PharmaSources/Spuer 203August 28, 2023

Tag: R&D Projects , Pipelines

Last week, Eli Lilly posted its Q2 and H1 financial reports this year. With the sales volume of Tirzepatide of USD 1.548 billion in H1 of the year and other excellent performances higher than expected, Eli Lilly's stock price rose by 14.87% on that day. As one of the transnational pharmaceutical companies, Eli Lilly's market value was once over USD 500 billion, occupying the hot search page at that time. Until now, almost all top ten transnational pharmaceutical companies in the world have published their semi-annual reports.

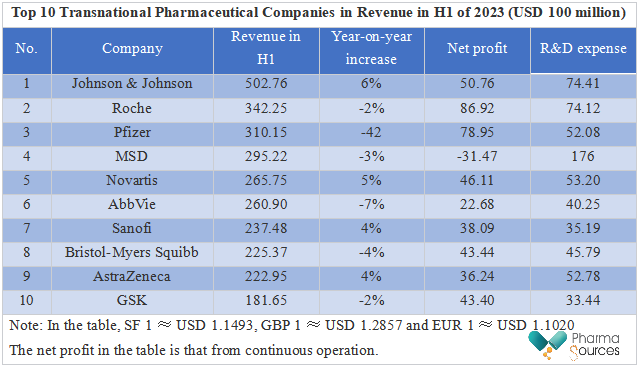

Table: Top 10 Transnational Pharmaceutical Companies in Revenue in H1 of 2023 (USD 100 million)

From the semi-annual report data of transnational pharmaceutical companies, it can be seen that in the past half year, some companies had good achievements while others were confronted with difficulties. Depending on anti-COVID-19 oral medicine, Paxlovid, and COVID-19 vaccine, Comirnaty, Pfizer earned a lot of money in the previous two years, but it suffered a sharp drop in revenue in H1 of this year. Eli Lilly and Novo Nordisk became big winners with the blessing of their diet pills. According to data released by pharmaceutical companies, many projects have been cut off just in H1 of the year, valuing billions of dollars, which shows that, in the global pharmaceutical capital winter, even transnational pharmaceutical companies must allocate resources rationally and make every penny count.

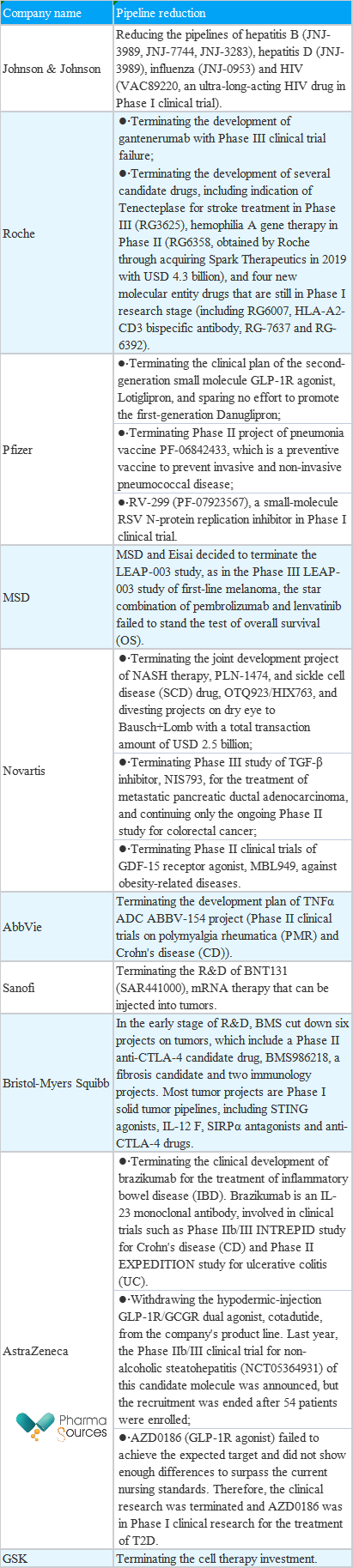

Table 2 Pipeline Reduction of Transnational Pharmaceutical Companies in H1 of 2023 (According to Incomplete Statistics in Financial Reports and Public Information)

