Suzanne ElvidgeFebruary 12, 2025

Tag: biosimilar , EU , US , monoclonal antibody

Biological drugs are therapeutics that are made by living organisms or are created from cells and tissues, and include therapeutic proteins and monoclonal antibodies. They have changed the face of healthcare, particularly for cancers, autoimmune diseases, chronic inflammatory disorders and genetic disorders. They are complex drugs and the costs to develop and manufacture them are high, which is reflected in the drug prices. [1]

Biosimilars (previously known as biogenerics) are lower cost but highly similar versions of originator or reference biologics. They can be produced by other manufacturers once the patent expires, allowing more patients to access highly effective drugs. [2, 3]

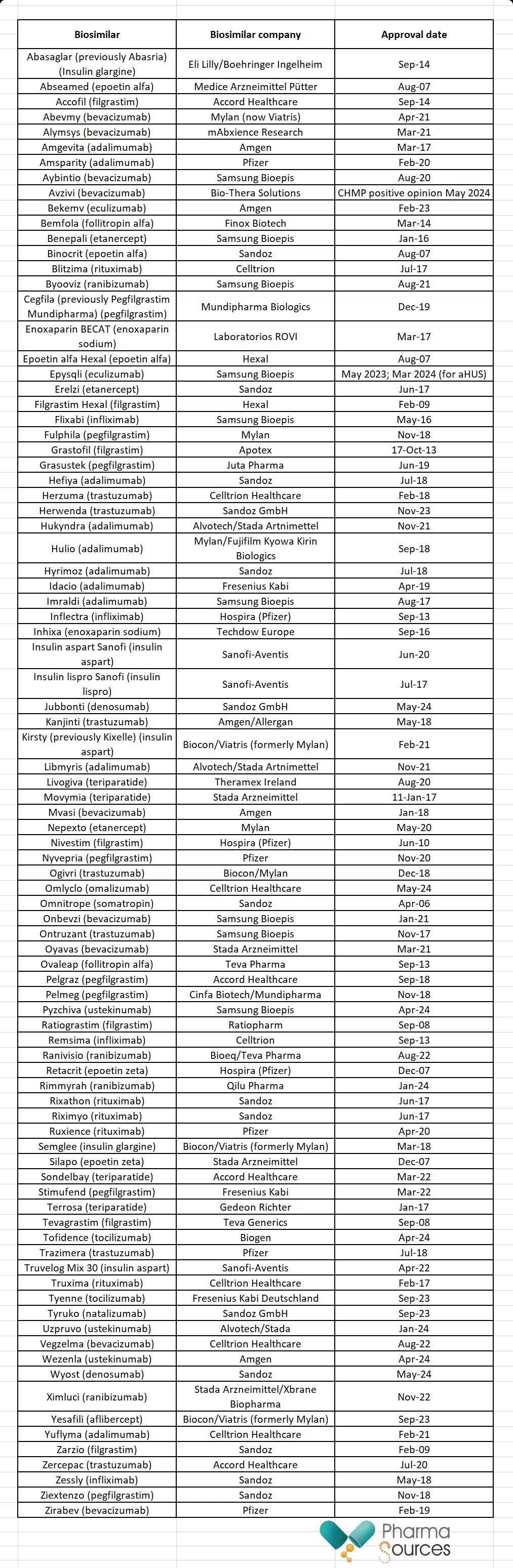

The first biosimilar, Omnitrope, was approved in Europe in April 2006. This is a human growth hormone and was created by Sandoz. Omnitrope is a biosimilar form of Pfizer’s originator biologic Genotropin (somatropin). As of 16 July 2024, there were 106 biosimilars approved in the EU (see Table 1).

Table 1: Biosimilars approved in the EU

Source: GaBI [4]

