KevinMarch 14, 2025

Tag: Innovative drugs , Chinese Market , R&D

Abstract: Over the past decade, China's innovative drug market has experienced remarkable transformation and growth. With the combined drive of policies, technology, and capital, China's innovative drug industry has entered a golden period of growth. This paper provides a detailed analysis of the current status and research progress of China's innovative drug market from five perspectives: market size and growth, policy support, technological advancement, overseas market expansion, and capital market support.

The rapid advancement of biopharmaceutical technologies has provided robust support for innovative drug R&D. For instance, the application of cutting-edge technologies such as gene editing, cell therapy, and targeted therapy has yielded remarkable results in treating cancers, rare diseases, and other conditions for innovative drugs. Notably, 91 new drugs were added to the catalog of medicines covered by national medical insurance system in 2024, with 38 of these being "world-first" innovative drugs - a record high in both proportion and absolute numbers.

Over the past decade, China's innovative drug market size has grown at a remarkable pace. In 2019, China's innovative drug market was valued at USD 132.5 billion. By 2023, the market size had surpassed RMB 700 billion. By 2024, it had further expanded to over RMB 1.13 trillion. According to the forecast of Forward Industry Research Institute, the innovative drug market size in China is expected to reach nearly RMB 2.3 trillion by 2030. Among them, the factors driving the continuous growth of China's innovative drug market size are as follows:

In 2015, reforms in drug review processes were initiated, reducing clinical trial approval times from three years to 60 days. Priority review channels have accelerated the launch of innovative drugs made in China such as PD-1. Additionally, through annual medical insurance negotiations, the hospital admission cycle for innovative drugs has been shortened from five years to just 1.5 years, accelerating their commercialization and market adoption. Meanwhile, the dynamic adjustment of the medical insurance catalog and policies that prioritize the inclusion of innovative drugs in medical insurance have further accelerated their market penetration. For example, medical insurance expenditures on innovative drugs reached RMB 90 billion in 2023 - a 14-fold increase from 2019.

The demand for innovative drugs in China continues to grow. With the aging population and shifting disease patterns, the need for innovative drugs is rising, particularly in fields such as tumor, cardiovascular diseases, and neurological disorders. With over 400 million patients suffering from complex conditions such as tumor and autoimmune diseases, the demand for targeted drugs like PD-1 and CAR-T treatments has increased dramatically.

The increase in enterprise R&D investment has promoted the R&D and marketing of more innovative drugs. For instance, by rapidly targeting internationally recognized hotspots such as VEGF and EGFR, companies like Fosun Kite and Innovent have expedited their product launches. However, China's innovative drug market is still in its early stages compared to developed countries. In the United States, innovative drugs make up 80%, whereas in China, the figure is only around 10%. However, this gap is closing rapidly, and it is anticipated that by 2025, China will likely become the world's second-largest market for innovative drugs.

Technological advancement is the core driving force behind the rise of China's innovative drug market. In recent years, China has achieved remarkable breakthroughs in the R&D of innovative drugs, particularly in cutting-edge fields such as bispecific antibody, ADCs (antibody-drug conjugates), and CAR-T cell therapy, reaching a level of international excellence. For example, PD-1/VEGF bispecific antibody of Akeso, Inc. broke the record for the largest overseas licensing deal for a single product by a Chinese pharmaceutical company in 2022, with a deal worth USD 5 billion. China's innovative drug R&D has mainly progressed through the following three key stages:

PD-1 monoclonal antibody breakthrough: This stage was primarily focused on rapidly following international hot targets, with pharmaceutical companies in China developing 37 PD-1/PD-L1 monoclonal antibodies, leading to a large-scale R&D trend. These me-too drugs lower production costs, enabling PD-1 (made in China) to be priced at one-third of the cost of imported versions, significantly improving clinical accessibility.

Rise of new therapies: There have been technological breakthroughs in the fields of antibody-drug conjugates (ADCs) and bispecific antibodies, with a significant increase in the number of clinical developments. While China has made preliminary progress in areas such as cell therapy, core technologies still require further breakthroughs.

Gene therapy breakthroughs: Companies such as Neurophth have completed dual regulatory submissions for gene therapy in both China and the United States, marking a significant accumulation of technological expertise in cutting-edge fields like gene editing. Additionally, Academician Wang Guangji of the Chinese Academy of Engineering has emphasized the need to enhance in vivo tracking technology R&D for cell therapeutic drugs to boost international competitiveness.

Integrated development of industry-university-research: The integration model of industry-university-research is accelerating, with scientific research institutes focusing on the discovery of new targets and companies promoting technological transformation. The 2024 Implementation Plan for Full-Chain Support of Innovative Drug Development further strengthens the connection between basic research and industrial applications.

