PharmaSources/YiFebruary 22, 2022

On February 2, AbbVie announced its performance in the fourth quarter and full year of 2021, representing an annual revenue of USD 56.197 billion (+22.7%) and R&D investment of USD 7.084 billion (+8%).

From the business segments, in 2021, AbbVie represented a revenue in immune diseases of USD 25.284 billion (+14.1%), USD 7.228 billion (+8.7%) in neoplastic hematologic disorders, USD 5.927 billion (+69.5%) in nervous system diseases, USD 3.567 billion (+63.3%) in ophthalmic nursing, USD 5.233 billion in medical aesthetics, USD 796 million in women's health and USD 5.489 billion in other key products.

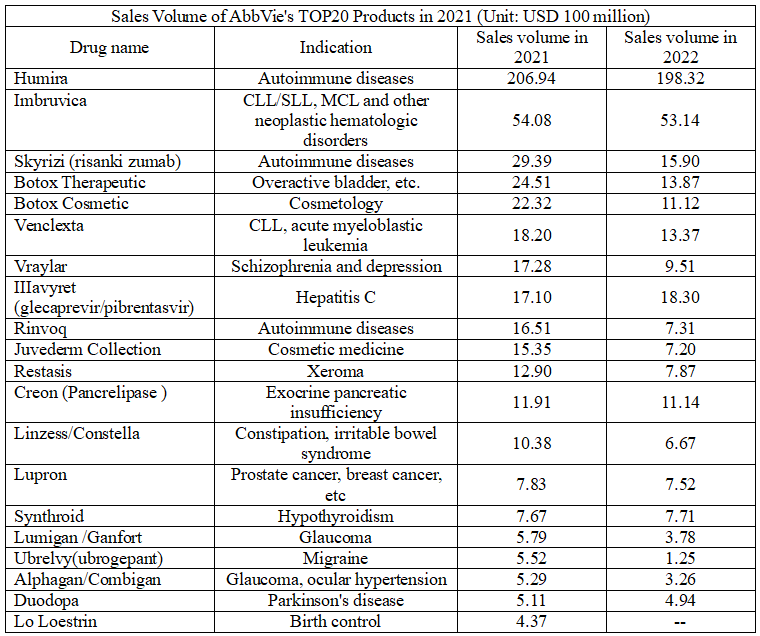

In terms of specific products, AbbVie has 13 products with sales volume exceeding USD 1 billion in 2021, among which Hu-mira has a sales volume exceeding USD 20 billion. It is expected to remain at the top of the global drug sales list in 2021. In addition, two other autoimmune drugs of AbbVie, Skyrizi (IL-23 inhibitor) and Rinvoq (JAK inhibitor), also performed well, with the sales volumes of USD 2.939 billion and USD 1.651 billion in 2021 respectively.

In 2021, both candidate drugs for autoimmune diseases have made new advanced. Skyrizi (risankizumab, 150mg) was approved by EMA in November 2021 as a single drug or combined with me-thotrex-ate (MTX) to treat adult active psoriatic arthritis (PsA) with insufficient response or intolerance to one or more disease-modifying antirheumatic drugs (DMARD). Moreover, the application of a new indication for the treatment of moderately to severely active Crohn's disease (CD) in patients (aged ≥ 16 years) with insufficient response, loss of response or intolerance to conventional or biological agents was accepted by EMA in December 2021. In the United States, FDA approved Skyrizi (risankizumab) of a single dose of 150mg injection for the treatment of moderate to severe plaque psoriasis in adults in April 2021.

Rinvoq was approved by EMA in January 2021 for the treatment of adult active psoriatic arthritis (PsA) with insufficient response or intolerance to one or more disease-modifying antirheumatic drugs (DMARD), and for the treatment of adults with active ankylosing spondylitis (AS) who have an inadequate response to conventional therapy. In August 2021, the drug was approved by EMA for the treatment of adults and adolescents aged 12 years and above with moderate to severe atopic dermatitis (AD) suitable for systematic treatment. In addition, in September 2021, Rinvoq was submitted to FDA and EMA for regulatory approval for the treatment of moderately to severely active ulcerative colitis (UC) in adults. It was approved by FDA in December 2021 for the treatment of adults with active psoriatic arthritis (PsA) who have an inadequate response or intolerance to one or more tumor necrosis factor (TNF) blockers.

