Spuer 203May 06, 2024

Tag: Opzelura , JAK inhibitor , NSV

Recently, the drug clinical trial registration and information publicity platform of CDE indicated that the JAK inhibitor Ruxolitinib Phosphate Cream (brand name: Opzelura) introduced by China Medical System from Incyte has initiated Phase III clinical trials of vitiligo in China. It is known to us all that Ruxolitinib is the world's first approved JAK inhibitors, whose tablets (brand name: Jakafi) applying to polycythemia vera, myelofibrosis and graft versus-host disease, were approved for marketing in the United States in December 2011, so did the cream in September 2021, which was approved for atopic dermatitis and non-segmental vitiligo (NSV). In December 2022, China Medical System introduced the rights and interests of Ruxolitinib Cream in China and Southeast Asia.

This is not the only collaboration between CMS and Incyte. Just at the beginning of this month, CMS also announced again that they will enter into collaboration and licensing agreements in Greater China and most of Southeast Asia for the Povorcitinib, a selective oral small molecule JAK1 inhibitor, used to treat non-segmental vitiligo, hidradenitis suppurativa (HS), prurigo nodularis (PN), asthma and chronic spontaneous urticaria. Povorcitinib is also a selective oral small molecule JAK1 inhibitor, which is currently conducting Phase III clinical trials for non-segmental vitiligo and HS in several overseas countries. Moreover, it is also in progress that Phase II clinical trials for the treatment of PN, asthma and chronic spontaneous urticaria. Since then, another star drug under development by Incyte has also been acquired by CMS.

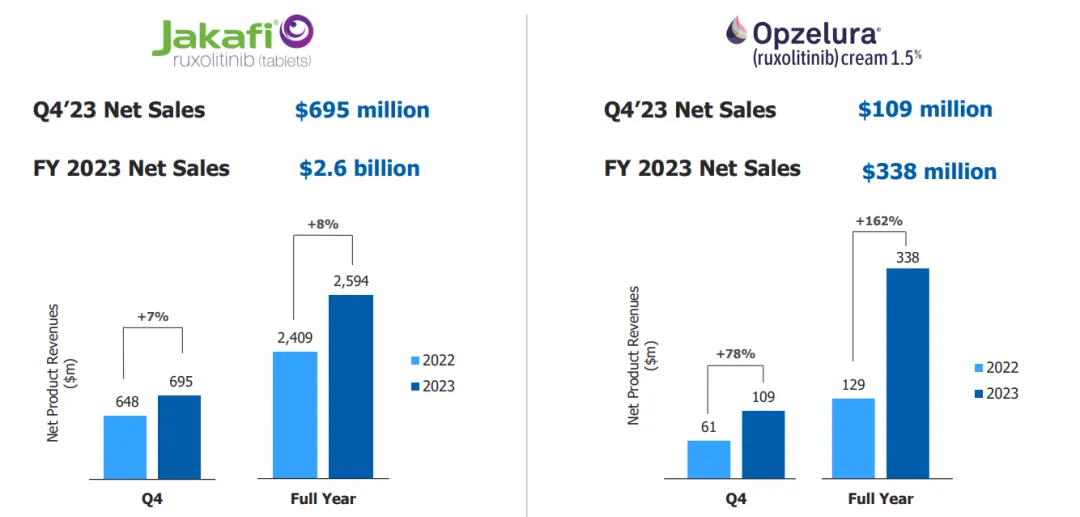

It is not difficult to understand CMS's thinking. It was when the key patent of Ruxolitinib was about to expire that Incyte took a different approach and launched Ruxolitinib Cream, which successfully became the first and only FDA-approved JAK inhibitors for repigmenting skin lesions caused by vitiligo. Given the enormous clinical needs of vitiligo patients, the sales growth of Ruxolitinib Cream is really impressive, with the sales volume reaching USD 340 million in 2023. This time, the small molecule oral Povorcitinib introduced, CMS also wants to add a double insurance in the indication field of vitiligo.

