Krebs QinMarch 14, 2025

Tag: Biologics , Small molecule drugs , generics , biosimilars

The choice between small molecule drugs and biologics for the drug model developed for a certain indication has indeed become a significant strategic dilemma for drug manufacturers. This decision is further complicated by evolving regulatory landscapes, such as the Inflation Reduction Act (IRA) in the United States, which treats small molecule drugs and biologics differently. The IRA stipulates that small molecule drugs will become eligible for Medicare's price negotiation process in 7 years of launch, and the "fair price" implemented after negotiation will take effect in 9 years. The periods for biologics are 11 years and 13 years respectively.

In addition to IRA, biologics have also gained greater benefits compared to small molecule drugs thanks to a longer exclusivity period. Biologics can be granted 12 years of competitive protection for biosimilars, compared to the competitive protection for generics of 5 years granted to new small molecule drugs. The policy preference for biologics of the United States Congress is dependent on the fact that more time and resources are required to develop biologics and the patent protection is weaker, for which manufacturers need additional protection to recoup their development costs and receive an adequate return on investment. However, this hypothesis has always been one of the focus topics of debate between drug manufacturers and legislatures. A recent paper published in the Journal of the American Medical Association specifically looked into this hypothesis. This study compares biologics and small molecule drugs with their respective up-to-date data on development time, clinical trial success rate, R&D cost, patent protection, exclusivity period, revenue and treatment cost.

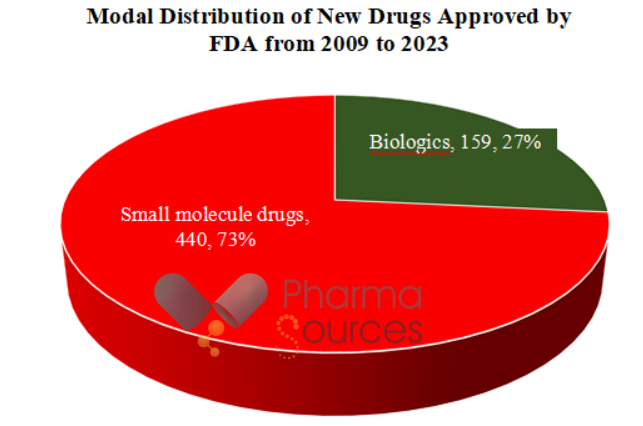

The study finds that from 2009 to 2023, FDA approved 599 new therapeutic drugs,

· including 159 (27%) biologics and 440 (73%) small molecule drugs (Figure 1).

Figure 1. Modal Comparison of New Drugs Approved by FDA from 2009 to 2023.

· The median development time for biologics was 12.6 years (IQR=10.6-15.3 years), while that for small molecule drugs was 12.7 years (IQR=10.2-15.5 years). Notably, the P-value of the two groups is 0.76, which shows that there is no significant difference in development costs between the two groups.

· Biologics boast a higher clinical trial success rate at every stage of development.

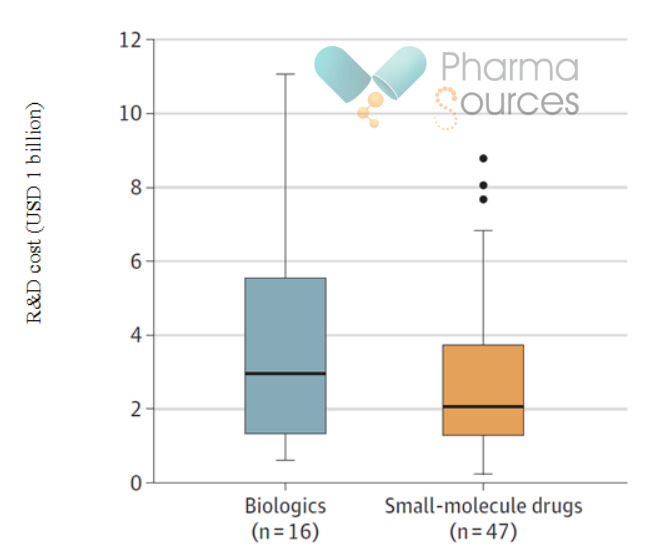

Figure 2. Box Plot of Development Costs for Biologics and Small Molecule Drugs. (Source: JAMA)

· The median development cost is estimated to be USD 3 billion (IQR=USD 1.3 billion - USD 5.5 billion) for biologics, while that for small molecule drugs is USD 2.1 billion (IQR=USD 1.3 billion - USD 3.7 billion) (Figure 2). In this comparison, the P-value of the two groups is 0.39, which also shows that there is no significant difference in development costs between the two groups.

