Shruti TalashiNovember 20, 2024

Tag: medication , drug globalization , Drug Shortage

The pharmaceutical business has been experiencing globalization for a number of years due to factors such as the growing need for cutting-edge treatments in developing nations, the need for drug companies to cut costs, and the rising difficulties in recruiting clinical trial participants in developed countries. Worldwide, pharmaceutical corporations have set up production and research centers. Ina similar vein, the constant increase in noncore activity outsourcing has fueled the expansion of global contract R&D and manufacturing firms.Trend predicting by Statista.com shows that the global pharmaceutical industry's revenue increased from $390.2 billion in2001 to $1.2 trillion in 2018. The data science firm IQVIA projects that this revenue would grow ata 4-5% CAGR (as opposed to the6.3% CAGR seen for 2014–2018) and reach $1.5 trillion in 2023. The projection from NAVADHI Market Research is $1.7trillion by 2023,which is somewhat higher.Rather than netrevenue, which is theamount ofmoney actually received after deducting rebates and other expenses, the values are based on invoice price. IQVIA projects net sales to increase at a 0-3% compound annual growth rate (CAGR) through 2023.[1]

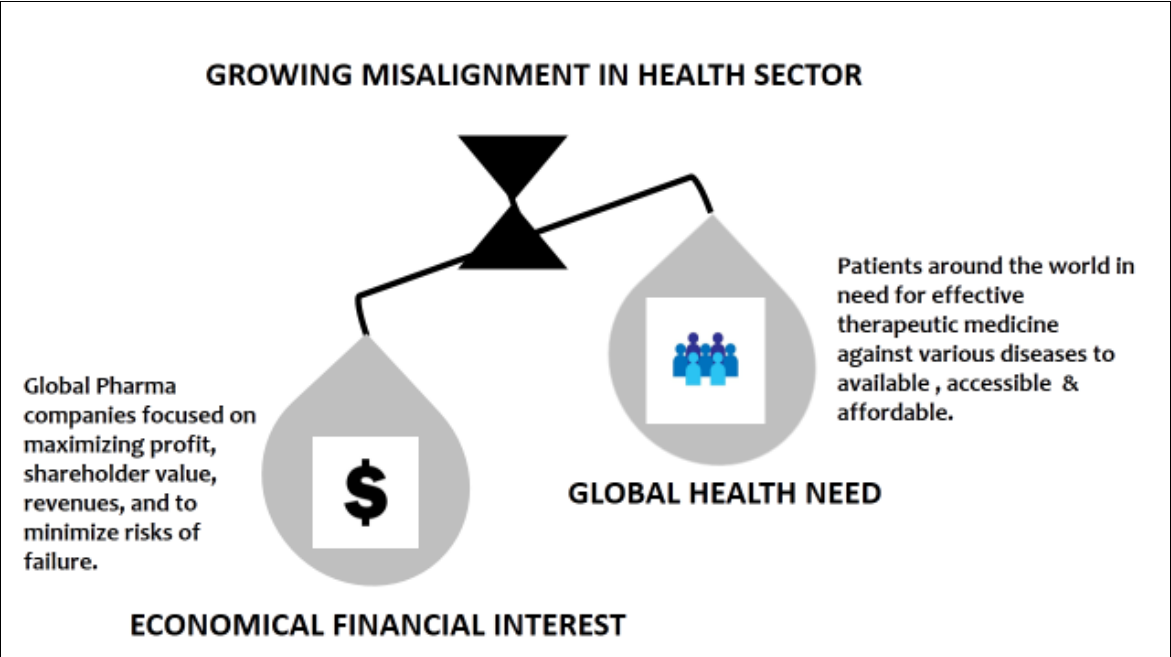

Leading international healthcare organizations, whether public, private, or nonprofit, aim to increase access to cutting-edge medications at reasonable prices and to countries and areas that have historically lacked the resources—facilities, money, and skilled labor—necessary for the profitable production and distribution of these drugs. Drug globalization is driven by a number of factors, each with pros and cons. The globalization of the medical supply chain presents both benefits and drawbacks. The current scenario of drug shortage is an outcome of the growing misalignment in health sector.

Figure 1. Showing the dominance of economical financial interest over global health leading to the growing misalignment in health sector.

There exists problems like inequitable access as in certain nations, inadequate healthcare systems or substantial out-of-pocket expenses may prevent people from affording pharmaceuticals, even in the face of growing availability. In developing nations, access to reasonably priced generic medications may be impeded by stringent intellectual property rights. The growth of drug counterfeiting is made possible by globalization, which puts patient safety at risk. Research into profitable diseases may be given priority by pharmaceutical companies, who may disregard neglected diseases that impact developing countries in favor of wealthier nations with larger profit margins.Pipeline medications should ideally improve on currently available therapies or target areas with few therapy choices. Due to safety concerns or ineffectiveness, only a small portion of medications in development make it to market.Medications that are still undergoing clinical trials and do not yet have regulatory approval for marketing are referred to as drugs in development. Before entering the market, pipeline pharmaceuticals go through a number of stages, including pre-clinical, Phase I, II, and III.[2]