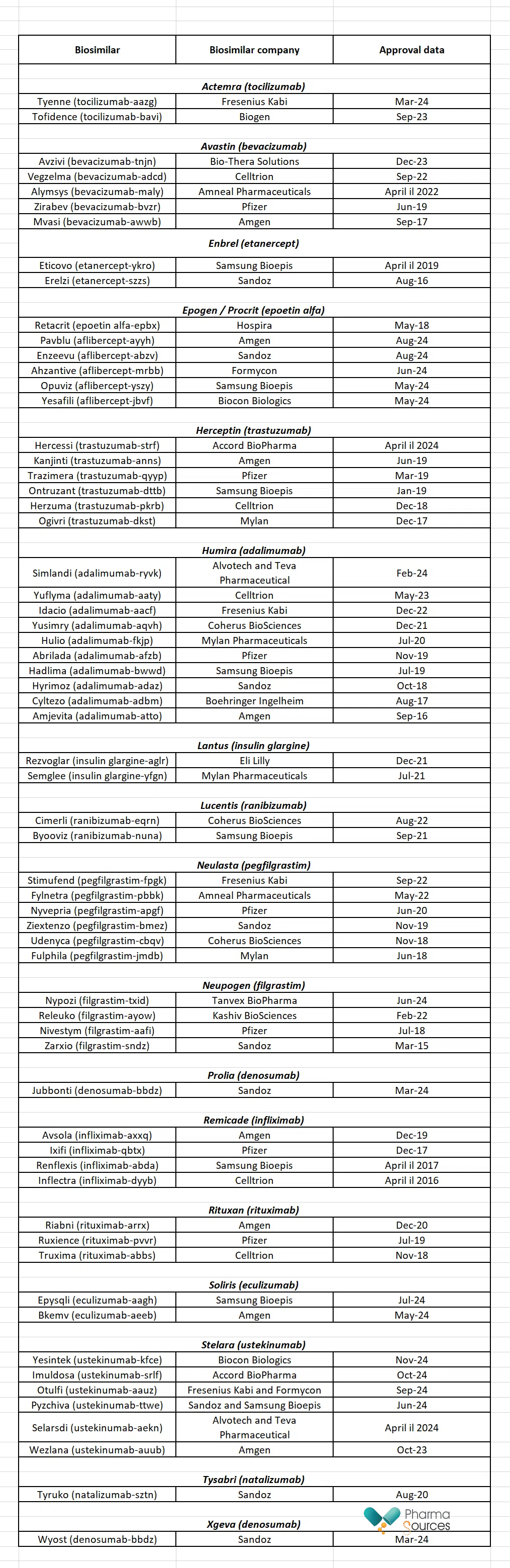

The US approved its first biosimilar in 2015, Sandoz’s Zarxio (filgrastim-sndz). This is a biosimilar form of Amgen’s reference biologic Neupogen. As of 4 December 2024, the US Food and Drug Administration (FDA) had approved 63 biosimilars (see Table 2). [2, 4]

Table 2: Biosimilars approved in the US

Source: Drugs.com [2]

The global biosimilars market was worth around $20.44 billion and is expected to rise to around $73.03 billion in 2030, growing at a compound annual growth rate (CAGR) of 17.3%. Europe makes up more than half of the global market. The US, Chinese and Indian markets are growing. [5]

The expansion of the biosimilars market has a number of drivers, the primary one being cost. Biologic drugs can cost up to $80,000 in the US. In 2018, 0.4% of drugs prescribed in the US were biologics, but they accounted for 46% of net drug spending. In Canada in 2021, biologics made up 2% of prescription drug claims, but 29% of public drug spending. The percentages of drug spend for biologics are similar in Australia, the EU and the UK. [1-3, 6]

Biosimilar list prices are generally 15-35% lower than their reference biologics. In addition, biosimilar competition can drive down the prices of both competitor biosimilar drugs and the original reference biologics. As a result of this, biosimilars have the potential to cut US patient healthcare costs by $38-124 billion between 2021 and 2025. [1-3, 6]

Originator biologics have a period of exclusivity before biosimilar developers can access data, seek approval or market their drugs. [3]

Once the exclusivity period is over, companies developing biosimilars have to show that their product is highly similar to the reference product, including purity, chemical identity and bioactivity. It also must have no clinically meaningful differences in safety and effectiveness. [2]

