Krebs QinOctober 18, 2024

Tag: Oncology , Immunology , Q2

The Q2 2024 financial reports have highlighted a notable divergence in oncology and immunology products, with trends becoming increasingly evident. Specifically, there is a balance between small molecules and monoclonal antibody drugs (mAbs) in the realm of oncology super blockbuster drugs, while immunology appears dominated by monoclonal antibodies and protein-based treatments.

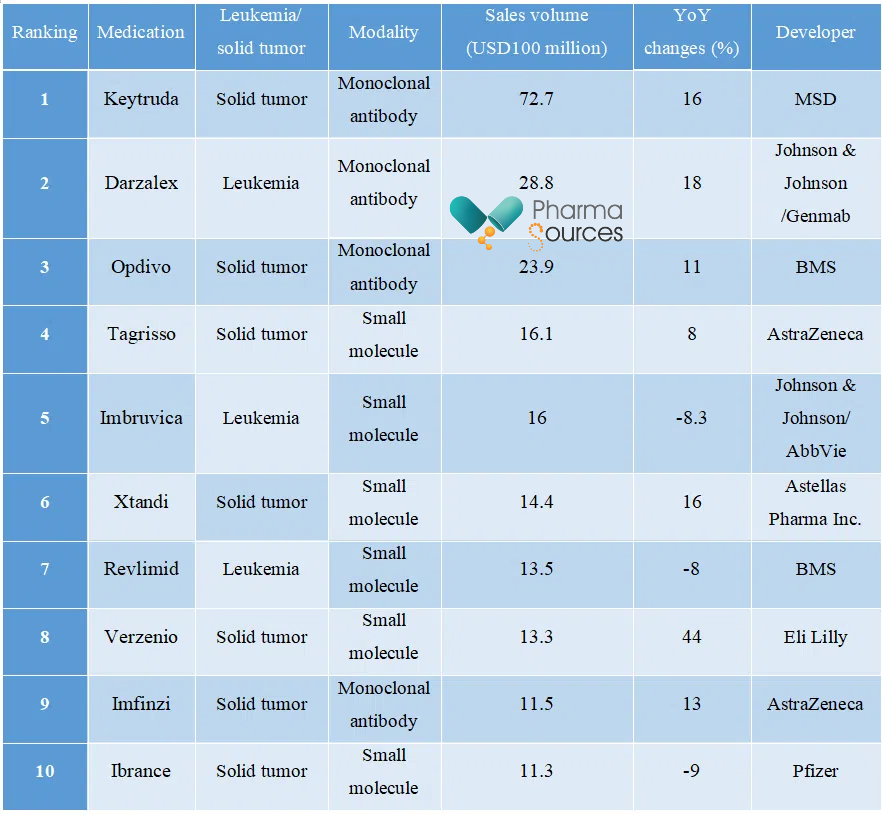

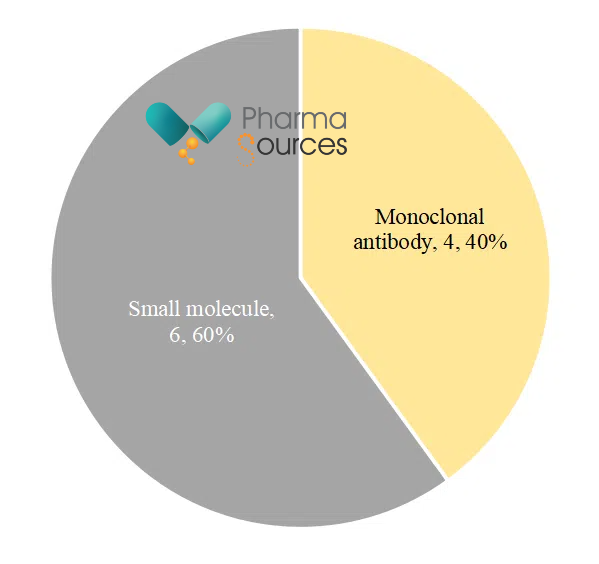

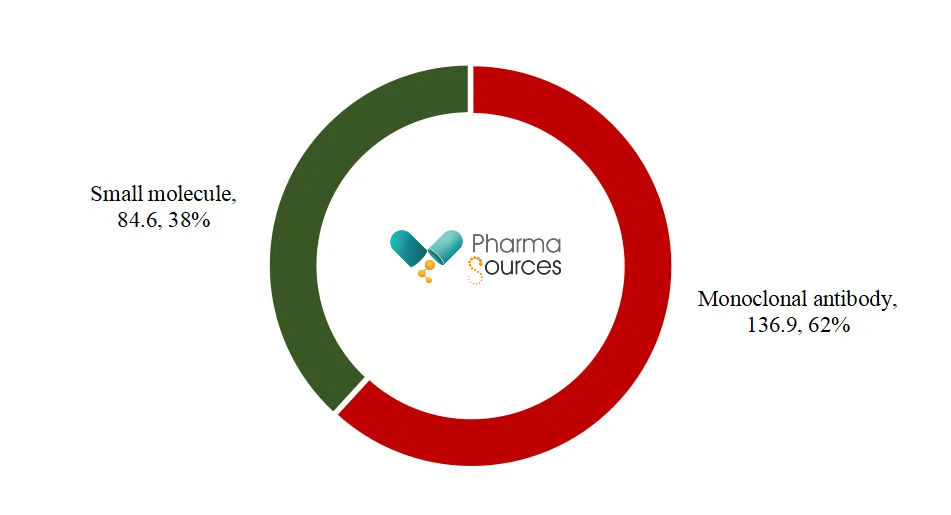

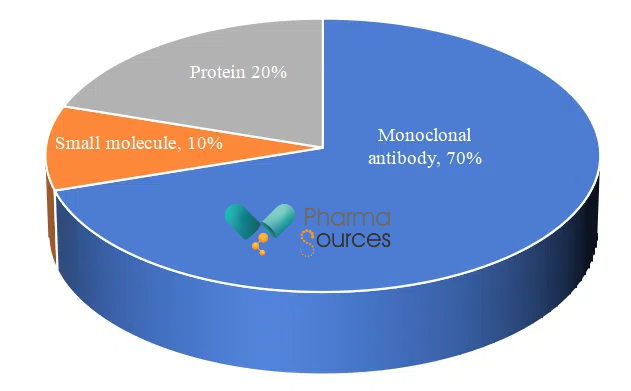

Table 1 highlights the top ten oncology products by sales for Q2 2024. Keytruda maintains its dominant position at the top. Among the top ten oncology products, there are six small molecule drugs, with the remaining four spots occupied by monoclonal antibodies (Figure 1). In terms of sales volume, thanks to Keytruda's exceptional performance, monoclonal antibody oncology drugs in the top ten generated USD13.69 billion, capturing 62% of the market share, while the six small molecule oncology drugs produced a total of USD8.46 billion, accounting for 38% of the market share (Figure 2).

Table 1. Top Ten Oncology Products by Sales Volume in Q2 2024

Number Distribution of Top 10 Oncology Products Modalities in Q2 2024

Distribution of Sales Volume (USD100 Million) for Top 10 Oncology Drug Modalities

