Xiao YanMarch 14, 2025

Tag: TCM , Sales Volume , Traditional Chinese Medicine , TOP 10

During the critical period from 2016 to 2024, significant progress has been made in the R&D and marketing of new drugs of traditional Chinese medicine, with 29 (excluding extracts) approved for marketing. It is particularly gratifying that 27 of these new drugs have been included into China's National Reimbursement Drug List (Category B).

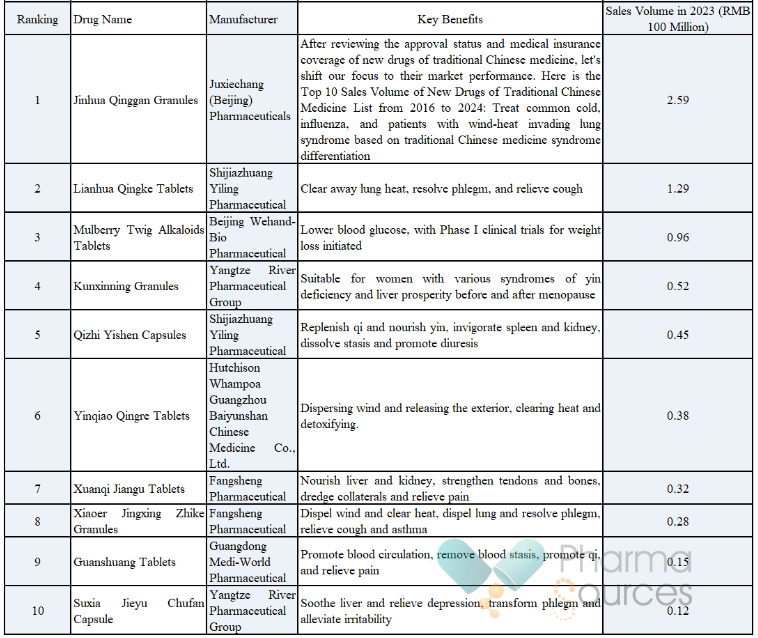

After reviewing the approval status and medical insurance coverage of new drugs of traditional Chinese medicine, let's shift our focus to their market performance. Here is the Top 10 Sales Volume of New Drugs of Traditional Chinese Medicine List from 2016 to 2024:

It can be seen that Jinhua Qinggan Granules tops the list with sales volume of RMB 259 million. As the first traditional Chinese medicine drug developed and validated through evidence-based medical standards, including randomized, double-blind, multi-center, placebo-controlled tests, this Chinese patent medicine has been proven effective both in China and in the globe, playing a crucial role in fields of treating colds and influenza. Especially during the COVID-19 pandemic, as a recommended Chinese patent medicine by the National Health Commission, it gained widespread public recognition. Lianhua Qingke Tablets comes in second with sales volume of RMB 129 million, known for their effectiveness in clearing away lung heat, resolving phlegm, and relieving cough.

Compared to the sales volume of innovative drugs of chemicals and biological drugs, however, there is still a long way to go for the new drugs of traditional Chinese medicine in this top 10 list. For instance, in 2023, Anlotinib, one of the leading innovative drug of chemicals, generated sales volume of RMB 3.66 billion, and numerous innovative biological drugs also significantly outperformed new drugs of traditional Chinese medicine in terms of sales volume. The best-selling new drug of traditional Chinese medicine, Jinhua Qinggan Granules, has a sales volume that is not even one-tenth of that of the innovative drug of chemicals Anlotinib. Moreover, the entry threshold for the Top 10 is merely RMB 10 million, whereas the threshold for the Top 10 innovative chemical and biological drugs reaches RMB 1.4 billion, highlighting a significant disparity.

Jinhua Qinggan Granules and Lianhua Qingke Tablets have secured leading positions in the top 10 sales volume of new drugs of traditional Chinese medicine, and their success is no accident.

From a market performance perspective, since being approved for marketing in 2016, Jinhua Qinggan Granules has seen consistent growth in sales volume. In 2023, its sales volume soared to RMB 259 million, securing a significant position in the market for cold and influenza drugs. The National Health Commission's endorsement of this Chinese patent medicine during the COVID-19 pandemic has greatly increased its popularity, leading many patients to proactively purchase it during the influenza season. Lianhua Qingke Tablets approved for marketing in 2020, achieving sales volume of RMB 133 million in 2022, followed by a dip to RMB 129 million in 2023. Despite this minor drop, it is making its mark in the cough medicine market. During peak respiratory disease season, many pharmacies consider it as their top recommended cough remedy.