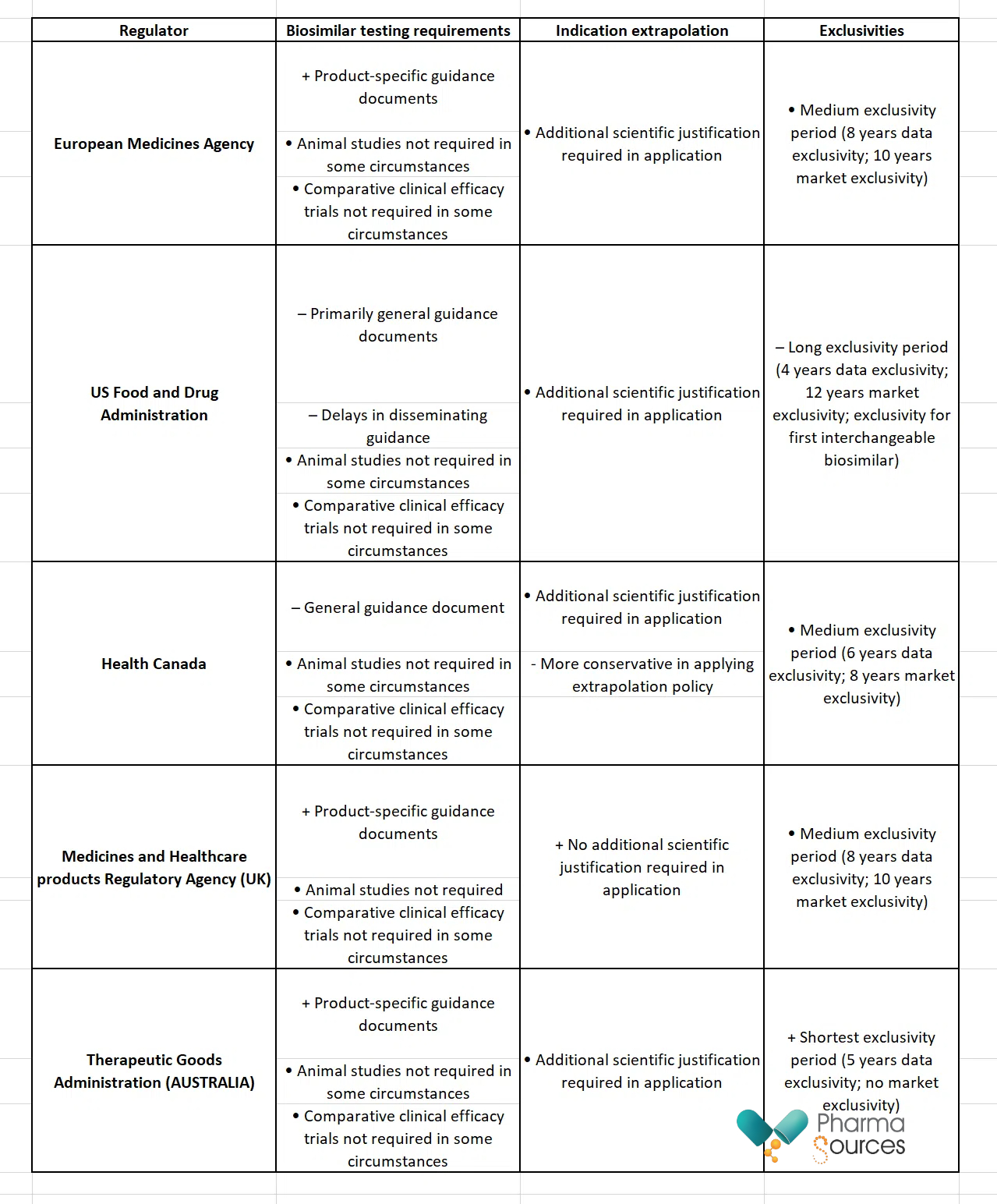

Biosimilars have different approval pathways around the world (see Table 3).

Table 3: Comparing the biosimilar approval policies of five national medicines regulators

+ Policy supportive of biosimilar approval and/or utilization; • Policy neutral regarding support of biosimilar approval and/or utilization; – Policy not supportive of biosimilar approval and/or utilization

Source: Knox et al. [3]

The process begins with confirming that the molecule has the same amino acid sequence, and comparable structure and folding. Any differences must be assessed as to whether they will cause any changes to function or stability. The company then carries out nonclinical comparative studies and may need to carry out clinical comparative studies. Different types of studies required may include: [3]

In vitro toxicology studies – assessing toxicity in cells and tissues

In vivo toxicology studies – assessing toxicity in animal studies

Comparative efficacy studies – clinical trials comparing the efficacy of the originator product and biosimilar

Comparative immunogenicity testing – clinical trials comparing the immune response to the originator product and biosimilar

Pharmacokinetic/pharmacodynamic clinical studies – clinical trials looking at the effects/concentration of the drug in humans

Switching studies – clinical trials looking at the safety of switching from originator biologics to biosimilars.

Many originator biologics are approved for a variety of indications. With indication extrapolation, biosimilars can be assessed in clinical trials for one indication, and the approval is then extrapolated to the other indications. [3]

Biosimilar manufacturers face challenges getting a drug to market, from drug development to approval. [7, 8]

There is a lack of guidelines for biosimilar development.

