PharmaSources/CaicaiMarch 04, 2021

Tag: Bevacizumab , sales , Qilu

According to industry news, Qilu Pharmaceutical achieved sales of bevacizumab (trade name: Ankeda) of about RMB1.8 billion in 2020. This figure is very staggering and this drug can be called a leading biosimilar as the sales of Roche’s original drug bevacizumab (trade name: Avastin) in China are estimated to exceed RMB3 billion in 2019, and Qilu’s bevacizumab has a lower price.

Sales of the original drug exceeding RMB3 billion in China

Bevacizumab is a humanized IgG1 monoclonal antibody prepared using recombinant DNA technology, which inhibits the binding of human vascular endothelial growth factor (VEGF) to its receptor by binding to VEGF, to block the angiogenic signaling pathway and inhibit tumor cell growth. Bevacizumab, with a unique mechanism of action, can be combined with chemotherapeutics to improve efficacy and can also be used in combination with various molecular targeted drugs and biological immune drugs.

Developed by Roche, bevacizumab was first approved by the FDA in 2004, approved in Europe in 2005, marketed in China in 2010 for the treatment of metastatic colorectal cancer under the trade name Avastin, and approved by the NMPA in 2015 for the treatment of non-small cell lung cancer (NSCLC). It has currently been approved for several solid tumor indications, including colorectal cancer, NSCLC, glioblastoma, renal cell carcinoma, cervical cancer, ovarian cancer, fallopian tube cancer, and peritoneal cancer.

This drug, one of Roche’s three major monoclonal antibodies, has dominated the sales list for years. In 2019, it achieved global sales of USD7.49 billion and sales of about RMB1.5 billion in PDB sample hospitals in China with actual sales in China estimated to exceed RMB3 billion. Avastin became off-patent in China in 2018.

Two biosimilars marketed

Two bevacizumab biosimilars have so far been marketed.

The bevacizumab biosimilar of Qilu Pharmaceutical was approved for marketing in Dec. 2019 under the trade name Ankeda, for the treatment of patients with advanced, metastatic or recurrent NSCLC and metastatic colorectal cancer, and it became the first bevacizumab biosimilar approved for marketing in China.

Innovent’s bevacizumab biosimilar for injection was approved for marketing in June 2020 under the trade name BYVASDA, and it became the second bevacizumab biosimilar approved for marketing in China.

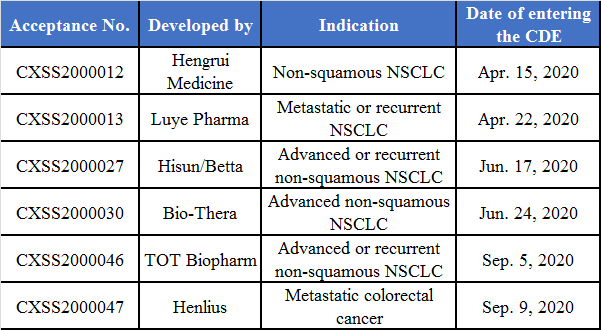

In addition, six other companies have submitted marketing applications. Based on the date of entering the CDE, Hengrui and Luye are the earliest, both of which submitted applications in Apr. 2020 and are currently submitting supplementary data; Hisun/Betta and Bio-Thera submitted applications in June 2020; TOT Biopharm and Henlius submitted applications successively in Sep. 2020 under the new biologics registration class. There are several pharmaceutical companies in phase III clinical trials.

(Source: NMPA website)

Fierce price war

Three companies currently market bevacizumab in the Chinese market, namely Roche, Qilu, and Innovent. The marketing of biosimilars will bring about a price war. Many health care products suppliers also want to get into the market.

After the NRDL (National Reimbursement Drug List of China) negotiations in 2017, the price of Roche’s original drug dropped from RMB5,176/100mg to RMB1,998/100 mg, after which the price slowly declined to RMB1,934/100mg in 2018 and 2019 and was adjusted to RMB1,500/100mg in response to the price reduction by Qilu. The drug was successfully negotiated to enter the NRDL again in 2020, however, the price is currently unknown.

Qilu’s bevacizumab biosimilar was priced at RMB1,266/100mg after marketing and then slowly declines to the current price of RMB1,198/100mg. After marketing, the price of Innovent’s bevacizumab followed Qilu’s, being RMB1,188/bottle displayed on a website in Shaanxi Province in July 2020. Biosimilars are basically priced at 80% of the price of the original drug.

With the prices of the original drug and biosimilars getting closer, the price fight will become increasingly intense in the future.

Going overseas

With good sales in China, Chinese-produced bevacizumab is also starting to go overseas. Innovent and Bio-Thera are the leaders.

Bio-Thera signed an agreement with BeiGene in Aug. 2020 to license the intellectual property related to BAT1706 and its product rights and interests in China to BeiGene for a total upfront payment and milestones of up to USD165 million. Bio-Thera received the upfront payment of USD20 million (equivalent to RMB136 million) made by BeiGene in October of the same year.

In Jan. 2021, Bio-Thera announced that the marketing application for its bevacizumab biosimilar (code: BAT1706) was accepted by the FDA.

In Jan. 2020, Innovent licensed commercial rights for BYVASDA to Coherus BioSciences in the U.S. and Canada. According to the terms of the agreement, Coherus will pay up to USD45 million for upfront and milestone payments. In addition, Coherus will also pay a double-digit percent of royalty payments to Innovent.

In Jan. 2021, Innovent reached a collaboration agreement on BYVASDA with another overseas company, Etana from Indonesia, to grant Etana an exclusive license for BYVASDA in Indonesia. Under the collaboration, Innovent will receive milestones for development and commercialization as well as double-digit royalties on net sales. The specific financial terms have not yet been disclosed.

Big market potential

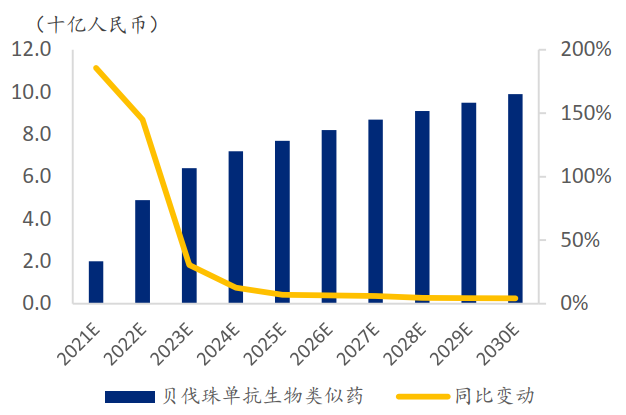

According to the forest of Frost & Sullivan, the market size of bevacizumab biosimilars in China is about RMB6.4 billion in 2023 and will reach RMB9.9 billion in 2030, with the CAGR of 2019E-2023E and 2023E-2030E being 344% and 6%, respectively.

(Source: Frost &Sullivan, SPDB International)

Caicai, a Master of Pharmacy from Shanghai Jiaotong University, used to work in the Institute of Science and Technical Information. Currently as a practitioner in the drug surveillance system, she is good at interpreting industry regulations, pharmaceutical research developments, etc.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025