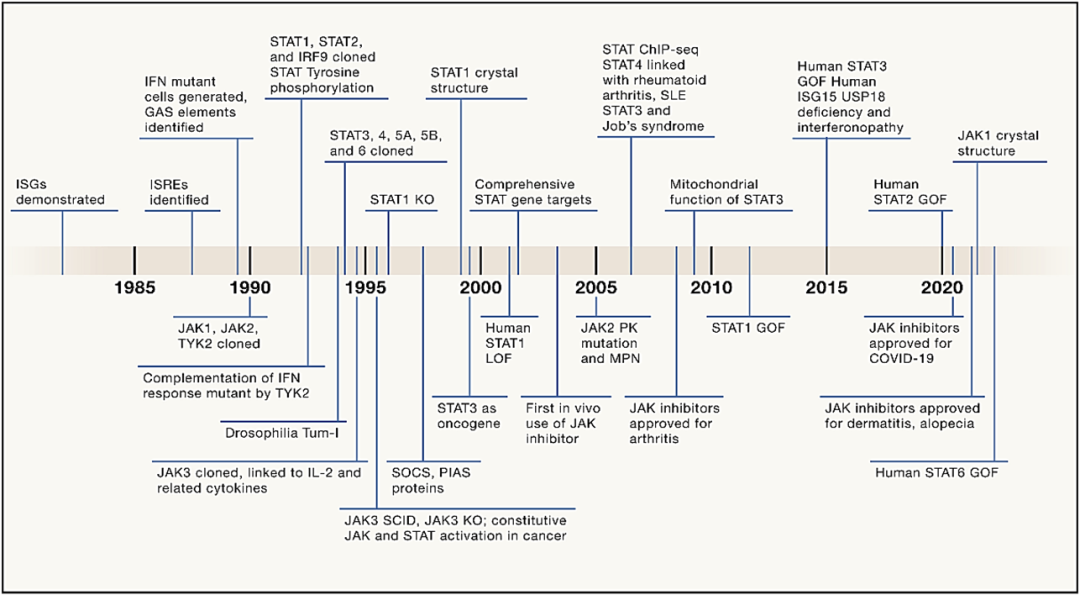

Speaking of JAK inhibitors, what must be mentioned is the Janus kinase (JAK) signal transduction and transcription activation factor (STAT) pathway (JAK-STAT Pathway) that was discovered 30 years ago, and has since gained continued attention in transformation and application. Under the stimulation of cytokines, the pathway regulates various biological activities in vivo and mediates numerous immune responses, which is not only immune defense, but also the process of promoting tumor cell survival, immune evasion and persistent inflammation.

Cytokine receptors binding to JAK, contribute to activation and phosphorylation of tyrosine residue in the receptor tail of JAK. Receptor phosphorylation creates docking sites for cytoplasmic STAT which is recruited into the receptor complex via tyrosine phosphate binding to the SH2 structural domain and autophosphorylation. Activated phosphorylated STAT (pSTAT) forms homodimerization or heterodimerization via intermolecular SH2-phosphotyrosine interactions, and then nucleus translocation binding DNA regulatory elements, thereby changing chromatin accessibility and inducing gene transcription.

Figure 2: The Development History of the JAK-STAT Pathway (Reference 3)

Mechanistically, the JAK-STAT pathway plays a significant part in cellular processes with its rapid membrane-to-nuclear signaling mode. Its dysregulation is related to inflammation and autoimmune diseases. Many cytokines, including interleukins (ILs) and interferons (IFNs), growth factors and colony-stimulating factors, serve as ligands for intracellular JAKs-associated cytokine receptors. This process involves the activation of STAT proteins transported to the nucleus, thereby inducing the expression of key mediators of inflammation and cancer.

With further research, the JAK-STAT pathway has also been rapidly transformed into clinical practice, contributing to the emergence of JAK inhibitors. Therapy inhibiting JAK kinase has become an effective treatment option for autoimmune diseases and skin diseases. JAK inhibitors exert an anti-inflammatory effect by inhibiting the production of cytokines involved in Th1, Th2, Th17 and Th22 immune pathways. This mechanism contrasts with that of bDMARDs drugs which are monoclonal antibodies targeting at only one or two specific cytokines. The topical dosage form of JAK inhibitors can take effect quickly within hours while the oral dosage form can take effect within a few days. Till now, 13 JAK inhibitors have been approved globally and two generations of JAK inhibitor iterations have been successfully completed, giving birth to several blockbuster drugs including Ruxolitinib and Upadacitinib.

For JAK inhibitors which have already shown great therapeutic potential in tumors, autoimmune diseases, and hematological diseases, etc., the next priority is also on the indication of vitiligo, which still has huge unmet clinical needs around the world. In the process of the onset of vitiligo, the type II gamma interferon (IFN-γ) produced by CD8+ T cells in the lesion binds to receptors, activating the JAK1 and JAK2 pathways respectively, and activating the JAK-STAT1 pathway through downstream JAK1 and JAK2 paired kinases, contributing to STAT1 phosphorylation, thereby initiating the transcription and secretion of related genes, attacking melanocytes, and resulting in depigmentation. Ruxolitinib Phosphate Cream is approved for marketing, marking the start of comprehensive competition in the field of vitiligo indications for JAK inhibitors.

