PharmaSources/XiaoyaowanMay 31, 2021

Tag: Tumor , chemotherapy , targeted therapy , immunotherapy

According to statistics, the market size of China’s oncology treatment industry reached RMB387.6 billion in 2020, with a compound annual growth rate of 10.3% in the past five years as compared to RMB261.4 billion in 2016, and this market size is expected to exceed RMB700 billion by 2025.

Lung cancer, liver cancer, gastric cancer, colorectal cancer, and breast cancer are the top five cancers in China among the various tumors with high incidence. Among them, lung cancer is the one with the most patients in China, with more than 800,000 patients/year, followed by gastric cancer, colorectal cancer, and liver cancer, with more than 400,000 patients/year for each cancer, and then breast cancer with about 300,000 patients/year.

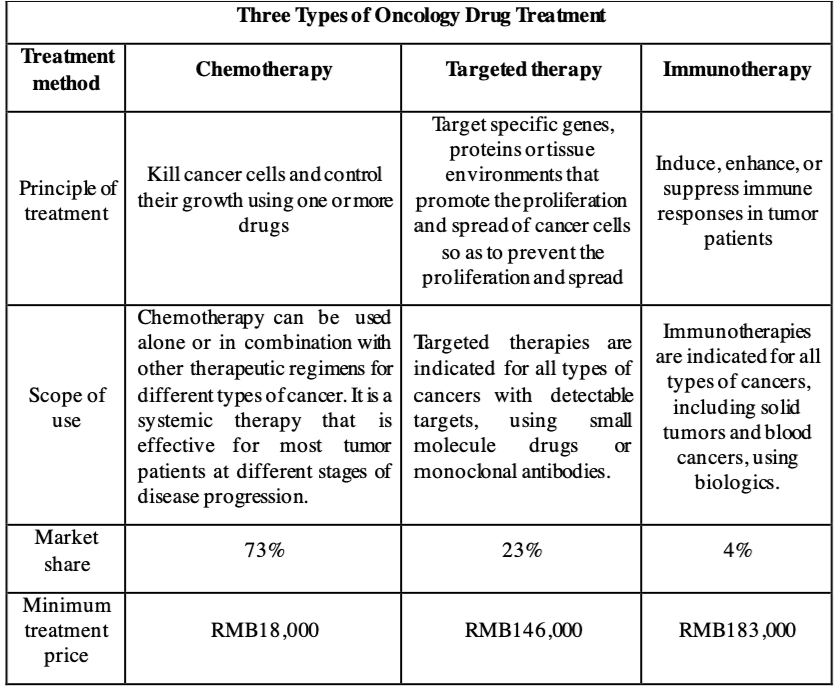

China’s oncology drug treatment market is still dominated by chemotherapy drugs at present, which takes the lead in oncology drug sales. In 2019, of China’s oncology drug market, chemotherapy drugs accounted for 73%, targeted drugs accounted for 23%, and immunotherapy drugs accounted for only 4%. Chemotherapy drugs such as nimustine, doxorubicin, and vinblastine are the main varieties in oncology chemotherapy drug treatment in China.

Source: Organized according to public data.

Chemotherapy is the most traditional tumor treatment, with the clear disadvantage of high toxicity. Targeted therapy can improve the effects of cancer treatment owing to its clear target, enhanced efficacy, and controlled side effects. Tumor immunotherapy is considered to be the only method that may permanently cure cancer. The marketing approval and clinical trials of CAR T-cell therapies expand new clinical techniques for tumor treatment. So far, there have been three CAR T-cell therapies approved by the FDA for marketing, Novartis’ Kymriah and Kite’s Yescarta and Tecartus.

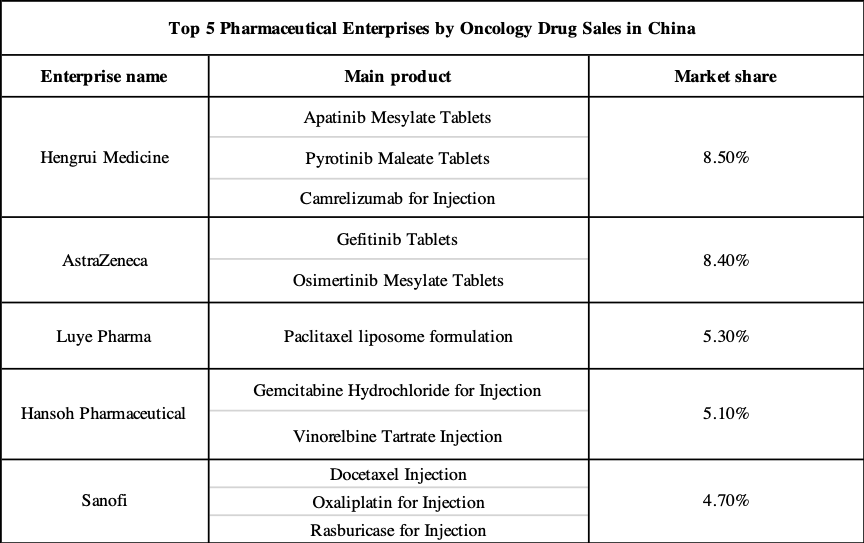

The current market pattern of oncology pharmaceutical enterprises is concentrated in China. Hengrui Medicine, AstraZeneca, Luye Pharma, Hansoh Pharmaceutical, and Sanofi ranked among the top five in terms of the share of the oncology drug sales market in China in 2019, with a combined share of 32.1% of the overall market. With the continuous increase of pharmaceutical policies in China, pharmaceutical enterprises with no advantages in technologies or the size of funds will be gradually eliminated from the market. If you are looking for bio pharmaceutical products and bio pharmaceutical companies, then Pharmasources would be your best choice.

Source: Organized According to Public Data

It is worth mentioning that the market pattern of oncology drugs in China is quite different from that in the regulated markets such as Europe and the U.S. In 2019, the top 10 best-selling oncology drugs in the U.S. were all innovative therapies, while four of the top 10 best-selling oncology drugs in China were traditional chemotherapy drugs, and in the same year, the share of chemotherapy drugs in the global oncology drug sales market was only 17.1%. The oncology drug market in China has a relatively large room for adjustment.

As the government introduces a series of policies to encourage R&D, China’s oncology drug treatment market is shifting toward an innovation-driven market, with increasing molecular targeted therapies,tumor immunotherapies, and combination therapies in development to address the unmet medical needs of tumor patients.

In the future, the development of innovative oncology drugs will lead to the pattern restructuring of oncology drugs in China, and chemotherapy drugs will be gradually replaced by targeted drugs and immunotherapy drugs. This trend has been confirmed by the breakdown of market sales revenue over the past years. Tumor patients in China will have options of more therapies such as targeted therapies and immunotherapy drugs with good efficacy, and low toxicity.

Besides the enriching and upgrading of oncology drug varieties, another clear trend of oncology drugs in China is price reductions. The Work Program for the Adjustments of the National Reimbursement Drug List in 2019 (Draft for Comment) issued by the National Healthcare Security Administration proposes to give priority to national essential drugs, drugs for major diseases such as cancer and rare diseases, etc. At the same time, the NRDL (National Reimbursement Drug List of China) access significantly reduces oncology drug prices and tumor patients’ economic burden through offer negotiations. A total of 153 oncology varieties succeeded in four NRDL negotiations, with the lowest average price reduction of 38.56%, involving various oncology drugs.

Xiaoyaowan, a pharmaceutical industry practitioner, a word carrier in the We-media era focusing on changes of the pharma industry.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025