Neeta RatanghayraApril 28, 2024

Tag: obesity , Pharmacotherapies , GLP-1

The history of pharmacotherapy for obesity is marked by a series of promising drugs that were withdrawn due to safety concerns. Throughout the last century, treatments for obesity have included substances like amphetamines, thyroid hormones, dinitrophenol, and various drug combinations known as "rainbow pills," which were withdrawn shortly after regulatory approval due to serious adverse effects. However, recent clinical trials involving advanced therapeutic candidates have reignited optimism for breakthrough pharmacotherapies for obesity. This review focuses on emerging treatments for obesity, particularly those involving combinations of gut hormones.

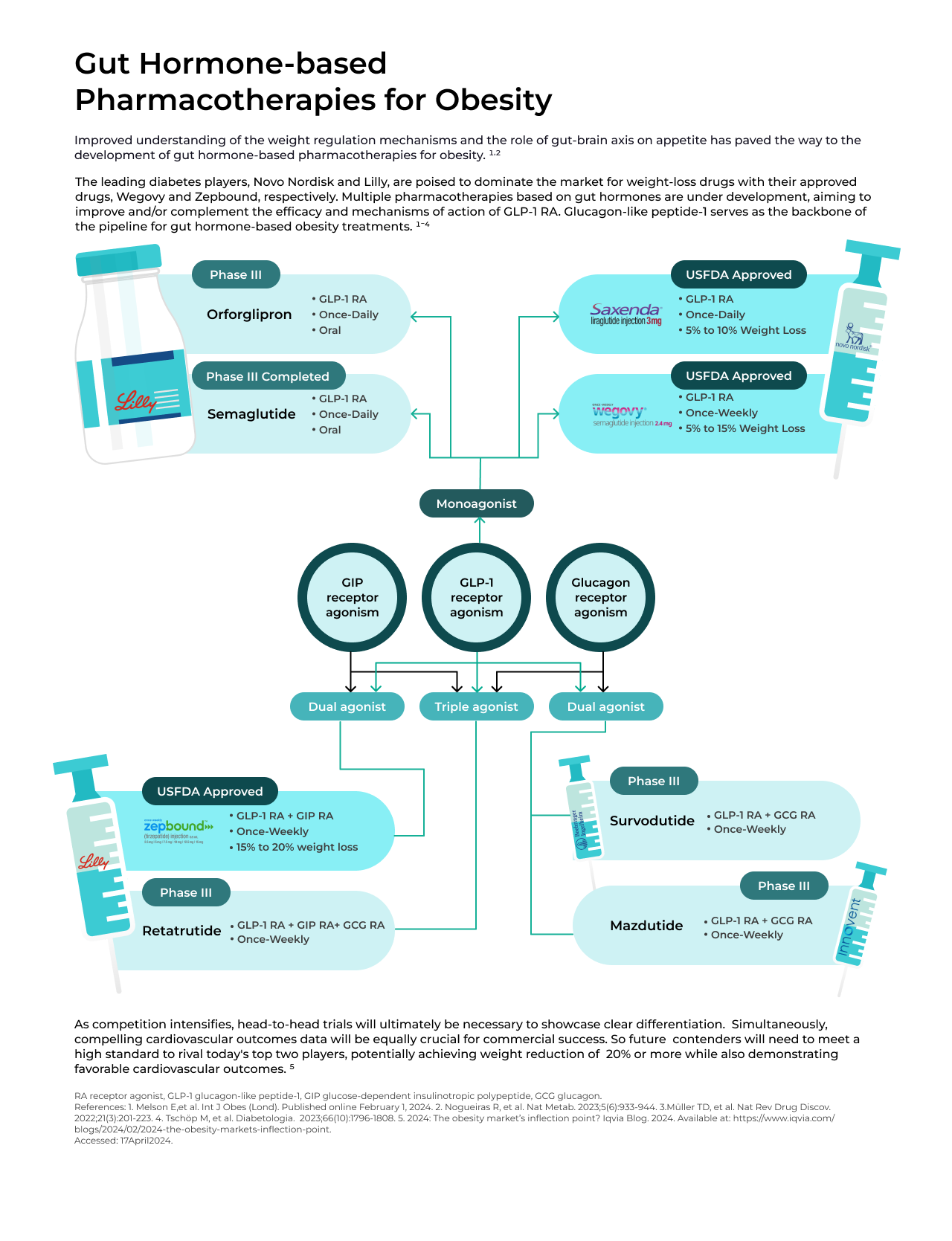

In recent years, there has been rapid development in gut hormone-based pharmacotherapies for obesity and type 2 diabetes mellitus (T2DM). Combinations of glucagon-like peptide 1 (GLP-1) with other gut hormones such as glucose-dependent insulinotropic polypeptide (GIP), and glucagon either as dual or triple agonists, are currently under investigation. These combinations aim to enhance and complement the effects of GLP-1 on weight loss and obesity-related complications. By combining hormones in this manner, it is possible to reduce the dosage of individual hormones, thereby broadening the therapeutic range and reducing the risk of toxicity.

Currently approved and investigational gut hormone-based pharmacotherapies operate through various mechanisms:

- GLP-1 receptor agonists - By activating the GLP-1 receptor, GLP-1 receptor agonists stimulate insulin secretion after meals and aid in weight loss by promoting satiety and delaying gastric emptying through both peripheral and central actions.

- Dual GLP-1/GIP agonists - GIP, produced by K-cells (located in the jejunum) in response to food consumption, stimulates insulin secretion, boosts glucagon secretion, promotes lipogenesis, and enhances lipid buffering capacity. Along with GLP-1 receptor agonists, GIP offers a synergistic boost to the incretin effect, aiding in the regulation of blood glucose levels and facilitating weight reduction.