Vitiligo is a chronic autoimmune disease caused by the loss of pigment-producing melanocytes in the skin. Research suggests that the hyperactivity of JAK signaling pathway is closely linked with the occurrence and development of vitiligo. According to statistics, there are approximately 2-3 million vitiligo patients worldwide. Vitiligo consists of non-segmental vitiligo and segmental vitiligo, of which non-segmental vitiligo accounts for about 85%. Currently, only Ruxolitinib Phosphate Cream is available as a targeted treatment for vitiligo. Ruxolitinib Phosphate Cream has also achieved rapid growth since its launch, achieving sales volume of USD 338 million in 2023, a year-on-year increase of 162%.

According to data from Pharma ONE of China National Pharmaceutical Industry Information Center, it is expected that the global vitiligo drug market will grow rapidly, reaching USD 4.91 billion by 2024. Judging from the epidemiology of vitiligo, the patient population is very large and it is more likely to occur in youth, so it is huge and urgent to meet the demand for treatment of vitiligo. The rapid increase in the volume of Ruxolitinib Phosphate Cream has naturally given other drugs under development more impetus to compete comprehensively, in order to gain a share of the huge pie in the blue ocean market. However, when it comes to the indication of vitiligo, the competition currently still belongs to JAK inhibitors.

Figure 3: Sales Volume of Ruxolitinib Phosphate Cream (From Incyte Official Website)

Though 13 JAK inhibitors have been approved globally, not all drugs are utilized in vitiligo. The biggest rival of Ruxolitinib Phosphate is Upadacitinib which grows rapidly, reaching the revenue threshold of USD 2.5 billion in just three years.

The end of 2023 witnessed that the launch of a Phase III clinical trial of Upadacitinib in the treatment of non-segmental vitiligo was announced by AbbVie. The product ranks the third JAK inhibitors initiated a Phase III research of vitiligo following Ritlecitinib (Pfizer) and Povorcitinib (Incyte). The published Phase IIb study showed that at week 24, compared to placebo, the primary endpoint of a significant reduction in percent change from baseline (%CFB) in F-VASI was achieved in the 11 mg and 22 mg doses of Upadacitinib. In the secondary endpoint, higher response rates were also observed for Upadacitinib compared with placebo, including F-VASI 75 (F-VASI decreased by ≥75% from baseline) at week 24 for both 11mg and 22mg doses, and total vitiligo area scoring index 50 (T-VASI 50, defined as T-VASI decreased by ≥50% from baseline) at week 24 for the 22mg dose. The excellent clinical data also gave AbbVie full confidence to compete with its old rival Ruxolitinib in the future.

At the same time, as mentioned above, Ritlecitinib developed by Pfizer and Povorcitinib by Incyte have also entered the Phase III clinical stage. Like Upadacitinib, these two drugs are also designed for oral tablets. The released data from their respective Phase IIb studies showed that oral Ritlecitinib and Povorcitinib were effective and well tolerability in the treatment of patients with active non-segmental vitiligo within their respective clinical research periods. The ongoing Phase III studies will release data within the next two years, and whether topical preparations with better clinical data outperform oral small molecule preparations will soon be answered in the near future.

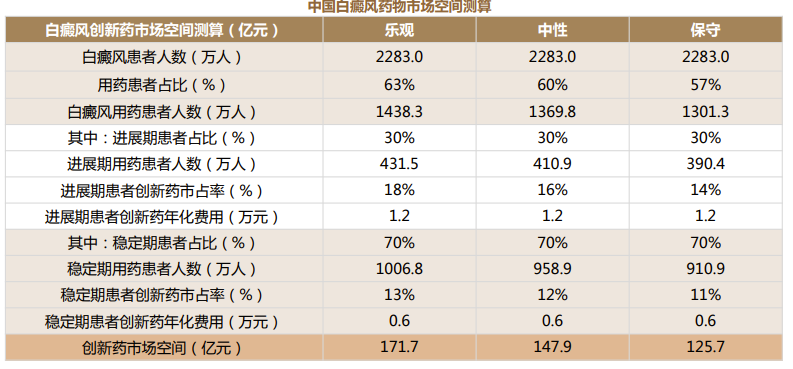

Statistics show that the number of vitiligo patients in China reached approximately 22.83 million in 2021, and the prevalence rate has gradually increased in recent years. According to China's diagnosis and treatment guidelines, drug treatment for vitiligo includes hormone therapy, immunosuppressant and vitamin D derivatives. However, there are certain disadvantages in existing treatment options. For example, hormone therapy requires a long cycle of administration and may lead to adverse reactions throughout the body, so it cannot be used for a long time. Otherwise, it may cause drug dependency or drug resistance.

