Krebs QinMay 27, 2024

Tag: Pharmaceutical giant , R&D funds , Investment

The significance of R&D investment in biopharmaceutical companies cannot be overstated.

Firstly, R&D investment lies at the core of discovering and developing new drugs. These new drugs have the potential to treat illnesses, elevate patients' quality of life, and even save lives. For instance, the R&D of revolutionary new drugs like cancer immunotherapy and gene therapy demands substantial investment of funds and resources. Secondly, the biopharmaceutical industry is featured by fierce competition, with continuous emergence of new technologies and drugs. To retain a competitive edge in the market, companies must consistently invest in R&D, fostering innovation and developing more effective and safer drugs. Moreover, the R&D and production of drugs must strictly comply with regulatory requirements. R&D investment ensures that companies have sufficient resources to conduct necessary clinical trials, quality control, and safety assessment, thereby guaranteeing the safety, efficiency, and compliance of drugs. Moreover, the world is confronted with multiple health challenges, such as emerging infectious diseases, antibiotic resistance, and chronic illnesses. Biopharmaceutical companies, through sustained R&D investment, can better address these challenges and provide innovative solutions and pharmaceutical therapeutic schemes. Lastly, the biopharmaceutical industry is a vital driver of economic growth and a significant creator of employment opportunities. R&D investment can not only propel the company's own progress but also stimulate the development of related industry chains, fostering economic expansion and the creation of employment opportunities.

The strategic allocation of R&D funds plays a vital role in biopharmaceutical companies, and its importance can be evaluated from both positive and negative perspectives:

Optimize R&D efficiency. By employing effective strategies for allocating R&D funds, companies can enhance their R&D efficiency. Through appropriate resource allocation, with a focus on the most promising projects, companies can expedite the discovery of new drug candidates and facilitate their market introduction.

Accelerate the innovation. Targeted utilization of R&D funds can spur innovative development. Companies can invest in emerging technology platforms, R&D tools, and talent cultivation, thereby facilitating scientific progress and expediting the discovery and development of new drugs.

Reduce risks. Proper allocation of R&D funds can mitigate the risk of the R&D project failure. By investing in multiple projects, companies can diversify risks, ensuring business sustainability even in the face of project failures.

Waste resources. Inefficient utilization of R&D funds can result in the wastage of resources. If companies spread their funds too thinly, investing in unpromising or low-priority projects, it may lead to the wasteful allocation of funds and hinder the development progress.

Miss opportunities. Improper use of R&D funds may result in the missing of important innovation opportunities. Insufficient investment in critical technologies or fields may cause companies to overlook groundbreaking opportunities in the market, impacting their competitiveness and long-term development.

Affect the company reputation: Project failures or poor outcomes in R&D can tarnish a company's reputation. Ineffective utilization of R&D funds, resulting in multiple project failures or the launch of low-quality products, can undermine market confidence in the company, affecting its market position and brand image.

Pharmaceutical industry giants spare no expenses when it comes to R&D, including substantial investments in product pipeline development and lavish spending on acquiring other companies or assets.