- GLP-1 and glucagon co-agonists - Glucagon, released by pancreatic alpha cells, primarily affects the liver by stimulating the production of glucose. Glucagon agonism suppresses food intake and boosts energy expenditure, indicating its potential for facilitating weight loss. Combining glucagon with the actions of GLP-1 may enhance weight loss while also safeguarding against the risk of hyperglycemia.

- Triple agonist (GLP-1/GIP/glucagon) - Triple agonists targeting GLP-1/GIP/glucagon receptors hold the potential for superior weight loss and glycemic control compared to dual agonists.

- Liraglutide (Saxenda; Novo Nordisk)

Liraglutide, a GLP-1 receptor agonist, received FDA approval as Saxenda in 2014 for weight loss in adults with a body mass index (BMI) of 30 or greater, or a BMI of 27 or greater with at least one weight-related condition, such as high cholesterol or high blood pressure. In 2020, the FDA expanded its approval to include chronic weight management in children aged 12 and older with obesity and weighing more than 132 pounds. Liraglutide is a weaker GLP-1 agonist compared to Novo's breakthrough drug, Wegovy (Semaglutide). The recommended daily dose of Saxenda is 3 mg.

- Semaglutide (Wegovy; Novo Nordisk)

Novo Nordisk's, Semaglutide, (marketed as Ozempic for diabetes and Wegovy for obesity) gained FDA approval in 2021 for long-term weight management in adults who are obese or overweight and have at least one weight-related conditions, such as high blood pressure, type 2 diabetes, or high cholesterol. In 2022, FDA approval extended to the use of Wegovy, alongside diet and exercise, for children and adolescents with a BMI equal to or exceeding the 95th percentile. Wegovy demonstrated an average weight reduction of 14.9% in STEP-1, a 68-week clinical trial of nondiabetic patients with obesity or overweight and at least one weight-related comorbidity. Unlike Saxenda, Wegovy requires just a weekly injection (with the recommended dose being 2.4 mg once weekly).

