Spur 203/PharmaSourcesDecember 14, 2023

Tag: PD-1 , Pertuzumab , Herceptin

The competition for the subcutaneous formulation of PD-1/PD-L1 inhibitors has been spreading globally for a long time, with Roche and Bristol Myers Squibb (BMS) currently leading the pack.

Recently, BMS announced that the Opdivo subcutaneous injection formulation, compared to its intravenous injection formulation has met the primary and key secondary endpoints in the phase III CheckMate-67T study for systemic treatment or metastatic clear cell renal cell carcinoma (ccRCC) patients. The study results showed that, compared to the intravenous preparation, the subcutaneous preparation of Nivolumab demonstrated non-inferior pharmacokinetic characteristics and Objective Response Rate (ORR). After being suppressed by Keytruda for many years, BMS has finally surpassed MSD's Keytruda by the progress of Opdivo subcutaneous preparation.

In September this year, Roche announced that its targeted antibody PD-L1 inhibitor Tecentriq (atezolizumab), a subcutaneous preparation, has been approved for marketing by the UK Medicines and Healthcare products Regulatory Agency (MHRA). The Tecentriq subcutaneous preparation is approved in the UK for all indications previously approved for the intravenous preparation, including certain types of lung cancer, bladder cancer, breast cancer, and liver cancer. Compared to the 30-60 minute intravenous infusion, it only takes about 7 minutes. According to Roche's press release, this approval marks the first time that the Tecentriq subcutaneous preparation has been approved by a regulatory agency worldwide, and the drug is currently under review by the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

This is the fourth tumor-targeting product from Roche to be administered via subcutaneous injection, following Phesgo (pertuzumab + trastuzumab), Herceptin (trastuzumab), and MabThera (rituximab). After gradually reducing its dependency on the "big three", Roche is also seeking differentiation in the field of antitumor drugs through formulation innovation. Tecentriq had sales volume of CHF 3.717 billion (USD 3.896 billion) in 2022, which is still far behind Opdivo's USD 9.362 billion. Whether the subcutaneous preparation of Tecentriq can open up new growth opportunities for Roche remains to be seen and is worth looking forward to.

Two years ago, the first globally approved subcutaneous injection PD-1/PD-L1 drug was born in China. NMPA conditionally approved the listing of the Envafolimab, making it the first domestically approved PD-L1 inhibitor in the country. It is also the world's first subcutaneous injection PD-L1 inhibitor. Now, two years have passed, and in a highly competitive domestic market, the market performance of Envafolimab has also been a focus of attention.

The biggest selling point of subcutaneous injection products is to greatly improve the compliance of PD-1/PD-L1 products. In the case where there is not much difference in safety and efficacy data compared to intravenous injection formulations, subcutaneous injection will greatly reduce the long administration time caused by intravenous injection and save medical resources.

Is it possible for subcutaneous preparation to translate clinical advantages and differentiation into market advantages? This still needs more time to be verified on a global scale.

