PharmaSources/DopineJanuary 13, 2020

Tag: TOP 10 , etanercept , Humira , sales

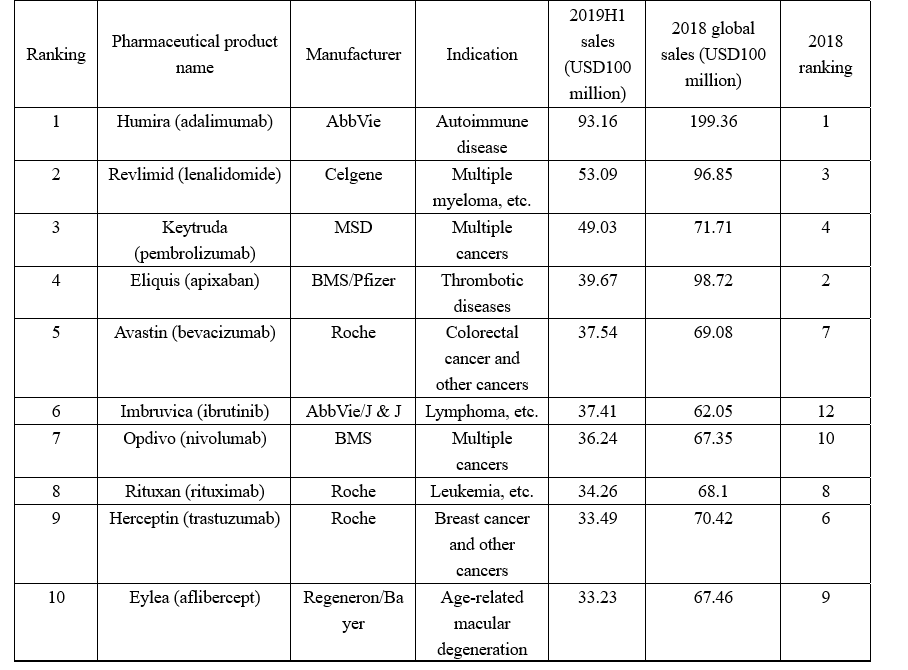

How time flies! I’ve obtained the statistics of the top 10 pharmaceutical products by sales in 2019H1 after organizing the financial reports of the companies. Please see the following table (sales of Eylea are converted into USD according to the exchange rate when the related statement was released). Adalimumab is expected to continue to top the list of pharmaceutical products by sales based on its sales in 2019H1, while, the 2019H1 sales of etanercept of which the sales ranked fifth in 2018 were eye-popping to reach only USD2.965 billion and the drug may not be among the top 10 pharmaceutical products by sales this year (Editor's Note: this year=2019, same as below). Here, I'd like to successively analyze the pharmaceutical products in the following table.

