WNDMay 21, 2024

Tag: Commercial Models , Innovative drugs , Cooperative marketing

Marketing is the crucial stage in the life cycle of a pharmaceutical product, directly determining the success of its development. Large pharmaceutical companies typically possess a robust sales system, giving them a unique advantage in terms of first-mover advantage for product commercialization. However, emerging Biotech companies differ from traditional pharmaceutical companies. While they exhibit high levels of technological proficiency during the product R&D phase, they encounter new challenges once the product is launched, including pricing issues for innovative drugs (refer to the previous article Overview of Pricing for Innovative Drugs) and promoting product sales. This article will introduce the commercial models chosen by Biotech companies after the launch of their products, and analyze the operation strategies adopted by domestic companies during the later stages of their product life cycle.

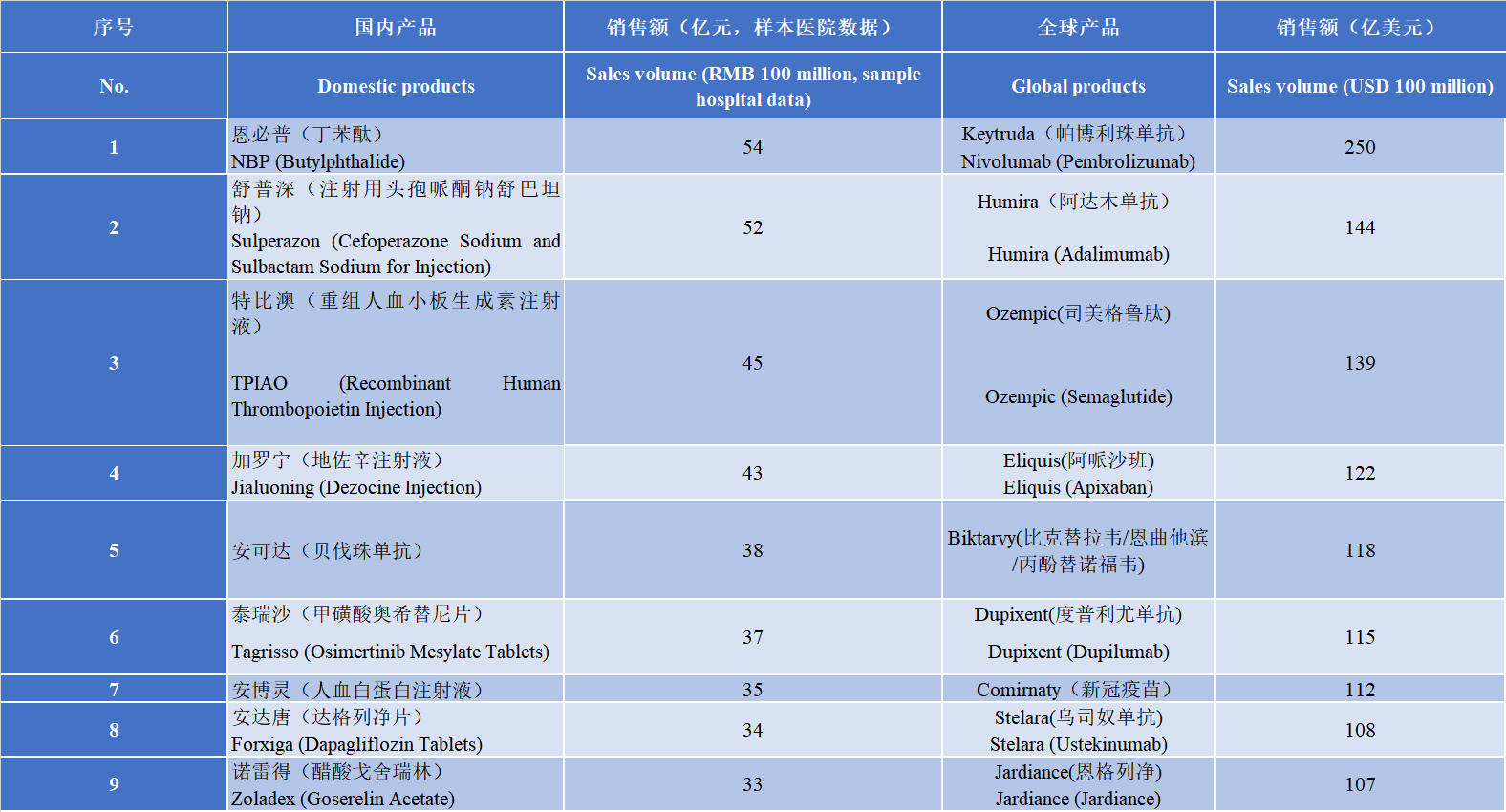

The commercialization of innovative drugs is a common problem in the world. According to statistics, about half of the new molecular entity drugs approved by FDA in the past decade had significantly lower sales volume than market expectations after being launched. Product sales not reaching expectations is often influenced by multiple factors. Internal factors within the enterprise mainly include the marketing team and its capacity building; while external factors mainly include the new drug pricing mechanism, payment mechanism, and market access mechanism in the region where the product is launched. At present, the commercialization of domestic innovative drug products is still not mature enough. The market size is still relatively small, and the ecological environment for the commercialization of innovative drugs needs further optimization. From the perspective of the market share of innovative drugs, in 2023, the proportion of domestic innovative drugs accounted for about 10%, while that in the United States reached 80%. There is also a significant gap in sales volume. Top 10 domestic drug sales (sample hospital data) in 2023 are CSPC Pharmaceutical Group Enbipu (NBP), Pfizer's Sulperazon, Sansheng Tebiao (TPO), etc. Among them, there are 6 imported drugs, and the proportion of innovative drugs made in China is extremely low. Top 10 drugs in global sales volume in 2023 are MSD pembrolizumab, AbbVie adalimumab, Novo Nordisk semaglutide, etc. Almost all of them are innovative drugs. This shows that there is still a long way to go for the commercialization of domestic innovative drugs.

表 国内及全球销售额TOP10产品列表

Table List of top 10 products by domestic and global sales volume

This model requires a high level of overall strength for the enterprise, and requires huge capital investment and operational capabilities, including the formation of sales teams and promotion of product academics. From the annual reports of listed companies, commercialization seems to be more "money-consuming" than R&D also tests the cash flow of the enterprise. Even though large domestic pharmaceutical companies, such as Hengrui Pharmaceuticals, have continued to shrink their commercialization teams in recent years, the current sales force is still more than 9,000, and they continue to consolidate their strong sales capabilities in advantageous fields. From 2023, the sales expenses will be about RMB 7.5 billion, the R&D expenses in the same period were about RMB 4.9 billion. In addition, mature large pharmaceutical companies often have a rich product portfolio including generics and innovative drugs, which can resist the impact of sales fluctuations of a single product on the commercialization team. However, emerging