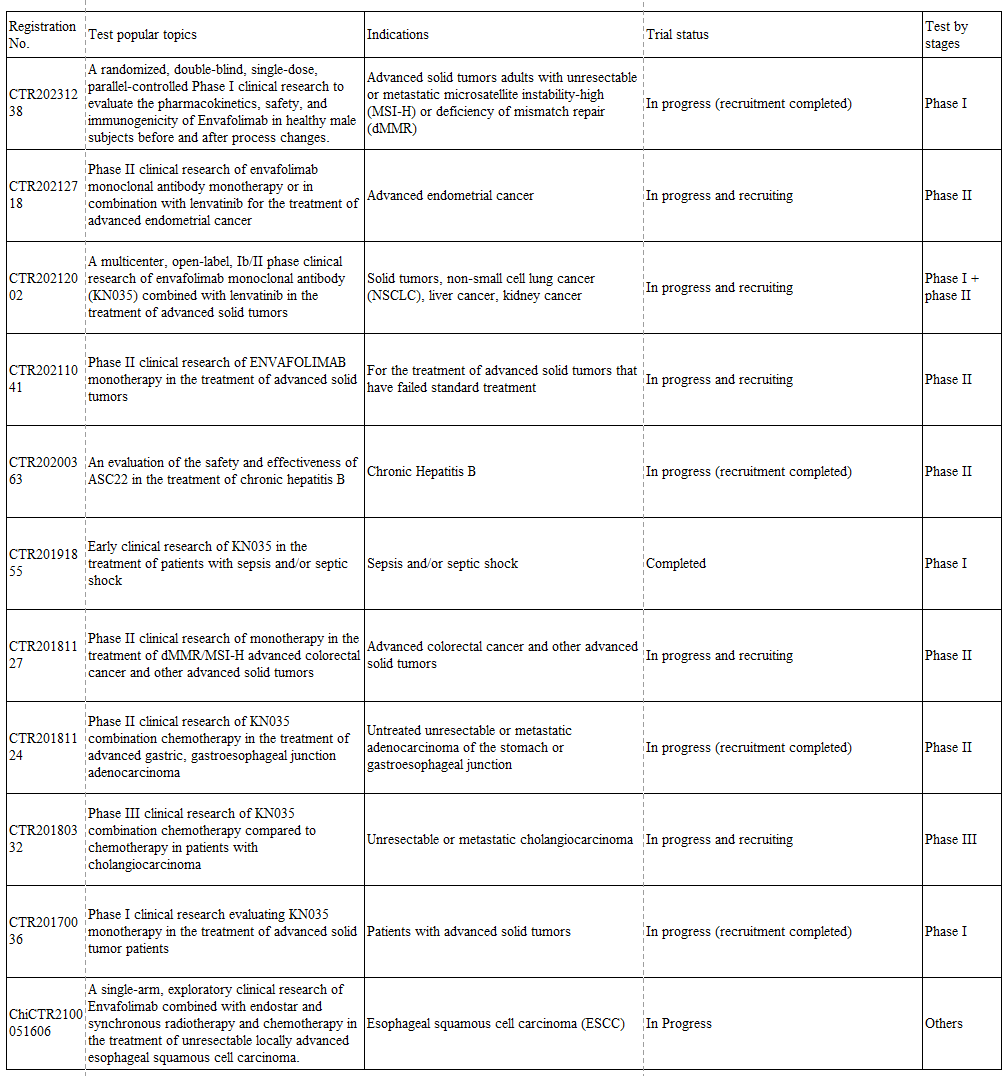

Table 1: Clinical trials of envafolimab monoclonal antibody being conducted in China (compiled from Drugdataexpy)

In November 2021, the National Medical Products Administration (NMPA) approved the conditional marketing of Envafolimab through drug review and approval procedures, for use in adult patients with unresectable or metastatic microsatellite instability-high (MSI-H) or deficiency of mismatch repair (dMMR) advanced solid tumors. This marked the first approval of a PD-1/PD-L1 drug in China for this indication. Before Keytruda was approved for this indication in September 2021, envafolimab monoclonal antibody was the only PD-1/PD-L1 drug approved for this indication, holding a monopoly in the market. So, what market performance did it deliver during these two years?

Envafolimab monoclonal antibody has a complex development history, with multiple parties involved in its ownership. As the original developer, Alphamab Oncology is responsible for production and quality, 3D Medicines is responsible for clinical development in the field of oncology, while Ascletis Pharma Inc. is responsible for development and commercialization in the field of viral diseases, and Simcere Pharmaceutical is responsible for the exclusive commercial promotion in Chinese Mainland. According to public information, under the collaboration of Alphamab Oncology, 3D Medicines, and Simcere Pharmaceutical, envafolimab monoclonal antibody covered approximately 20,000 patients in 2022 and generated revenue of RMB 567 million in its first complete year of commercialization.

Depending on the single indication, even with the advantage of subcutaneous administration compliance, it is difficult to translate into market advantage. In the current domestic fierce market, envafolimab monoclonal antibody has also been carried out multiple clinical trials to actively expand its indications. Among them, compared with chemotherapy, combination chemotherapy in the treatment of cholangiocarcinoma has already entered Phase III clinical trials, and it is currently in a leading position in this indication field in the country. In the future, it is expected to break through the RMB 1 billion mark by expanding its market with new indications.

Roche's PD-L1 antibody Tecentriq subcutaneous injection formulation was the first to be approved for marketing in the UK, and its commercialization in other European countries as well as in the United States is also expected to be completed next year, when the global Tecentriq subcutaneous preparation will bring considerable anticipation. BMS also closely follows, and the Phase III clinical trial of Opdivo subcutaneous injection formulation has also successfully reached its completion, which will inject new differentiation in the growth curve of Opdivo as well.

As the absolute ruler in the global PD-1 field, MSD also had to advance its preparations for the expiration of Keytruda's key patents and exclusive period in 2028, which further increases the impetus for MSD to develop subcutaneous preparations, and it has spent a lot of resources on the development of the Keytruda subcutaneous preparation as well.