Reducing pipelines is actually not rare, especially for transnational pharmaceutical companies. There are usually dozens or even more than 100 clinical projects, especially preclinical projects, in their pipelines. It is also common to reduce one or two or even more in the R&D process. In fact, because of the huge and even slightly redundant operating system of transnational pharmaceutical companies, reducing pipelines can be more beneficial for them to integrate resources, achieve differentiated layout and take the lead. Therefore, it must be a kind of strategy to decide which one to reduce and how to conduct.

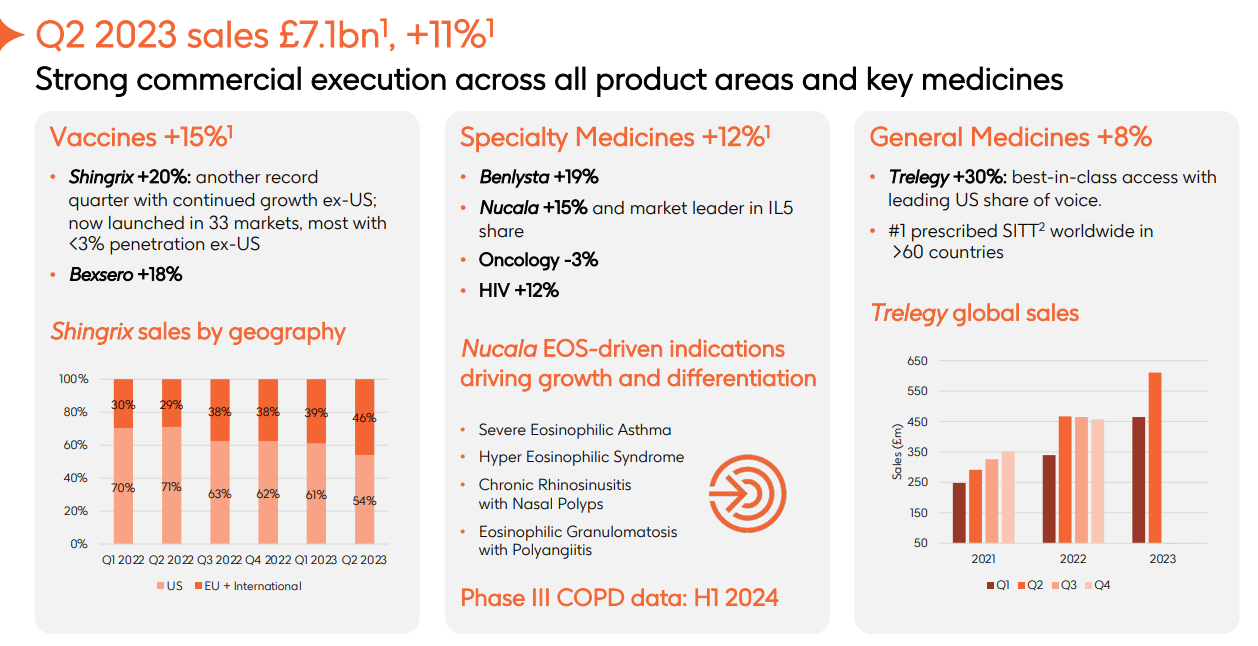

It is the most decisive to give up the whole research. At the beginning of this year, GSK directly announced that it would terminate its R&D investment in cell and gene therapy, including a letetresgene-autoleucel (lete-cel) in Phase III and GSK3845097 (NY-ESO1/dnTGFb TCR-T) and GSK39019611 (NY-ESO-1/CD8a TCR-T) in Phase I. Company executives said that although cell therapies such as CAR-T had significant success in treating hematologic tumors, there were too many projects in this field, and the prospect of expanding to the field of solid tumors was far more challenging than supposed. Therefore, given all the development and manufacturing costs and possible risks, it is not the best option for GSK to continue to invest in the cell therapy.