Novo Nordisk has presented data from a phase 3 trial demonstrating that an oral version of Wegovy performs comparably to its original injected therapy. Oral Semaglutide 50 mg achieved 15.1% weight loss in adults with obesity or overweight in the OASIS 1 trial. The choice between a daily tablet or weekly injection for obesity treatment has the potential to provide patients and healthcare providers with the opportunity to select the option that best suits individual treatment preferences.

- Tirzepatide (Zepbound; Eli Lilly)

Manufactured by Eli Lilly, Tirzepatide (Zepbound) is the latest addition to the weight loss armamentarium. Tirzepatide, a once-weekly GLP-1/GIP receptor agonist, gained FDA approval as Zepbound in November 2023. It is approved for chronic weight management in adults with obesity or overweight with at least one weight-related condition, such as high blood pressure, type 2 diabetes, or high cholesterol. Tirzepatide joins Wegovy in competing for market share in the category of drugs specifically approved for weight loss. Tirzepatide achieved up to 15.7% weight loss in adults with obesity or overweight and type 2 diabetes in SURMOUNT-2.

- Orforglipron (Eli Lilly)

Eli Lilly's Orforglipron is a once-daily oral nonpeptide GLP-1 receptor agonist. Its efficacy in managing diabetes and obesity has been evaluated through a series of recently conducted randomized controlled trials. Phase 2 findings, published in the New England Journal of Medicine, demonstrate that Orforglipron achieved a mean weight reduction of up to 14.7% at 36 weeks in adults with obesity or overweight. Orforglipron distinguishes itself from other candidates due to its extended half-life of 29-49 hours.

- CagriSema (Novo Nordisk)

CagriSema is a fixed-dose combination therapy for obesity comprising 2.4mg of Semaglutide and 2.4mg of Cagrilintide. Cagrilintide, acting as a long-acting amylin analogue, enhances the weight loss effects of Semaglutide. Findings from a Phase II trial of CagriSema reveal that this combination therapy led to a notable reduction in body weight by 15.6% from baseline at Week 32 of treatment.

In response to these promising results, Novo Nordisk has initiated a new Phase III trial, designed to compare the efficacy and safety of the maximum dose of Zepbound with CagriSema. The SURMOUNT-1 Phase III trial demonstrated that Zepbound produced a decrease in body weight at 72 weeks, with reductions of 15% from baseline at the lowest dose and 20.9% at the highest dose (15mg). These outcomes suggest that CagriSema may elicit a more substantial change in body weight from baseline compared to even the highest dose of Zepbound, within a fixed duration.

- Survodutide (Boehringer Ingelheim)

Survodutide, a dual agonist of the glucagon/GLP-1 receptors, is coinvented by Boehringer Ingelheim and Zealand Pharma. This innovative compound activates both the GLP-1 and glucagon receptors, playing a crucial role in regulating metabolic functions. In Phase II trials, Survodutide exhibited significant efficacy in overweight or obese patients, with individuals experiencing up to 19% weight loss after 46 weeks of treatment. Building on these promising results, Boehringer Ingelheim has announced its decision to progress Survodutide into three registrational Phase III studies.

- Mazdutide (Innovent Biologics)

Mazdutide has emerged as the first GLP-1 receptor/GCG receptor dual agonist to successfully complete Phase 3 trials. In January 2024, the Phase 3 GLORY-1 trial of Mazdutide in Chinese adults with overweight or obesity, met both primary and key secondary endpoints. Mazdutide 4 mg and 6 mg demonstrated superiority over placebo in terms of reducing body weight and improving various weight-related and cardiometabolic measures. By week 32, Mazdutide showcased superiority to placebo in weight reduction, with a notable proportion of patients achieving at least 5% weight loss, and further enhancements in efficacy observed up to week 48. Backed by robust clinical data highlighting its impact on multiple cardiometabolic indicators, Mazdutide is poised for widespread adoption in the Chinese market. Innovent, as a Chinese biotech firm, holds a strategic advantage in navigating the regulatory and logistical complexities in the Chinese pharmaceutical landscape.