As the candidate products of Hu-mira, it is difficult for Skyrizi and Rinvoq to replicate the success of Hu-mira. Especially for Rinvoq, due to the safety data of to-faci-tinib showed the risk of heart attack, FDA required to add additional information about malignant tumor and the risk of thrombosis in the American label of Rinvoq, as well as the mortality and MACE (defined as cardiac death, myocardial infarction and stroke) risk in the black box warning and warning and prevention measures. However, AbbVie still expects a lot for the two products, which may generate a sales volume of USD 15 billion by 2025.

Both Im-bru-vica and Venclexta maintained steady growth in terms of neoplastic hematologic disorders. In 2021, clinical research of the combination of Im-bru-vica and Venclexta for the first-line treatment of CLL yielded positive results. Moreover, in September 2021, Im-bru-vica won a patent lawsuit in the United States Courthouse, preventing its generic drug from being sold until 2036.

In terms of the segment of nervous system diseases, the sales volume of Ubrelvy for migraine, the first oral calcitonin gene-related peptide (CGRP) receptor antagonist approved by FDA for migraine attacks, and antipsychotics Vraylar grew significantly in 2021. In 2021, Qulipta (atogepant), a CGRP receptor antagonist from AbbVie, was approved by FDA for the prophylactic treatment of migraine attack (EM) in adults. It is worth mentioning that the current market for CGRP receptor antagonists is highly competitive, with 8 drugs (4 monoclonal antibody +4 chemotherapeutic drugs) approved for marketing. Vraylar is an atypical antipsychotics, which has been approved for the treatment of bipolar I disorder and schizophrenia. In 2021, two Phase III clinical researches of Vraylar in adjuvant treatment of major depression achieved positive top-line results. It is estimated that its sales volume will continue to grow in the future, and AbbVie predicts that its peak will reach USD 4 billion. In addition, in 2021, AbbVie adjusted the development direction for Alzheimer's disease, abandoning the development of Tau protein inhibitor ABBV-8E12 and seriously advancing the Aβ candidate drug.

Re-stasis is the only blockbuster drug in the ophthalmic nursing to surpass the sales volume of USD 1 billion. In 2021, AbbVie won another success in this field, namely Vuity. It is a new optimized formula of pilo-car-pine (M-choline receptor agonist), which is specially designed for the treatment of presbyopia by the constriction of the pupil to enhance depth of focus. It can improve near and medium sightedness, while maintaining pupil responsiveness to different light conditions. In October 2021, the drug was approved by FDA for the treatment of presbyopia, making the first eye drop specially used for the treatment of it. In addition, in September 2021, AbbVie partnered with Regenxbio reached to develop and commercialize RGX-314, a potential one-time gene therapy for the treatment of wet age-related macular degeneration (wAMD), diabetes retinopathy (DR) and other chronic retinal diseases.

Compared to AbbVie's financial reports in recent years, AbbVie's business has become more diversified after completing the acquisition of Allergan in May 2020, and its revenue volume in 2021 has reached a new high, which has increased from USD 45.804 billion in 2020 to USD 56.197 billion. It is worth mentioning that in 2020, AbbVie's revenue ranked the fifth in revenue among global pharmaceutical company in China, and the eighth in 2019. In 2021, AbbVie is expanding into new businesses in a variety of ways, but there are reports that the company plans to sell its women's health business in order to pay down debt and free up cash to focus on new drugs R&D.

Yi, a pharmacist pays attention to the research and development trends of new drugs at home and abroad, expects to improve himself in the continuous input and output, and grow together with medical we-media.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025