Spur 203May 21, 2024

Tag: Pharmaceutical Dosage , Improvement , Opportunities

It's difficult to create innovative drugs with high thresholds, and generics are highly competitive with few barriers, leading to excessive competition. This phenomenon has caused more and more companies to turn their attention to the market for modified new drugs, creating a new path between complete innovation and imitation. Due to the characteristics of lower R&D risks, shorter development cycles and higher returns, this niche market of modified new drugs is gradually drawing people's attention. Although the development of modified new drugs in China started relatively late, they have benefited from better safety, effectiveness, and compliance. Driven by factors such as the national policy's emphasis on clinical value and the upgrading of novel preparation technology, the market size of modified new drugs has rapidly grown. Improving the original dosage forms to address unmet clinical needs and extend the product life cycle is a major R&D approach for modified new drugs at present.

The recent approval of several new dosage forms of blockbuster drugs has confirmed this point to some extent. Last month, FDA officially approved a new dosage form (Entresto sprinkle) of Novartis's blockbuster cardiovascular product Entresto (Sacubitril Valsartan Sodium, Entresto). Entresto Sprinkle is supplied in the form of capsules with film-coated oral granules inside for oral administration. It is approved in two specifications, containing 6mg sacubitril and 6mg valsartan; or containing 15mg sacubitril and 16mg valsartan. It is worth noting that Entresto achieved a staggering sales volume of USD 6.035 billion globally last year. Similarly, FDA also approved Abbvie's new oral solution dosage form of Upadacitinib (Rinvoq) this month, with the brand name Rinvoq LQ. Last year, the global sales volume of Upadacitinib also reached USD 3.969 billion.

After considering the approval of the new dosage form of Sacubitril Valsartan Sodium and Upadacitinib, we can find that original manufacturers are making efforts to extend the product life cycle. When the patents on key compounds of the two drugs expire in recent years, the approval of new dosage forms will deepen the protection of the products and delay the speed of market segmentation by generics.

Throughout history, whether it is Risperidone and paliperidone palmitate that shine in the field of psychiatry or the classic drug Paclitaxel in the field of tumor, they have all ushered in a new engine of growth after continuous dosage form upgrades. And with the continuous development of preparation technology platforms such as slow release control, microspheres, liposomes, and inhalation preparations, more possibilities are added to the dosage form improvement. Pharmaceutical dosage form improvement has been on the fast track of high-speed development, whether it is driven by products or preparation technology.

Opening the global drug sales data for 2023, it is not difficult to find that all good times don't last long. The former king of medicine Humira saw a sharp decline in sales volume under the impact of patent cliff, and Keytruda took over as the new king of medicine. Meanwhile, several blockbuster products including Lenalidomide, Etanercept, and Ibrutinib have continued to decline under the erosion of generics after their patents expired. Modifying the original dosage forms is currently a strategy for many drugs to extend their product life cycle. Both changing Keytruda into subcutaneous preparation and changing semaglutide into oral preparation reflect the wisdom of the original drug manufacturers.

Among numerous modified dosage forms, the long-acting injectable suspensions of paliperidone palmitate undoubtedly stands out as the most impressive one, achieving an astonishing global sales volume of USD 4.115 billion in 2023. Paliperidone is a kind of atypical antipsychotics that is the primary metabolic product of Risperidone. INVEGA, a daily oral preparation, was approved in the United States in 2006. INVEGA SUSTENNA, a monthly preparation, was approved in the United States in 2009. INVEGA TRINZA, a three-month preparation, was approved in the United States in 2015. INVEGA HAFYERA, a six-month preparation, was approved in the United States in 2021.

The commercial success of the long-acting injectable suspensions of paliperidone palmitate is attributed to two major reasons. Firstly, it really addresses the unmet clinical needs. The treatment of schizophrenia is relatively long, and some patients have poor medication compliance, they may have a tendency to spit out the medication or refuse to swallow it. Some special injections can achieve the purpose of long-acting or attenuated toxicity. As the only antipsychotics currently available that can extend the medication interval to once every six months, the long-acting injectable suspensions of paliperidone palmitate not only guarantees corresponding therapeutic effects, but also greatly reduces the times of hospital visits for patients, saving time and improving the efficiency of medical resource utilization.