- Retatrutide (Eli Lilly)

Retatrutide functions by targeting GLP-1, GIP, and glucagon receptors. This simultaneous activation of the GLP-1, GIP, and glucagon receptors, known as triagonism, combines the anorectic and insulinotropic effects of GLP-1 and GIP with the energy expenditure effect of glucagon. In Phase II trials, Retatrutide demonstrated significant efficacy, achieving an average weight reduction of up to 17.5% at 24 weeks and 24.4% at 48 weeks in obese or overweight adults.

The introduction of new pharmacotherapies for obesity management brings with it a set of potential challenges. One significant aspect is the anticipated variability in treatment responses, even with the introduction of novel molecules tailored for obesity treatment. This variability suggests that individuals may respond differently to these treatments, necessitating personalized approaches to optimize outcomes.

Another challenge lies in the tolerance and titration of these new obesity pharmacotherapies. A considerable proportion of individuals may struggle with tolerating these treatments or may encounter difficulties in adjusting them to the most effective doses. This highlights the importance of careful monitoring and management to address potential adverse effects and optimize treatment efficacy.

Concerns regarding micronutrient deficiencies and the loss of lean muscle mass during the rapid weight-loss phase are also prominent. These issues underscore the importance of comprehensive monitoring and support throughout the treatment process to ensure overall patient well-being.

Furthermore, obesity, like other chronic diseases, requires long-term treatment for effective management. Ensuring that obesity medications are both effective and well-tolerated is crucial for maintaining treatment adherence and preventing weight regain over time.

Despite advancements in pharmacotherapy, a notable difference remains between the weight loss achievable with bariatric surgery and currently approved obesity pharmacotherapies.

Lastly, the administration of currently approved GLP-1 receptor agonists via injection may present a barrier for some individuals. The development of oral GLP-1 receptor agonists aims to address this challenge, offering potential improvements in convenience, acceptance, and adherence, thereby expanding options for obesity management.

The introduction of GLP-1 receptor agonists, particularly Novo Nordisk's Wegovy, marked a significant turning point in the obesity market, as it represented the first instance where pharmacological interventions yielded substantial weight loss of 10-15%. However, with Eli Lilly's Zepbound entering the obesity market, Novo Nordisk anticipates heightened competition.

Dual- and triple-action approaches that target multiple pathways concurrently, such as GLP-1 receptor/GIP, GLP-1 receptor/GIP/glucagon (Retatrutide), or amylin/GLP1R (CagriSemra), appear to offer increased potency and may potentially push weight reduction to the mid-20% range or even beyond. Meanwhile, oral options are striving to achieve efficacy levels comparable to injectable treatments.

As competition intensifies, the necessity for head-to-head trials becomes evident to establish clear differentiation. Lilly has recently initiated the SURMOUNT-5 obesity trial, a head-to-head phase III trial of Zepbound against Novo's Wegovy. Additionally, compelling cardiovascular outcomes data will be crucial for commercial success. Hence, future competitors aiming to challenge the dominance of today's leading players will need to meet a stringent standard, potentially achieving weight reduction of 20% or more while also demonstrating favorable cardiovascular outcomes.

1. Melson E, et al. Int J Obes (Lond). Published online February 1, 2024.

2. Nogueiras R, et al. Nat Metab. 2023;5(6):933-944.

3. Müller TD, et al. Nat Rev Drug Discov. 2022;21(3):201-223.

4. Tsch?p M, et al. Diabetologia. 2023;66(10):1796-1808.

5. 2024: The obesity market's inflection point? Iqvia Blog. 2024. Available at: https://www.iqvia.com/blogs/2024/02/2024-the-obesity-markets-inflection-point. Accessed: 17April2024.

Neeta Ratanghayra is a freelance medical writer, who creates quality medical content for Pharma and healthcare industries. A Master’s degree in Pharmacy and a strong passion for writing made her venture into the world of medical writing. She believes that effective content forms the media through which innovations and developments in pharma/healthcare can be communicated to the world.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

+86 15021993094

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025