Neeta RatanghayraSeptember 29, 2024

Tag: Policies , Rare disease , Orphan Drug

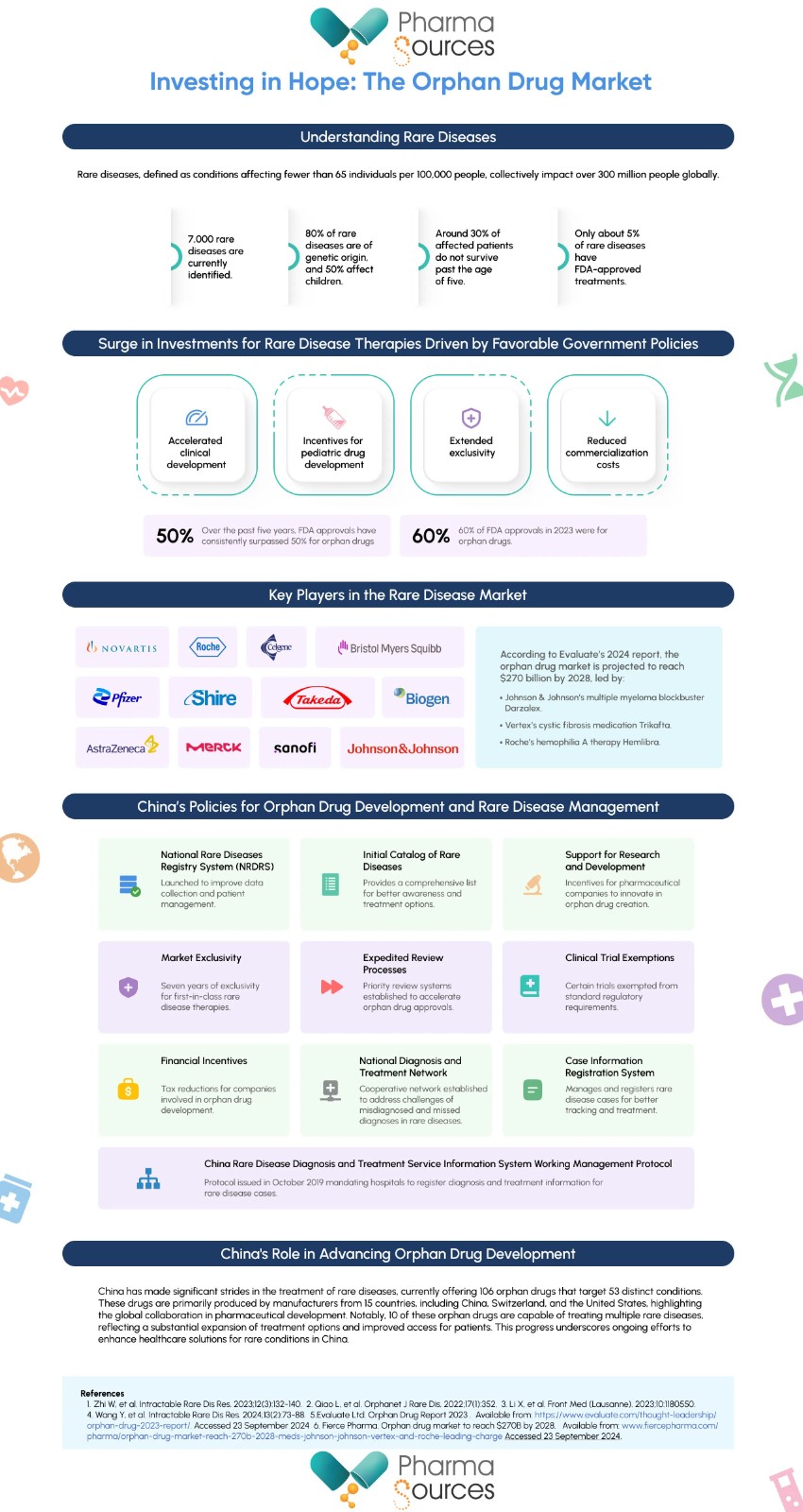

The World Health Organization defines rare diseases as conditions that impact fewer than 65 individuals per 100,000 people. Currently, there are approximately 7,000 unique rare diseases identified, with 80% being of genetic origin and 50% affecting children.