Figure 2. Sales Volume of Top 10 Oncology Drug Modalities in Q2 2024

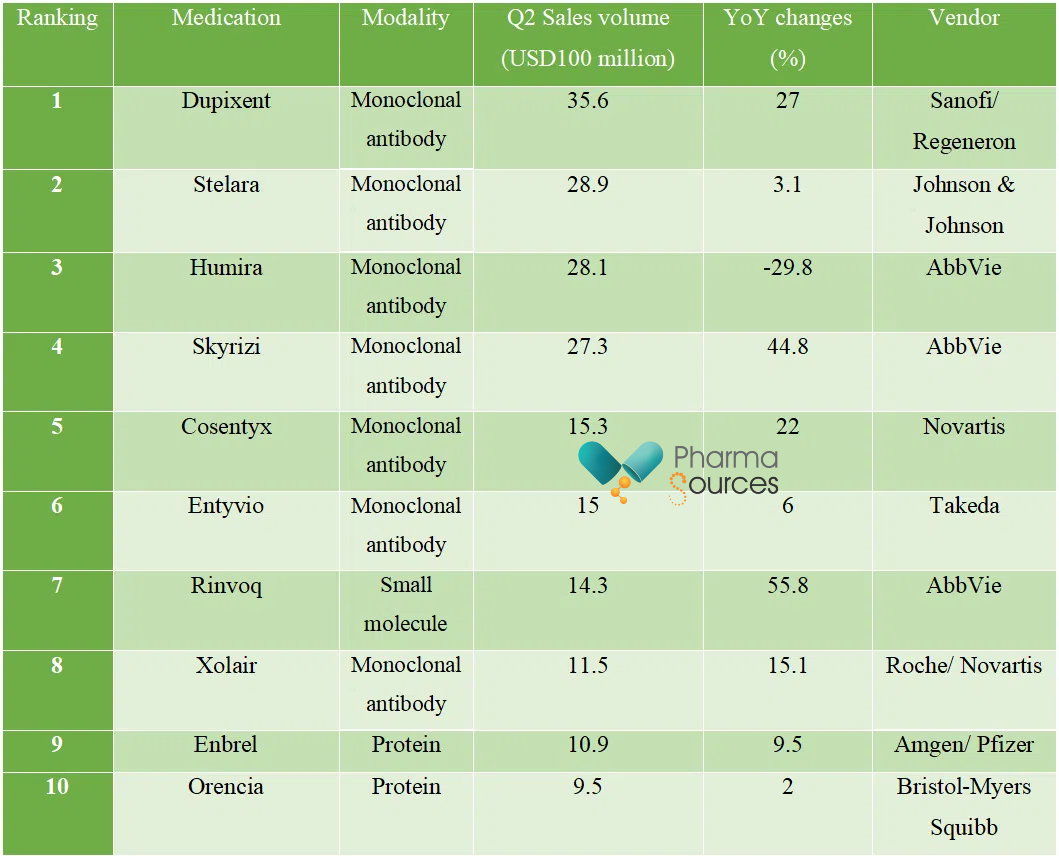

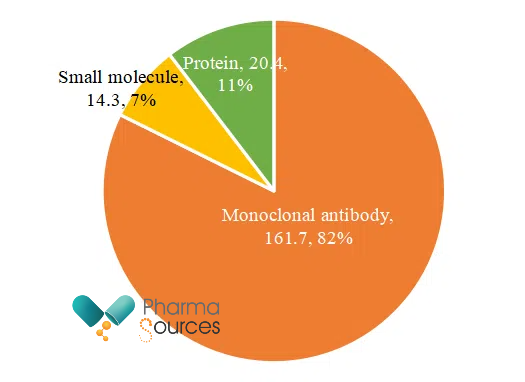

In stark contrast, the Q2 2024 lineup of top ten immunology products is almost entirely composed of monoclonal antibodies and fusion proteins (Table 2). Of the top ten immunology drugs by sales, seven are monoclonal antibody products, two are fusion proteins, and only one small molecule drug, AbbVie's newcomer Rinvoq (Upadacitinib), made the list (Figure 3). This Janus kinase small-molecule inhibitor received FDA approval in August 2019 and has since climbed into the top ten in immunology drug sales. It achieved sales of USD 1.43 billion in Q2 2024, with a year-over-year growth of 56%, showcasing its strong performance. However, Rinvoq remains an outlier in the immunology domain; even expanding the list to 15 shows it is still the only small molecule, as ranks 11 to 15 are entirely held by monoclonal antibodies (e.g., Tremfya (Johnson & Johnson, USD 910 million), Taltz (Eli Lilly, USD 820 million), Actemra (Roche, USD 740 million), Nucala (GSK, USD 610 million), and Simponi (Johnson & Johnson, USD 540 million)).

From a sales perspective, Rinvoq, as an isolated example of a small molecule drug, accounted for just 7% of total sales in the top ten, while proteins and mAbs accounted for 11% and 82%, respectively, demonstrating the overwhelming dominance of protein and antibody therapeutics over small molecule immunology drugs.

Table 2. Top Ten Immunology Products by Sales Volume in Q2 2024

Number Distribution of Top 10 Immunology Drug Modalities in Q2 2024

Figure 3. Number Chart of Top 10 Immunology Drug Modalities in Q2 2024

Distribution of Sales Volume (USD100 Million) for Top 10 Immunology Drug Modalities in Q2 2024

Figure 4. Sales Volume of Top 10 Oncology Drug Modalities in Q2 2024

Both small molecule drugs and monoclonal antibodies have the potential to become blockbuster drugs in oncology and immunology.