Secondly, in the past few decades of rapid development of preparation technology, paliperidone palmitate has taken advantage of nanocrystal technology and used nanocrystal wet milling technology to make fine drug particles. With the increase of the surface area of drug particles, the water solubility of the drug is improved, thus forming the water suspension preparation that can be used for intramuscular injection, and also increasing the absorption rate and bioavailability of the drug. After administration, paliperidone palmitate dissolved slowly, with smaller particles dissolving first and larger particles dissolving later. The dissolved paliperidone palmitate is then completely hydrolyzed into Paliperidone by esterases. Through the improvement of dosage forms, paliperidone palmitate has met clinical needs, which is conducive to maintaining long-term therapeutic effects and reducing recurrence rates. It has significant clinical application value and also extends the product's life cycle.

Table 1 Approved long-acting injectable suspensions of paliperidone palmitate

序号 No. | 商品名 Brand name | 国内通用名 Domestic generic name | 上市规格(国内说明书) Listing specifications (domestic instruction) | 上市规格(FDA) Listing specifications (FDA) | 给药频率 Frequency of administration | 注射部位 Injection site | 美国上市年份 Year of listing in the United States | 原研进口时间 Original research import time | 持证商 Certificate holder |

1 | Invega Sustenna 善思达 Invega Sustenna | 棕榈酸帕利哌酮注射液 Paliperidone Palmitate Injection | 0.75 mL: 75 mg, 1.0 mL: 100 mg, 1.5 mL: 150 mg(按帕利哌酮计) 0.75 mL: 75 mg, 1.0 mL: 100 mg, 1.5 mL: 150 mg (Measured by Paliperidone) | 39 mg/0. 25 mL, 78 mg/0.5 mL,117 mg/0.75 mL, 156 mg/1 mL, 234 mg/1.5 mL(按棕榈帕利哌酮酯计) 39 mg/0.25 mL, 78 mg/0.5 mL, 117 mg/0.75 mL, 156 mg/1 mL, 234 mg/1.5 mL (Measured by paliperidone palmitate) | 1月 January | 三角肌或臀肌 Deltoid or gluteus | 2009 | 2011 | 国内:Janssen -Cilag International NV China: Janssen - Cilag International NV |

2 | Invega Trin-2za 善妥达 Invega Trin-2za | 棕榈帕利哌酮酯注射液(3M) Paliperidone Palmitate Injection (3M) | 0.875 mL: 175 mg, 1.315 mL: 263 mg, 1.75 mL: 350 mg, 2.625 mL : 525 mg(按帕利哌酮计) 0.875 mL: 175 mg, 1.315 mL: 263 mg, 1.75 mL: 350 mg, 2.625 mL : 525 mg (Measured by Paliperidone) | 273 mg/0. 875 mL, 410 mg/1.315 mL, 546 mg/1.75 mL, 819 mg/2.625mL(按棕榈帕利哌酮酯计) 273 mg/0.875 mL, 410 mg/1.315 mL, 546 mg/1.75 mL, 819 mg/2.625 mL (Measured by paliperidone palmitate) | 3月 March | 三角肌或臀肌 Deltoid or gluteus | 2015 | 2018 | 国内: Janssen- Cilag International NV China: Janssen - Cilag International NV |

3 | Invega Hafy-era | - | - | 1.092 g/3.5mL (312mg·mL-1), 1.560 g/5mL(312 mg ·mL-1) | 6月 June | 臀肌 Gluteus | 2021 | / | Janssen pharmaceuticals, Inc. |

Figure 1: Approved long-acting injectable suspensions of paliperidone palmitate

Of course, paliperidone palmitate is just one of the outstanding stars among many modified dosage forms. The improvement of pharmaceutical dosage forms cannot be separated from the continuous upgrading of preparation technology, the continuous evolution of excipients, and more importantly, the unmet clinical needs.