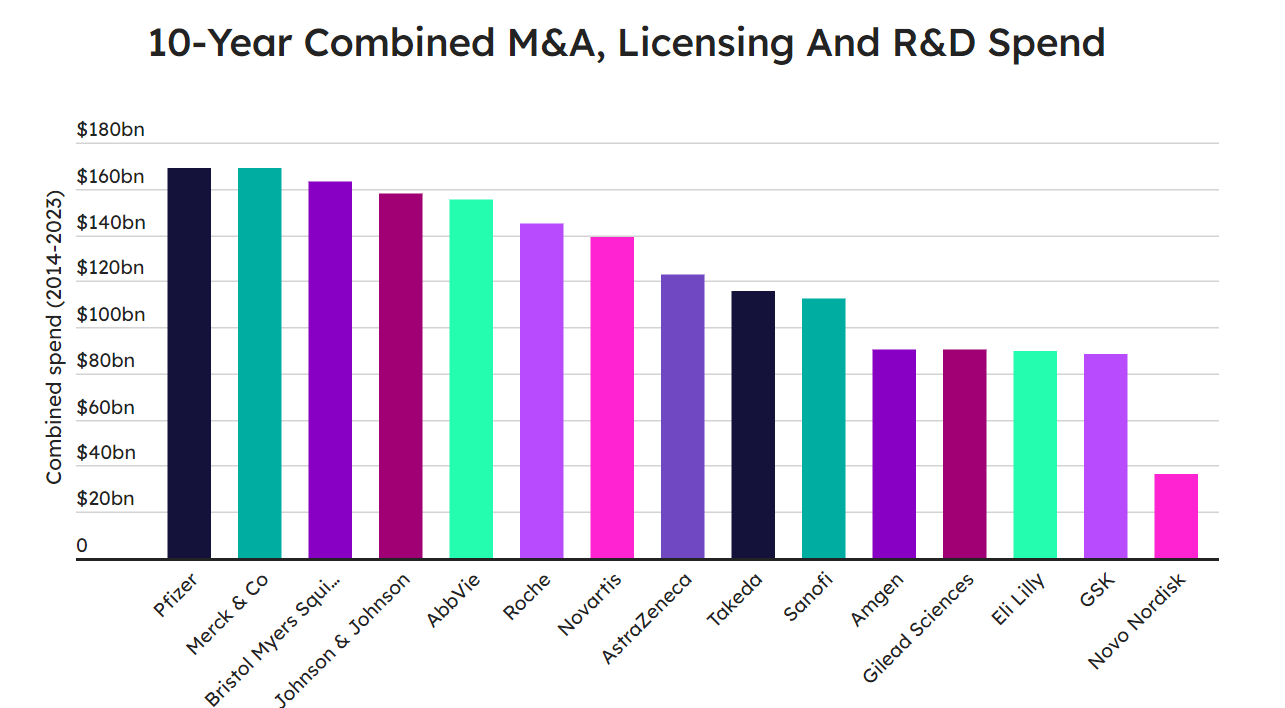

According to Evaluate's ten-year data tracking the R&D investments of major biopharmaceutical companies, Pfizer secures the top spot with a cumulative R&D investment of USD 169.2 billion over the decade. MSD closely followed with USD 169.1 billion. It is worth noting that Pfizer's Comirnaty alone generated over USD 50 billion in revenue within a short span of two years, while MSD's Keytruda amassed a colossal wealth of over USD 102 billion over the past ten years.

Figure 1 Ranking of Cumulative R&D Investment over the Past Decade (2014-2023) for 15 Pharmaceutical Giants (Data source: Evaluate; figure source: Scrip. Note: R&D investment includes expenses related to company merger and acquisition as well as project introduction.)

The noteworthy data in Figure 1 comes from Novo Nordisk, the top-valued European pharmaceutical giant from Denmark. Over the past decade, this company, with a market value ranking first in Europe, has made a comparatively modest R&D investment of USD 36.6 billion, placing it at the bottom among the 15 major pharmaceutical companies. In the past decade, Novo Nordisk, a relatively secluded player, refrained from making blockbuster acquisitions like Pfizer's USD 43 billion acquisition of Seagen or aggressively entering the booming fields of oncology and immunology at the time. Instead, it quietly and lucratively thrived on its century-old foundation in diabetes, creating the immensely successful GLP-1 (glucagon-like peptide-1) that swiftly gained prominence in the weight-loss drug market, establishing itself as the undisputed leader in the industry. From the comparison diagram in Figure 2, it is evident that Novo Nordisk's investment style embodies a "minimalist" approach. Nevertheless, the enormous wealth generated by the immensely successful semaglutide drug has fueled noticeable investment enthusiasm at Novo Nordisk since 2019.