In terms of applicable conditions, Jinhua Qinggan Granules are used to treat common colds and influenza, particularly for patients with wind-heat invading lung syndrome based on traditional Chinese medicine syndrome differentiation. The medication effectively alleviates symptoms such as fever, headache, and generalized body aches. During influenza season, many patients observed that after taking Jinhua Qinggan Granules, their fever and headache symptoms were significantly alleviated, leading to a faster recovery. Lianhua Qingke Tablets focuses on clearing away lung heat, resolving phlegm, and relieving cough, particularly effective for cough and phlegm caused by acute tracheobronchitis and bronchitis. Some bronchitis patients reported that after taking Lianhua Qingke Tablets, their coughing frequency decreased, and it became easier to expel phlegm.

There are multiple reasons for the sales growth of both products. From the perspective of the products themselves, they have a clear efficacy in targeting common illnesses, which effectively address patients' health issues. Moreover, during the R&D process, strict medical standards were followed. Jinhua Qinggan Granules, for instance, is a Chinese patent medicine developed and validated based on evidence-based medicine standards, providing strong assurance of the product's efficacy. From a marketing perspective, during the pandemic, these products were extensively publicized and promoted as anti-epidemic medications, and their popularity increased rapidly. In addition, their inclusion in medical insurance coverage has made them more affordable to patients, further driving sales growth.

Although new drugs of traditional Chinese medicines have made positive strides in being approved for marketing and included in medical insurance coverage, their overall sales volume performance has been disappointing. The main reasons are as follows.

From a market environment perspective, some innovative drugs of traditional Chinese medicine were brought to market at a less-than-ideal time. Except for Jinhua Qinggan Granules, most innovative drugs of traditional Chinese medicine were launched from 2019 to 2021, coinciding with the outbreak of the pandemic. During the pandemic control period, the normal medical service operations in hospitals were disrupted to some extent, leading to a decrease in patient visits and making it difficult to carry out regular drug promotion activities. Aside from Jinhua Qinggan Granules, Lianhua Qingke Tablets, and other anti-epidemic drugs, the sales of most innovative drugs of traditional Chinese medicine products were sluggish. Many pharmaceutical companies had to cancel their originally planned in-person new drug promotion campaigns. Consequently, both doctors and patients had limited opportunities to learn about the new drugs of traditional Chinese medicine, creating significant obstacles for their market promotion.

The implementation of the centralized procurement policy has also had an impact on innovative drugs of traditional Chinese medicine. Take Mulberry Twig Alkaloid Tablets as an example. During its R&D process, it was positioned as a competitor to the Western drug Acarbose, which boasts an annual sales volume of over RMB 2 billion. The goal was to capture a share of the antidiabetic drug market. However, when Mulberry Twig Alkaloid Tablets entered the market, Acarbose was included in the centralized procurement program, leading to a significant price reduction - from RMB 60 per box to just RMB 6. This drastic price drop severely squeezed the market space for Mulberry Twig Alkaloid Tablets. Potential patients may have opted for the lower-priced medication included in centralized procurement, resulting in significant market competition pressure for Mulberry Twig Alkaloid Tablets and slow sales volume growth.

A company's strategic planning also affects the commercialization of innovative drugs of traditional Chinese medicine to a certain degree. Some companies, despite obtaining approval for innovative drugs, have not prioritized them as key products due to strategic considerations regarding their existing product markets. Some could be less enthusiastic about promoting new drugs due to concerns that it could interfere with the stable revenues generated by their existing products, which already occupy a certain market share. This leads to insufficient promotion efforts for new drugs of traditional Chinese medicine, making it challenging for them to gain widespread market recognition and acceptance.

Fierce market competition is another crucial factor behind the sluggish sales volume of new drugs of traditional Chinese medicine. Some traditional markets for products like kidney tonics and rheumatism drugs have become highly competitive "red ocean". If new products lack differentiated selling points, even if they are approved for marketing, it will be difficult to challenge the market position of established brands. In the kidney-tonifying traditional Chinese medicine market, where numerous well-known brands already exist, new innovative drugs of traditional Chinese medicine without unique therapeutic effects, ingredients, or other competitive advantages will struggle to attract consumer attention, making market promotion extremely challenging.