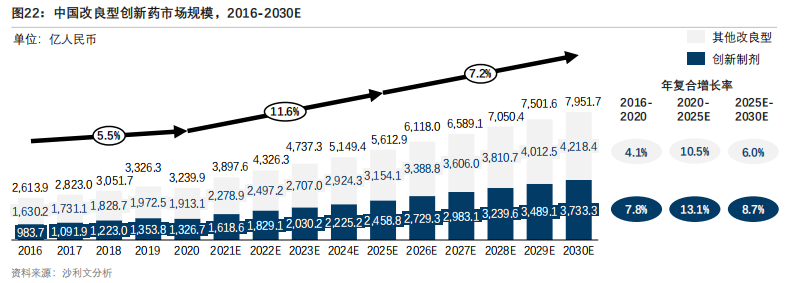

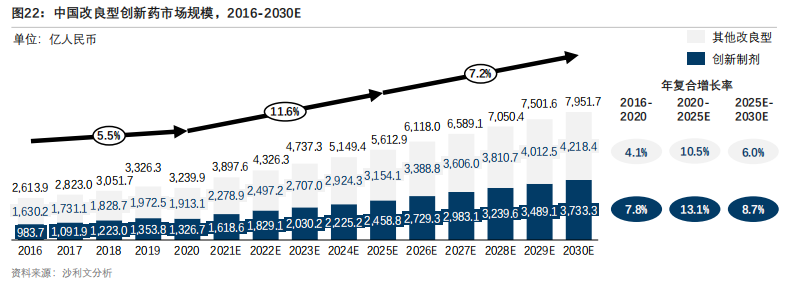

According to the data from Sullivan Consulting, the number of patients with chronic diseases in China has been continuously increasing, and the demand for modified new drugs has increased accordingly. With the promotion of technological innovation and favorable policies, the market size of China's modified innovative drugs increased from RMB 261.39 billion to RMB 323.99 billion from 2016 to 2020, with a compound annual growth rate of 5.5%. It is estimated that by 2025, the market size of China's modified innovative drugs will reach RMB 561.29 billion, with a compound annual growth rate of 11.6%. And it is expected to reach RMB 795.17 billion by 2030, with a compound annual growth rate of 7.2%.

Figure 22: Market size of modified innovative drugs in China, 2016-2030E

Figure 2: Market size of China's modified innovative drugs (Source: Sullivan Consulting)

According to the new classification of drug registration in China, modified new drugs refer to drugs that have been optimized in terms of their structure, dosage form, prescription process, administration route, indications, etc., based on known active ingredients, and have significant clinical advantages. Among them, the modified type of dosage form, prescription process, and administration route under Class 2.2 has accounted for the highest proportion of applications in the past three years, exceeding 50%. In other words, the pharmaceutical dosage form improvement accounts for half of the modified new drugs. In the current situation of involution in generics and overcrowding of innovative drug targets, there are more ways to break the deadlock than just one. The pharmaceutical dosage form improvement is a good approach, which brings new development opportunities for generic drug companies actively undergoing transformation.

Currently, the pharmaceutical dosage form improvement is mainly focused on oral preparations. Common cases include the development of granules, oral solutions and dry suspensions, based on tablets or capsules, for special populations such as children and individuals with dysphagia. For instance, in recent years, modified drug preparations such as Entecavir granules, Amlodipine Besylate Dry Suspensions, and Sodium Phosphate Powder have been approved.