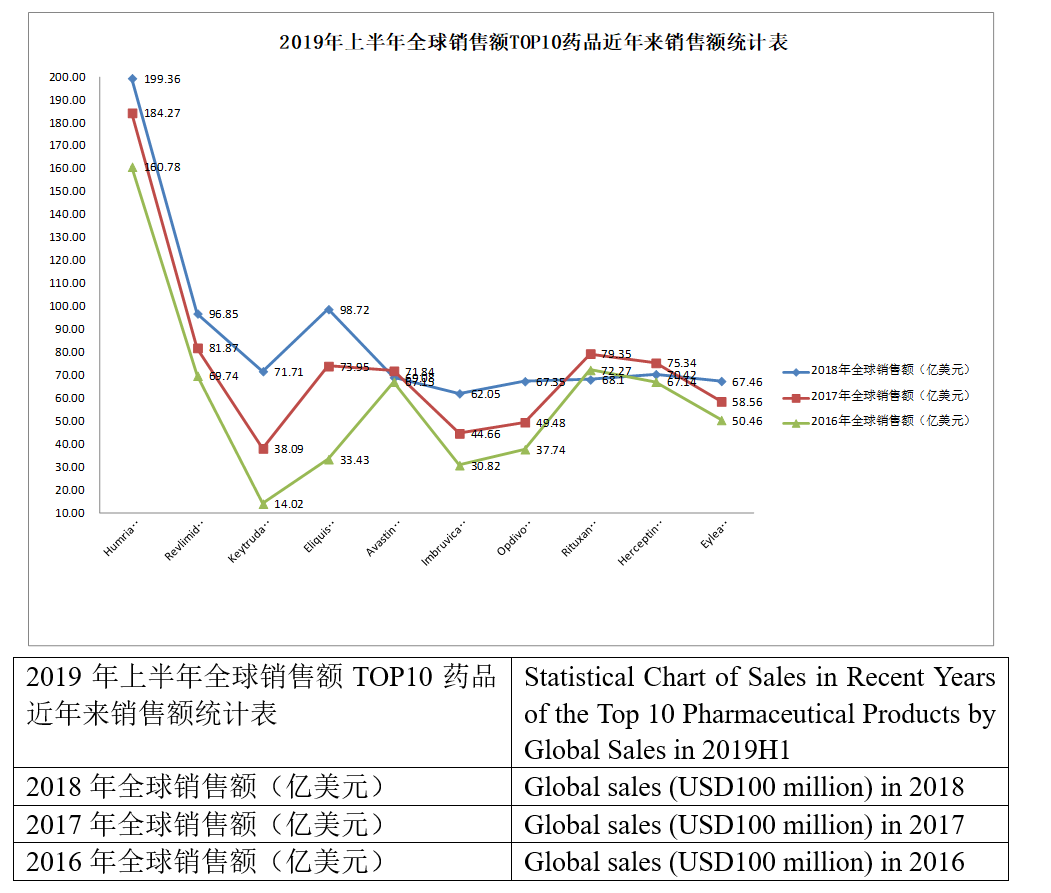

Developed by AbbVie, Humira (adalimumab) is the first fully human anti-TNF-α monoclonal antibody approved by the FDA. It was marketed in the U.S. in 2002, the EU region in 2003 and China in 2010 and has so far been approved for more than 10 indications. Humira‘s sales have been soaring since it was marketed, and it has topped the list of global pharmaceutical products by sales for years. However, the annual growth of Humira‘s sales has been slower than previous years with the patent expiration and the marketing of multiple biosimilars. Yet, its sales still far exceed the sales of the pharmaceutical product ranking second. But the hope that its annual sales will exceed USD20 billion might evaporate into a dream. It is worth mentioning that Humira has been reduced its price in China to cope with the impacts from generic drugs, and the first adalimumab similar--Bio-Thera‘s QLETLI has been approved by the NMPA for marketing at the beginning of this November, which is expected to be a tremendous impact to Humira in the future.

Revlimid (lenalidomide) is a new-generation immunomodulatory drug characterized by immunoregulation, anti-angiogenesis, and anti-tumor. Clinically, it is extensively used to treat multiple myeloma, lymphoma, myelodysplastic syndrome, and acute myelogenous leukemia, etc., being a drug commonly used in the world and China for multiple myeloma and myelodysplastic syndrome. Developed by Celgene, the original drug of lenalidomide was first approved for marketing in the U.S. in 2005 and approved in China in 2013. The annual sales of lenalidomide have been growing at a sustained and stable pace since it was marketed, and it has been the core product of Celgene over the years. Its global sales reached as high as USD9.685 billion in 2018, accounting for 63.4% of the annual revenue of Celgene. The annual sales of lenalidomide are expected to exceed USD10 billion in the future with the successful approval for indolent lymphoma and other indications. Enterprises have started to lay out the area given the huge market potential of lenalidomide. There have been two lenalidomide generic drugs approved in China, separately SL Pharm‘s Lisheng and Chia Tai Tianqing‘s Anxian. Furthermore, Jiangsu Hansoh, Yangtze River Pharmaceutical, and Qilu Pharmaceutical are also working on the approval of their lenalidomide generic drugs. However, it is learned that some patents of lenalidomide will not expire until 2027, which means that its market share will not be shaken before 2022.