Between 2022 and 2050, the burden of non-communicable illnesses will rise while early mortality and ill health from communicable, maternal, nutritional, and newborn disorders will decline. The top causes of disease burden worldwide in 2022 were ischemic heart disease (ISD), stroke, diabetes, chronic obstructive pulmonary disease (COPD), low back pain (which is more common in women), chronic kidney disease (CKD), Alzheimer's disease, and various musculoskeletal illnesses. Up to 2050, when non-communicable diseases will account for a higher percentage of cases than infectious diseases, this trend is predicted to continue. It is possible to accelerate the condition of health by treating metabolic and behavioral hazards, such as smoking, high blood pressure, high body mass index, and excessive blood sugar. It is possible to accelerate the condition of health by treating metabolic and behavioral hazards, such as smoking, high blood pressure, high body mass index, and excessive blood sugar. Based on a 2050 assessment, the countries in the Middle East and North Africa are expected to bemost impacted by this "improved behavioral and metabolic risk scenario."[3]

Drug shortages are assessed using a variety of techniques, and these techniques vary from one country to the next. Concerning shortages, manufacturers, pharmacists, and medical professionals can immediately inform authorities or trade associations. Regulatory entities may proactively search for information regarding potential shortages through surveys or conversations with relevant parties. There may be differences in national criteria for what qualifies as a drug shortage. This may consider factors such as the severity of the condition the drug is meant to treat, the availability of alternative medications, the duration of the shortage, and the impact on patient care. The followingcriteria can beusedtocategorizeshortages:impactintensity(critical,severe,orminor),therapeuticareaaffected, and root reason (production issues, financial concerns, etc.).Analyzing data from electronic health records or pharmacy dispensing canreveal trends and potential shortages. The difficulty is that medicine shortages are not consistently measured across national borders. Due to variations in data collection and reporting methods, cross-national comparisons may be challenging. Particularlyin less developed healthcare systems, shortages might go unnoticed. While evaluation methodologies often center on reported shortages, the true impact include indirect costs as well, such as extended treatment periods for patients or increased labor costsfor healthcare professionals.[2]

The Food and Drug Administration (FDA) publishes information on medicine shortages and maintains an updated drug shortage database. Additionally, they have a mechanism for classifying medicines as scarce, and the US Food and Drug Administration sent the annual Report on Drug Shortages for the year 2023 to Congress. Last year was another challenging one for shortages due to a lack of necessary

pharmaceuticals, including those for parenteral feeding, cancer treatment, and other serious medical illnesses. The FDA has noted that capacity constraints, issues with quality, and increased demand are affecting producers both domestically and abroad. The supply chain is under more stress when there are natural disasters, factory closures, and other unforeseen circumstances. Over time, fewer new shortages have occurred despite these difficulties;fromarecordhighof251in2011tojust55in2023.[4]