Additionally, the inherent characteristics of traditional Chinese medicine itself also impact its commercialization. The complex theoretical system of traditional Chinese medicine and its relatively long feedback cycle for efficacy evaluation often result in a slow start during the first 5 years after market entry. Unlike Western medicine, which relies on "novelty" to quickly capture market share and achieve rapid sales growth in the short term, traditional Chinese medicine, despite its longer life cycles and greater growth potential after 5 years, faces slower sales volume acceleration in early stages due to this slow development pattern.

Additionally, it takes time for physicians to recognize the therapeutic value of innovative drugs of traditional Chinese medicine. New drugs of chemicals and biological drugs often achieve breakthrough advancements in mechanisms or efficacy, with clinical data demonstrating significantly superior therapeutic effects compared to older varieties. In contrast, new drug of traditional Chinese medicine often struggle to demonstrate a significant improvement in efficacy over older varieties, requiring more time for validation and acceptance. This makes it difficult for innovative drugs of traditional Chinese medicine to gain a competitive edge quickly in the market. Many physicians remain more cautious in their medication choices and may adopt a wait-and-see approach toward new drugs of traditional Chinese medicine that require extended time to validate their efficacy, prioritizing the use of well-established drugs with extensive clinical experience. This further constrains the market expansion of new traditional Chinese medicine products.

Despite current challenges in sales volume performance, new drugs of traditional Chinese medicine hold promising prospects for future development, contingent on identifying breakthrough strategies and clarifying development direction.

From a R&D perspective, focusing on specialized fields is key. The aging population has elevated age-related chronic conditions - such as cardiovascular diseases and diabetes - to major public health priorities. The R&D of new drugs of traditional Chinese medicine should focus on these fields by leveraging its inherent strengths in regulating bodily functions and alleviating chronic symptoms. For instance, in diabetes treatment, new drugs of traditional Chinese medicine could target not only blood glucose reduction but also holistic patient health improvement and complication risk mitigation. Certain traditional Chinese medicine compounds with demonstrated effects in regulating blood glucose/lipid levels and enhancing microcirculation hold promise as next-generation therapeutics for diabetes. In addressing pediatric conditions such as childhood colds and coughs, the R&D of child-friendly new drugs of traditional Chinese medicine with palatable tastes and convenient administration can effectively meet market demands. While Western medicines currently dominate the pediatric drug market, traditional Chinese medicine holds unique advantages in symptom relief and immune system enhancement. Developing child-oriented new drugs of traditional Chinese medicine would provide safer, more holistic healthcare options for children.

Furthermore, synergistic collaboration between R&D and sales is also critical. Pharmaceutical companies should not only focus on the R&D process but also place great importance on the market promotion of new drugs. On one hand, the R&D process must thoroughly account for market demands and patient acceptability. For instance, innovations in pharmaceutical dosage form by developing tablets, capsules, and other convenient dosage forms can enhance portability and ease of administration, thereby improving patient compliance. On the other hand, sales teams must deeply understand the unique features and advantages of new drugs to formulate targeted marketing strategies. Establishing strong collaborative relationships with healthcare institutions and physicians, combined with academic promotion and clinical validation, will help improve physicians' recognition of and willingness to prescribe these new drugs. Pharmaceutical companies can further leverage Internet platforms to conduct online promotion and sales, thereby expanding the market reach of new

Looking ahead, with increasing government supports for traditional Chinese medicine and continuous innovation in TCM theories and technologies, new drugs of traditional Chinese medicine are expected to achieve greater breakthroughs in the market. The globalization of traditional Chinese medicine is also accelerating, providing new drugs of traditional Chinese medicine with opportunities to enter international markets and expand their growth potential. In the international market, new drugs of traditional Chinese medicine can attract more global patients by leveraging their unique therapeutic effects and safety profile. Some new drugs of traditional Chinese medicine that demonstrate significant efficacy in treating chronic diseases and complex conditions may emerge as new highlights in the global pharmaceutical market. As long as new drugs of traditional Chinese medicine identify the right development direction and continuously innovate and make breakthroughs, they will surely occupy an important position in the pharmaceutical market in the future.

[1] MENET

[2] National Medical Products Administration Official Website

[3] BJNEWS.COM.CN Improved listing efficiency: In the past year, four Class 1.1 new drugs of traditional Chinese medicine have been approved [EB/OL]. [January 8, 2025]. http://m.toutiao.com/group/7457479158688498185/?upstream_biz=doubao

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025