Meanwhile, the pharmaceutical chemicals currently commonly used for the treatment of vitiligo have not yet been approved for the indication of vitiligo, such as topical immunosuppressant tacrolimus ointment (atopic dermatitis), glucocorticoid dexamethasone cream (neurodermatitis), and calcipotriol ointment (psoriasis). The launch of targeted drugs is urgently needed. In sync with the global market, China's vitiligo drug market is also a blue ocean. According to Topsperity Securities' estimation, the market for innovative drugs for vitiligo is expected to exceed RMB 10 billion.

Figure 4: The Estimated Market Space for Vitiligo Drugs in China (Source: Topsperity Securities)

中国白癜风药物市场空间测算 | The Estimated Market Space for Vitiligo Drugs in China |

白癜风创新药市场空间测算(亿元) | The Estimated Market Space for Vitiligo Innovative Drugs (RMB 100 million) |

乐观 | Optimistic |

中性 | Neutral |

保守 | Conservative |

白癜风患者人数(万人) | Number of vitiligo patients (in tens of thousands) |

用药患者占比(%) | Proportion of patients using drugs (%) |

白癜风用药患者人数(万人) | Number of vitiligo patients using drugs (in tens of thousands) |

其中:进展期患者占比(%) | Specifically: Proportion of patients in the progressive stage (%) |

进展期用药患者人数(万人) | Number of patients using drugs in the progressive stage (in tens of thousands) |

进展期患者创新药市占率(%) | Market share of innovative drugs among patients in the progressive stage (%) |

进展期患者创新药年化费用(万元) | Annual cost of innovative drugs for patients in the progressive stage (RMB 10,000) |

其中:稳定期患者占比(%) | Specifically: Proportion of patients in the stabilization stage (%) |

稳定期用药患者人数(万人) | Number of patients using drugs in the stabilization stage (in tens of thousands) |

稳定期患者创新药市占率(%) | Market share of innovative drugs among patients in the stabilization stage (%) |

稳定期患者创新药年化费用(万元) | Annual cost of innovative drugs for patients in the stabilization stage (RMB 10,000) |

创新药市场空间(亿元) | Market space for innovative drugs (RMB 100 million) |

This year, it is also highly possible that the first JAK inhibitor self-developed in China will be born. Currently, three innovative JAK inhibitors have entered the NDA stage, namely Jaktinib developed by Zelgen Biopharmaceuticals, Almacitinib by Hengrui Pharmaceuticals, and Golcitinib by Dize Pharmaceuticals. Unfortunately, none of the initial indications for these three drugs include vitiligo. But in recent days, Zelgen Biopharmaceuticals announced that it had been approved to conduct a Phase II/III clinical trial of hydrochloric acid Jaktinib cream for the treatment of non-segmental vitiligo in adolescents and adults of 12 years and older, filling the gap left by the termination of the Phase II/III clinical trial of Almacitinib for vitiligo and the absence of JAK inhibitor made in China innovative drugs in this field.

Although the clinical progress of innovative JAK inhibitors made in China is still relatively slow at present, there has been some progress in other targeted drugs represented by CKBA ointment. CKBA ointment is currently undergoing a Phase II clinical trial for the indication of vitiligo. The first patient completed enrollment in November 2023. Meanwhile, with the compound patents for Upadacitinib and Baricitinib being invalidated one after another within a year, generics are expected to be launched in the coming years. The future of domestic substitution is promising.

1. Qi F. Janus Kinase Inhibitors in the Treatment of Vitiligo: A Review. Front Immunol. 2021;

2. New Advances in the Treatment of Vitiligo with JAK-STAT Inhibitors. Chinese Journal of Dermatology, 2024, 57 (1): 71-75. doi: 10.35541/cjd.20230173;

3. Philips RL, Wang Y, Cheon H, Kanno Y, Gadina M, Sartorelli V, Horvath CM, Darnell JE Jr, Stark GR, O'Shea JJ. The JAK-STAT pathway at 30: Much learned, much more to do. Cell. 2022 Oct 13;185(21):3857-3876. doi: 10.1016/j.cell.2022.09.023.

4. TONACEA Biotech: Applications and Concerns of JAK Inhibitors in Dermatology;

5. Topsperity Securities: Vitiligo: Billion-Level Untapped Market, Excellent Domestic R&D Landscape

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025