Krebs QinDecember 20, 2024

Tag: Weight Loss Market , M&A , Wegovy

The development of weight-loss drugs is currently one of the hottest topics in the pharmaceutical industry. Some analyst firms even predict that the market for weight-loss drugs will grow to a size of USD 200 billion in the future, rivaling the current market for oncology products. Therefore, many biopharmaceutical and technology companies are eager to enter this market with enormous development potential. In Q3 of this year, Novo Nordisk's weight-loss drug Wegovy achieved sales performance of USD 2.5 billion, and it is projected to reach global sales volume of USD 13 billion next year, catapulting it into the top ten list of blockbuster drugs in one fell swoop. Despite the dominance of Novo Nordisk's Wegovy and Eli Lilly's Zepbound in the current weight-loss drug market, there are still a number of weight-loss drug developers who are pushing ahead with their projects, believing that "it's not too late for wildflowers to bloom". Meanwhile, in a parallel battlefield, the competition for acquiring weight-loss drug projects and companies is undergoing intense overt and covert struggles.

The latest hot acquisition target is Viking Therapeutics, founded 12 years ago and headquartered in San Diego, California.

Viking Therapeutics' oral peptide weight-loss drug VK2735 has demonstrated high efficacy and safety in Phase I clinical trials, attracting widespread attention in the industry. VK2735 is a dual GLP-1/GIP receptor agonist. In its Phase I study, subjects experienced significant weight loss, and VK2735 showed good safety and tolerability. In the highest dose group of 100 mg, VK2735 achieved a placebo-adjusted weight loss rate of 6.8% over 28 days, a figure that has impressed the industry. While many analysts are optimistic about the future of VK2735, they also believe that Viking Therapeutics will be the next hot acquisition target for pharmaceutical giants.

Viking does not have stable capital injection, and achieving the goal of bringing VK2735 to market alone is somewhat challenging, especially considering that the research on the oral version is still in Phase I and the subcutaneous injection clinical trials are only in Phase II. Therefore, a substantial capital injection is required to make the product market-ready. Previously, Viking seemed to be in a state of "waiting for the right price", awaiting the achievement of key milestones. Now, with the release of Phase I data for the oral preparation, it seems to be the best time, making Viking's acquisition a transaction that is increasingly becoming a reality.

Several large companies, including Pfizer and AstraZeneca, have long had their intentions to acquire weight-loss drug assets or companies, which is no secret. AstraZeneca acquired the GLP-1 weight-loss drug asset AZD5004 from China's Eccogene Inc., which is also an oral preparation. However, unlike VK2735, AZD5004 is a small molecule drug. AstraZeneca recently presented Phase I data for AZD5004 at ObesityWeek 2024, showing a four-week weight loss rate of 5.8%. Therefore, AstraZeneca may not have a strong intention to continue acquiring oral weight-loss drug assets. On the other hand, after terminating its small molecule GLP-1 oral weight-loss drug asset lotiglipron, Pfizer also halted the clinical research of another oral small molecule weight-loss drug danuglipron with a twice-daily dosing regimen. Currently, Pfizer only has the once-daily dosing regimen of danuglipron for obesity left, so its acquisition intention may be stronger.

In addition to Viking Therapeutics, other companies that are "acquisition targets" also include the following owners of weight loss drug candidates:

Headquarters: South San Francisco, California, United States

Establishment year: 2021

Market value (as of November 6, 2024, the same below): USD 2.2 billion

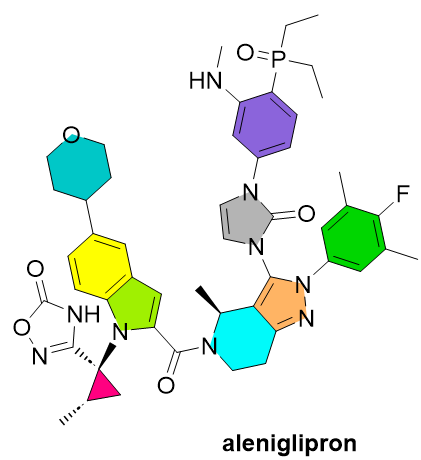

Major weight-loss drug asset: Aleniglipron (also known as GSBR-1290, an oral GLP-1 receptor agonist), with Phase II data released

Acquisition highlights: The Phase II data for Aleniglipron is comparable to that of Eli Lilly's small-molecule oral GLP-1 weight-loss candidate orforglipron (with a 6.2% weight loss rate after 12 weeks, adjusted for placebo). However, Aleniglipron may have a lower discontinuation rate. Small-molecule oral drugs offer significant cost advantages, representing the next wave of hotspots in weight-loss drug development. Small to mid-sized companies with oral weight-loss drug assets and promising mid-to-late clinical trial data will inevitably become key acquisition targets.

