Shruti TalashiJanuary 02, 2024

Tag: Global R&D , Development , ESG

As the global healthcare system refocuses after the pandemic, a recent report on the global R&D trend 2023 which was put together as a public service by the IQVIA Institute for Human Data Science and not derived from proprietary sponsor trial information has highlighted significant changes in therapeutic and geographic investments as well as the continued emphasis on novel mechanisms of action, cutting-edge development techniques, and expedited regulatory pathways to maximize the development and delivery of new therapies to patients.[1]

Global R&D spending by multinational pharmaceutical businesses has reached a new high of $138 billion in 2022, a 43% increase since 2017. These days, there is an increasing prevalence of close collaboration between research institutes, healthcare providers, and corporate partners. Yet the biopharmaceutical industry has seen substantial ups and downs in recent years due to a number of factors, including global economic performance, technological advancements, particularly in the areas of artificial intelligence and gene editing-based therapeutics, positive clinical outcomes, regulatory approvals, and emerging markets. Drug development R&D spaces that are creating innovative treatments and diagnostics using cutting-edge technologies had successfully attracted the attention of investors more and more. Venture capital (VC) investment in the biopharmaceutical industry has been noted to have increased significantly since the pandemic. Private equity firms have emerged as the major participants in biopharma investment, especially in later-stage startups with promising pipelines. Consequently, while merger and acquisition (M&A) activity in the biopharma sector continues to be significant. Biopharma firms that are developing novel therapies and diagnostics with state-of-the-art technology are given preference when it comes to receiving venture capital funding. In the case of gene therapy-based pharmaceuticals, for example, 'Verve pharmaceuticals' raised $250 million in Series D funding (stage) in October 2023 to advance its gene editing medications for cardiovascular disorders. Biopharma investment is expanding beyond of traditional hubs like the US and Europe, with a growing interest in Asia and other emerging countries. Fate Therapeutics, for example, raised $240 million in Series E funding (stage) in October 2023 to enhance its cell-based immunotherapy platform for cancer and autoimmune illnesses. More in trend, AI-powered Diagnostics, for example, Owkin in October 2023 received $180 million in Series C funding (stage) to build AI-powered tools for drug discovery and clinical trial design. For instance, in October 2023, Pear therapies received $150 million in Series D funding (stage) to explore digital therapies for mental health issues and chronic diseases. Notably, global digital health funding fell 3% quarter on Quarter, from $3.5B in Q1'23 to $3.4B in Q2'23. Despite the fact that digital health funding has stayed relatively steady over the last three quarters, it fell to its lowest level since Q3'17 in Q2'23. There are countless examples of biopharma businesses that have lately garnered large VC capital.[2]

The engagement of emerging biopharma businesses (EBP) in deals has increased over the last five years, with emerging companies without a larger firm representing 57% of deals in 2022 which has been up from 53% five years ago. However a transition is seen as deals involving larger companies have increased in year 2022. EBP are responsible for two-third of the drug molecules. EBP of Chinese-based enterprises market share now exceeds that of the Europe. Companies headquartered in the United States account for approximately half of all EBP development. The R&D pipeline is continually expanding, with over 21,300 pharmaceuticals in the pipeline as of January 2023 and involves over 2,700 corporations and over 100 academic or research institutes worldwide. Oncology is the pipeline's focal point, accounting for 38% or 2,331 compounds and growing at a 10.5% CAGR over the last five years. The clinical development pipeline for non-rare cancers rose by 7% in 2022, but development for rare cancers has plateaued or fallen somewhat since 2020, suggesting that pharmaceutical companies are beginning to transition away from rare cancers. More than 900 next-generation biotherapeutics are now under development, with rising interest in CAR T and NK cell therapies, as well as gene editing and nucleic acid vaccines. In 2022, more over 40% of next-generation biotherapeutics in development were for oncology, offering significant hope for cancer treatment.[1]