Policy support is one of the critical factors behind the rapid growth of China's innovative drug market. In recent years, the Chinese government has implemented a range of policies to drive the R&D, and market access of innovative drugs. For example, the government has utilized a combination of policies, including price management, medical insurance reimbursement, commercial insurance, drug distribution and usage, as well as investment and financing, to optimize the drug review and approval processes and the assessment mechanisms for healthcare institutions, thereby collectively advancing the breakthroughs and development of innovative drugs. These coordinated initiatives provide robust policy support for the R&D and commercialization of innovative drugs, thereby fostering the sustained and healthy development of the pharmaceutical industry. Notably, the number of first-in-class IND submissions received by the Center for Drug Evaluation, NMPA (CDE) has steadily increased since 2017, reaching 1,241 in 2023, with a year-on-year increase of 31.7%. This indicates that policy initiatives have stimulated a more active R&D and registration process for innovative drugs.

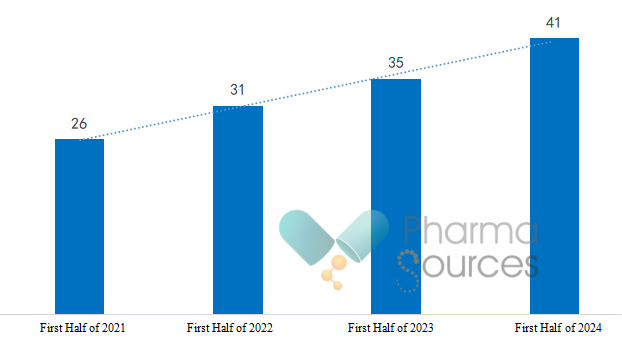

Number of New Drug Projects Included in Center for Drug Evaluation Breakthrough Therapy Designation Drug Variety (2021 - H1 2024) (Source: CDE Official Website)

In 2024, "innovative drugs" were for the first time incorporated into the government work report, reflecting the country's strong focus on the development of the innovative drug industry. The adjustments in medical insurance policies have also provided strong support for the growth of the innovative drug market. More than 80% of innovative drugs are incorporated into the medical insurance system within two years of approval, greatly shortening their market entry timeline. These policies reduce the financial burden on patients and enhance the accessibility of innovative drugs in the market.

Expanding into overseas markets is a key development direction for Chinese innovative pharmaceutical companies. In recent years, the globalization of Chinese innovative drugs has been progressing rapidly. In 2024, the number of overseas licensing deals for Chinese innovative drugs reached 147, with the total disclosed transaction value reaching USD 36.6 billion, with a year-on-year increase of 68%. This demonstrates that the recognition and competitiveness of Chinese innovative drugs in the global market are steadily growing.

The advantages of Chinese innovative drugs going global are mainly reflected in two aspects:

Firstly, the global innovative drug market has a massive demand, especially in developed countries where strong purchasing power and high pricing flexibility create vast market opportunities for Chinese innovative drugs;

Secondly, the cost advantage in R&D enables Chinese innovative drugs to be more competitive in the international market. For example, BeiGene's Brukinsa (Zanubrutinib) was approved for marketing in the United States, signifying the formal entry of Chinese innovative drugs into the global market.

The support from the capital market has provided strong financial backing for the development of Chinese innovative drugs. In recent years, China's multi-tiered capital market service system has continuously improved, providing innovative pharmaceutical companies with diversified financing channels. For instance, the biopharmaceutical sector has raised nearly RMB 200 billion over the past five years since the launch of the STAR Market, leading to several innovative pharmaceutical companies achieving valuations exceeding RMB 10 billion. And the Hong Kong Stock Exchange's 18A rules support the listing of unprofitable biotech companies, providing an important financing platform for innovative pharmaceutical companies. According to iFinD data, as of 2024, there were 166 innovative drug concept companies in the A-share pharmaceutical and biotechnology industry, with a total market capitalization of RMB 2.7 trillion.

Furthermore, the capital market has supplied funding for innovative pharmaceutical companies and promoted industry consolidation and development through mergers and acquisitions. For example, there was a surge in mergers and acquisitions cases on the Hong Kong market in 2024. It is projected that by 2027, there will be 3 to 5 biopharma companies in the A/H-share markets with market capitalizations exceeding RMB 100 billion. This indicates that the capital market has played a crucial role in driving the transformation of innovative pharmaceutical companies from Biotech to Biopharma.

In summary, the past decade has been a golden period for the rapid growth of China's innovative drug market and a critical phase in the country's transition from a major pharmaceutical player to a global pharmaceutical powerhouse. Looking ahead, China's innovative drug market is expected to maintain its strong growth momentum and contribute even more to the global pharmaceutical market with continued support from policies, technological advancements, and capital investment.

1. Brukinsa® (Zanubrutinib) Approved in the United States for the Treatment of Chronic Lymphocytic Leukemia. Retrieved January 20, 2023, from https://mp.weixin.qq.com/s/kRLQ19NYVpM4vGmZ7M-5TA

2. https://www.businesswire.com/news/home/20210901006049/en/U.S.-FDA-Grants-BRUKINSA%C2%AE-Zanubrutinib-Approval-in-Waldenstr%C3%B6m%E2%80%99s-Macroglobulinemia

3. China Innovative Drug Industry Research Report 2024.

4. Overview of China's Innovative Drug Field Development in the First Half of 2024

5. 2024 Annual Innovation White Paper of Innovative Drugs and Supply Chain.

6. 2025 Panorama Spectrum of China's Innovative Drug Industry

Kevin, specializing in drug clinical evaluation, rational drug use, and pharmaceutical management research.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025