PharmaSources/CaicaiAugust 17, 2023

Tag: R&D , Medical Anti-corruption , Hengrui Pharmaceuticals

On July 21st, the National Health Commission held a video conference with the Ministry of Education, Ministry of Public Security, National Audit Office, State-owned Assets Supervision and Administration Commission, National Medical Insurance Bureau, State Drug Administration, and other departments to deploy a one-year nationwide campaign to combat corruption in the pharmaceutical field. A few days later, the disciplinary committee also released relevant news. The anti-corruption campaign has begun.

According to reports, since the beginning of this year, about 150 hospital presidents and secretaries have been investigated, involving the purchase of drugs, medical devices, etc. Unlike in the past, this anti-corruption campaign will no longer focus solely on "hospital presidents and secretaries," but will also focus on "chairmen and general managers."

Let's look at some data first.

In 2022, Shanghai Pharmaceuticals (601607.SH) had sales expenses of 14.279 billion yuan, ranking first among A-share medical companies. Fosun Pharma (600196.SH) ranked second with sales expenses of 9.171 billion yuan, followed by Buchang Pharmaceutical (603858.SH) with sales expenses of 7.484 billion yuan, and Hengrui Pharmaceuticals (600276.SH) with sales expenses of 7.348 billion yuan, ranking fourth. In addition, Huadong Medicine (000963.SZ), BeiGene (688235.SH), Baiyunshan (600332.SH), and others all had sales expenses exceeding 5 billion yuan in 2022.

Why are the sales expenses of domestic healthcare companies so high? On the surface, it is mainly because these pharmaceutical companies use methods such as drug rebates, hospital visits, and academic promotion conferences to promote their products, and these expenses are hidden in the sales expenses. The fundamental reason for this phenomenon is that domestic pharmaceutical companies lack true innovation and core competitiveness in their products, so they can only occupy the market through the transfer of benefits and other related methods.

However, in the long run, high sales expenses not only increase the cost of medical treatment and medication, but also affect the healthy development of the domestic pharmaceutical industry. Therefore, anti-corruption is imperative and imminent.

The sales expense ratio refers to the ratio of sales expenses to operating income, which can to some extent reflect the unit sales expenses spent by the company to achieve unit income, or the proportion of sales expenses to operating income.

