PharmaSources/Zhulikou431May 31, 2021

Tag: pediatric drug , china , NMPA

As mentioned in the previous article, the U.S. is currently the largest pediatric drug market in the world, followed by China. However, compared to the U.S. which has formal pediatric drug legislation and mature pediatric drug policies and regulations, the development of pediatric drugs in China has many shortcomings:

Firstly, Chinese pharmaceutical enterprises are not enthusiastic enough about pediatric drugs. Owning to the characteristics of pediatric drugs: high R&D expenses, big drug evaluation (clinical trial) difficulties, and need for long-term efforts in market layout to produce market stickiness, most Chinese pharmaceutical enterprises are not willing to research or produce pediatric drugs.

Secondly, there are not enough pharmaceutical manufacturers and medical product suppliers of pediatric drugs in China, there is a relative lack of the produced varieties and suitable dosage forms, and the produced varieties are homogeneous without sufficient product advantages. According to publicly reported data, there are only 30 with R&D and production capabilities for pediatric drugs among more than 4,500 pharmaceutical enterprises in China, and very few enterprises focus on R&D and production of pediatric drugs. Pediatric drugs account for less than 2% of the total drug formulations, and there is a serious supply-demand imbalance.

China’s pediatric drug market is dominated by respiratory system drugs, digestive system drugs, anti-infective drugs and nutritional supplements, with respiratory system drugs accounting for a much higher share of the market than drugs in other therapeutic areas. The mainstream manufacturers of pediatric drugs in China include China Resources Double Crane, Sunflower Pharmaceutical, Jumpcan Pharmaceutical, Honz Pharmaceutical, Yipinhong Pharmaceutical, Sanjing Pharmaceutical, and Yabao Pharmaceutical, which mainly focus on therapeutic areas of children’s colds, indigestion, coughs and phlegm, and nutritional supplements. With the enhancement of people’s consumption power in China, Chinese manufacturers of pediatric drugs need to strengthen market analysis and cultivation.

Thirdly, there is no systematic legal and regulatory system for pediatric drugs or a perfect essential pediatric drugs list in China. The 2017 NRDL (National Reimbursement Drug List of China) (2,535 western and Chinese patent drugs) specifies 540 pharmaceutical products or dosage forms for children, and the 2020 NRDL (2,800 western and Chinese patent drugs) to be officially implemented on Mar. 1, 2021 has added several varieties of pediatric drugs. The support for pediatric drugs is gradually increasing, however, they still have a significant gap with other drugs in the proportion of all varieties.

Thirdly, there is no systematic legal and regulatory system for pediatric drugs or a perfect essential pediatric drugs list in China. The 2017 NRDL (National Reimbursement Drug List of China) (2,535 western and Chinese patent drugs) specifies 540 pharmaceutical products or dosage forms for children, and the 2020 NRDL (2,800 western and Chinese patent drugs) to be officially implemented on Mar. 1, 2021 has added several varieties of pediatric drugs. The support for pediatric drugs is gradually increasing, however, they still have a significant gap with other drugs in the proportion of all varieties.

