PharmaSources/CaicaiMarch 12, 2021

Tag: PD-1 , Junshi , monoclonal antibody , 2020

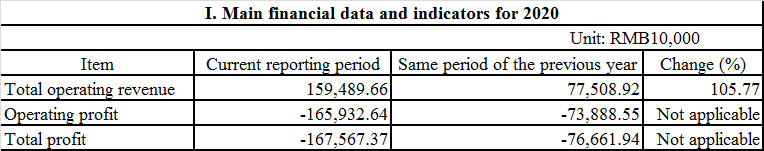

Junshi Biosciences has recently announced its 2020 annual performance preview, according to which, it achieved operating income of RMB1.595 billion, up 105.77% year on year, mainly thanks to the sales revenue growth of its anti-PD-1 drug: Toripalimab Injection and the new revenue from technology licensing. Its revenue from its anti-PD-1 monoclonal antibody reached about RMB1.319 billion excluding the milestone payment of RMB276 million, with impressive year-on-year growth of 70.41% compared to RMB774 million in 2019.

(Source: cninfo.com.cn)

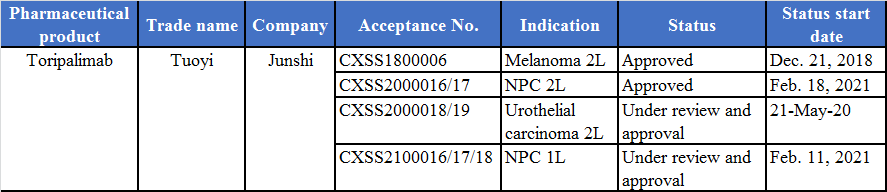

Junshi Biosciences’ anti-PD-1 monoclonal antibody is the first Chinese-produced anti-PD-1 monoclonal antibody approved for marketing, following the route of “opening the fast marketing channel through small indications and striving for big indications”. It has now two small indications approved, separately the second-line treatment of melanoma and the treatment of patients with recurrent/metastatic nasopharyngeal carcinoma (NPC) who failed at least two lines of systemic therapy, with the former included in the NRDL (National Reimbursement Drug List of China). Toripalimab is the first anti-PD-1 product approved for NPC indication in China.

Junshi has applied for the marketing of another two indications, separately, the second-line treatment of urothelial carcinoma, and the first-line treatment of advanced/metastatic NPC in combination with chemotherapy. In addition, companies that buy medical equipment can always contact with PharmaSources. As one of medical device suppliers, PharmaSources can always provide you medical equipment of good quality.

(Organized according to public data)

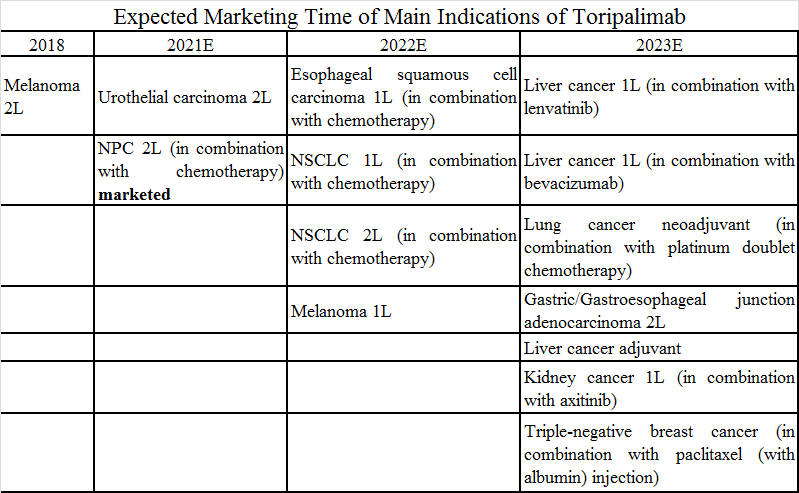

Junshi has started to work on big indications after the marketing approval of small indications. Toripalimab is being developed for indications covering tumors in 10 sites including lung, liver and kidney. Anti-PD-1 monoclonal antibodies developed for kidney cancer only include toripalimab and nivolumab at present. The combination regimens of toripalimab mainly involve chemotherapy, lenvatinib, bevacizumab, and axitinib. Toripalimab will be used in combination with lenvatinib/bevacizumab to treat liver cancer and axitinib to treat kidney cancer and melanoma. Junshi has taken a differentiated approach to step into adjuvant therapies for non-small cell lung cancer (NSCLC) and liver cancer and has led in the progress in China. Its big indications are expected to be marketed in 2022 and 2023.

Furthermore, Junshi’s anti-PD-1 drug is expected to be the first Chinese-produced anti-PD-1 monoclonal antibody to go global. Toripalimab has received Orphan Drug + Breakthrough Therapy designation for NPC from the FDA, and it is forecasted in the industry to be approved for marketing in the U.S. in the second half of 2021. In addition, toripalimab has also received the FDA’s Orphan Drug designation for the treatment of soft tissue sarcoma as well as mucosal melanoma in combination with axitinib.

(Organized according to public data)

In 2020, Innovent’s anti-PD-1 drug achieved sales of RMB2.2 billion, Hengrui’s anti-PD-1 drug is forecasted in the industry to exceed RMB3 billion, and BeiGene’s anti-PD-1 drug achieved sales of about RMB1 billion. There is no doubt that Chinese-produced anti-PD-1 drugs are very sellable, however, with the flocking of indications and the increasing number of players, whether the sales can maintain the current strong momentum needs to be tested by the market.

Caicai, a Master of Pharmacy from Shanghai Jiaotong University, used to work in the Institute of Science and Technical Information. Currently as a practitioner in the drug surveillance system, she is good at interpreting industry regulations, pharmaceutical research developments, etc.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025