YefenghongApril 11, 2022

Tag: HPV Vaccine , Walvax , NMPA

Bivalent HPV Vaccine of Walvax Approved for Marketing: Who Will be the Leader of the Market Valuing RMB 100 billion?

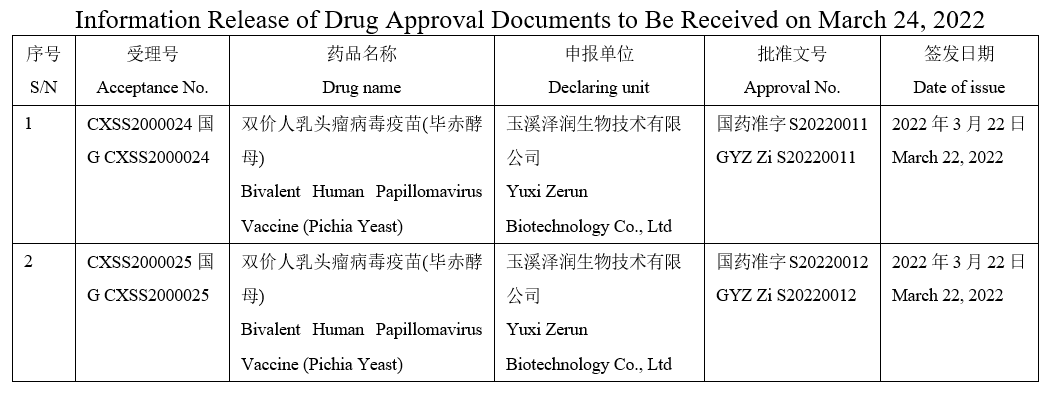

On March 24, it was revealed on the official website of National Medical Products Administration that the self-developed recombinant human papillomavirus (HPV) bivalent (type 16/18) vaccine (yeast) of Zerun Biotechnology, the holding subsidiary of Walvax, has been approved for marketing (hereinafter referred to as "bivalent HPV vaccine").

This is the second Chinese bivalent HPV vaccine to be approved for marketing. This increases the number of approved HPV vaccines marketed in China to five, namely GlaxoSmithKline (GSK) bivalent HPV vaccine Cervarix, Merck Sharp & Dohme (MSD) quadrivalent HPV vaccine Gardasil, Merck Sharp & Dohme nine-valent HPV vaccine Gardasil9, and Innovax bivalent HPV vaccine Cecolin. The two MSD vaccines are exclusively distributed by A-share listed company Zhifei Biological. With this, the "2+3" (two Chinese and three imported) pattern has been formally formed.

Human papillomavirus (HPV) is an umbrella term for a group of more than 200 related viruses, and is one of the most common pathogens of reproductive system diseases. Most HPV viruses disappear in the body through immunization, but some high-risk HPV viruses, namely types 16, 18, 31, 33, 45, 52 and 58, may cause the cancer. Among them, HPV types 16 and 18 cause about 70% of cervical cancer cases worldwide, and HPV types 6 and 11 cause about 90% of anal and genital warts cases worldwide.

Just in 2020, 118,500 people were diagnosed with cervical cancer in China, of which 59,100 died. Although women are more susceptible and have more severe disease than men, this does not mean that HPV does not affect men. All HPV serotypes that can infect women can also infect men and cause serious diseases in men, including penile, anal, head and neck cancers.

HPV vaccination significantly reduces the incidence of cervical cancer and is recommended by WHO as a primary prevention measure for cervical cancer, enjoying significant economic benefits.

There are now three HPV vaccines commercially available worldwide: bivalent, quadrivalent and nine-valent, of which the bivalent vaccine can prevent HPV16 and HPV18 infections. According to international statistics, more than 70% of cervical cancers are caused by these two viruses. The quadrivalent vaccine can protect against the infections of HPV types 6, 11, 16 and 18; and the nine-valent vaccine is for nine HPV subtypes 6, 11, 16, 18, 31, 33, 45, 52, and 58. According to international statistics, the nine-valent vaccine can prevent 90% of cervical cancers.

In the 1980s, German virologists first confirmed the causal relationship between HPV and cervical cancer. However, it was not until the beginning of the 21st century that American scientists created the first vaccine against HPV, and in 2006, MSD quadrivalent HPV vaccine Gardasil was officially approved for marketing, a span of more than 20 years.

In China, the research team of Xiamen University and Innovax set up a project to develop Chinese HPV vaccine Cecolin in 2002, and declared the clinical trials in 2007, but it was not approved for marketing until 2019 and the first batch of vaccination was in May 2020, a time span of 18 years.

It is evident that there is strong R&D barriers for HPV vaccine production.

Before 2016, due to the delayed approval of imported vaccines and the fact that Chinese vaccines were still under development, women with the earliest awareness of cancer prevention had to go to Hong Kong for HPV vaccines at great expense, which once became a health trend for middle-class women in China.

In 2016, GSK Cervarix was approved for marketing in China. Following that, MSD quadrivalent HPV vaccine and nine-valent HPV vaccine were also marketed in China in 2017 and 2018 respectively. Thus, it broke the embarrassing fact that many young women travelled outbound for vaccines.

However, due to the lack of production capacity, the Chinese market has long been under pressure to supply HPV vaccines, and imported HPV vaccines once had to be "grabbed". This phenomenon was only alleviated in December 2019 when the bivalent HPV vaccine Cecolin from Wantai BioPharm was approved for marketing. Nevertheless, a serious shortage of the nine-valent HPV vaccine still exists because of the absent China-made vaccines.