Biosimilars create competition for originator companies, reducing their income. To make it harder for biosimilar manufacturers, originator companies create ‘patent thickets’ – multiple layers of patents. Patent litigation increases costs and delays development.

The biosimilar development process begins with reverse engineering the originator biologic to be able to manufacture it – this requires accessing sufficient quantities of the originator product, which can be difficult and costly.

Biologics are produced by living cells and changes in culture conditions can alter the structure of the end molecule, and therefore its efficacy and toxicity – this requires in depth characterisation and robust manufacturing processes.

Preclinical and clinical trials of biologics are needed to prove similarity, and this requires cutting edge tools and techniques.

The lengthy review process and the lack of an abridged approval pathway both slow the approval process.

While biosimilars are lower cost to develop than originator biologics, the process is still expensive, and developers need to recoup their costs while competing with the originator and other biosimilars.

Once approved, in order to ensure the uptake of biosimilars, both healthcare professionals and patients need to be educated about their use. Patients need to be taught that the side effects will be the same, or almost the same, as the brand name drug that they have been taking. Healthcare professionals need to be reassured that the regulatory authorities carry out reviews to confirm that the biosimilar has no clinically meaningful differences in safety or efficacy compared with the reference biologic. [8]

Regulatory authorities worldwide are trying to smooth the path to approval for biosimilars. As an example, in the US, the FDA’s Biosimilars Action Plan aims to improve the efficiency of the biosimilar development and approval process, maximise scientific and regulatory clarity, ensure better understanding of biosimilars, and support their adoption. [9]

Biologics play an important role in the management of hard-to-treat diseases, and the growth of biosimilars will make these high cost and effective drugs accessible for more patients. Increasing biosimilar uptake will require more support from governments and regulatory authorities and better education for both healthcare professionals and patients.

1.Russell, M.D. and J.B. Galloway, Driving down the cost of biologics: lessons from a nationalised health-care system. Lancet, 2024. 404(10464): p. 1723-1724.

2.Stewart, J., What biosimilars have been approved in the United States? Drugs.com, 4 December 2024. Available from: https://www.drugs.com/medical-answers/many-biosimilars-approved-united-states-3463281/.

3.Knox, R.P., V. Desai, and A. Sarpatwari, Biosimilar approval pathways: comparing the roles of five medicines regulators. J Law Biosci, 2024. 11(2): p. lsae020.

4.Biosimilars approved in Europe. Generics and Biosimilars Initiative. Last accessed: 16 July 2024. Available from: https://www.gabionline.net/biosimilars/general/biosimilars-approved-in-europe.

5.Newcomer, T., Biosimilar Market Report: 5th Edition, Q2 2024. Samsung Bioepis. 2024. Available from: https://www.samsungbioepis.com/upload/attach/SB+Biosimilar+Market+Report+Q2+2024.pdf.

6.Feng, K., et al., Patient Out-of-Pocket Costs for Biologic Drugs After Biosimilar Competition. JAMA Health Forum, 2024. 5(3): p. e235429.

7.Top 5 Challenges Faced By Biosimilars: Navigating the Complex Landscape. DrugPatentWatch, 22 October 2024. Available from: https://www.drugpatentwatch.com/blog/top-5-challenges-faced-biosimilars/.

8.Sheynin, N., The Booming Market of Biosimilars. AlphaSense, 8 November 2024. Available from: https://www.alpha-sense.com/blog/trends/biosimilars-market/.

9.Biosimilars Action Plan. FDA. Last accessed: 26 April 2024. Available from: https://www.fda.gov/drugs/biosimilars/biosimilars-action-plan.

Based in the north of England, Suzanne Elvidge is a freelance medical writer with a 30-year experience in journalism, feature writing, publishing, communications and PR. She has written features and news for a range of publications, including BioPharma Dive, Pharmaceutical Journal, Nature Biotechnology, Nature BioPharma Dealmakers, Nature InsideView and other Nature publications, to name just a few. She has also written in-depth reports and ebooks on a range of industry and disease topics for FirstWord, PharmaSources, and FierceMarkets. Suzanne became a freelancer in 2006, and she writes about pharmaceuticals, consumer healthcare and medicine, and the healthcare, pharmaceutical and biotechnology industries, for industry, science, healthcare professional and patient audiences.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025