Acquisition hurdles: The development timeline appears to lag behind orforglipron by at least a year. In cases of similar mechanisms, efficacy, and modalities, the timeline determines future market position and current acquisition value.

Headquarters: Gaithersburg, Maryland, United States

Establishment year: 1997

Market value: USD 510 million

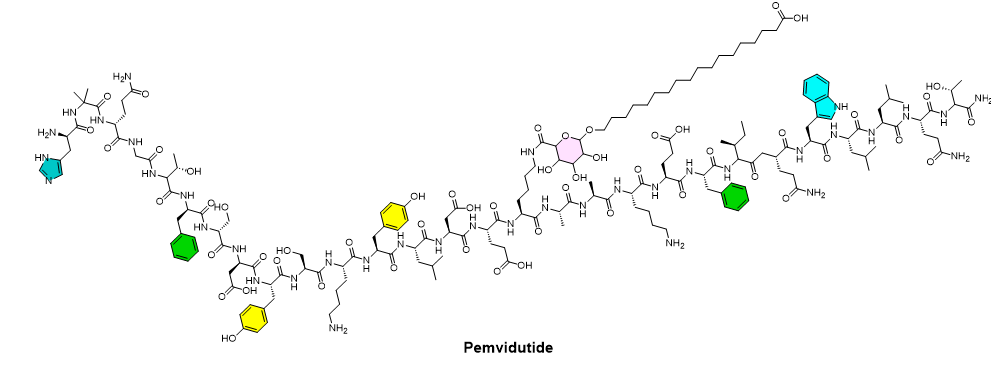

Major weight-loss drug asset: Pemvidutide (a once-weekly injectable peptide GLP-1/glucagon dual receptor co-agonist), currently in Phase III research.

Acquisition highlights: Pemvidutide demonstrates slightly better long-term weight loss rates compared with Wegovy. The 48-week weight loss rate for 2.4 mg pemvidutide is 15.6%. Pemvidutide is also undergoing clinical research for metabolic dysfunction-associated steatohepatitis (MASH).

Acquisition hurdles: A 20% discontinuation rate may be a limiting factor, but as patients progress into Phase III, dose reductions are allowed, which should help with tolerability.

Headquarters: Copenhagen, Denmark

Establishment year: 1999

Market value: USD 8.76 billion

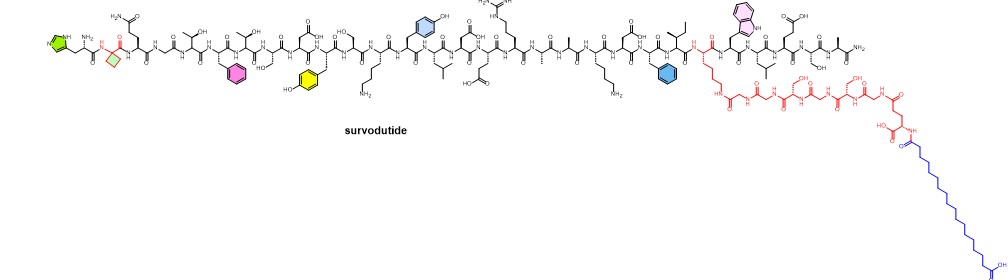

Major weight-loss drug asset: Survodutide (a once-weekly injectable peptide GLP-1/glucagon dual receptor co-agonist), currently in Phase III clinical trials and licensed to Boehringer Ingelheim for development; Dapiglutide (a GLP-1/GLP-2 co-agonist), currently in Phase II; Petrelintide (amylin analogue), currently in Phase II.

Acquisition highlights: Zealand Pharma will receive around 10% royalties based on global sales volume of survodutide. The project has entered Phase III and is expected to be one of the first challengers to Wegovy and Zepbound. It has a weight loss rate of 19% at 46 weeks. It has received FDA's Breakthrough Therapy designation for MASH. Zealand Pharma also boasts mid-stage assets of a novel mechanism, including a GLP-1/GLP-2 dual receptor co-agonist and the amylin agonist petrelintide. Zealand Pharma recently presented Phase I data for petrelintide at the ObesityWeek 2024 conference, generating widespread interest. The multiple ascending dose Phase I test data showed average weight loss of 4.8%, 8.6%, and 8.3% after 16 weeks of weekly injections at doses of 2.4 mg, 4.8 mg, and 9.0 mg, respectively, compared with 1.7% in the pooled placebo group. This indicates that petrelintide not only fills a current gap in weight-loss drugs in terms of mechanism but also has the potential to compete with semaglutide and tirzepatide in terms of efficacy in the future. Bank of America analysts predict that petrelintide will primarily target the GLP-1 intolerant or failure market (representing about 20% of patients) and estimate peak annual sales volume to reach USD 8 billion.