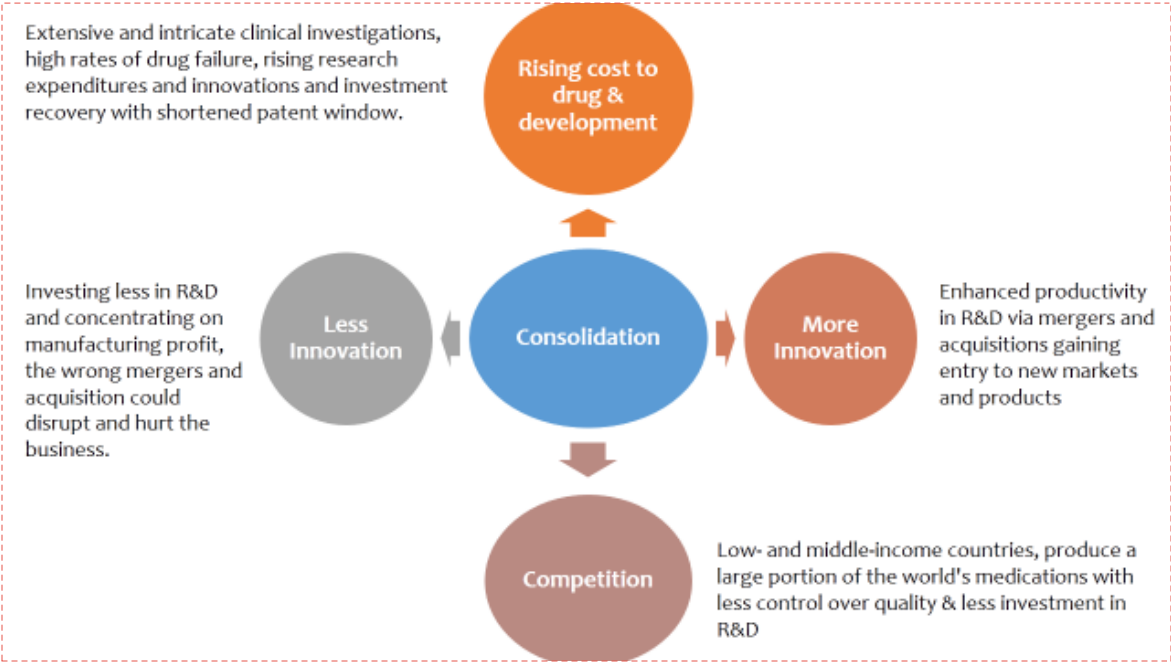

Consolidated manufacturing and a profit-driven mindset are the main causes of the elevated danger of a medicine shortage. The concentration of medical manufacturing in a small number of locations, usually in low-and middle-income countries, is a major contributing factor. An outage at one plant might lead to a worldwide shortage. Pharmaceutical companies may begin to favor pharmaceuticals with thehighest profitmargins over moreimportant but less lucrativeones as a resultofglobalization. On the other hand, medication shortages are a widespread issue that negatively impacts the overall profit and loss of thehealthcare system. The ultimate result is anet loss in terms of patient well-being, effective resource usage, and the pharmaceutical industry's reputation—even though some parties may see short-term advantages. Government intervention and manufacturing diversification are a couple of possible remedies. It is possible to lessen the risk of a single point of failure by spreading out the production of medications across multiple locations and regions. Governments can guarantee that individuals have access to essential drugs by regulating drug costs and promoting domestic manufacturing.[5]

Figure 2. Consolidation in the pharm and biotech industry impact rising cost, competition & innovation.

Globalization has the potential to make a greater variety of medications available in more countries, especially for impoverished nations. The competition among generic medicine producers in low-cost manufacturing nations may result in lower costs for necessary prescription drugs. Globalization makesit easier for pharmaceutical corporations and academic institutions to collaborate across national boundaries, which could hasten the process of finding new drugs. International healthcare results can be enhanced by exchanging medical knowledge and best practices.Given the stark differences in COVID-19 immunization rates, the social contract between the general public, governments, and the biopharmaceutical industry needs to be rapidly modified in order to fulfill its intended health purpose. Policymakers need to reconsider how the pharmaceutical research and development ecosystem is financed and governed because pharmaceuticals shouldn't be viewed as a luxury. Instead of focusing solely on maximizing financial return, the public and private sectors should work together to meet patient needs and promote public health.[6]

In conclusion, drug globalization offers a double-edged sword. Increased access and lower prices in developing nations come alongside concerns like affordability gaps, fake medications, and research focused on profits over neglected diseases. As the disease burden grows, we need a more balanced approach. Prioritizing public health,diversifying manufacturing, and fostering collaboration are crucial to ensure everyone benefits from advancements in medicine.

Nigel Walker, Impact of globalization on pharmaceutical industry. Pharma Almanac Published on October 28, 2019 Accessed on June 10, 2024 URL:https://www.pharmasalmanac.com/articles/impacts-of-glocalization-on-the-pharmaceutical-industry

Torreele E. Why are our medicines so expensive? Spoiler: Not for the reasons you are being told…. Eur J Gen Pract. 2024 Dec;30(1):2308006. doi: 10.1080/13814788.2024.2308006. Epub 2024 Feb 1. PMID: 38299574; PMCID: PMC10836477.

Institute for Health Metrics and Evaluation (IHME).Global Burden of Disease 2021: Findings from the GBD 2021 Study.Seattle, WA: IHME, 2024.

Drug Shortage report CY 2023, FDA's Center for Drug Evaluation and Research and FDA’s Center for Biologics Evaluation and Research Published May 6, 2024; Accessed on June 10, 2024.

URL: https://www.fda.gov/drugs/drug-safety-and-availability/drug-shortages

Shukar S, Zahoor F, Hayat K, Saeed A, Gillani AH, Omer S, Hu S, Babar ZU, Fang Y, Yang C. Drug Shortage: Causes, Impact, and Mitigation Strategies. Front Pharmacol. 2021 Jul 9;12:693426. doi: 10.3389/fphar.2021.693426. PMID: 34305603; PMCID: PMC8299364.

Tannoury M, Attieh Z. The Influence of Emerging Markets on the Pharmaceutical Industry. Curr Ther Res ClinExp. 2017 Apr 18;86:19-22. doi: 10.1016/j.curtheres.2017.04.005. PMID: 29234483; PMCID: PMC5717296.

boasts a dual mastery of lab research and writing. Her doctoral study outcome as M.Phil in biomedical science while studying breast cancer and an extraordinary masters degrees dissertation work on exploring role of Gal-lectin in cancer metastasis fuels her extensive research interests. She has gained few publication in journals. Bridging the science-public gap is her passion, aided by expertise in diverse techniques. From oncology to antibiotic/drugs production, she's led and managed complex projects, even clinical trials. Now, as a freelance Content Coordinator for Sinoexpo Pharmasource.com, her industry knowledge shines through valuable insights on cutting-edge topics like GMP, QbD, and biofoundry.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025