PharmaSources/Zhulikou431October 27, 2021

Tag: Innovative drugs , CIN , FDA

Recently, there is a saying in the pharmaceutical industry: not all innovative drugs have a future. This saying reminds me of the lyrics - wild lilies also have spring. To be honest, the high failure rate in the field of innovative drugs make all practitioners and investors prepare for failure very early.

Is such a high failure rate daunting? We are delighted to see that the efforts and hardships of the past decade have prepared the teams involved in Chinese innovative drug industry, whether developers, investors or regulators, for this situation. Many projects have been successful, and some are on the road to success.

On October 8, 2021, Evive Biotech, a subsidiary of Yifan Pharmaceutical Co., Ltd., announced that the European Medicines Agency (EMA) had officially accepted the Marketing Authorization Application (MAA) of Evive Biotech on Ryzneuta™ for treating neutropenia (CIN) caused by chemotherapy, and centralized review procedure has begun. This is another good news after Evive Biotech submitted Ryzneuta™ (known as F-627) Biologics License Application (BLA) to FDA in early 2021.

For a long time, the status of pharmaceutical research and development in China has been worrying, mainly reflected in the insufficient investment in R&D funds of enterprises. At the same time, there is a waste of R&D resources and low efficiency in some areas. Pharmaceutical R&D projects are homogenous with intense competition from same target development, which can be described as full of involution. There is a lack of innovation or high level of innovation for pharmaceutical enterprises. In recent years, the pharmaceutical market in China has become more mature and perfect. With the adjustment and influence of policies such as new drug evaluation system, generic drug consistency evaluation, volume-based purchasing, adjunctive medication monitoring and upgrading of health insurance directory, the examination and approval of new drugs is gradually accelerated. The development momentum of innovative drugs in China has been significantly improved, the innovative achievements of some biopharmaceutical companies have been constantly revealed, and the vitality of innovative drugs has been constantly released. The innovative drugs from China are creating history and going abroad. On the other hand, the cooperation between Chinese and foreign pharmaceutical companies and R&D institutions is becoming more frequent. An increasing number of pharmaceutical companies and medical supplies manufacturers choose report their results in both China and the US or China and the Europe. In this way, some projects can not only advance the layout of domestic and international markets, but also make full use of foreign intellectual support and review experience to promote the optimization of domestic review process.

In 2015, the State Council issued the Advice about Reforming Drugs and Medical Devices Appraisal and Accreditation System. In February 2016, the China Food and Drug Administration issued the Advice about Resolving the Backlog of Drug Registration Applications and Implementing Priority Review and Approval. In 2017, the General Office of the CPC Central Committee and the General Office of the State Council issued the Advice about Deepening the Reform of Examination and Approval System to Encourage the Innovation of Drugs and Medical Devices. The above reform of drug review and approval system and the gradual establishment of a sound drug priority review and approval system have promoted the development of drug innovation.

In 2016, the General Office of the State Council issued the Pilot Program of Drug Marketing Permit Holder System, which is of great significance for encouraging drug innovation and improving drug quality.

In 2018, National Healthcare Security Administration included 17 anti-cancer drugs in Class B of the National Basic Medical Insurance, Industrial Injury Insurance and Maternity Insurance Drug List, paving the way for innovative drugs to be included in the health insurance directory through negotiation.

In 2019, the newly revised Drug Administration Law was put into effect, stipulating that the state encourages research and innovation of new drugs.

In 2020, the outbreak of COVID-19 affects the R&D of drugs and review efforts. However, the pressure of the pandemic has provided a rare opportunity for the development of COVID-19 prevention and treatment drugs. Many companies are taking advantage of the situation and actively expanding the field of COVID-19 indications, engaging in a new chapter.

From 2020 to present, NMPA of China has continuously updated and revised many guiding principles in order to coordinate with the implementation of the revised Drug Administration Law in 2019.

In October 2021, the adoption of eCTD format for drug declaration in China was launched.

After the National Day in 2021, NMPA responded positively to the call for pre-BE filing in drug R&D, which will also promote the introduction and updating of policies in this area.

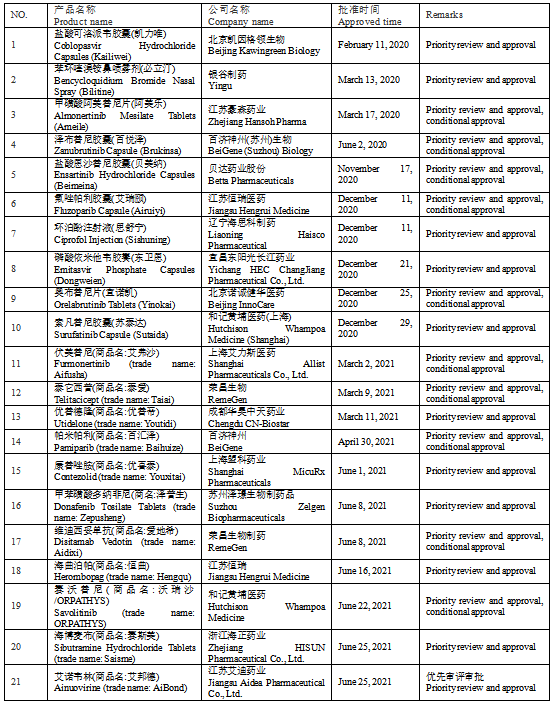

In recent years, the number of new drug declarations and approvals of new drugs independently developed in China has continued to increase. According to incomplete statistics, NMPA approved 10 domestic innovative drugs in 2020, and 11 in 2021 (as of September 2021) (see Table 1 for details)