Figure: Performance of GSK in Q2 (Decline of 2% in Revenues from the Field of Tumors)

This actually requires more determination on the part of a company. Considering reasons, it is probably related to GSK's lack of significant achievements in the field of tumors in recent years. Currently, its PD-1 tumor pipeline has lost its first-mover advantage, and markets that it can obtain are limited. ADC Blenrep, under accelerated approval, was withdrawn from the market in the United States shortly after its marketing. In addition, the progress in the field of cell therapy is far less than Novartis and other rivals, and pipelines without advantages will be reduced. Therefore, it is reasonable for GSK to directly abandon the cell therapy.

Johnson & Johnson faced the same situation. It has reduced its area in the infectious disease market by reducing seven projects, most of which are those in hepatitis B, hepatitis D, AIDS and influenza. Against the backdrop of not receiving many dividends from COVID-19, Johnson & Johnson has actually lagged behind Pfizer, Gilead, GSK and other old rivals in the infectious disease field. At present, there is really no pipeline that can be used in the later stage, Whether Johnson & Johnson will continue to invest in this field is also unknown.

From the pipelines that have been reduced by transnational pharmaceutical companies in the past six months, many are still many unknown fields in the current R&D.

In terms of indications, the first one is NASH, one of indications with a high R&D failure rate at present. Transnational pharmaceutical companies have also suffered a setback in this field. In February this year, Johnson & Johnson and MSD terminated their cooperation with Arrowhead and NGM Bio on NASH products. According to the caliber of NGM Bio, it can be inferred that MSD's decision is made based on the interim analysis of liver fat reduction at the 24th week, instead of safety issues. In other words, the efficacy of MK-3655 is not enough to support MSD, and the same is true of Johnson & Johnson. For now, in terms of both external cooperation and self-development, in the field of NASH, more than half of pipelines are still in failure.

In addition to NASH, neurodegenerative diseases are also one of the hardest hit areas. Neurodegenerative diseases represented by Alzheimer's disease have always been an unknown field of R&D. This year, Roche and Eli Lilly have terminated the related clinical pipelines of Gantenerumab and Solanezumab, which are disease fields difficult to overcome. These disease areas have a huge unmet market, so it is understandable that pharmaceutical companies are active in engaging in related fields, even if they have to reduce relevant pipelines. But different from biotech, transnational pharmaceutical companies still have opportunities for trial and error, and resume in the future.

Of course, these are only the two most representative disease fields, with a high R&D failure rate. It is actually understandable that transnational pharmaceutical companies reduce related pipelines. As an indication with mature development, the reduction of tumor and autoimmune disease pipeline is mostly because of the exploration failure of a certain target. TIGIT, as a target that has not yet been developed, is also bearing the brunt. Tiragolumab suffered two failures in Phase III clinical trials, and Roche's highly promising TIGIT+PD-L1 combination missed the primary endpoint of PFS in two lung cancer indications. As a promising target for immune disease and tumor treatment, IL-12 suffered the hardest hit in the beginning of the year and was abandoned by MSD, AstraZeneca, and BMS.

In addition, regardless of the mature target exploration, due to the speed and clinical data not as good as competitors, the pipeline will face the risk of being reduced, which is the case of AstraZeneca's two kinds of GLP-1 mentioned in the table above. Despite of mature target mechanisms and entering into clinical trials, considering the speed and clinical data behind Eli Lilly and Novo Nordisk, it had no choice but to stop loss in time by withdrawing investment. In other words, me-better or even me-worse are of little significance for transnational pharmaceutical companies.

In summary, for transnational pharmaceutical companies, there are different ways and reasons to reduce pipelines. As a company with sufficient cash reserves, there are still opportunities for trial and error even if it has to give up after investing a certain amount of funds. For the unknown fields in the new drug R&D, these multinational pharmaceutical companies still need to continuously invest money and time to take the lead in overcoming difficulties. Learning to give up in a timely manner is an art, and it will bring far more than losing.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025