Currently, the subcutaneous injection formulation of the Keytruda is also undergoing Phase III MK-3475-A86 trial to evaluate subcutaneous administration in combination with chemotherapy, compared with intravenous administration in combination with chemotherapy, for the treatment of squamous and non-squamous first-line non-small cell lung cancer (NSCLC). According to information disclosed by MSD in August, the study has reached the endpoint at present, yet it has not announced the next steps. Meanwhile, MSD is also preparing for many scenarios, another focus is on the compound formulation of the Keytruda combined with hyaluronidase, which differs from the injection of the Keytruda as a single-drug administered every three weeks -- this compound formulation can achieve administration once every six weeks, and the Phase I clinical trial is expected to be completed in 2026.

In addition, Pfizer is keeping pace with the progress of above-mentioned MNC. Although it is not its strength area, its PD-L1 subcutaneous preparation Sasanlimab is currently in Phase III clinical stage, with indications targeting more differentiated non-muscle invasive bladder cancer, and the trial is expected to end by mid-2024. However, there is little public data on this project at present, and it does not have a high priority in Pfizer currently. Given Pfizer's direct acquisition of Seagen's ADC drug revenue this year, more in-depth exploration in the field of anti-tumor of this drug is also possible in the future.

The layout speed of domestic enterprises is not slow either, Hengrui Pharmaceuticals, TopAlliance, and BeiGene all have PD-1 subcutaneous preparation products entering clinical trials. Hengrui Pharmaceuticals' SHR-1901 initiated clinical trials for the first time at the end of 2021, which is the second domestically produced subcutaneous injection formulation of PD-1 monoclonal antibody product to enter clinical stage. Junshi Biosciences' JS001sc injection is developed based on the marketed product Toripalimab injection, targeting advanced nasopharyngeal carcinoma. And BeiGene's tislelizumab subcutaneous injection formulation was also approved for clinical use in China last month for the treatment of malignant tumors, and it is expected that there will be increasingly fierce competition in the future for PD-1 subcutaneous formulation in the domestic market as well.

From the above, it is not difficult to see that the competition of PD-1 subcutaneous preparations is spreading globally. In the future, the competition will surely be fierce. This differentiated path is becoming increasingly difficult with the increasing number of companies entering the market.

If we carefully consider the logic, it is inevitable that PD-1 transitioned from intravenous injection to subcutaneous injection in the course of history. As the expiration dates of the patents for Keytruda and Opdivo draw closer, MSD and BMS will inevitably do everything they can to maintain their global market dominance. The second global tier of PD-1, represented by Roche and Pfizer, will also pursue differentiated strategies to establish clinical advantages as their new path. Moreover, the application of hyaluronic acid technology, represented by recombinant human hyaluronidase (rHuPH20), in large molecule drugs has achieved the conversion from intravenous to subcutaneous administration and dosage optimization to reduce the burden of disease treatment. This has successfully led to the launch of several major products from Roche and Johnson & Johnson, confirming the feasibility of delivery technology. All these factors have contributed to making the current competition of PD-1 subcutaneous formulation competition fierce.

From a market logic perspective, it is not difficult to understand that by simultaneously improving the method of administration and developing combination therapies, the impact of market monopolies and generic drugs resulting from patent expiration can be mitigated. This can fully utilize existing market advantages to extend the product lifecycle, as has been proven through Roche's strategy of replacing intravenous preparations with subcutaneous ones. Roche has developed subcutaneous formulations of trastuzumab, Herceptin Hylecta, and a combination of trastuzumab and pertuzumab, Phesgo, both of which have achieved high growth since their launch. This year, Phesgo's sales reached USD 700 million, doubling from the previous period. It appears that MSD and BMS have also followed this market logic.

Last week, Junshi Biosciences' PD-1 Monoclonal Antibody Toripalimab received FDA approval, undoubtedly injecting a strong boost into the overseas market for innovative domestic drugs. This is the first market approval for a domestic PD-1 product in the United States and carries milestone significance. Its indication for differentiated nasopharyngeal carcinoma further highlights the comprehensive competition among PD-1 drugs, now extending to subcutaneous preparations. We are eagerly awaiting who will be the first to enjoy the benefits of PD-1 subcutaneous preparations in the future.

1. https://www.roche.com/investors/updates/inv-update-2023-08-29b;

2. Phase 3 CheckMate -67T Trial of Subcutaneous Nivolumab (nivolumab and hyaluronidase) Meets Co-Primary Endpoints in Advanced or Metastatic Clear Cell Renal Cell Carcinoma,from BMS;

3. 药智数据、CDE以及临床试验登记平台官网;

4. Study of Pembrolizumab (MK-3475) Subcutaneous (SC) Versus Pembrolizumab Intravenous (IV) Administered With Platinum Doublet Chemotherapy in Participants With Metastatic Squamous or Nonsquamous Non-Small Cell Lung Cancer (NSCLC) (MK-3475-A86)。

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025