pharmaceutical companies also face greater instability. Since there are fewer innovative products in the initial stage of listing, any unsatisfactory sales volume of core products will have a significant impact on the commercialization team. Currently, BeiGene and Innovent Biologics are representatives of successfully commercialized emerging pharmaceutical companies in China. Both companies have sales teams with over 3,000 employees, and their portfolio of listed products continues to expand. Zanubrutinib has become the first blockbuster drug in China with sales exceeding USD 1 billion.

As it is difficult for emerging pharmaceutical companies to establish sales teams, some enterprises tend to choose CSO (Contract Sales Organization) for product sales, achieving a win-win situation, where CSO helps pharmaceutical companies expand their market, and the companies can continue to focus on R&D. Baheal Pharma Group, a leading pharmaceutical commercialization CSO company in China, has recently demonstrated its excellence through its performance. Despite the industry's winter, its stock price and performance have bucked the trend, achieving a net profit growth of approximately 30% in 2023 and maintaining high-speed growth for three consecutive years. Leading CSOs have gradually become one of the preferred options for emerging innovative pharmaceutical companies. In November of last year, Baheal Pharma Group signed a Strategic Agreement on Commercial Cooperation with Ruidi'ao, agreeing to be responsible for the exclusive promotion and sales of Ruidi'ao's series of radioactive drugs in the mainland market after their launch.

In addition to the above two models, some emerging pharmaceutical companies also seek opportunities to collaborate with large companies, jointly developing product pipelines and gradually building their own sales teams or creating differentiated competitive advantages distinct from those of large companies. Alphamab Oncology has developed the world's first subcutaneous injection PD-L1 - Envafolimab, which was initially developed by Henlius and jointly developed (mainly clinical development) with 3D Medicines since 2016. In 2020, Henlius, 3D Medicines, and Simcere Pharmaceutical Group reached a strategic cooperation. Henlius, as the original developer, is responsible for production and quality; 3D Medicines is responsible for clinical development in the field of tumor; and Simcere Pharmaceutical Group is responsible for the exclusive commercial promotion of the product in Chinese Mainland. The three parties focus on their respective areas of strength and achieve win-win cooperation. For another example, Hutchison Pharmaceuticals reached a cooperation agreement with Takeda. Relying on Takeda's strong professional expertise in diseases of digestive tract and its comprehensive global commercialization layout, Hutchison Pharmaceuticals successfully sold fruquintinib in the United States, leading to a rapid increase in product sales.

Domestic innovative drugs have been developing for more than a decade. In recent years, with the rapid launch of innovative products, how to successfully achieve commercialization has become an urgent problem facing the pharmaceutical industry. The above three models are currently quite representative, and different companies tend to choose appropriate commercial models based on their own conditions. In the future, China's innovative drugs will develop rapidly, and it is inevitable that there will be breakthroughs in their commercialization formats. With the joint efforts of different entities such as the government, industry associations, and companies, the domestic commercialization environment will continue to improve.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025