Yefenghong/PharmaSourcesMarch 01, 2023

Tag: Insulin , volumn-based procurement , Tonghua Dongbao , Gan & Lee Pharmaceuticals

Two leaders of insulin made in China, Tonghua Dongbao and Gan & Lee Pharmaceuticals, has announced their performance in 2022 respectively. As the first year of volumn-based procurement of insulin, two companies' performance both declined in 2022.

In 2022, the total revenue of Tonghua Dongbao was RMB 2.775 billion, down 15.09% year-on-year; Its net profits after deducting non-recurring gains and losses was RMB 846 million, down 21.47% year-on-year Tonghua Dongbao indicated that the reason was that the product price declined due to the volumn-based procurement of insulin started in 2022, and the expansion was restricted due to the epidemic.

While Gan & Lee Pharmaceuticals, as another industry leader, fell into loss directly. The net loss of Gan & Lee Pharmaceuticals in 2022 was expected to reach RMB 390-470 million, from surplus to deficit year-on-year, being loss for the first time since the listing of Gan & Lee Pharmaceuticals. In addition to volumn-based procurement of insulin, another reason for its performance loss is that in the first three quarters of 2022, in order to assist commercial companies to adjust the prices of products in stock for volumn-based procurement in terminal medical institutions, Gan & Lee Pharmaceuticals calculated the compensation in total RMB 563 million, offsetting the revenue in 2022.

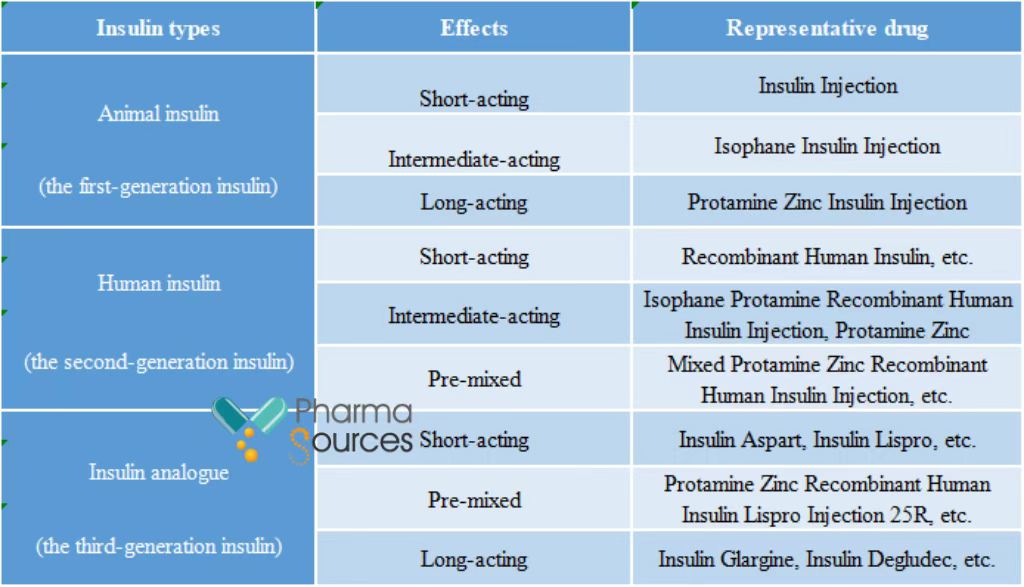

According to public data, the insulin market is more than RMB 20 billion in China, but patient's treatment rate using insulin is only about 5%. With a wide potential market in the future in China, the insulin market is expected to exceed RMB 50 billion by 2030. There are many kinds of insulin. Currently, the second-generation insulin and third-generation insulin are the mainstream in the market. According to the different action time, insulin can be divided into fast-acting insulin, premixed insulin, intermediate-acting insulin and long-acting insulin.

Insulin product classification (Source: Chinese Journal of Diabetes Mellitus, and Research Institute of Orient Securities)

On November 26, 2021, National Healthcare Security Administration completed the sixth batch of centralized volume-based procurement of drugs in national organizations, which is the special procurement of insulin. For this volumn-based procurement, there are 6 purchase groups as follows: mealtime human insulin, basal human insulin, premixed human insulin, mealtime insulin analogue, basal insulin analogue, and premixed insulin analogue, with a procurement period of 2 years.

The strategy of "increasing sales volume by preference price" has not been successful, then how can the two companies reshape the performance growth curve?

The quotation of Gan & Lee Pharmaceuticals was the most radical at the time. Finally, its 6 kind products all won the bidding with a huge price reduction, with a maximum reduction of 67%; Among them, the price of Insulin Glargine Injection (Basalin) was reduced from RMB 143.97/piece to RMB 48.71/piece.