Large company as AstraZeneca is focused on developing next-generation drug delivery technologies under new modalities such as lipid nano-particles (LNPs) for delivering therapeutic molecules such as siRNA and mRNA to treat various diseases. These programs, however, are mostly in the preclinical or early clinical stages. Similarly an EBP, Envisia Therapeutics is a promising startup focused on developing targeted liposomal nanoparticles for improved delivery of siRNA therapeutics against cancer. Their innovative technology, preclinical results, and lofty aspirations make them a firm to keep an eye on in the next years. Although these firms would face numerous hurdles during scaling up process & the clinical validation process, yet Envisia Therapeutics may benefit from the tailored approach. Also, Astrazeneca, in collaboration with Memorial Sloan Kettering and Cornell University, has shown that ultra-small (< 8 nm) silica particles nanoparticles with attached engineered antibody fragments penetrated the tumor and showed significant accumulation within the tumor tissues for imaging and detection of HER2-overexpressing breast cancer. The use of ultra-small silica particles in next-generation drug delivery systems is a promising path. [3,4]

The point made is that nevertheless various EBP and top large biopharma companies are working on their R&D pipelines yet start-up and mid-stage companies are facing challenges in the race of drug development market with main hurdle of conducting the clinical studies. They certainly need support by either collaborating, finding innovative trial design, seek government or other funding etc. in order to validate their drug molecule within the timeline. The FDA recognizes the critical role that entrepreneurs play in promoting healthcare innovation. The agency's many efforts aim to make the regulatory process easier for emerging enterprises and to help them bring life-saving technologies to market faster. The FDA's website includes an innovation area with a wealth of information for startups. For entrepreneurs to ask concerns and gain clarity on regulatory requirements, the FDA provides dedicated hotlines and email addresses. The FDA provides frequent workshops and webinars on a variety of startup-related topics, including regulatory processes, clinical trials, and quality management systems. The FDA gives financial help to companies creating novel medical technology through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, as well as the FDA Innovation Fund for companies developing breakthrough medical products. Also that the FDA collaborates with incubators and accelerators to give mentorship, assistance, and resources to companies. FDA is running various online activities on the monthly and yearly basis to keep the stakeholders updated about the regulatory requirements and guidelines in the process of drug development and drug approval. FDA expands in-person face-to-face meetings. More information is available on our Update on In-Person Face-to-Face Formal Meetings with FDA webpage. [5]

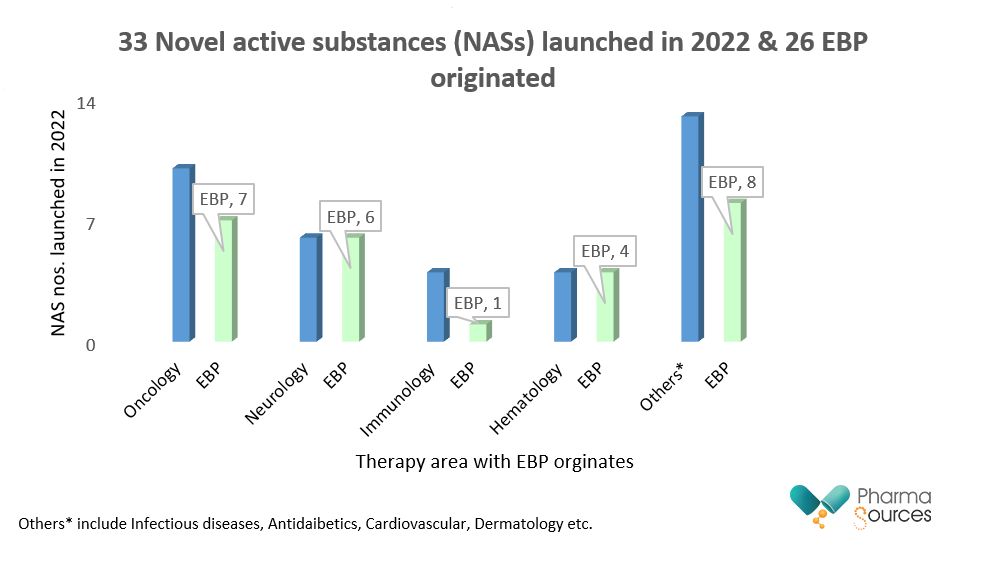

Novel active substances (NASs) launched in 2022 included 33 specialty drugs of which 26 were EBP originated. A novel active substance is a new chemical entity (NCE) that has not before been approved for any therapeutic purpose in the pharmaceutical business. These are essentially novel medications in development that have the potential to solve unmet medical needs or provide significant improvements over existing therapies.[5]

Figure represents total launched Novel active substances (NASs) for the year 2022 across different therapy areas & EBP originated. (Data collected from qviainstitute.org)

