Yefenghong/PharmaSourcesApril 19, 2023

Tag: ADC , CDMO , Pharma Outsourcing

Recently, the heat on ADC pipeline deals is around, and the deal sizes are kept refreshing.

On February 23, Keymed Biosciences Inc. announced that KYM Biosciences, a joint venture established by Keymed (70% of KYM ownership) and Lepu Biopharma, and AstraZeneca have entered into a global exclusive out-license agreement to develop and commercialize CMG901. CMG901 is a Claudin 18.2-targeting anti-body drug conjugate (ADC) comprising of a Claudin 18.2-specific antibody, a cleavable linker and a toxic payload, monomethyl auristatin E (MMAE), which is co-developed by Keymed Biosciences Inc. and Lepu Biopharma. Under the terms of the agreement, AstraZeneca will be granted an exclusive global license for research, development, registration, manufacturing, and commercialization of CMG901; In return, KYM Biosciences shall receive an upfront payment of US$ 63 million with the potential for additional payments up to US$ 1.125 billion subject to achievement of certain development, regulatory and commercial milestones.

On February 26, it is reported that Pfizer is in talks to acquire Seagen, a pioneer in ADC, in a potential deal that is likely valued more than US$ 30 billion. In July last year, rumor had it that MSD was in talks to acquire Seagen in a deal that could be worth roughly US$ 40 billion or more, however, finally it was reported that the two companies couldn't reach an agreement over pricing.

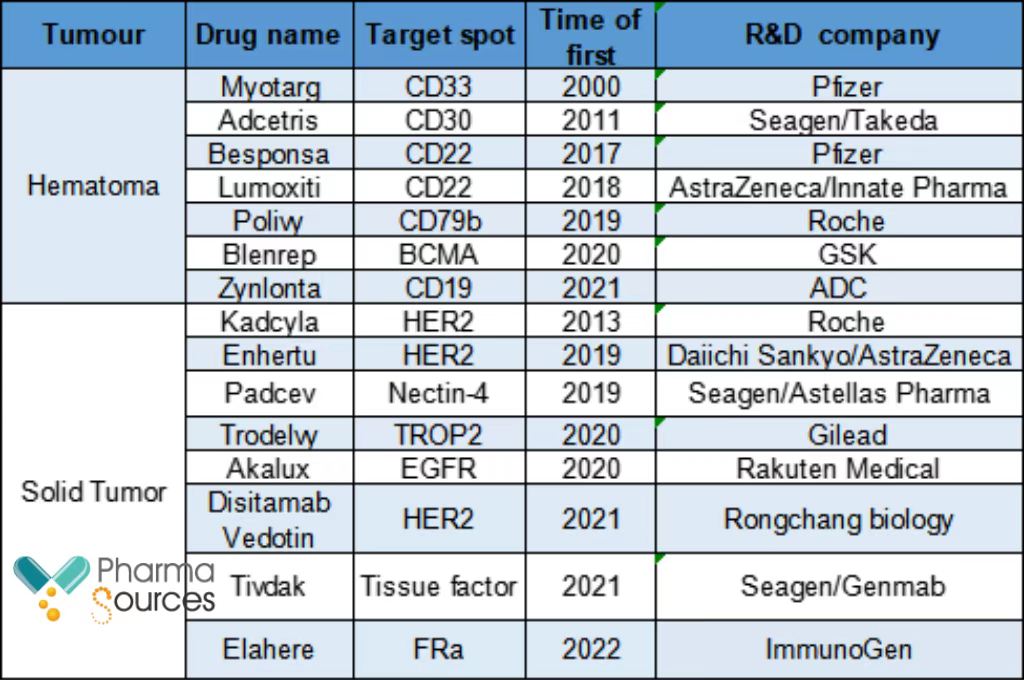

Two deals got leaked out in four days, ADC is getting hot again. Currently, a total of 15 antibody-drug conjugates (ADCs) are currently approved for marketing globally. The global ADCs market size was valued at US$ 5.221 billion in 2021. And the annual average compound growth rate was about 30% from 2014 to 2021. As a result, the race contract development and manufacturing organizations (CDMOs) for ADCs is rising.

Approved ADC for marketing globally

(Sources: IQVIA Research, CITIC Securities, released information)

ADC (Antibody-Drug Conjugate) has three main components: the antibody, the linker, and the payload. Wherein, the antibody is a monoclonal antibody drug with strong target specificity that can accurately target tumor cells; the payload is a small molecular toxin with high toxicity that strengthens tumor cell killing capability of ADC; the linker is a chain-typed molecular tool for connecting the other two functional molecules used in the synthesis of ADC.

An ideal ADC shall remain stable in blood circulation, reach the therapeutic target accurately and eventually release the cytotoxic payloads in the vicinity of the targets (e.g., cancer cells) to have killing effects on tumor cells.

The projects of ADC not only require the manufacturing enterprise to master the development and manufacturing of the monoclonal antibody and the bioconjugate, but also can develop the linker and the payload, which have very high manufacturing challenges. Thus, many developers of ADC choose to outsource operations. According to the data released in last September from MSD's ADC base, 70% of current ADC projects under development were outsourced to professional outsourcing agencies.