Potential market valuing RMB 100 billion due to low Chinese HPV vaccination rate

In 2020, WHO released the Global Strategy to Accelerate the Elimination of Cervical Cancer, which recommends that 90% of girls should complete HPV vaccination by age 15 by 2030. 110 countries have already included HPV vaccine in their national immunization programs by the end of 2020. Chinese government has not yet added HPV vaccines to the list of publicly funded vaccines. At the end of 2020, however, China has indicated that it will fully support the strategy to accelerate the elimination of cervical cancer. Some local governments have already included the second-tier vaccines in their reimbursement lists. For example, certain provinces and cities, such as Ordos, Guangdong Province and Xiamen, have already introduced free HPV vaccination services. Based on market forecasts, HPV vaccine is also expected to be included in the national immunization program in the future, and the Chinese market demand is growing rapidly.

Institutions are also optimistic about the future demand growth of HPV vaccine. According to the research report of Guolian Securities, the market penetration rate of HPV vaccine stock in China is only 5.2%, and there is still much room for improvement. In the future, with the promotion of vaccination awareness and policy, assuming that the vaccination rate of 9-15 years old/16-45 years old people reaches 70% and 25%-30% respectively, the total demand for HPV vaccines in China is expected to be 268 million, and the cumulative demand in the female market alone is over RMB 100 billion.

In addition, with the future approval of the male indications for HPV vaccine in China, the sales volume may usher in another round of explosive growth.

The projection is also manifested in the financial reports of the companies. According to the information disclosed in the 2021 annual report, the revenue of Innovax's vaccine products reached RMB 3.278 billion last year, an increase of 360.75% year-on-year, and the gross margin of the company was as high as 92.78%. Its performance growth was mainly attributed to the increase in revenue from bivalent HPV vaccines, reagents and active ingredients.

According to the annual report of MSD, HPV vaccine contributed a large amount of revenue to the company and is known as the best-earning vaccine product, achieving revenue of US$ 5.673 billion last year, up 44% year-on-year. Growth in HPV vaccine revenue came mainly from strong global demand, especially in the Chinese market, where the demand exceeded supply, MSD said. It should be noted that after Zhifei Biological took the exclusive distributorship of MSD's quadrivalent and nine-valent HPV vaccines in the Chinese Mainland, its performance was also out of the woods, making a big profit.

In addition to the multinational pharmaceutical companies, GSK and MSD, several Chinese companies and medical supply distribution companies have engaged in the Chinese HPV R&D.

Let's talk about the bivalent and quadrivalent vaccines.

In addition to the currently marketed products from GSK, Innovax, and Walvax, two HPV bivalent vaccines are also being developed by Rec-Biotechnology, though they are still in the Phase I clinical stage.

The major manufacturers of quadrivalent vaccines are Chengdu Institute of Biology, Chinese Academy of Sciences, Shanghai Institutes for Biological Sciences, and Bovax, of which the researches of Chengdu Institute and Bovis are in Phase III clinical stage and those of Shanghai Institutes for Biological Sciences are in Phase II clinical stage.

Now, let's focus on nine-valent vaccines.

As the HPV vaccine with the highest market interest, the companies involving nine-valent HPV vaccines currently include Innovax, Bovax, Health Guard Biotechnology, Rec-Biotechnology and Shanghai Zerun Biotechnology.

Among them, there are four companies that have entered the Phase III clinic, namely, Innovax, Bovax, Health Guard Biotechnology, and Rec-Biotechnology, and only Rec-Biotechnology and Bovax have products suitable for people aged 9-45.

In terms of the R&D progress, in April 2020, Bovax was the first to enter Phase III clinical trials for the nine-valent HPV vaccine; in September 2020, Innovax was the second to enter Phase III clinical trials, and has now completed the third injection of clinical field vaccination, and has simultaneously started non-inferiority evaluation trials with competing vaccines; in May 2021, Rec-Biotechnology started Phase III clinical trials, and plans to complete the three doses of vaccination in the first half of this year.

In addition, Health Guard Biotechnology has also expanded its clinical research on the nine-valent vaccines for the men-related indications. Its R&D for women is in Phase III clinical stage, while the process for men is in Phase I clinical stage, although it is a little later.

In addition to the bivalent, quadrivalent and nine-valent vaccines that have attracted many Chinese pharmaceutical companies, the eleven-valent and fourteen-valent HPV vaccines, which cover more HPV virus types, are also attractive. For example, the eleven-valent vaccines of National Vaccine & Serum Institute are currently in Phase II clinical, and the fourteen-valent vaccines of SinoCellTech are also entered the clinical stage.

The R&D of Chinese HPV vaccine is in full swing, and as time goes by, we will know who can eventually seize the opportunity in this vast market. But what is certain is that the boom of HPV vaccines is expected to last for more than a decade, judging from the vaccination targets of WHO, and the R&D progress and competitive landscape of Chinese companies.

References: jiemian.com, Guolian Securities, Zheshang Securities, and annual reports of companies

Ye Fenghong, a medical editor specializing in oncology at a healthcare internet company, has conducted in-depth research on the pathogenesis and clinical treatment of lung cancer and breast cancer. She has previously been involved in the design and synthesis of anti-tumor drugs and has some experience in computer-aided drug design. She is currently devoted to introducing cutting-edge cancer treatment drugs to a wide range of readers, aiming to help more people avoid cancer pain and embrace good health.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025