药品名称 Drug name | 注册分类 Registration classification | 企业名称 Enterprise name | 审评结论 Review conclusion |

注射用醋酸戈舍瑞林缓释微球 Goserelin Acetate Sustained Release Microspheres for Injection | 化药2.2 Class 2.2 chemical drug | 山东绿叶制药有限公司 Shandong Luye Pharmaceutical Co., Ltd. | 批准生产 Approved production |

盐酸右美托咪定鼻喷雾剂 Dexmedetomidine Hydrochloride Nasal Spray | 化药2.2 Class 2.2 chemical drug | 四川普锐特药业有限公司 Sichuan Purity Pharmaceutical Co., Ltd. | 批准生产 Approved production |

苯甲酸氨氯地平干混悬剂 Amlodipine Besylate Dry Suspension | 化药2.2 Class 2.2 chemical drug | 广州一品红制药有限公司 ApicHope Pharmaceutical Co., Ltd. | 批准生产 Approved production |

醋酸阿比特龙片(I) Abiraterone Acetate Tablets (I) | 化药2.2 Class 2.2 chemical drug | 成都盛迪医药有限公司 Chengdu Suncadia Medicine Co., Ltd. | 批准生产 Approved production |

注射用右兰索拉唑 Dexlansoprazole for Injection | 化药2.2 Class 2.2 chemical drug | 江苏奥赛康药业有限公司 Jiangsu Aosaikang Pharmaceutical Co., Ltd. | 批准生产 Approved production |

盐酸氨溴索无水吞服颗粒 Ambroxol Hydrochloride Anhydrous Swallowing Granules | 化药2.2 Class 2.2 chemical drug | 山东科成医药科技有限公司;上海医药集团(本溪)北方药业有限公司 Shandong Kecheng Pharmaceutical Technology Co., Ltd.; Shanghai Pharmaceutical Group (Benxi) North Pharmaceutical Co., Ltd. | 批准生产 Approved production |

盐酸伊立替康脂质体注射液 Irinotecan Hydrochloride Liposome Injection | 化药2.2 Class 2.2 chemical drug | 江苏恒瑞医药股份有限公司 Jiangsu Hengrui Pharmaceuticals Co., Ltd. | 批准生产 Approved production |

注射用醋酸戈舍瑞林缓释微球 Goserelin Acetate Sustained Release Microspheres for Injection | 化药2.2 Class 2.2 chemical drug | 山东绿叶制药有限公司 Shandong Luye Pharmaceutical Co., Ltd. | 批准生产 Approved production |

阿立哌唑口溶膜 Aripiprazole Oral Soluble Film | 化药2.2 Class 2.2 chemical drug | 力品药业(厦门)股份有限公司;厦门力卓药业有限公司 Xiamen LP Pharmaceutical Co., Ltd.; Xiamen Li Zhuo Pharmaceutical Co., Ltd. | 批准生产 Approved production |

盐酸右美托咪定鼻喷剂 Dexmedetomidine Hydrochloride Nasal Spray | 化药2.2 Class 2.2 chemical drug | 上海恒瑞医药有限公司 Shanghai Hengrui Pharmaceutical Co., Ltd. | 批准生产 Approved production |

注射用醋酸曲普瑞林微球 Triptorelin Acetate Microspheres for Injection | 化药2.2 Class 2.2 chemical drug | 丽珠医药集团股份有限公司;上海丽珠制药有限公司 Livzon Pharmaceutical Group Inc.; Shanghai Livzon Pharmaceutical Co., Ltd. | 批准生产 Approved production |

依达拉奉舌下片 Edaravone Sublingual Tablet | 化药2.2 Class 2.2 chemical drug | 南京百鑫愉医药有限公司;药源生物科技(启东)有限公司 Nanjing Biosnwill Pharmaceutical Co., Ltd.; Yaoyuan Biotechnology (Qidong) Co., Ltd. | 批准生产 Approved production |

盐酸美金刚口溶膜 Memantine Hydrochloride Oral Soluble Film | 化药2.2 Class 2.2 chemical drug | 齐鲁制药有限公司 Qilu Pharmaceutical Co., Ltd. | 批准生产 Approved production |

阿立哌唑口溶膜 Aripiprazole Oral Soluble Film | 化药2.2 Class 2.2 chemical drug | 齐鲁制药有限公司 Qilu Pharmaceutical Co., Ltd. | 批准生产 Approved production |