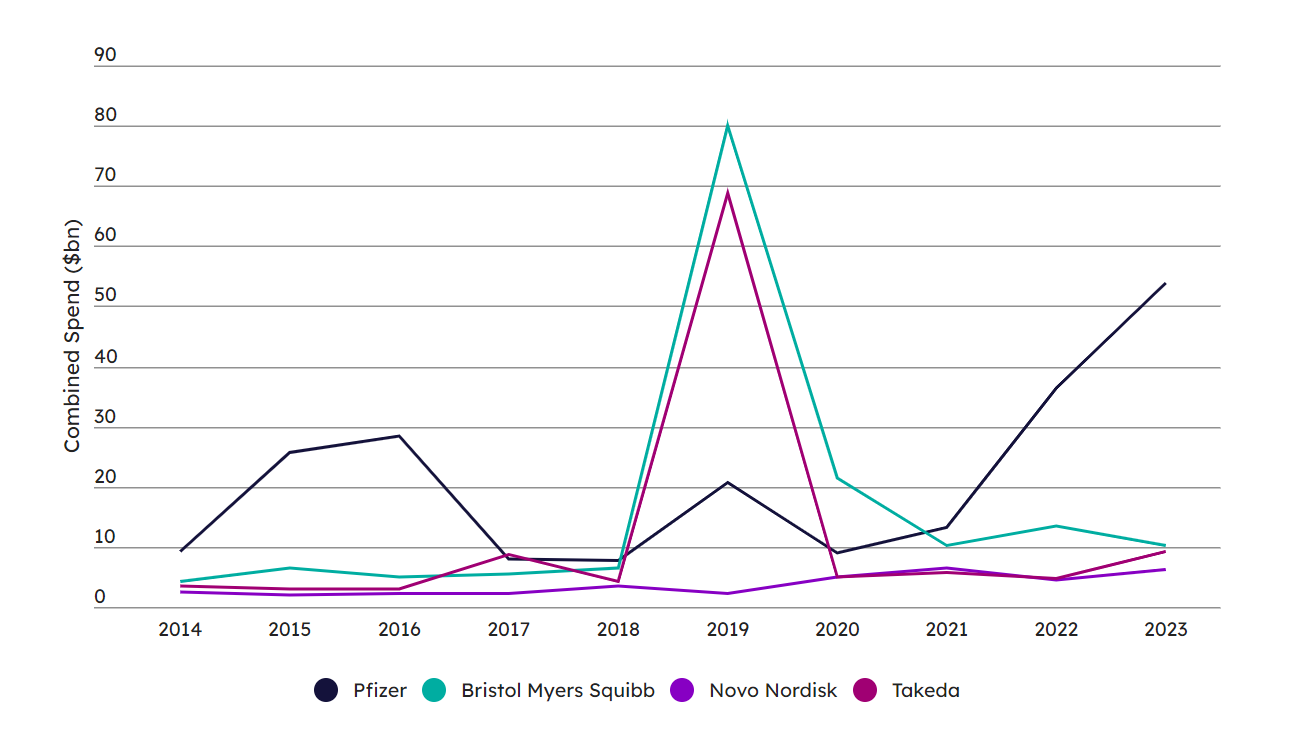

Figure 2 Comparison of R&D Investment Trends over the Past Decade among Four Major Pharmaceutical Companies (Pfizer, Bristol-Myers Squibb, Novo Nordisk, and Takeda) (Data source: Evaluate; figure source: Scrip)

Diverging from Novo Nordisk's "modest" strategy, Pfizer has steadfastly embraced a "bold" approach to R&D investment, consistently maintaining high levels of investment intensity throughout the years. The significant revenue generated by Comirnaty in 2021 and 2022 has notably propelled Pfizer to increase its investment efforts, especially with the bold USD 43 billion acquisition of Seagen in 2023.

Both Bristol-Myers Squibb and Takeda Pharmaceutical have exhibited a somewhat impulsive shopping pattern, with their respective acquisitions of Celgene and Shire in 2019 leading to a surge in R&D investment that year, while other years remained relatively calm.