· The median of patent protections for biologics is 14 (IQR=5-24 patents), while that for small molecule drugs is 3 (IQR=2-5 patents). In terms of the number of patents, there is a significant difference between small molecule drugs and biologics (P-value < 0.001).

· The median of patent protections for biologics is 14 (IQR=5-24 patents), while that for small molecule drugs is 3 (IQR=2-5 patents). In terms of the number of patents, there is a significant difference between small molecule drugs and biologics (P-value < 0.001).

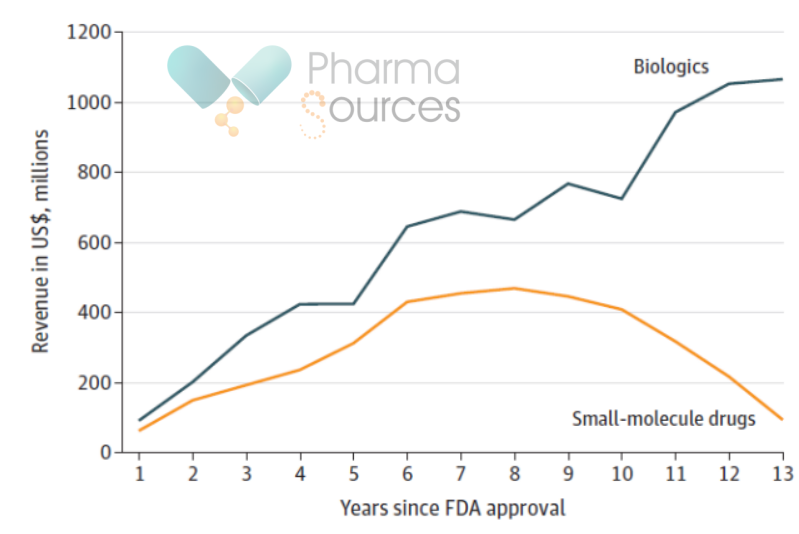

Figure 3. Comparison of the Annual Median Sales Volume of Biologics and Small Molecule Drugs after Approval. (Source: JAMA)

· The median year for peak sales volume of biologics is the 13th year, and its median peak sales volume is USD 1.1 billion (IQR=USD 500 million - USD 2.9 billion); and the median year of peak sales volume of small molecule drugs is the 8th year, and its median peak sales volume is USD 500 million (IQR=USD 100 million - USD 1.2 billion). The P-value of 0.01 on the median peak sales volume of the two groups indicates that there is a significant difference between small molecule drugs and biologics in terms of sales volume. What's more, biologics have a higher annual median sales volume after FDA's approval than small molecule drugs (Figure 3).

· From the perspective of pricing, the average annual cost of treatment is USD 92,000 (IQR=USD 31,000 - USD 357,000) for biologics and USD 33,000 (IQR=USD 4,000 to USD 177,000) for small molecule drugs. The P-value between the two groups in terms of annual cost is 0.005, indicating that biologics are significantly more expensive than small molecule drugs in terms of treatment cost.

Considering the data and analyses presented above, next, we will discuss whether legislators' preferential policies for biologics are reasonable.

The policy basis for the setting of IRA and exclusivity period lies on the hypothetical development costs, risks and revenue potential of different modal drugs. However, an analysis of the data from past 15 years reveals that the success rate of biologics in each clinical stage is higher than that of small molecule drugs, and there is no statistically significant difference in development time and cost. With regulatory approval, the patent thickets of biologics are denser, each type of products is exposed to more patent infringement claims, and the exclusivity period is longer than that of small molecule drugs. The time-honored medicine brand Humira's "long-living competitiveness" provides the most convincing proof. In addition, the price of biologics is higher than that of small molecule drugs, so is its sales volume. These findings challenge the foundational assumptions underlying the efforts of legislatures to establish protective policies for biologics.

Proponents of the Biologics Price Competition and Innovation Act argued that biologics do not benefit from patent protection as effectively as small molecule drugs, so they advocated for the United States Congress to set up a 12-year exclusivity period for biologics in addition to patent protection. However, the study published in JAMA shows that the number of patents for biologics is 4 times that of small molecule drugs, which can better resist the competition of generics.

When it comes to patent protection, legal proceedings serve as an important tool for branded drug manufacturers to get ahead of their competitors, which can't be more evident in Humira. The data of this study shows that the manufacturers of biologics claim 12 times as many patent infringements on each product involved in litigation as those of small molecule drugs. Contrary to the expectations at the time when the Biologics Price Competition and Innovation Act was passed, biologics patents may be more effective than patents for small molecule drugs in slowing down biosimilar market entry. One of common strategies employed by biologics manufacturers is to secure new patents before the expiration of the 12-year exclusivity period, which can at least bring challenges to biological drug manufacturers by delaying them. In other words, patent protection has erected substantial legal barriers for them. As such, the extension of exclusivity period is even more untenable.