盐酸米托蒽醌脂质体注射液 Mitoxantrone Hydrochloride Liposome Injection | 化药2.2 Class 2.2 chemical drug | 石药集团中诺药业(石家庄)有限公司 Zhongnuo Pharmaceutical (Shijiazhuang) Co. Ltd. | 批准生产 Approved production |

他达拉非口溶膜 Tadalafil Oral Soluble Film | 化药2.2 Class 2.2 chemical drug | 齐鲁制药有限公司 Qilu Pharmaceutical Co., Ltd. | 批准生产 Approved production |

淋巴示踪用盐酸米托蒽醌注射液 Mitoxantrone Hydrochloride Injection for Lymphatic Tracer | 化药2.2 Class 2.2 chemical drug | 上海创诺制药有限公司 Shanghai Acebright Pharmaceutical Co., Ltd. | 批准生产 Approved production |

注射用利培酮缓释微球 Risperidone Sustained Release Microspheres for Injection | 化药2.2 Class 2.2 chemical drug | 山东绿叶制药有限公司 Shandong Luye Pharmaceutical Co., Ltd. | 批准生产 Approved production |

注射用右旋兰索拉唑 Dexlansoprazole for Injection | 化药2.2 Class 2.2 chemical drug | 盛禾(中国)生物制药有限公司 Sunho (China) Biopharmaceutical Co., Ltd | 批准生产 Approved production |

奥氮平口溶膜 Olanzapine Oral Soluble Film | 化药2.2 Class 2.2 chemical drug | 齐鲁制药有限公司 Qilu Pharmaceutical Co., Ltd. | 批准生产 Approved production |

普瑞巴林缓释片 Pregabalin Extended Release Tablets | 化药2.2 Class 2.2 chemical drug | 江苏恒瑞医药股份有限公司 Jiangsu Hengrui Pharmaceuticals Co., Ltd. | 批准生产 Approved production |

兰索拉唑胶囊 Lansoprazole Capsules | 化药2.2 Class 2.2 chemical drug | 北京四环制药有限公司 Beijing Sihuan Pharma Co., Ltd. | 批准生产 Approved production |

注射用紫杉醇聚合物胶束 Paclitaxel Polymeric Micelles for Injection | 化药2.2 Class 2.2 chemical drug | 上海谊众生物技术有限公司 Shanghai Yizhong Biotechnology Co., Ltd. | 批准生产 Approved production |

孟鲁司特钠口溶膜 Montelukast Sodium Oral Soluble Film | 化药2.2 Class 2.2 chemical drug | 齐鲁制药有限公司 Qilu Pharmaceutical Co., Ltd. | 批准生产 Approved production |

水合氯醛/糖浆组合包装 Chloral Hydrate/Syrup (Complex Packing) | 化药2.2 Class 2.2 chemical drug | 南京特丰药业股份有限公司 Nanjing Tefeng Pharmaceutical Co., Ltd. | 批准生产 Approved production |

左奥硝唑分散片 Levonidazole Dispersible Tablets | 化药2.2 Class 2.2 chemical drug | 湖南华纳大药厂股份有限公司,湖南华纳大药厂科技开发有限公司,长沙市华*** Hunan Warrant Pharmaceutical Co., Ltd., Hunan Warrant Pharmaceutical Technology Development Co., Ltd., Changsha Warrant *** | 批准生产 Approved production |

左奥硝唑胶囊 Levonidazole Capsules | 化药2.2 Class 2.2 chemical drug | 湖南华纳大药厂股份有限公司,湖南华纳大药厂科技开发有限公司,长沙市华**** Hunan Warrant Pharmaceutical Co., Ltd., Hunan Warrant Pharmaceutical Technology Development Co., Ltd., Changsha Warrant **** | 批准生产 Approved production |

注射用左亚叶酸钠 Levofolinic Acid for Injection | 化药2.2 Class 2.2 chemical drug | 南京海纳制药有限公司 Nanjing Healthnice Pharmaceutical Co., Ltd. | 批准生产 Approved production |

