascletis | New-generation NS3/4A protease inhibitor | Untreated non-cirrhotic genotype 1b chronic hepatitis C | June 2018 |

5 | Pyrotinib Maleate Tablets | Airuini | Chemical drugs 1 | Hengrui Medicine | Pan-ErbB receptor tyrosine kinase inhibitor | HER2-positive advanced breast cancer | Aug. 2018 |

6 | Fruquintinib Capsules | Elunate | Chemical drugs 1 | Hutchison MediPharma | VEGFR1, 2 and3 | Metastatic colorectal cancer 3L | Sep. 2018 |

7 | Roxadustat Capsules | Ai Rui Zhuo | Chemical drugs 1 | FibroGen | Hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI) | Anemia associated with chronic kidney disease | Dec. 2018 |

8 | Toripalimab Injection | Tuoyi | Therapeutic biological products 1 | Junshi Biosciences | PD-1 | Melanoma 2L | Dec. 2018 |

9 | Sintilimab Injection | Tyvyt | Therapeutic biological products 1 | Innovent | PD-1 | Classical Hodgkin's lymphoma 3L | Jan. 2019 |

10 | Polyethylene Glycol Loxenatide Injection | Fulaimei | Chemical drugs 1 | Hansoh Pharmaceutical | GLP-1 | Improvement of blood sugar control in adult patients with type 2 diabetes | May 2019 |

11 | Camrelizumab for Injection | AiRuiKa | Therapeutic biological products 1 | Hengrui Medicine | PD-1 | Classical Hodgkin lymphoma 3L, hepatocellular carcinoma 2L | June 2019 |

12 | Benvitimod Cream | Symbiox | Chemical drugs 1 | Zhonghao Pharmaceutical | TPK | Mild to moderate stable psoriasis vulgaris in adults | June 2019 |

13 | Carrimycin Tablets | Bite | Chemical drugs 1 | Tonglian Pharmaceutical | / | Upper respiratory infection | July 2019 |

14 | Sodium Oligomannurarate Capsules | GV-971 | Chemical drugs 1 | Green Valley Pharmaceutical | APP | Alzheimer's disease | Nov. 2019 |

15 | Tislelizumab Injection | Baizean | Therapeutic biological products 1 | BeiGene | PD-1 | Classical Hodgkin lymphoma 3L | Nov. 2019 |

16 | Flumatinib Mesylate Tablets | Hansoh Xinfu | Chemical drugs 1 | Hansoh Pharmaceutical | Bcr-Abl | Adult patients with Philadelphia chromosome-positive chronic myeloid leukemia (Ph+ CML) in the chronic phase | Nov. 2019 |

17 | Niraparib Tosylate Capsules | ZEJULA | Chemical drugs 1 | Zai Lab | PARP | Maintenance treatment of adult patients with recurrent epithelial ovarian, fallopian tube, or primary peritoneal cancer who are in complete or partial response to platinum-based chemotherapy | Dec. 2019 |

18 | Remimazolam Tosylate for Injection | Ruibeining | Chemical drugs 1 | Hengrui Medicine | GABAa | Sedation for routine gastroscopy | Dec. 2019 |

19 | Coblopasvir Hydrochloride Capsules | Kailiwei | Chemical drugs 1 | Beijing Kawin | NS5A | Used in combination with sofosbuvir to treat adult patients with genotypes 1, 2, 3 and 6 HCV infections without or with compensated liver cirrhosis who are untreated or treated with interferon | Feb. 2020 |

20 | Almonertinib Mesilate Tablets | Ameile | Chemical drugs 1 | Hansoh Pharmaceutical | EGFR | Adult patients with locally advanced or metastatic T790M mutation-positive NSCLC, who have progressed on or after prior EGFR TKI therapy | Mar. 2020 |

(Source: NMPA, company financial reports, and official websites; by Apr. 9, 2020)

What are the proportions of chemical drugs and biological drugs?

Among those 20 Chinese-produced Class 1 new drugs, there are 15 chemical drugs and 5 biological drugs, meaning that chemical drugs account for a larger proportion, being 75%.

Among the global top 10 drugs by sales in 2019, there were 6 biological drugs and 4 chemical drugs; wherein, the total sales of biological drugs reached USD58.86 billion and those of chemical drugs reached USD37.90 billion, with the former exceeding the latter by over USD20 billion. Therefore, the potential of biological drugs is still enormous in the future.

More Chinese-produced Class 1 biological products are expected to be applied for marketing in the next years, and the proportion of biological drugs will gradually increase.