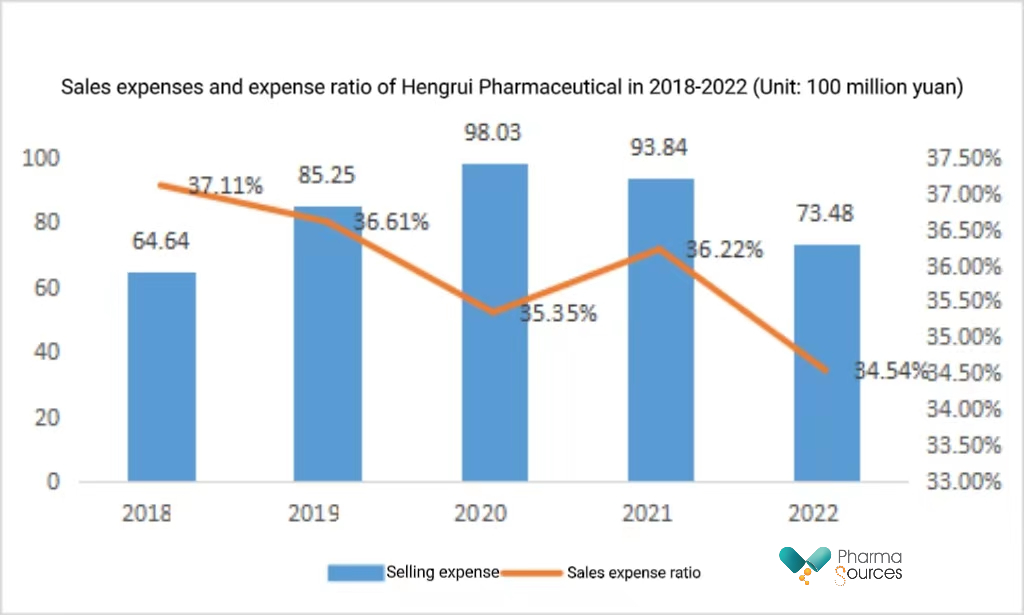

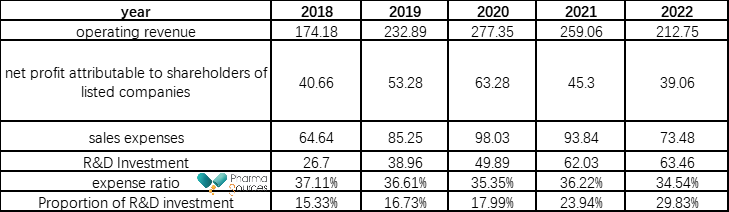

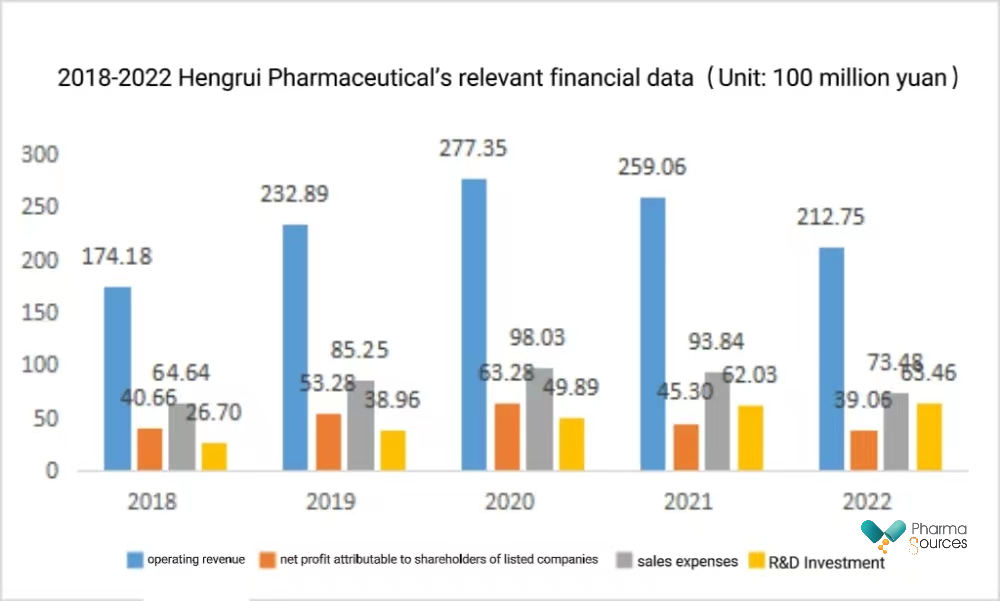

Next, let's take a look at how high the sales expense ratio of domestic pharmaceutical companies is through a more intuitive set of data. Let's first look at the data of Hengrui, which is a typical domestic example.

By querying the data from 2018 to 2022, it can be seen that Hengrui's average annual sales expenses in these five years were 8.304 billion yuan, and the sales expense ratio was above 30%, with most of them above 35%. In other words, for every 100 yuan earned, 35 yuan is spent on marketing, which is quite high. Moreover, this is not the highest ratio.

(Data source: Company annual report, Sales expense ratio (%) = Sales expense / Operating income)