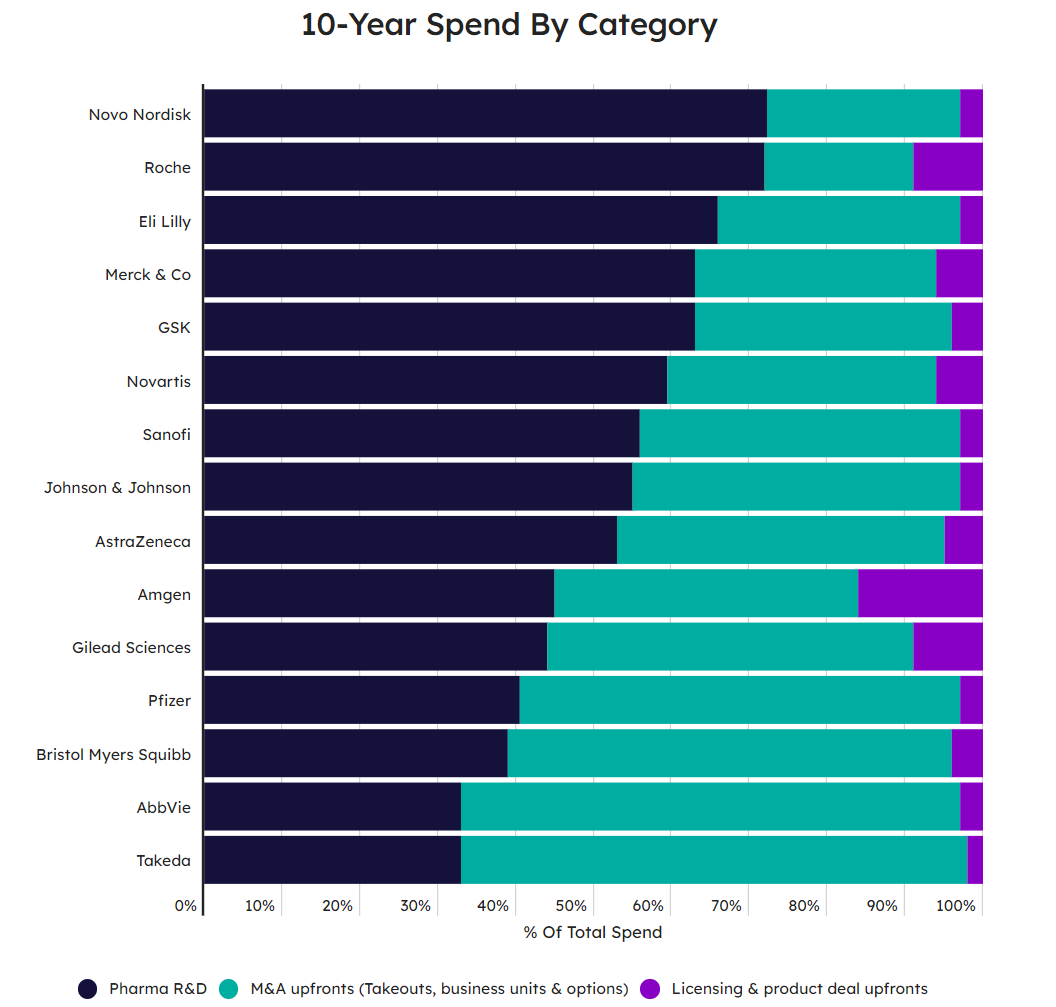

From the distribution of R&D investment attributes shown in Figure 3, it is apparent that Novo Nordisk falls into the category of cautious internal development, with the highest proportion (73%) of R&D investment among major pharmaceutical companies. Roche closely follows with 72%, while Takeda Pharmaceutical has the largest proportion (65%) of corporate acquisition expenditure, and AbbVie (64%) is also quite generous in this regard. Amgen has the highest proportion of project introductions (16%), largely attributable to their astonishing USD 13.4 billion acquisition of global rights to Celgene's psoriasis drug, Otezla (apremilast), in 2019.

Figure 3 Distribution of R&D Investment Types among the Top 15 Pharmaceutical Companies (Data source: Evaluate; figure source: Scrip)

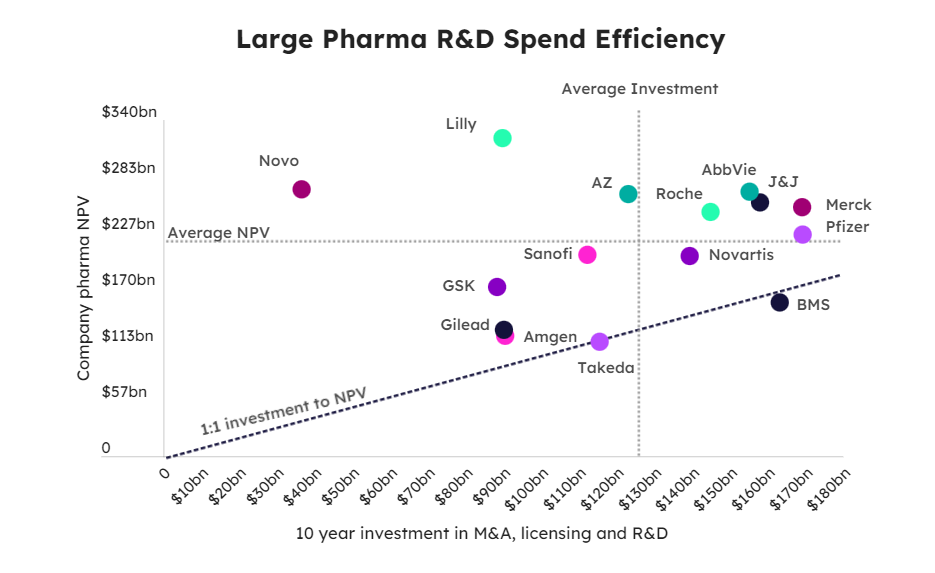

Assessing the investment returns is relatively challenging, but analysts utilize the net present value (NPV) of each company's assets as a standard to evaluate the returns on R&D investment. Specifically, it involves comparing the NPV of each company's therapies (including approved therapies and therapies in the R&D stage) with their expenditures.