Daiichi Sankyo made it clear that it will spend US$ 13.6 billion on ADC and bispecific antibody technology under its five-year plan, among which US$ 2.3 billion will be spent on the supply chain, and a large amount of expense will be paid to the CDMO.

Therefore, the broad market prospects, booming R&D enthusiasm and relatively high outsourcing rate all provide CDMO with great development opportunities. But CDMO itself doesn't have the ability to solve the "one stop" manufacturing of ADC, many mergers and combinations emerge.

WuXi XDC

In July 2021, WuXi XDC, a joint venture between WuXi Biologics and WuXi STA is dedicated to providing end-to-end CDMO services for ADC and other bioconjugates. The company's services cover the R&D, process and manufacturing of antibodies and other bio-conjugated drug substance, linkers/chemical payloads, conjugated stock solution and preparations. In technical cooperation, WuXi Biologics's ADC research team has developed a novel technology platform "WuXiDAR4TM", which greatly enhances DAR4 (four payload molecules per mAb) percentage in the final ADC product and improves conjugation efficiency. WuXi STA provides the customer with great flexibility for linkers/payloads evaluation with the support of its manufacturing experience in various payloads and linkers. The company not only can provide common payloads, such as MMAE/F and DM1/DM4, and it also can develop and manufacture various novel payloads and conjugated compounds. As of the first half of 2022, WuXi Biologics has secured 76 ADC integrated projects globally, 27 of which had completed IND submission.

BrightGene & TOT Biopharm

Also in July 2021, BrightGene and TOT Biopharm jointly announced that both parties would conduct a strategic cooperation in ADC CDMO services, facilitating the R&D and commercialization of innovative drugs. According to the agreement, the two enterprises will provide customers with ADC product early-stage process development, amplification of intermediate size and GMP manufacturing services together.

TOT Biopharm is one of the earliest enterprises involved in ADC in China. It has rich experience in ADC development and manufacturing, and also has perfect manufacturing facilities and quality systems to ensure regulatory compliance. BrightGene is a domestic leader in original new drugs and high-end generic drugs in the pharmaceutical industry. It has successfully developed various high-end generic drugs. The roles of both parties under this cooperation are as follows based on their respective strengths: BrightGene will be mainly responsible for providing intermediates, including linker and payload; TOT Biopharm will be mainly responsible for monoclonal antibody manufacturing and ADC CMC process development, conjugation and preparation filling, as well as providing services for preclinical research, clinical research and commercialized production based on GMP standards. In addition, both BrightGene and TOT Biopharm are located in the Suzhou Industrial Park, avoiding the risk of cross-region supervision. The two have achieved powerful combination by complementary technology and resources.

ZH Biotech

In June 2022, ChemExpress (40%) and biodrug CDMO leader enterprise ZG Biotech (60%) established ZH Biotech to build a one-stop ADC CDMO service platform. ZH Biotech has the advantages in process development and conjugation technology, is proficient in the development technology of lysine and cysteine conjugation process. It has introduced international novel patented conjugation technology, and proficiently masters the conjugation technology, purification, preparation process development technology.

MabPlex

MabPlex is a large module biodrug CDMO enterprise founded earlier in China. As one of the few providers that can provide complete one-stop ADC (Toxin/Linker-Toxin synthesis, ADC conjugation and preparation manufacturing) CDMO services, it is committed to delivering one-stop and customized services for global pharmaceutical companies from R&D to manufacturing. By virtue of CHO culture and ADC technology platform, rich experience in CMC and registration and application, MabPlex continues to expand its domestic and international markets.

According to statistics, currently it has more than 170 ADC projects under development in China, nearly 60 of which have entered clinical stage. The broad market prospects, booming R&D enthusiasm and relatively high outsourcing rate all provide CDMO with great development opportunities. The inherent complexity of ADC has put forward extremely high requirements on the development, preparation and manufacturing process. Along with the challenges from the supply chain management and GMP management, most pharmaceutical companies choose to outsource the professionally challenging ADC to CDMO enterprises, which can not only make up the disadvantages of the companies in research teams and facilities, but also can break through technical bottleneck, effectively reduce drug development cost and shorten the drug's time to market. Globally, the pursuit of one-stop solution by ADC CDMO enterprise is the key to attract customers. With the piling up of the heat on ADC, the demand on ADC CDMO will be magnified. According to Grand View Research, the ADC CDMO market size is expected to reach US$ 8.2 billion in 2021, and US$ 18.4 billion by 2028, making it a rare blue ocean market.

Lepu Biopharma and Keymed Jointly Announce Global Exclusive Licence Agreement with AstraZeneca for CMG901

WuXi AppTec, The Watershed Moment for ADCs Has Arrived — Now, CDMO Selection Is the Last Barrier

WuXi Biologics bulletin, BrightGene Annual Report, TOT Biopharm official website and ZH Biotech official website.

Caijing, MabPlex is going to go public, is an era of rapid domestic ADC CDMO development arriving?

Ye Fenghong, a medical editor specializing in oncology at a healthcare internet company, has conducted in-depth research on the pathogenesis and clinical treatment of lung cancer and breast cancer. She has previously been involved in the design and synthesis of anti-tumor drugs and has some experience in computer-aided drug design. She is currently devoted to introducing cutting-edge cancer treatment drugs to a wide range of readers, aiming to help more people avoid cancer pain and embrace good health.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025