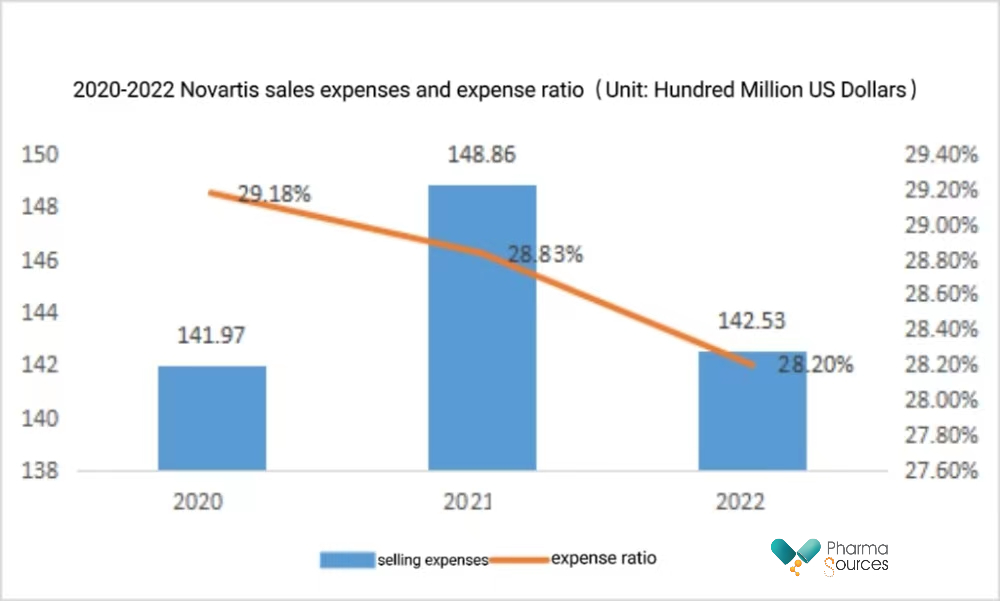

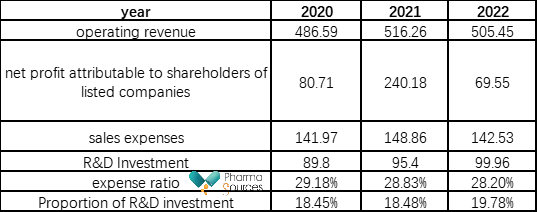

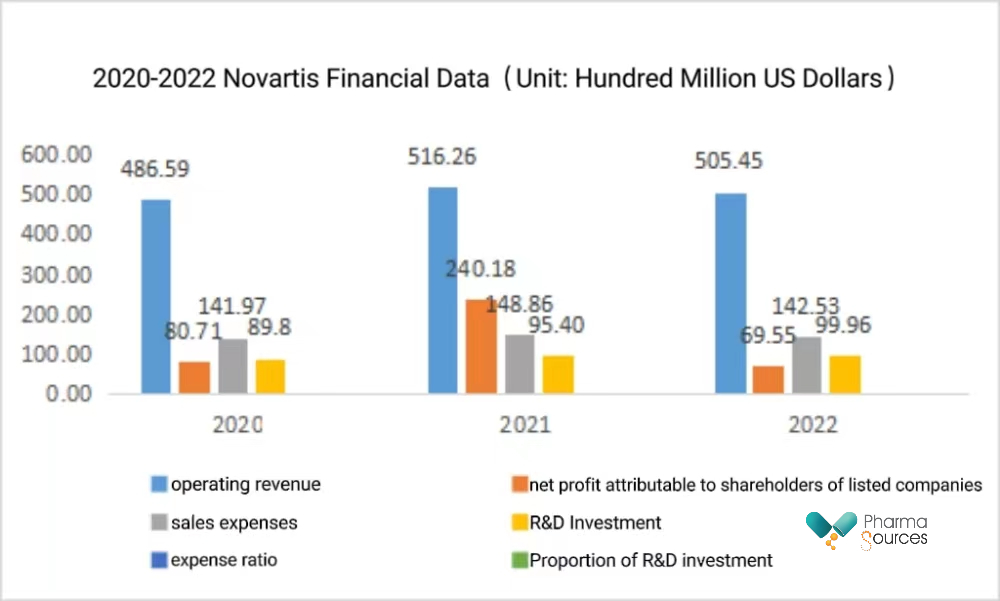

For a more intuitive comparison, let's also look at Novartis, an overseas company with high marketing expenses. The average sales expenses for the past three years, from 2021 to 2022, were 14.445 billion US dollars, and the sales expense ratio was below 30%. Taking the data from 2022 as an example, there is a difference of nearly 6 percentage points, which can be considered a significant gap.

(Data source: Company annual report, Sales expense ratio (%) = Sales expense / Operating income)

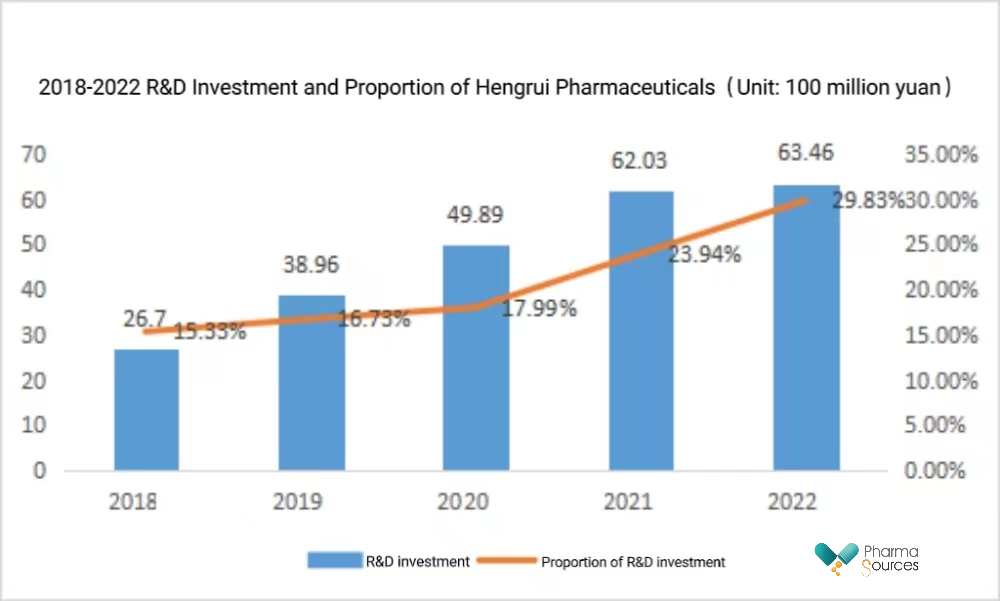

Let's take a look at Hengrui's R&D investment and its proportion over the past five years. In the past five years, Hengrui's average R&D investment was 4.821 billion yuan, and the proportion increased year by year, reaching nearly 30% in 2022.