Oncology Blockbusters

· Small molecule drugs: Often kinase inhibitors, targeting specific mutations or pathways essential for cancer cell survival and proliferation, such as Novartis' imatinib (Gleevec) and Genentech’s erlotinib (Tarceva).

· Monoclonal antibody: These target specific antigens on cancer cells, exemplified by MSD’s Keytruda and Bristol-Myers Squibb’s Opdivo.

· ADCs: These are hybrids of small molecules and mAbs, linking antibodies with cytotoxic drugs to deliver targeted chemotherapy, such as Genentech's ado-trastuzumab emtansine (Kadcyla).

· CAR-T cell therapy: Involves modifying a patient’s T cells to better recognize and combat cancer cells, as seen with Kite Pharma's Yescarta (axicabtagene ciloleucel).

Immunology Blockbusters

· Monoclonal antibody: These often neutralize specific cytokines or cell surface proteins involved in autoimmune reactions, like AbbVie's Humira (adalimumab).

· Fusion protein: Engineered proteins that mimic natural inhibitors to suppress immune responses, such as Amgen/Pfizer's etanercept (Enbrel).

· Small molecule drugs: These include JAK inhibitors that interfere with signaling pathways in immune responses, as illustrated by Pfizer's tofacitinib (Xeljanz).

The differentiation in blockbuster drug modalities between oncology and immunology stems from the distinct nature of these diseases and the required mechanisms of action. Key differences include:

√Target specificity: oncology drugs typically focus on mutations or proteins unique to cancer cells, whereas immunology drugs target components of the immune system to modulate its activity.

√ Mechanism of action: cancer therapies may either directly induce cytotoxic effects or modulate the immune system to attack cancer cells, while immunology treatments primarily aim to suppress inappropriate immune responses.

√Therapeutic goals: in oncology, the aim is often to eradicate cancer cells or significantly reduce tumor burden. In contrast, immunology focuses on managing or preventing autoimmune and inflammatory responses.

The differences highlighted reflect the fundamental pathophysiological distinctions between cancer and autoimmune diseases, as well as the therapeutic strategies required for their effective management.

The diverging applications of monoclonal antibodies and small molecule drugs in immunology and oncology can be attributed to a variety of factors related to the nature of the diseases, needed mechanisms of action, and therapeutic objectives.

Immunology Blockbusters

· Target specificity and regulation

√Precision: Monoclonal antibodies exhibit a high degree of specificity, allowing them to precisely target and modulate particular components of the immune system, such as cytokines or cell surface receptors. This specificity is especially important in treating autoimmune diseases, where the goal is to dampen the hyperactive immune response without broadly suppressing the immune system.

√Long half-life: Monoclonal antibodies typically have a long half-life, which is beneficial for chronic disease treatment that requires ongoing modulation of the immune system. For instance, drugs like adalimumab (Humira) and infliximab (Remicade) reduce inflammatory responses in autoimmune diseases by targeting TNF-alpha.

· Mechanism of action

√Blocking specific pathways: Monoclonal antibodies can block specific immune pathways related to disease pathology. For example, by targeting the IL-4 receptor alpha, monoclonal antibodies can effectively reduce inflammatory responses in diseases like asthma and atopic dermatitis.

√Immunoregulation: Monoclonal antibodies can modulate immune checkpoints or other regulatory pathways to restore immune balance, such as drugs targeting IL-8 or OX40 receptors.

Oncology Blockbusters

· Diverse mechanisms and targets

√Broad range of targets: Small molecule drugs can target various intracellular pathways and proteins involved in processes such as cell proliferation, apoptosis, and DNA repair. This diversity is crucial in oncology since cancer cells often harbor multiple mutations and dysregulated pathways.

√Oral bioavailability: Many small molecule drugs can be administered orally, offering greater convenience than the injectable administration required for monoclonal antibodies. This can enhance patient adherence and quality of life.

· Rapid action and metabolism

√Quick onset: small molecule drugs typically have a faster onset of action, which is critical in rapidly progressing cancers. For instance, tyrosine kinase inhibitors like imatinib (Gleevec) can swiftly inhibit the activity of oncogenic kinases.

√Flexible metabolism: The quicker metabolism and excretion of small molecule drugs facilitate dose adjustment and side effect management.

· Combination therapy:

√Synergistic effects: small molecule drugs are often used in conjunction with other therapies (including monoclonal antibodies and chemotherapy) to achieve synergistic effects. For example, combining small molecule inhibitors with immune checkpoint inhibitors can enhance the antitumor response.