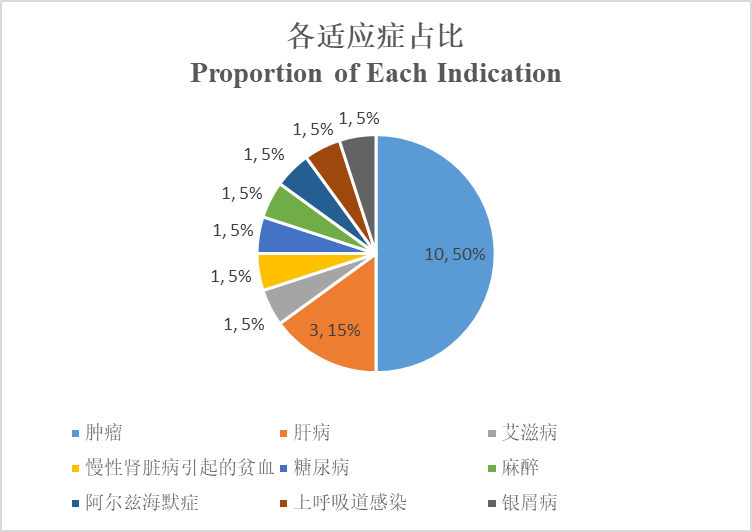

What are the areas of their indications?

From the perspective of indications, 10 of those 20 Chinese-produced Class 1 new drugs are indicated for tumors, accounting for half, followed by 3 indicated for liver disease. Furthermore, Alzheimer's disease, diabetes, anesthesia, psoriasis, and infection, etc. are also covered.

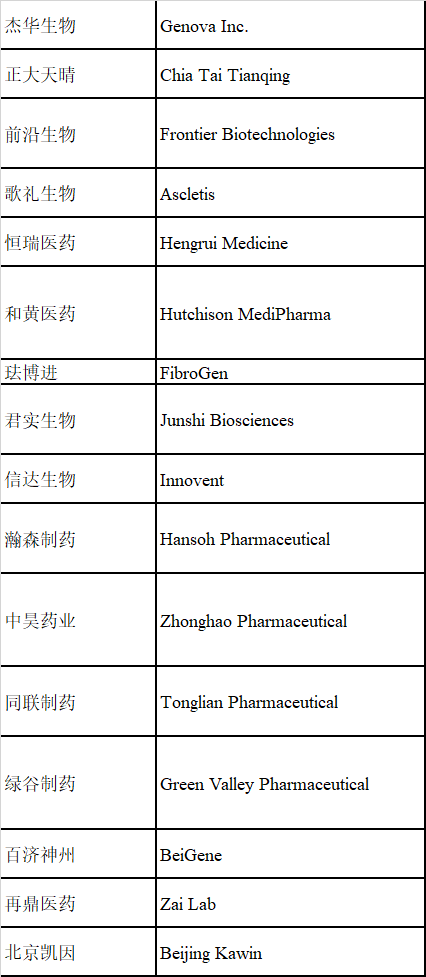

肿瘤 | Tumor |

肝病 | Liver disease |

艾滋病 | HIV |

慢性肾脏病引起的贫血 | Anemia associated with chronic kidney disease |

糖尿病 | Diabetes |

麻醉 | Anesthesia |

阿尔兹海默症 | Alzheimer's disease |

上呼吸道感染 | Upper respiratory infection |

银屑病 | Psoriasis |

From the perspective of targets, PD-1 is the hottest, with 4 Chinese-produced Class 1 new drugs belonging to anti-PD-1 monoclonal antibodies, separately, Junshi’s toripalimab, Innovent’s sintilimab, Hengrui’s camrelizumab, and BeiGene’s tislelizumab. Hot targets such as PARP and GLP-1 are also covered besides PD-1.

Strategically, many of those drugs have "titles". Toripalimab is the first Chinese-produced anti-PD-1 monoclonal antibody marketed; loxenatide is the first Chinese-produced GLP-1 agonist marketed; flumatinib is an "upgrade" of Gleevec; niraparib is the second PARP inhibitor marketed in China; Danoprevir Sodium Tablets is the first Chinese-produced DAA against hepatitis C virus; albuvirtide is the first Chinese-produced long-acting anti-HIV drug.

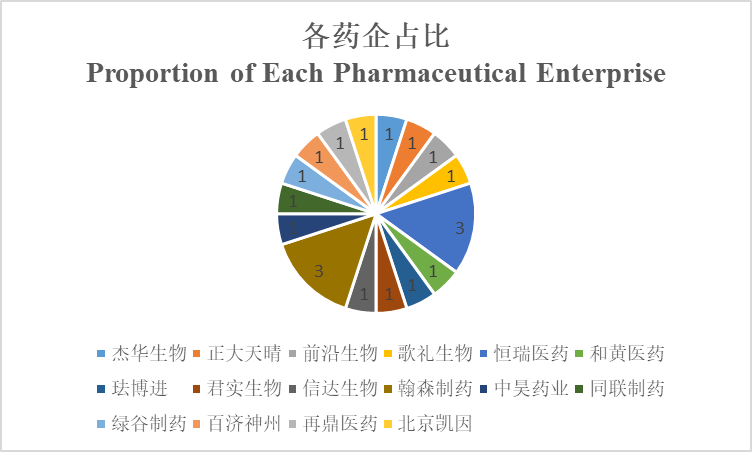

Which pharmaceutical enterprise has the largest number?