(Data source: Company annual report, R&D investment ratio = R&D investment / operating income)

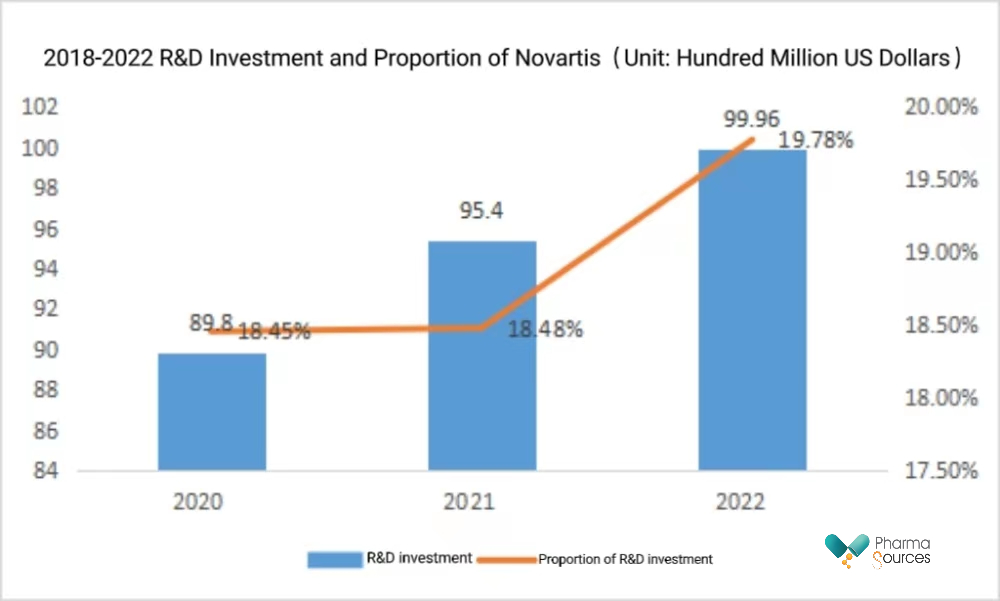

From 2020 to 2022, Novartis' R&D investment increased year by year, with a proportion close to 20%. In terms of the proportion of R&D investment, Hengrui's proportion is much higher than Novartis'.

(Data source: Company annual report, R&D investment ratio = R&D investment / operating income)

Take a look at a set of data from the Wind system. As of the end of 2022, there were a total of 497 healthcare companies listed on the A-share market, with total sales expenses of 324.891 billion yuan in 2022. Among them, 41 companies had sales expense ratios above 50%, and 149 companies exceeded 30%. The total R&D investment in 2022 was 113.132 billion yuan, with an average of about 22.9 million yuan per company. In 2022, BeiGene had the highest R&D expenses, reaching 11.152 billion yuan, and it was the only company that exceeded 10 billion. Hengrui Pharmaceuticals ranked second with 4.887 billion yuan, and Fosun Pharma ranked third with 4.302 billion yuan. There were only 15 companies with R&D expenses exceeding 1 billion yuan.

It can be said that the sales expenses of pharmaceutical companies are generally higher than their R&D expenses. Taking Hengrui as an example, in 2022, the sales expenses were about 1 billion yuan higher than the R&D investment, which is a significant gap. In the case of Novartis, the gap between R&D investment and sales expenses is even greater, with a difference of nearly 4.2 billion US dollars in 2022.

(Data source: Company annual report)

(Data source: Company annual report)

(Data source: Company annual report)

(Data source: Company annual report)

According to analysis from industry insiders, the development of innovative drugs is difficult, requires large investments, has a long cycle, and carries high risks of failure, with many uncertainties. On the contrary, high-cost marketing has a higher success rate and quick results.

Overall, it can be said that relying on increasing sales revenue to improve market share is exhausting the pond. For major domestic pharmaceutical companies, only by increasing R&D investment and having products that combine innovation and core competitiveness can this problem be fundamentally resolved.

Caicai, a Master of Pharmacy from Shanghai Jiaotong University, used to work in the Institute of Science and Technical Information. Currently as a practitioner in the drug surveillance system, she is good at interpreting industry regulations, pharmaceutical research developments, etc.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

+86 15021993094

Follow Us:

Pharma Sources Insight July 2025

Pharma Sources Insight July 2025