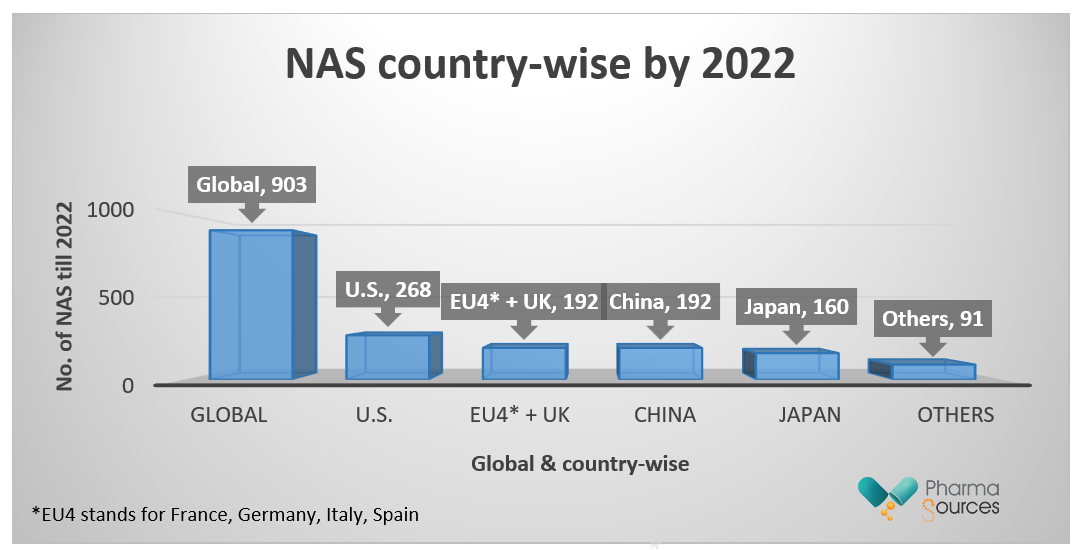

In the previous five years, the number of novel active substances (NASs) developed by EBP businesses has more than doubled. Products developed by EBPs are increasingly being released by an EBP firm, demonstrating greater independence on the part of EBP enterprises in bringing products from development to market. In the last five years, 353 novel active compounds have been launched globally, increasing the total during the last 20 years to 903.[1]

Figure represents the involvement various countries across globe in contributing the NAS by 2022. (Data collected from qviainstitute.org)

Despite a dip in overall success rates (down to 6.3%), 2022 saw a surprising surge in clinical development productivity. This was largely driven by simpler trials (fewer sites for rare diseases and oncology) and improved Phase II and III success rates. While oncology still suffers through longer trials, infectious diseases and dermatology shine with high success probabilities. Overall, the Clinical Development Productivity Index rose again after years of decline, hinting at a brighter future for bringing new drugs to market. Also that the clinical trial landscape is evolving rapidly, fueled by innovative trial designs and regulatory shifts. While scientific complexity soars, with groundbreaking therapies dominating launches, agencies adapt, embracing novel approaches like decentralized trials and real-world evidence. Faster track reviews boost approvals, leading to earlier launches and shorter "white space" between research phases. AI and other enablers hold further promise for streamlining clinical development, paving the way for a more productive and efficient future for bringing new drugs to market. Innovative trial designs, such as umbrella and adaptive protocols, are gaining traction in biopharma, accounting for 17% of new trials in 2022. Oncology leads the way, with roughly 30% of cancer studies utilizing these adaptable forms. The COVID-19 pandemic also sparked a boom in creative designs for infectious disease research, allowing for faster data collecting and decision-making through master protocols and adaptive structures. This trend toward innovative methodologies demonstrates the industry's dedication to simplifying research and delivering life-saving medications to patients as quickly as possible, with oncology and infectious illnesses leading the way. [1]