Figure 4 Distribution of Return on Investment among Major Pharmaceutical Companies (Data source: Evaluate; figure source: Scrip)

In Figure 4, the data in the upper-left quadrant represents investments that yielded returns higher than the average level despite below-average expenditures. It is evident that the two pharmaceutical giants, Novo Nordisk and Eli Lilly, focusing on investment in diabetes and obesity, are "fortunate ones". Analysts believe that for every dollar spent by Novo Nordisk over the past decade, they generated a return of USD 7.36, showcasing unparalleled profitability. The closest contender to Novo Nordisk is Eli Lilly, with a return of USD 3.58 for every dollar invested.

On the other end of the spectrum are Takeda and Bristol-Myers Squibb. Some analysts argue that their methods have produced negative returns, but it is fair to say that early-stage assets should not be prematurely evaluated in such a manner. Despite the massive USD 74 billion Celgene deal, Bristol Myers Squibb (BMS) has fallen short of meeting investors' return expectations. Moreover, the company has become overly reliant on its legacy products, with 70% of its revenue coming from products that have been on the market for more than a decade.

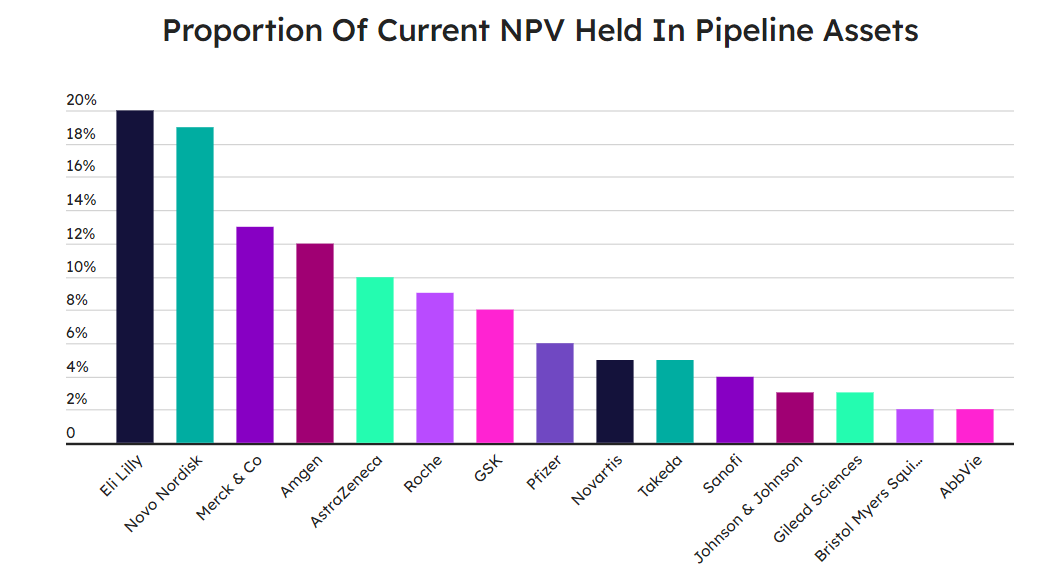

Looking at future profit potential, Novo Nordisk and Eli Lilly emerge as the big winners (Figure 5), with potential NPVs of 20% and 19%, respectively, hidden within their promising futures, awaiting a breakthrough. Novo Nordisk's insulin analogue and the combination therapy Cagrisema, along with Eli Lilly's oral GLP-1 agonist (orforglipron), bear the hope of taking both companies to new heights. Furthermore, Eli Lilly's 3G weight-loss drug candidate retatrutide and the Alzheimer's therapy donanemab also hold high-value NPVs.

Figure 5 Comparison Diagram of Net Present Value (NPV) of Pipeline Product Assets among Major Pharmaceutical Companies (Data source: Evaluate; figure source: Scrip)

Cairns, E. et al. Analysis: Novo And Lilly Make Their Money Work. Scrip. 26. 04. 2024.

Cairns, E. et al. AbbVie Needs To Freshen Up. 22. 03. 2024.

Jackson, M. BMS Will Cut $1.5bn And 2,200 Jobs To Reinvest In Needed Growth. Scrip. 25. 04. 2024.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025