Rare diseases collectively impact more individuals than cancer and AIDS, with around 30% of affected patients not surviving past the age of five. Despite their varied etiology and clinical manifestations, these conditions often impose a significant disease burden on patients and healthcare systems. Alarmingly, only about 5% of these diseases have FDA-approved treatments, highlighting the urgent need to improve patient access to orphan drugs (drugs used to prevent, diagnose or treat a rare disease or condition).

In recent years, investments in the development of therapies for rare diseases have surged, driven by favorable government policies such as accelerated clinical development, incentives for pediatric drug development, extended exclusivity, and reduced commercialization costs. This has led to increased interest from pharmaceutical companies in rare diseases. Both large pharmaceutical companies and smaller biotechnology firms play crucial roles in the development of rare disease therapies. Many small biotech companies initiate drug development, which larger firms may later acquire or market.

The competitive landscape is evolving rapidly, particularly with the rise of cell and gene therapy technologies, which present new opportunities for treatment. Key players in the rare disease market include Novartis, Roche, Celgene, BMS, Shire, Merck, Johnson & Johnson, Pfizer, Biogen, Sanofi, AstraZeneca, and Takeda.

The increasing market interest has also led to significant mergers and acquisitions within the sector. Notable transactions include AstraZeneca's $39 billion acquisition of Alexion in 2021 and Amgen's $28 billion purchase of Horizon Therapeutics in 2022, reflecting a trend of large companies integrating rare disease assets into their portfolios.

Companies are adapting their strategies to navigate the complexities of the rare disease landscape. For instance, Pfizer has shifted from a standalone research unit to a more integrated approach, aligning rare disease programs with broader therapeutic areas while seeking external innovations that strategically complement its focus.

Rapid advancements in genetic research, particularly the dramatic decline in genomic sequencing costs—from billions in the early 1990s to under $1,000 today—are driving growth in the field of rare diseases. Genetic conditions make up about 80% of all rare diseases. Despite significant progress in drug development and regulatory approvals, challenges remain, particularly concerning patient access and pricing. Gene therapies, while promising potential cures, often come with high price tags; every approved gene therapy in the U.S. has become the most expensive drug in the world upon its approval.

According to Evaluate’s 2024 report, the top 10 most valuable orphan drugs are projected to generate over $57 billion in revenue by 2028.

The report states that by 2028, the global orphan drug market is expected to account for approximately one-fifth of all non-generic prescription drug sales, totaling around $1.5 trillion. Within this landscape, it is anticipated that over one-third of global drug sales for major pharmaceutical companies such as Johnson & Johnson (J&J) and AstraZeneca will originate from orphan drugs, predominantly in the oncology sector.

The orphan drug sector remains a highly attractive market. Several factors contribute to the ongoing appeal of orphan drugs. These include high pricing structures, targeted clinical trials, well-defined patient populations, and development incentives that support this vital sector. Additionally, regulatory flexibility plays a significant role; nearly 60% of new drug approvals by the FDA in 2023 were designated as orphan drugs, encompassing approvals from both the Center for Drug Evaluation and Research (CDER) and the Center for Biologics Evaluation and Research (CBER). Over the past five years, the proportion of orphan drug approvals by the FDA has consistently exceeded 50%.

This combination of market dynamics and regulatory support underscores the continued viability and attractiveness of orphan drugs in the pharmaceutical landscape.

Investing in Hope: The Orphan Drug Market

China has identified 207 diseases as rare. Approximately 20 million individuals in China are affected by these conditions, highlighting the urgent need for improved policies related to diagnosis, treatment, and access to medications.

The economic burden of these diseases on patients and their families is substantial. Recent studies indicate a notable improvement in the accessibility of orphan drugs between 2017 and 2020, reflecting the effectiveness of existing policy measures.