In clinical research, the process for biosimilars to enter the market is not even close to find its relief. Unlike most small molecule drugs (which require only bioequivalence data), biosimilars must undergo extensive clinical trials to secure FDA approval. This requirement significantly increases the complexity and investment needed for market entry. Moreover, the policy regarding interchangeability labeling for biosimilars remains in place. This means that not all approved biosimilars can be automatically substituted for originator drugs at pharmacies. To obtain the interchangeability, developers must invest additional time and resources to gather the data mandated by the FDA. Furthermore, the willingness and probability of prescribers to switch from biologics to biosimilars (i.e., replacing originator drugs with biosimilars) are markedly lower than those for small molecule generics. Collectively, these factors invisibly safeguard the market position of branded biologics and slow their "phase-out" process, advantages that small molecule drugs cannot match.

The result of these disparities is that biosimilars typically capture only 25% of the market share of the original branded biologics within two years of entering the market. In contrast, small molecule generics usually seize 65% to 90% of the market share within one year of their entry. What closely related to market share is the price decline of branded drugs. The average price reduction for biologics two years after the entry of biosimilars is a mere 10%, whereas the price reduction for small molecule drugs one year after the launch of generics is substantial, often reaching a level of "halving". This also explains why the peak sales volume for small molecule drugs arrives so swiftly (Figure 3).

Compared with small molecule drugs, biologics enjoy a longer exclusivity period, thereby generating higher total revenue. The median revenue for biologics over their life cycle is USD 3.7 billion, nearly twice that of small molecule drugs, which have a median revenue of USD 2 billion. Given the median development costs of biologics (USD 3 billion) and small molecule drugs (USD 2.1 billion), biologics appear more valuable to drug manufacturers.

The results of this JAMA study indicate that there is little evidence to support the notion that biologics rightfully enjoy a longer exclusivity period, or a longer period of independent pricing compared with small molecule drugs. The legislation in the United States appears to disproportionately favor biologics, while the development of small molecule drugs holds several unparalleled advantages over biologics in certain aspects, such as drug stability, pharmacokinetics, oral delivery, targeting intracellular targets, low immunogenicity, and supply chain management. The legislatures' unfavorable policies regarding the development of small molecule drugs may influence the modal selection of drug manufacturers when developing a particular drug. Such external influences are more artificial in nature, rather than a natural selection process.

In response to the "unfair" policy-making in the commercialization of small molecule drugs, the United States Congress has initiated relevant discussions and introduced the EPIC Act (Ensuring Pathways to Innovative Cures Act), which has garnered bipartisan support but has yet to be finalized. The EPIC Act proposes to unify the price negotiation exemption period for small molecule drugs and biologics to 13 years. This measure aims to ensure that drug manufacturers have sufficient time to recoup their development costs, providing a fairer competitive environment for small molecule drug R&D, and encouraging greater innovation.

Beyond the EPIC Act, the Orphan Cures Act seeks to expand the exemption scope for small molecule orphan drugs, while the MINI Act aims to extend the protection period for drugs targeting specific genes (such as siRNA therapies) to 13 years. These drugs are currently classified as small molecule drugs. All three acts have received bipartisan support. However, considering the potentially significant role of the IRA in balancing the United States federal budget, efforts to secure price negotiation exemptions for small molecule drugs may face considerable obstacles.

Organizations and individuals opposing the so-called "small molecule penalty" strategy represented by the IRA argue that it may reduce the expected United States market revenue of selected small molecule drugs for price negotiations by 8%. This could lead to a USD 232.1 billion reduction in R&D investment over 20 years, resulting in the development of 177 fewer small molecule drugs. Moreover, a nine-year period may be insufficient for manufacturers of some small molecule drugs to recover their R&D costs. The modal selection effect of the IRA has already begun to emerge. For example, Pfizer has announced a strategic shift in its oncology pipeline, primarily towards biologics. This shift may accelerate the existing trend of increasing the proportion of biologics in the global R&D pipeline. Analysts predict that the impact of the IRA on the industry's overall direction may not become apparent until 2026.

Ref.

Cohen, J. P. Inflation Reduction Act Favors Biologics Over Small Molecules: In The Long Term, This Could Partly Undermine Bill’s Effort To Contain Costs. Forbes. 15. 01. 2023.

Wouters, O. J. et al. Differential Legal Protections for Biologics vs Small-Molecule Drugs in the US. JAMA. Published online November 25, 2024. doi:10.1001/jama.2024.16911

Hargreaves, B. Pushback Against IRA’s Controversial ‘Pill Penalty’ Faces Stiff Budgetary Headwinds. Biospace. 11. 12. 2024.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025