Deepak HegdeFebruary 05, 2024

Tag: CM , Biomanufacturing

ABSTRACT: This article, which is Part 3 and the concluding part of the series on continuous manufacturing focuses on CM in China and adoption of CM for biologic products.

CM had been progressing in China both from companies as well as CDMO side.

In 2021, Henlius, a global biopharmaceutical company setup in 2010, successfully launched China's first continuous manufacturing clinical production workshop1 to achieve end-to-end continuous production and thus improving productivity with stable and controllable quality.

In 2021, Shanghai Pharmaceuticals enlisted Syntegon Technology to build a laboratory for continuous manufacturing technology in China2. The facility would be dedicated to the promotion and application of the new technology in the field of innovative drugs and provide new ideas and accessible experimental platforms for the development of orphan drugs. Syntegon's continuous manufacturing platform works by dosing, mixing, and granulating sub-quantities of the desired product-called X-Keys-that continuously run through the manufacturing chain before being removed. Those X-Keys allow traceability of ingredients, an essential element for pharmaceutical production. Another appeal of the platform is that it doesn't require technology transfer or scale-up.

In the CDMO space, WuXi AppTec was one of the first movers in the CM space. WuXi STA, a subsidiary of WuXi AppTec started building its flow chemistry capability in 2014. In 2022, WuXi STA, opened a new continuous manufacturing (flow chemistry) plant at its Changzhou campus in China for large-scale active pharmaceutical ingredient (API) and advanced intermediate production.3 The plant features 11 continuous production lines which support 20 types of challenging reactions, including low temperature metallo-organic reactions, photochemical reactions, high-temperature & high-pressure reactions, nitration reactions, ozonolysis, etc. WuXi STA now has multiple flow chemistry R&D labs and 25 continuous manufacturing lines in Shanghai Waigaoqiao, Shanghai Jinshan, and Changzhou sites in China.

In Jan 2023, WuXi STA also opened its first continuous manufacturing (CM) line for oral solids is in operation at its drug product site in Wuxi city, China.4 This line focuses on continuous direct compression equipment with the unit operations including dispensing, blending, lubrication, tablet compression, and coating. Process Analytical Technology (PAT) has been implemented within the CM line to monitor blending uniformity, allowing for real-time analysis and control during production to ensure high product quality.

Continuous manufacturing (CM) has been a goal for the pharmaceutical industry for several years. While small molecule drug substances and drug products have achieved this in many cases, biologics are behind the global implementation of CM because of their more complex manufacturing processes.

A recent report5 indicates that the demand for continuous bioprocessing is increasing, and expenditures in both upstream and downstream continuous bioprocessing equipment are among the top three new expenditures by the companies surveyed.

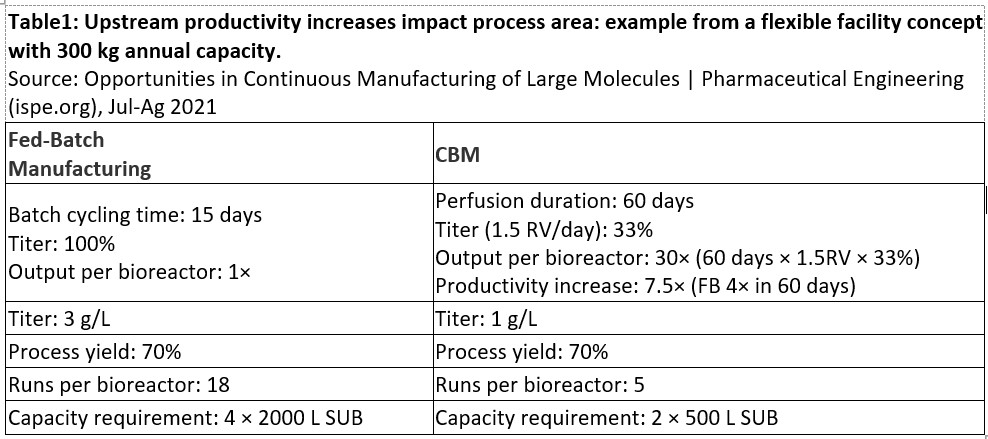

Continuous manufacturing of biologic products has several promising "paradigm shifts" that make the prospect attractive to many organizations6. Table 1 provides a real-world example of the benefits of moving to a continuous manufacturing platform. Improvements in facility area reduction, increase in upstream productivity, downstream column size reduction, and reduced buffer usage are just some of the benefits that can be realized when continuous biomanufacturing is implemented.

Abbreviations: RV, reactor volume; FB, fed batch; SUB, single-use bioreactor.