The Chinese government has actively established a national framework for addressing rare diseases, aiming to enhance diagnostic and treatment capabilities while ensuring better access to medications. Key milestones include the launch of the National Rare Diseases Registry System (NRDRS) and the release of an initial catalog of rare diseases, both of which are significant steps toward improving patient care.

The Chinese government has implemented a range of policies aimed at fostering the development and marketing of orphan drugs, leading to notable advancements in this sector.

Support for Research and Development: The government has introduced incentives to encourage pharmaceutical companies to engage in the research and development of orphan drugs. This includes facilitating the exploration of new indications for existing drugs that target rare diseases. Notably, the Implementation Plan of China’s Drug Administration Law, introduced in May 2022, offers seven years of market exclusivity for first-in-class rare disease therapies, mirroring practices in the United States.

Expedited Review Processes: To streamline the approval of orphan drugs, the government has established priority review and approval processes. This initiative aims to accelerate the time it takes for orphan drugs to reach the market.

Clinical Trial Exemptions and Financial Incentives: Policies have been implemented to exempt certain clinical trials from standard regulatory requirements and to provide tax reductions for companies engaged in orphan drug development.

Recognizing the challenges of misdiagnosis and missed diagnoses in rare diseases, China’s healthcare system has established a national diagnosis and treatment cooperative network. This initiative includes:

Case Information Registration: The network is tasked with creating a comprehensive rare disease case information registration and management system.

Regulatory Framework: In October 2019, the National Health Commission issued the "China Rare Disease Diagnosis and Treatment Service Information System Working Management Protocol." This protocol mandates member hospitals within the cooperative network to register diagnosis and treatment information for rare disease cases and develop an information system to collect relevant data.

In addition to national policies, local governments have actively explored mechanisms to enhance the administration and security of rare disease management. These initiatives complement national efforts and aim to create a more robust framework for the treatment and care of individuals with rare diseases.

China currently has 106 orphan drugs available, targeting 53 rare diseases across various categories, including hematologic disorders, congenital metabolic conditions, neuropathies, and digestive system diseases. These drugs are primarily produced by manufacturers from 15 countries, including China, Switzerland, and the United States. Notably, 10 of these orphan drugs can treat multiple rare diseases. This landscape signifies a substantial expansion in treatment options for rare diseases in China, highlighting both domestic and international efforts in pharmaceutical development. The diversity of conditions addressed and the range of participating countries reflect the collaborative nature of the global healthcare market.

1. Zhi W, Liu M, Yang D, Zhang S, Lu Y, Han J. Analysis of marketed orphan drugs in China. Intractable Rare Dis Res. 2023;12(3):132-140.

2. Qiao L, Liu X, Shang J, et al. Evaluating the national system for rare diseases in China from the point of drug access: progress and challenges. Orphanet J Rare Dis. 2022;17(1):352.

3. Li X, Wu L, Yu L, He Y, Wang M, Mu Y. Policy analysis in the field of rare diseases in China: a combined study of content analysis and Bibliometrics analysis. Front Med (Lausanne). 2023;10:1180550.

4. Wang Y, Liu Y, Du G, Liu Y, Zeng Y. Epidemiology and distribution of 207 rare diseases in China: A systematic literature review. Intractable Rare Dis Res. 2024;13(2):73-88.

5. Evaluate Ltd. Orphan Drug Report 2023. Available from: https://www.evaluate.com/thought-leadership/orphan-drug-2023-report/. Accessed 23 September 2024.

6. Fierce Pharma. Orphan drug market to reach $270B by 2028, with Johnson & Johnson, Vertex, and Roche leading the charge. Available from: https://www.fiercepharma.com/pharma/orphan-drug-market-reach-270b-2028-meds-johnson-johnson-vertex-and-roche-leading-charge. Accessed 23 September 2024.

7. Zhi W, Liu M, Yang D, Zhang S, Lu Y, Han J. Analysis of marketed orphan drugs in China. Intractable Rare Dis Res. 2023;12(3):132-140.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025