Hengrui and Hansoh have the largest number: each has 3 among those 20 Chinese-produced Class 1 new drugs, while, others all have 1. Hengrui’s drugs include pyrotinib, remimazolam, and camrelizumab; Hansoh’s drugs include loxenatide, flumatinib, and almonertinib.

There is an increasingly apparent trend in Chinese pharmaceutical enterprises and healthcare supply companies. The comprehensive coverage of multiple hot targets is a development strategy to integrated pharmaceutical giants like Hengrui, Hansoh, and Chia Tai Tianqing, for example, Hengrui has the hot anti-PD-1 monoclonal antibody and also remimazolam within its characteristic anesthesia business. By contrast, the strategy to emerging small pharmaceutical enterprises such as Innovent, Ascletis, and Hutchison MediPharma is to develop priority business and find characteristic areas, for example, Ascletis focuses on the liver disease area and its 2nd Chinese-produced HCV drug: ravidasvir will be marketed soon besides its first Chinese-produced HCV DAA, while, Innovent focuses on biological drugs and does not dabble much in small molecule drugs.

How are their performances after marketing?

Among those 20 Class 1 new drugs, anlotinib and Chinese-produced anti-PD-1 monoclonal antibodies have so far had good performances. Wherein, anlotinib had the highest sales in 2019, which were between RMB2.5-3.0 billion, and the total sales of the 3 Chinese-produced anti-PD-1 monoclonal antibodies reached nearly RMB3 billion in 2019.

Except that tislelizumab and those marketed after it have not reached large sales, 9 of the other 14 drugs are estimated to exceed RMB100 million sales in 2019, separately, anlotinib, danoprevir sodium, pyrotinib, fruquintinib, toripalimab, sintilimab, loxenatide, camrelizumab, and sodium oligomannurarate. Those whose specific sales have been disclosed include RMB124 million of danoprevir sodium, RMB120 million of fruquintinib, RMB774 million of toripalimab, and RMB1.016 billion of sintilimab.

The sales of anlotinib, sintilimab and camrelizumab exceeded RMB1 billion. The best performers among those new drugs in the next 2-3 years are still expected to be anlotinib and Chinese-produced anti-PD-1 monoclonal antibodies.

Which drugs have entered the national reimbursement drug list (NRDL) of China?

The NRDL negotiation results were revealed (innovative drug products approved before Dec. 31, 2018 were qualified for the selection) on Nov. 28, 2019. Before this, the NRDL underwent 4 adjustments after 2000, separately in 2004, 2009, 2017, and 2018. The accelerated update frequency of the NRDL is conductive to the fast connection of new drugs between marketing and NRDL access. 6 new drugs among those 20 Class 1 new drugs have been included in the NRDL, separately, Recombinant Cytokine Gene-derived Protein Injection, Anlotinib Hydrochloride Capsules, Pyrotinib Maleate Tablets, Fruquintinib Capsules, Roxadustat Capsules, and sintilimab. More Chinese-produced Class 1 new drugs will be included in the future.

What are the future trends?

The marketing time gap between Chinese-produced drugs and imported drugs will become smaller and smaller in the future.

Take anti-PD-1 monoclonal antibodies, for instance, the world’s first anti-PD-1 monoclonal antibody: Keytruda was marketed in 2014, while, the first Chinese-produced anti-PD-1 monoclonal antibody: toripalimab was marketed in 2018, only 4 years thereafter. The gap was narrowed greatly compared to before. The gap in the future will become smaller and smaller.

Chinese-produced drugs will be first marketed overseas and then in China in the future.

BeiGene’s zanubrutinib was approved for marketing in the U.S. in December last year to become the first Chinese-produced new drug approved by the FDA, and it is expected to be marketed in China in the first half of this year. There will be more and more situations that Chinese-produced drugs are first marketed overseas and then in China in the future.

Pharmaceutical enterprises will be flourishing in the future, and new drugs will be no longer exclusive to pharmaceutical giants.

A good new drug can support a pharmaceutical enterprise, for example, sintilimab to Innovent, and toripalimab to Junshi. The applications of Chinese-produced new drugs will be in bloom in the future, and besides traditional pharmaceutical giants, emerging enterprises will yield unusually brilliant results.

Caicai, a Master of Pharmacy from Shanghai Jiaotong University, used to work in the Institute of Science and Technical Information. Currently as a practitioner in the drug surveillance system, she is good at interpreting industry regulations, pharmaceutical research developments, etc.

-----------------------------------------------------------------------

Editor's Note:

To become a freelance writer of En-CPhI.CN,

welcome to send your CV and sample works to us,

Email: Julia.Zhang@ubmsinoexpo.com.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025