A key driver of continuous manufacturing implementation is the opportunity to reduce the cost of goods. Continuous biomanufacturing allows organizations to make more products faster with lower capital costs and less operator intervention. For example, a company could make more material by using N-1 bioreactors in perfusion mode rather than N bioreactors in batch mode. A new capital facility could be less expensive to build if only an N-1 perfusion mode bioreactor configuration were installed. Continuous manufacturing also has positive impacts in reducing the risk of contamination over successive campaigns because downstream process resin lifetime could be consumed during a single campaign, allowing for timing of new campaigns and resin replacements.

Any organization considering CBM implementation needs to consider the following 1. Is CBM

technically feasible? 2. Is the business case acceptable? 3. Is the product risk acceptable? 4. Are the process risks acceptable? 5. Is the process control strategy acceptable 6. Is the implementation strategy

acceptable? 7. Is the logistic control strategy acceptable? If the answers to all these questions are a yes, then, the decision to implement a continuous manufacturing platform should be seriously investigated and strong consideration given to its implementation.

If continuous manufacturing is implemented in an existing facility, the impact on any new facility assets should also be factored into the decision-making process. When CBM requires smaller or less equipment, the facility footprint may be reduced, which can result in facility cost savings. The business case should also consider the scale of operations and whether the process can be "right sized" in critical unit operations, such as chromatography, to produce the desired outputs while controlling aspects such as column sizing, resin selection, and resin utilization. Resin storage and inventory can be reduced, which further improves the business case. A change of this magnitude will significantly disrupt the current sequence of day-to-day manufacturing. This sequence has several elements that must be addressed. Upstream process and downstream process unit operations require advanced scheduling and robust production planning to ensure long-term operational integrity and allow leaner start-up and shutdown sequences in terms of volumetric productivity, product quality, and contamination safeguards.

Regulatory considerations for biologics have a higher level of complexity than for small molecules. In general, current regulations and guidelines are supportive of innovative biopharmaceutical development and manufacturing approaches. The new ICH Q13 Guideline considers biotechnological biotechnological/biological processes with non-clear boundaries of what those types of processes include. It describes end-to-end continuous processes, whereas the reality is more complex. This is especially the case in biologics, where current processes are, at best, a mix of batch and continuous steps. Therefore, guidance on how to move from intermediate to true CM would be helpful. Also, while the concepts and principles of the guideline are directly relevant to new chemical entities, some would be different from biologics, which is not covered. Companies considering CBM platforms must be ready to support their applications with robust control strategies with sound evidence-based considerations as well as risk-based justifications. Also, CBM may not be suited for all companies and may only be advantageous to specific products in a portfolio. Hence decisions need to be taken prudently.

The landscape for CM has evolved substantially over the past few years. The acceptance and harmonization of regulatory guidance is expected to be very helpful in the rapid acceptance CM as an advanced manufacturing technique by the pharmaceutical industry across the world. The recognition of potential of CM and the adoption of CM as an advanced manufacturing technique by CDMO's will greatly accelerate the spread of CM from Big Pharma to even smaller biopharma and biotech companies. While there could still be some technical challenges in implementation or some specifics that need to be worked out, the overall direction of development of CM in the pharma industry is very positive.

The spread of CM from small molecules to biologic products is only expected to increase further given the fact that the portfolio of pharmaceutical companies (both for innovative drugs and generic) are now increasingly including biologic products. Besides, the need for cost effective lean manufacturing of products with consistently high quality, low carbon footprint, lower overall lifecycle costs and assurance of a robust supply chain will increase the acceptance and demand for CM as an advanced manufacturing technique.

Back to read:

1. Science & Technology-Manufacturing (henlius.com).

2. Fierce Pharma.com, Dec 9, 2021.

3. WuXi STA (stapharma.com), Jul 2022.

4. WuXi STA (stapharma.com), Jan 2023.

5. Langer, E. et al. 17th Annual Report and Survey on Biopharmaceutical Manufacturing Capacity and Production. Rockville, MD: Bioplan Associates, 2020.

6. Opportunities in Continuous Manufacturing of Large Molecules | Pharmaceutical Engineering (ispe.org), Jul-Ag 2021

Deepak Hegde, Ph.D., M.F.M, is an industrial pharmacist by training. He has a been involved in development and commercialization of both innovative and generic drugs from a very early phase of development to technical transfers for commercial manufacturing sites, for the past 25 years. During his career, he has worked at Rhone Poulenc, Novartis (Sandoz), USV Ltd., WuXi AppTec, GSK & EOC Pharma. He is currently working with Shenzhen Pharmacin Co. Ltd. as Senior Vice President-Technology & Manufacturing.

Email: deepak.hegde@hlkpharma.com

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

+86 15021993094

Follow Us:

Pharma Sources Insight July 2025

Pharma Sources Insight July 2025