Overall, the precision, specificity, and sustained action of monoclonal antibodies make them highly effective in modulating the immune system for autoimmune diseases. In contrast, the diversity, rapid action, and ability to target a wide range of intracellular pathways make small molecule drugs crucial for cancer treatment. These differences underscore the distinct therapeutic needs and biological complexities of autoimmune diseases versus cancer, driving the predominant use of monoclonal antibodies in immunology and the preference for small molecule drugs in oncology.

Current trends in the field of immunology suggest that monoclonal antibodies and other biologics are gradually supplanting small molecule drugs. This shift can be attributed to several factors:

· Efficacy and specificity:

as previously mentioned, monoclonal antibodies possess high specificity, enabling precise targeting and modulation of immune system components, which is particularly important in treating autoimmune diseases.

· Biosimilar competition

The introduction of biosimilars indicates a robust market for monoclonal antibodies. New biosimilars not only capture market share from branded biologics but also potentially erode the sales of small molecule immunological drugs due to their relatively lower cost.

· New approvals and indications

Monoclonal antibodies like Sanofi's Dupixent continue to receive FDA approval for additional indications, further solidifying their market position.

· Developer investment intentions

Pharmaceutical companies are heavily investing in the development and commercialization of biologics because these drugs are efficacious and can command premium pricing. Companies focus their R&D pipelines on biologics, which promise high returns and longer exclusive pricing periods.

· Challenges faced by small molecule drugs

√Complexity of immune modulation: the complexity involved in immune modulation often necessitates the high specificity and tailored actions that biologics provide, which small molecules might not achieve as effectively.

√Regulatory and developmental challenges: developing small molecules capable of safely and effectively modulating the immune system without off-target effects or toxicity is highly challenging, leading to a preference for biologics in this therapeutic area.

Though small molecule drugs will remain integral to immunology, particularly where oral administration and rapid onset are advantageous, trends indicate that monoclonal antibodies and other biologics will dominate the blockbuster drug market in immunology. The precision, efficacy, and favorable market dynamics of biologics are driving this transformation, making small molecule drugs increasingly rare in the heavyweight category of immunotherapeutics.

While it is an undisputed fact that biologics dominate the blockbuster scene in immunology, small molecule drugs have not become entirely obsolete. Their intrinsic advantages continue to make them a vital component in the field of immunology, exemplified by the performance of Rinvoq. The ongoing benefits of small molecule drugs are evident in the following areas:

√Oral bioavailability: small molecule drugs are often orally administered, offering greater patient convenience and compliance, which is particularly important for chronic and long-term treatment needs.

√Intracellular targets: these drugs can penetrate cells to target intracellular proteins and signaling pathways.

√Rapid action and flexibility: small molecule drugs typically have a fast onset of action, and their relatively swift metabolism and excretion allow for flexible dose adjustments, which are especially useful in treating acute or rapidly progressing conditions.

√Development cost and time: small molecule drugs generally have lower development costs and shorter timelines compared to biologics. The development of biologics involves complex bioengineering and production processes, whereas small molecule synthesis is more straightforward, allowing for quicker drug development cycles.

Despite the current dominance of biologics in immunotherapy, small molecule drugs continue to innovate and explore new treatment pathways. For instance, small molecule immunomodulators are under investigation to either enhance or suppress immune responses by modulating specific immune signaling pathways. These drugs could play a more significant role in future immunotherapies.

Moreover, combination therapies involving both small molecules and biologics are emerging as a promising strategy. This approach uses the strengths of both drug classes; for example, small molecules can quickly target intracellular pathways, while biologics modulate specific immune responses, achieving more comprehensive therapeutic effects.

Even though biologics like monoclonal antibodies and cell therapies are becoming increasingly prominent in cancer treatment, the future prospects for small molecule drugs in oncology remain strong. This is driven by the inherent advantages of small molecule oncology drugs:

· Targeting intracellular pathways

Small molecule drugs can penetrate cell membranes to target intracellular proteins and pathways that larger biologics often cannot reach. This capability is crucial for inhibiting kinases, transcription factors, and other intracellular targets related to cancer cell proliferation and survival.