Acquisition hurdles: Zealand Pharma may have a low willingness to be acquired, but the company has expressed its intention to seek partners for the joint development of petrelintide. Unlike the licensing model for survodutide, Zealand Pharma will be involved in the entire process of petrelintide's development and commercialization. Zealand Pharma's CEO stated that discussions have already begun with one of the top ten pharmaceutical companies regarding potential collaborative development for petrelintide, but declined to disclose further details.

Fractyl Health

Headquarters: Burlington, Massachusetts, United States

Establishment year: 2010

Market value: USD 110 million

Major weight-loss drug asset: Revita (an outpatient endoscopic procedure that utilizes thermal ablation to permanently alter duodenal dysfunction, thereby restoring metabolic health. Evidence suggests that Revita may provide durable weight maintenance and improved blood glucose control for obesity and type 2 diabetic patients. Clinical research is being conducted for patients who have achieved at least 15% weight loss with GLP-1 medication and wish to discontinue GLA-1 therapy without weight rebound). Rejuva (a novel locally administered AAV gene therapy currently in preclinical development, which can improve islet function. By altering the metabolic hormone response in patients' pancreatic islet cells, it achieves durable weight loss and long-term remission of type 2 diabetes).

Acquisition highlights: Solutions for long-term weight management are provided

Acquisition hurdles: Adverse reactions following special treatments

MSD (acquisition intention: high): With its king of medicine Keytruda's patent expiring in 2028, MSD has shown a strong interest in metabolic diseases but lacks a GLP-1 pipeline asset.

Novo Nordisk (acquisition intention: high): Novo Nordisk has been consolidating its leading position in the field of metabolic diseases through asset purchases.

Pfizer (acquisition intention: medium/high): Pfizer has been striving to develop oral weight-loss drugs but has encountered repeated setbacks. Currently, its only remaining GLP-1 small molecule weight loss candidate, daniglupron, does not have a promising outlook. Therefore, facing this dead end, Pfizer may opt for the introduction of external assets.

Johnson & Johnson (acquisition intention: medium/high): Recent setbacks in the field of metabolic diseases (Xarelto, Invokana, aprocitentan) have greatly stimulated J&J's desire to acquire external assets.

Eli Lilly (acquisition intention: high): Eli Lilly engaged in an "arms race" with Novo Nordisk in the development of weight-loss drugs.

AstraZeneca (acquisition intention: medium/high): The acquisition of the GLP-1 weight-loss drug asset AZD5004 from China's Eccogene Inc. has put AstraZeneca in a favorable position in the weight-loss drug competition. AstraZeneca has expressed a strong desire to develop a combination therapy with its weight-loss drug and Farxiga.

Boehringer Ingelheim (acquisition intention: high): BI has a high interest in the development of therapies for metabolic diseases. Its survodutide, licensed from Zealand Pharma, makes the acquisition of an independent weight-loss drug asset a strong attraction for BI.

Roche (acquisition intention: medium/high): The recent acquisition of GLP-1 assets from Carmot demonstrates Roche's interest in developing weight-loss drugs. Roche's relatively lean weight-loss drug pipeline suggests that more acquisitions may be on the horizon.

Daiichi Sankyo (acquisition intention: medium): Although metabolic diseases were once a development focus for Daiichi Sankyo, its current core assets are in oncology products.

Sanofi (acquisition intention: medium): Sanofi's development focus has shifted to inflammation and immunology products, but its historical involvement in metabolic disease development may reignite its enthusiasm for entering the obesity market.

Novartis (acquisition intention: medium): Although Novartis has several metabolic disease assets, its core competencies lie in oncology, immunology, and rare diseases.

Malone, E. Top 10 Drugs Q2 2024: Mounjaro Comes Roaring In. Skyrizi Also Makes Its Debut. Scrip. 24. 10. 2024.

Structure Therapeutics Reports Positive Topline Data from its Phase 2a Obesity Study and Capsule to Tablet PK Study for its Oral Non-Peptide Small Molecule GLP-1 Receptor Agonist GSBR-1290. Structure Press Release. 03. 06. 2024.

Boehringer Ingelheim to advance survodutide into three global Phase III studies in obesity. BI Press Release. 17. 08. 2023.

Obesity Drugs: The Next Wave of GLP-1 Competition. New drugs from public and private companies will challenge Novo and Lilly's dominance. Morningstar & PitchBook. Sept. 2024.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025