With the innovation there is a greater responsibility on the productivity enablers to work towards the common goal of sustainable development goals (SDGs) which applies across all industries. Biopharma is addressing the environment in its Environmental sustainable goals (ESG) commitments. Pharmaceutical businesses are turning their focus away from their personal carbon footprints and toward environmental issues that affect their whole value chain. This includes working with suppliers to minimize emissions, producing environmentally friendly goods, and partnering across industries to exchange best practices. While some companies, such as Amgen and Novo Nordisk, have lofty goals such as carbon neutrality by 2027 or "zero environmental impact," the overall approach is to leverage collaborative efforts and innovative solutions to address the environmental footprint of the entire biopharma ecosystem, going beyond their direct operations. AstraZeneca aspires to reach net-zero greenhouse gas emissions by 2030 by implementing aggressive carbon reduction objectives, investing in renewable energy, and implementing nature-based solutions. Novo Nordisk targets for "zero environmental impact" by 2030, focusing on projects such as sustainable manufacturing, renewable energy, and the circular economy. Eli Lilly and Company developed an ambitious DE&I strategy that included goals for labor representation and community engagement. When compared to larger, more established pharmaceutical companies, EBPs frequently confront distinct hurdles. However, they are increasingly important in the goal of environmental sustainability. Amyris Biotechnologies manufactures sustainable ingredients for cosmetics and pharmaceuticals using fermentation technology, reducing reliance on petrochemicals. Evolva develops bio-based replacements to traditional materials such as rubber and vanilla using environmentally friendly fermentation procedures. Moderna employs cell-free mRNA production technology, which consumes less water and energy than traditional vaccine manufacturing processes. Many additional EBPs are currently developing novel solutions to environmental concerns in the biopharma business. The future of sustainable biopharma is bright, and EBPs will play an important role in shaping it. [6]

In conclusion, EBPs and cutting-edge technologies drove a spike in biopharma R&D in 2023. Novel medications are reaching patients faster thanks to shorter trials and higher success rates, and AI and gene editing hold enormous potential for the future. Sustainability is gaining traction, and EBPs are leading the way in providing environmentally responsible solutions. Collaboration, regulatory support for EBPs, and ongoing technological breakthroughs are critical to realizing the full potential of R&D and providing hope to patients while protecting the environment. Biopharma has a bright future, and the journey toward delivering life-saving medications in an environmentally friendly manner has only just begun.

1. IQVIA institute for Human Data Science 'Global Trends in R&D 2023' FEBRUARY 2 0 2 3. URL: https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/global-trends-in-r-and-d-2023

2. Annalee Armstrong The top 10 M&A targets in biotech for 2022 posted date Feb 15, 2022 Accessed date Dec 19, 2023. URL: https://www.fiercebiotech.com/special-report/top-10-m-a-targets-biotech-for-2022

3. Veeva ID: Z4-54753 developing the next generation of drug delivery technologies ORIGINALLY PUBLISHED: 23 December 2021 LAST UPDATED 12 July 2023 Accessed on Dec 19, 2023. URL: https://www.astrazeneca.com/what-science-can-do/topics/next-generation-therapeutics/developing-the-next-generation-of-drug-delivery-technologies.html

4. Envisia Therapeutics Tomas Navratil, PhD, Vice-President, Development; Benjamin Maynor, PhD, Vice-President, Research; and Benjamin Yerxa, PhD, Chief Scientific Officer, all of Envisia Therapeutics, Inc, IMPROVING OUTCOMES IN OPHTHALMOLOGY VIA SUSTAINED DRUG DELIVERY URL: https://www.ondrugdelivery.com/wp-content/uploads/2018/04/Envisia-HR.pdf

5. Author Participated in in the two days Dec 06/07, 2023 SBIA | FDA Clinical Investigator Training Course (CITC) 2023.

6. Fraiser Kansteiner Pharma 'Setting sights on suppliers: How biopharma is tackling the environment in its ESG commitments' Posted date : Jul 19, 2022; Accessed date: Dec 19, 2023. URL : https://www.fiercepharma.com/pharma/setting-sights-beyond-scope-1-and-2-how-biopharma-tackling-environment-its-esg-commitments.

Ms. Shruti Talashi boasts a dual mastery of lab research and writing. Her doctoral study outcome as M.Phil in biomedical science while studying breast cancer and an extraordinary masters degrees dissertation work on exploring role of Gal-lectin in cancer metastasis fuels her extensive research interests. She has gained few publication in journals. Bridging the science-public gap is her passion, aided by expertise in diverse techniques. From oncology to antibiotic/drugs production, she's led and managed complex projects, even clinical trials. Now, as a freelance Content Coordinator for Sinoexpo Pharmasource.com, her industry knowledge shines through valuable insights on cutting-edge topics like GMP, QbD, and biofoundry.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025