· Oral administration

Many small molecule drugs can be formulated as oral agents, offering greater convenience and improved patient compliance compared to injectable biologics. This is particularly beneficial for chronic cancers requiring long-term treatment.

· Rapid development and approval

Compared to biologics, small molecule drugs generally have quicker development and regulatory approval processes, as biologics typically require more complex production and validation steps. This can expedite the availability of new therapies.

· Precision medicine

Advances in genomics and molecular biology are driving the development of small molecule drugs that target specific genetic mutations and molecular abnormalities in cancer cells.

· Combination therapy

Small molecule drugs are increasingly used in combination with other treatments, including immunotherapies and traditional chemotherapies, to enhance efficacy and overcome resistance. For example, combining small molecule inhibitors with immune checkpoint inhibitors can improve antitumor responses.

· Next-generation inhibitors

Developing next-generation small-molecule inhibitors against previously "undruggable" proteins, like KRAS, is a significant research area. Innovations in covalent inhibitors, molecular glues, and PROTACs are opening up new horizons for small molecule oncology products.

· Epigenetic modulators

Small molecule drugs capable of modulating epigenetic regulatory factors, such as histone deacetylase (HDAC) inhibitors and DNA methyltransferase inhibitors, are being explored for their potential to reverse aberrant gene expression patterns in cancer cells.

The future for small molecule drugs in oncology is bright, owing to their unique advantages, ongoing innovations, and the evolving landscape of cancer treatment. While biologics and other advanced therapies will continue to play significant roles, small molecule drugs will remain a critical part of the oncologic arsenal, providing targeted, convenient, and effective treatment options across various cancers.

Looking forward, the applications of small molecule drugs and monoclonal antibodies in oncology and immunology will continue to evolve toward increased specialization and differentiation. In oncology, the role of small molecule drugs will become more focused on precisely targeting specific genetic mutations and signaling pathways, particularly in intracellular processes less accessible to large molecule drugs. These drugs will also play an expanded role in overcoming resistance and developing combination therapies, further advancing personalized cancer treatment.

Simultaneously, the dominance of monoclonal antibodies in the field of immunology will continue to solidify and expand. In the future, monoclonal antibodies will become more diverse and complex, such as with the development of bispecific antibodies and antibody-drug conjugates, optimizing their application in autoimmune and inflammatory diseases. Due to their ability to precisely modulate specific components of the immune system, the potential of monoclonal antibodies to treat complex immune disorders will expand continually. Additionally, innovative therapies based on monoclonal antibodies, like fusion proteins and novel immunomodulators, will play increasingly significant roles in immunology.

As these two classes of drugs continue to evolve within their respective fields, treatments in oncology and immunology will become more personalized and precise. Future therapeutic strategies may increasingly lean on this trend of differentiation, combining the strengths of small molecule drugs and monoclonal antibodies to develop more effective and better-tolerated combination therapies, thereby providing patients with more comprehensive treatment options.

Regeneron Reports Second Quarter 2024 Financial and Operating Results. Regeneron Press Release. 01. 08. 2024.

AbbVie Reports Second-Quarter 2024 Financial Results. AbbVie Press Release. Retrieved on 31. 08. 2024.

Takeda Earnings Call Analysis. Takeda Press Release. Retrieved on 31. 08. 2024.

Bristol Myers Squibb Reports Second Quarter Financial Results for 2024. BMS Press Release. 26. 07. 2024.

Top 15 Immunology Medicines by Q2 2024 Sales. Maven Bio. 29. 08. 2024.

Hopkins, C. Keytruda Sales Climb 16 Percent in Q2 as Merck Pursues New Oncology Candidates. Precision Medicine Online. 30. 07. 2024.

Gil, B. Johnson & Johnson's cancer drug Darzalex could replace Stelara as its best-seller. Quartz. 17. 07. 2024.

AstraZeneca H1 and Q2 Results. AZ Press Release. 25. 07. 2024.

Bristol Myers Squibb Reports Second Quarter Financial Results for 2024. BMS Press Release. 26. 07. 2024.

Pfizer Reports Strong Second-Quarter 2024 Results And Raises 2024 Guidance. Pfizer Press Release. 30. 07. 2024.

Johnson & Johnson reports Q2 2024 results. J&J Press Release. 17. 07. 2024.

AbbVie Reports Second-Quarter 2024 Financial Results. AbbVie Press Release. 25. 07. 2024.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025