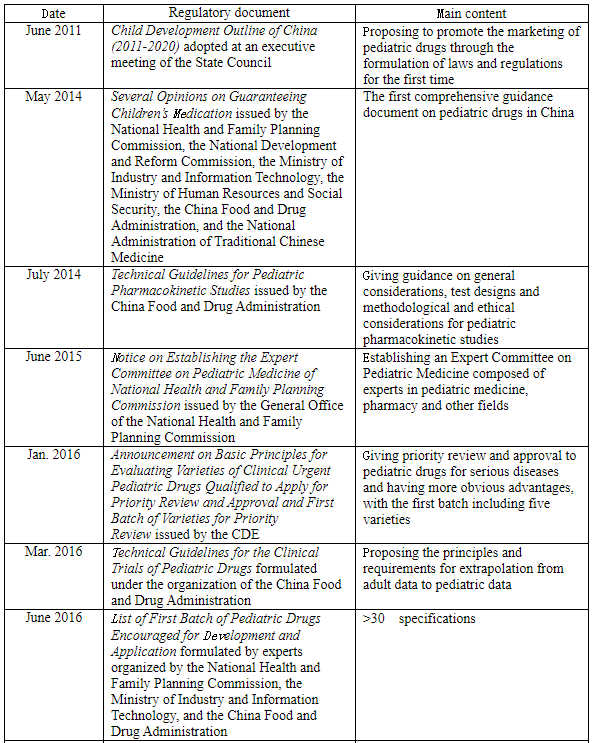

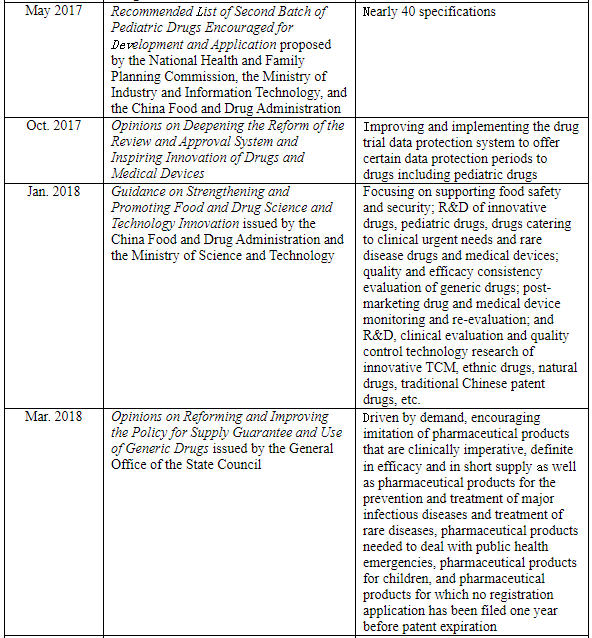

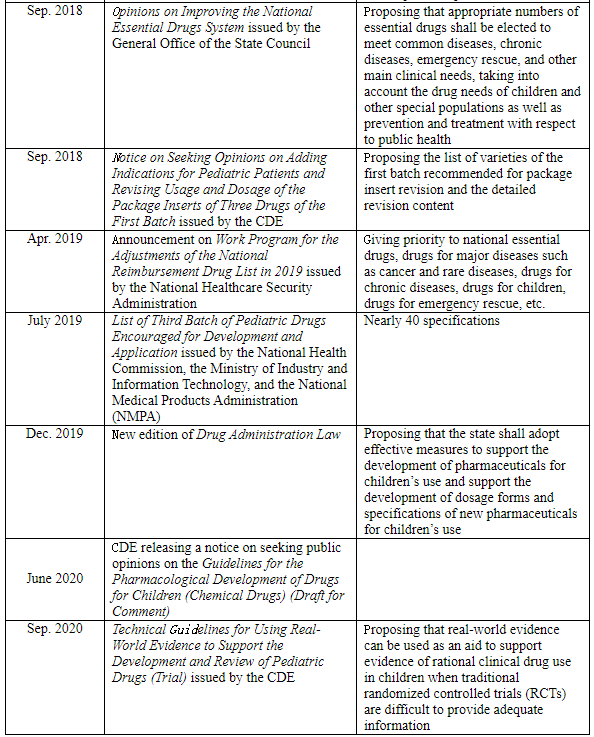

The new edition of the Drug Administration Law has officially come into force since Dec. 1, 2019 in China, in which Article 16 specifies, “The state shall adopt effective measures to encourage the development of and innovation in pharmaceuticals for children’s use, support the development of new varieties, dosage forms and specifications of pharmaceuticals for children’s use that meet the physiological characteristics of children, and prioritize the review and approval of pharmaceuticals for children’s use.” Furthermore, the state government departments of China have introduced a series of policies in the recent decade to encourage R&D, priority review, and other related aspects, so as to encourage Chinese pharmaceutical enterprises to increase the R&D and production of pediatric drugs:

Furthermore, the NMPA has successively issued some announcements on package insert revisions in recent years to require adding content related to children’s medication, showing that China is gradually strengthening the regulation of pediatric drugs.

Many Chinese small and medium-sized pharmaceutical enterprises are struggling in the market in the context of regulatory pressure, cost pressure and medical insurance expense control, however, we can see from the above that the population using pediatric drugs will continue to increase in the next five years with the continued relaxation of the family planning policy in the Chinese market.

Note: This article does not constitute any value judgement or investment advice.

1-2019年中国儿童用药行业市场分析

1. Market Analysis of China Pediatric Drug Industry in 2019

2-NMPA官网信息

2. NMPA website information

3-CDE官网信息

3. CDE website information

Zhulikou431, as a senior engineer, PDA member, ISPE member, ECA member, PQRI member, senior aseptic GMP expert, has deep knowledge in aseptic process development and verification, drug development and registration, CTD document writing and review, regulatory audit, international certification, international registration , quality system construction and maintenance, as well as sterile inspection, environmental monitoring and other fields. In recent years, he has focused on the analysis of trends in the macro pharmaceutical field and the risk management of pharmaceutical enterprise mergers and acquisitions projects.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025