As one of the anti-PD-1/PD-L1 monoclonal antibodies, an R&D hotspot in recent years, Keytruda (pembrolizumab) was first approved for marketing in the U.S. in Oct. 2015 and approved for marketing in China in July 2018. Marketed later than Opdivo, yet Keytruda has surpassed the latter to become the anti-PD-1 monoclonal antibody with the most extensive indications approved, and its sales surpassed Opdivo‘s sales in 2018 to rank fourth. Keytruda was approved by the FDA to treat esophagus cancer this July, while, the two pivotal Phase III clinical trials CheckMate-498 and CheckMate-459 of Opvido failed, therefore, Keytruda is expected to be the stable leader in the anti-PD-(L)1 monoclonal antibody area.

Eliquis is an oral, selective factor Xa inhibitor and the only oral anticoagulant that has performed better in risk reduction than warfarin in the 3 important prognoses of stroke or systemic embolism, major bleeding, and all-cause mortality. Co-developed by BMS and Pfizer, the drug entered China in 2013 and entered the new edition national reimbursement drug list (NRDL) in 2017. There has been a total of four xaban drugs approved at present, separately, rivaroxaban, apixaban, edoxaban, and betrixaban; wherein, rivaroxaban and apixaban account for most of the relevant market shares, and apixaban has particularly rapid growth, with the sales in 2017 fiscal year growing by about 50% year on year to surpass rivaroxaban to become the best-selling xaban anticoagulant. The apixaban generic drugs of Hansoh Pharmaceutical, Chia Tai Tianqing and Sichuan Kelun have been successively approved by the NMPA this year in China, therefore, the market competition in the area is expected to become fiercer in the future. Apixaban‘s sales may experience negative growth this year because its sales reached only USD3.967 billion in the first half of this year while its annual sales reached USD9.872 billion last year.

Avastin (bevacizumab) is a monoclonal antibody of Genentech, which can specifically bind to vascular endothelial growth factor (VEGF) protein. Its indications have covered colorectal cancer, breast cancer, lung cancer, kidney cancer, and ovarian cancer, etc. since it was approved by the FDA in Feb. 2004. The relevant generic drugs have appeared with the patent expiration, such as Amgen‘s Mvasi (approved in Sep. 2017) and Pfizer‘s Zirabev (approved in June 2019). In China, Qilu Pharmaceutical and Innovent have filed the marketing applications for their bevacizumab generic drugs, while, the bevacizumab generic drugs developed by enterprises such as Shanghai Henlius (Fosun Pharma), Sunshine Guojian Pharmaceutical, and Bio-Thera are at the clinical stage. As the review status of Qilu Pharmaceutical‘s "bevacizumab biosimilar" has been changed to "Under review", Qilu pharmaceutical hainan co ltd is expected to produce the first bevacizumab biosimilar in China soon. The annual sales of bevacizumab have not changed much over the years; its sales in 2018 were less than those in 2017, however, its sales this year may exceed those in 2018 given that its sales reached USD3.754 billion in the first half of this year.

Co-developed by AbbVie and J & J, Imbruvica (ibrutinib) is the world‘s first marketed once-daily oral BTK inhibitor and has been approved for 10 indications in 6 disease areas since it was approved by the FDA in 2013, however, the Phase III clinical trial of Imbruvica treating pancreatic cancer failed this year. Imbruvica‘s global sales have shown a tendency of straight climb since it was marketed, from USD692 million in 2014 to USD6.205 billion in 2018 to rank 12th among the list of global pharmaceutical products by sales in 2018, 3rd among small molecular drugs (the first was apixaban, and the second was lenalidomide) and 1st among tinib drugs. Its sales are expected to maintain some growth this year. AbbVie and J & J are advancing a huge clinical development project of Imbruvica treating tumors. The industry is very optimistic about the business prospects of Imbruvica. According to a report of the pharmaceutical market research firm EvaluatePharma, the global sales of Imbruvica will reach USD9.514 billion in 2024. Besides Imbruvica, the current BTK inhibitors approved also include AstraZeneca‘s acalabrutinib and BeiGene‘s zanubrutinib, with the latter being the first new anticancer product independently developed by a Chinese enterprise and approved by the FDA for marketing.