Table 1 Chinese Innovative Drugs Approved by NMPA in Recent Two Years

Analysis: As shown in the above statistics, at present, innovative drug enterprises and successful projects appear more frequently in the Yangtze River Delta region and areas with traditional advantages, such as Shandong Province. And the focus is cardiovascular disease.

As the strength of China's innovative drug companies grows, many leading enterprises begin to actively explore the international market and they have achieved gratifying results. The following is a brief summary of the development of innovative drugs in the international market in the past period of time:

Milestones of new drug R&D in China on November 15, 2019: Zanubrutinib, a new anticancer drug independently developed by BeiGene, was approved for marketing by FDA in the United States, and it became the first drug independently developed by China to be approved for marketing in the United States. In September 2021, FDA approved the second indication of brukinsa (zanubrutinib) for the treatment of Waldenstrom macroglobulinemia patients.

On December 20, 2019, CSPC announced that FDA had approved the listing application (NDA) of Conjupri (Levoamlodipine Maleate Tablets) for the treatment of hypertension.

In July 2020, trastuzumab (HLX02, EU trade name: Zercepac) independently developed by Henlius was approved for marketing in EU.

In May 2019, Lvye Pharmaceutical submitted a listing application for risperidone microspheres II for injection to FDA.

In November 2020, Bio-Thera Solutions, Ltd. announced that it had submitted the biological listing application (BLA) of BAT1706 (bevacizumab) injection to the FDA. Previously, the company had submitted a listing application of BAT1706 to EMA.

In December 2020, Hutchison Whampoa Medicine submitted a New Drug Application (NDA) for surufatinib to treat pancreatic and non-pancreatic neuroendocrine tumors (NET) to FDA.

In December 2020, Janssen/Legend Biotech announced that it would start the rolling submission of the Biologics License Application (BLA) of cilta-cel to FDA for the treatment of adult relapsed and/or refractory multiple myeloma.

In March 2021, Evive Biotech, a subsidiary of Yifan Pharmaceutical Co., Ltd., submitted Biological License Application (BLA) of Ryzneuta to FDA for the treatment of neutropenia caused by chemotherapy.

In March 2021, Junshi Pharmaceutical announced that it had started the rolling submission of BLA of toripalimab for the treatment of recurrent or metastatic nasopharyngeal carcinoma to FDA.

In April 2021, BeyondSpring announced that it had submitted a New Drug Application of plinabulin for CIN to CDE and FDA.

On May 18, 2021, Innovent announced that the sintilimab jointly developed by them and Eli Lilly had been officially accepted by FDA.

In September 2021, BeiGene announced that the New Drug Application of its self-developed PD-1 monoclonal antibody Baizean (common name: Tislelizumab Injection) was formally accepted by the US Food & Drug Administration (FDA).

On October 8, 2021, Evive Biotech, a subsidiary of Yifan Pharmaceutical Co., Ltd., announced that the European Medicines Agency (EMA) had officially accepted the Marketing Authorization Application (MAA) of Evive Biotech on Ryzneuta™ for treating neutropenia (CIN) caused by chemotherapy, and centralized review procedure has begun.

As shown the above data and information, although the failure rate in the field of innovative drugs is very high, with the overall relocation of the layout of international drug R&D field, Chinese innovative drug enterprises seize the opportunity to attract funds, recruit leading talents, build and improve teams, and rationally arrange product lines. At present, the dominant projects of China's leading innovative drug enterprises focus on both domestic and international markets at the beginning of the project. They actively conform to international regulatory requirements with most of the projects being implemented in accordance with the ICH guidelines.

At the same time, we should not forget the opening tip -- not all innovative drugs have a future! In order to avoid such lessons, innovative drug enterprises still have a lot of work to do in terms of patent distribution, equity distribution, improving internal structure management, enhancing the stability of R&D team, and strengthening the study of international laws and regulations.

1-Analysis of encouraging policies for new drug creation in China in the new period

2-NMPA

2-Official website of NMPA

3-FDA

3-Information on FDA official website

4-EMA

4-Information on EMA official website

About the author: zhulikou431, senior engineer, PDA member, ISPE member, ECA member, PQRI member, experienced aseptic GMP expert, profound attainments in aseptic process development and verification, drug R&D and registration, CTD document writing and audit, regulation audit, international certification, international registration, quality system construction and maintenance, aseptic inspection, environmental monitoring and others. In recent years, the author began to focus on the trend analysis of pharmaceutical macro-field and risk management of pharmaceutical enterprise merger and acquisition projects.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025