For that Gan & Lee Pharmaceuticals' 95% of income depends on insulin products, whether winning the bid or not is extremely important to the company's survival, that is why its quotation in volumn-based procurement was so radical.

With the change of market logistics of insulin in China, Gan & Lee Pharmaceuticals has put forward that its strategic path in 3-5 years is "specialization, globalization, openness, and diversification", with a sight to overseas markets. Its annual report shows that US market is the largest drug market of insulin, and is still expanding rapidly; As the second largest market of insulin, Europe market's price sensitivity is also relatively higher. And Gan & Lee Pharmaceuticals tries to achieve a full coverage in the emerging market of some countries and regions such as Asia Pacific, Middle East, North Africa, etc.

For drug R&D, Gan & Lee Pharmaceuticals' weekly preparation, the fourth-generation insulin GZR4, has been approved for IND in China and America at present. GZR4 is a weekly super long-acting insulin preparation, being subcutaneous injected once a week, with the indication of diabetes. With characteristics such as a longer half-life, a low administration frequency, a more smooth plasma-drug concentration and efficacy, a small diurnal variation of blood glucose and a lower risk of low blood glucose, the weekly super long-acting insulin preparation is one of the important directions of new drug R&D in diabetes drug R&D enterprise. Up to now, no insulin weekly preparation has been approved for marketing around the world.

Also as an industry leader of insulin made in China, Tonghua Dongbao's quotation was much more modest. In the quotation of volumn-based procurement of insulin in 2021, 5 products of Tonghua Dongbao all won the bidding as Group B (which price reduction was less than Group A), with an average price reduction of 41%.

It's learned that this volumn-based procurement's purchase quantity of China's medical institutions in the first year is about 210 million pieces. According to the price before volumn-based procurement, the purchase amount involved is about RMB 17 billion. It is expected to save RMB 9 billion/year in total for patients, for that the selected products' price reduced 48% in average.

Tonghua Dongbao adopted the similar strategy with Gan & Lee Pharmaceuticals. In the abroad business, on February 1, 2023, Tonghua Dongbao announced that the application for marketing of Human Insulin Injection, developed by its partner Sweden Realcan, has obtained the approval document accepted by EMA. With the approval of insulin glargine and insulin aspart in China, Tonghua Dongbao has started these products' registration in many developing countries successively, and planned to register and declare in developed countries at the same time.

For drug R&D, Tonghua Dongbao has also promoted the R&D of fourth-generation insulin product, and has a layout in diabetes innovative drug and gout innovative drug. In September 2021, Tonghua Dongbao's Sitagliptin Phosphate Tablet was approved for marketing in China, being its first oral hypoglycemic drug, which marks that the company has entered into the market of oral hypoglycemic drug formally. This will further enrich the company's product pipelines in the field of hypoglycemic drugs, providing more choices of drug for patients.

The volumn-based procurement of insulin brings pressure to the main business, and the road of the manufacturers of insulin made in China will be hard in the future. However, it is gratifying that the manufacturers of insulin made in China have not stopped their steps, while actively reformed to search for the breakthrough. Can the volumn-based procurement of insulin achieve "increasing sales volume by preference price" in 2023? Let's continue to pay attention.

1. Tonghua Dongbao 2022 Financial Year Performance Report, and Gan & Lee Pharmaceuticals 2022 Financial Year Performance Report.

2. International Diabetes Federation. IDF Diabetes Atlas, 10th ed. Brussels, Belgium: 2021.Available at:https://www.diabetesatlas.org.

3. Preclinical evaluation of novel CDK4/6 inhibitor GLR2007 in glioblastoma models.

4. Tonghua Dongbao, "Tonghua Dongbao's Scientific Research Reached a New High: Having the First Oral Hypoglycemic Drug and Entering into the Market of Oral Hypoglycemic Drug Formally!".

5. Tonghua Dongbao, "Tonghua Dongbao: The Phase I Clinical Trial of Gout's Class I New Drug, URAT1 Inhibitor (THDBH, 130 tablets), Has Reached Primary Endpoint".

Ye Fenghong, a medical editor specializing in oncology at a healthcare internet company, has conducted in-depth research on the pathogenesis and clinical treatment of lung cancer and breast cancer. She has previously been involved in the design and synthesis of anti-tumor drugs and has some experience in computer-aided drug design. She is currently devoted to introducing cutting-edge cancer treatment drugs to a wide range of readers, aiming to help more people avoid cancer pain and embrace good health.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025