As the world‘s first marketed anti-PD-1 drug, Opdivo (nivolumab) has been approved indications including melanoma, metastatic NSCLC, advanced renal carcinoma, classical Hodgkin lymphoma, and head and neck cancer, etc. Since marketed, with the expansion of indications, Opdivo‘s sales have been growing steadily, however, Opdivo was surpassed in 2018 by Keytruda, and the exploration of new indications of Opdivo has not been smooth this year. Its sales are expected to maintain growth in the future, however, it may be impossible to exceed Keytruda.

As an anti-CD20 monoclonal antibody developed by Genentech, Rituxan (rituximab) was approved by the FDA in Nov. 1997. It was originally approved by the FDA to treat non-Hodgkin lymphoma and chronic lymphoid leukemia and successively approved to treat autoimmune diseases such as rheumatoid arthritis (RA), granulomatosis with polyangiitis (GPA), and microscopic polyangiitis (MPA) and has been approved by the FDA to treat moderate to severe pemphigus vulgaris (PV) in June last year. However, there have been relevant generic drugs marketed with the patent expiration, such as Celltrion‘s Truxima; furthermore, the relevant generic products of four Indian companies Torrent, Zenotech, Intas, and Hetero have also been marketed, and many Chinese enterprises have laid out the area, wherein, Henlius‘ Hanlikang has been approved for marketing. The growth of the annual sales of Rituxan has been slow in recent years and shown a downtrend. It is not clear as to whether the sales this year will be more than those of 2018.

Herceptin (trastuzumab) is a recombinant DNA-derived humanized monoclonal antibody developed by Roche. It was first approved by the FDA in 1998 and approved in China in 2002, with indications including breast cancer and gastric cancer. There have been related generic drugs approved for marketing with the patent expiration, such as Samsung Bioepis‘ Samfenet, and Celltrion‘s Herzuma. Furthermore, the related generic drugs of Indian companies Biocon and Mylan have been marketed since 2013, and Russia and Iran have approved the related generic drugs of their countries. Celltrion has marketed the related generic drug in South Korea in 2014, and the Chinese company CP Guojian Pharm (3SBio) has received the NMPA‘s approval for the related generic drug in 2014. Herceptin‘s sales have shown a downtrend as impacted by generic drugs, and based on its sales in the first half of this year, its sales this year are very likely to continue to decline.

As a kind of VEGF-binding Fc fusion protein co-developed by Regeneron and Bayer, Eylea (aflibercept) was approved by the FDA for marketing in Nov. 2011 and approved in China in Feb. 2018. It has been approved multiple indications including wet-AMD, retinal vein occlusion (RVO), secondary macular edema (ME), and diabetic macular edema (DME), etc. However, Eylea is under intense pressure (e.g.) from Chengdu Kanghong's Langmu, Genetech‘s Lucentis (ranibizumab), and Novartis‘ Beovu® (brolucizumab, RTH258). Eylea‘s sales have been excellent since it was marketed, rapidly growing from USD900 million to USD6.746 billion in 2018. However, based on its sales in the first half of this year, the growth trend of Eylea is still unclear this year, and it may not keep growing in the future.

Based on the analysis above, the top 10 pharmaceutical products by sales in 2019H1 included 6 monoclonal antibodies, 3 small molecule drugs (lenalidomide, apixaban, and ibrutinib), and 1 fusion protein drug (aflibercept). Compared to the top 10 pharmaceutical products by sales in 2018, adalimumab is expected to still top the list in 2019, ibrutinib is expected to be ranked in 2019, etanercept is highly likely to be edged out in 2019, and other pharmaceutical products will only change in their rankings.

References:

[1] Janssen Receives Positive CHMP Opinion Recommending Expanded Use of Imbruvica (ibrutinib) in Two Indications in Europe

[2] Safety and Activity of the Investigational Bruton Tyrosine Kinase Inhibitor Zanubrutinib (BGB-3111) in Patients with Mantle Cell Lymphoma from a Phase 2 Trial, Retrieved January 29, 2019

-----------------------------------------------------------------------

Editor's Note:

To become a freelance writer of En-CPhI.CN,

welcome to send your CV and sample works to us,

Email: Julia.Zhang@ubmsinoexpo.com.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025