恩替卡韦颗粒 Entecavir Granules | 化药2.2 Class 2.2 chemical drug | 湖南华纳大药厂股份有限公司 Hunan Warrant Pharmaceutical Co., Ltd | 批准生产 Approved production |

Olanzapine Oral Fast Soluble Film | 化药2.2 Class 2.2 chemical drug | 江苏豪森药业集团有限公司 Jiangsu Hansoh Pharmaceutical Group Co., Ltd. | 批准生产 Approved production |

注射用左亚叶酸钠 Levofolinic Acid for Injection | 化药2.2 Class 2.2 chemical drug | 上海汇伦江苏药业有限公司,上海汇伦生命科技有限公司 Shanghai Huilun Jiangsu Pharmaceutical Co., Ltd., Shanghai Huilun Life Science and Technology Co., Ltd. | 批准生产 Approved production |

磷酸钠盐散 Sodium Phosphate Powder | 化药2.2 Class 2.2 chemical drug | 四川健能制药有限公司 Sichuan Jewelland Pharmaceutical Co., Ltd. | 批准生产 Approved production |

Figure 3: Class 2.2 new drugs currently approved in China (Data source: Drugdataexpy)

At the same time, oral soluble film has gained significant popularity in recent years for dosage form improvement. Among the currently approved Class 2.2 drugs, several varieties such as Aripiprazole Oral Soluble Film, Tadalafil Oral Soluble Film, Olanzapine Oral Soluble Film, Montelukast Sodium Oral Soluble Film, and Memantine Hydrochloride Oral Soluble Film have been approved and launched on the market. The reasons behind this popularity are easy to understand. Firstly, the feature of the oral membrane is the rapid drug absorption. Unlike oral gastrointestinal administration, drugs absorbed through the buccal mucosa enter the internal jugular vein directly and reach the systemic circulation, avoiding the first-pass effect. It has high bioavailability and are convenient to use, making it a promising new dosage form for the treatment of various diseases such as diabetes, migraine, and chemotherapy-induced nausea. In addition, the oral dissolvable film currently on the market can be declared for marketing after completing BE, and the clinical investment is far less than that of other modified dosage forms.

Oral dosage form improvement has lower technical barriers and R&D costs compared to complex injections, resulting in fewer approved varieties of high-end injectable dosage forms, including microspheres, liposomes, nano-preparations (including albumin), and micelles. Currently, the leaders in this field are concentrated among top pharmaceutical companies such as Luye Pharmaceutical, Hengrui Pharmaceuticals, and CSPC Pharmaceutical Group. In addition, inhalation preparations and topical administration for external use (emulsifiable paste, ointments, gel patches, etc.) are also among the popular directions for dosage form improvement. Inhalation preparations can directly enter the respiratory tract and lungs, where the enzymatic activity is relatively low, and drug absorption through the lungs can avoid the first-pass effect of the liver, making them the primary dosage form for the prevention and treatment of acute and chronic respiratory diseases globally. Meanwhile, external preparations represented by Loxoprofen Sodium Cataplasms and Flurbiprofen Cataplasms are revealing a rapidly growing blue ocean market with their soaring sales volume. Currently, this market is also waiting for clinically advantageous products to seize the opportunity.

1. Sullivan: Report on the Current Status and Development Trend of the Modified New Drug Industry;

2. Pharmcube: Top 100 best-selling drugs globally in 2023;

3. Drug delivery: Detailed explanation of Paliperidone as a marketed complex injection;

4. Clinical trial of paliperidone palmitate injection and risperidone oral solution in the treatment of acute schizophrenia [J], The Chinese Journal of Clinical Pharmacology, 2017, 33 (4): 308-311.;

5. Discussion on the pharmaceutical development of generic long-acting injections of paliperidone palmitate, Chin J Clin Pharmacol.

6. Pharmacodia: Is there a future for the development of chemical dosage form improvement? Summary of the article: the status of domestic applications for modified new drugs.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025