PharmaSources/CaicaiDecember 24, 2020

Tag: oncology drugs , best-selling , 2019

Information on the top ten best-selling oncology drugs in China and the U.S. in 2019 has recently been released by a related consulting agency of the industry.

The difference between China and the U.S. was big from the perspective of the drug type. In 2019, the top ten best-selling oncology drugs in the U.S. were all innovative drugs, while, 4 were traditional chemotherapeutics among the top ten best-selling oncology drugs in China, indirectly showing that there is huge room for upgrading the drugs and there will be more innovative drugs to replace traditional chemotherapeutics on the list in the future.

Overseas pharmaceutical giants “crushed” Chinese pharmaceutical enterprises from the perspective of innovation ability. The pharmaceutical enterprises of the top ten best-selling oncology drugs in the U.S. were all overseas pharmaceutical giants like MSD, Roche, BMS, AbbVie, and Pfizer, and likewise, most of the top ten best-selling oncology drugs in China were produced by those giants, with anlotinib being the only Chinese drug on the list.

From the perspective of the time of marketing, it took an average of 5 years late for the top ten best-selling oncology drugs in U.S. in 2019 to enter the Chinese market; it took more than 5 years for lenalidomide, denosumab, and bevacizumab thereamong to enter China after beingmarketed in the U.S.; furthermore, the blockbuster drug pomalidomide for treating multiple myeloma (MM) has not entered China.

From the perspective of the cancer type, no drug among the top ten best-selling oncology drugs in the U.S. or China was only approved for one indication, i.e., all of them were approved for many indications, for example, both pembrolizumab and nivolumab, the two hottest anti-PD-1 monoclonal antibodies in recent five years, have more than ten indications, and anlotinib, the only Chinese drug on the liste, also has multiple indications including the approved non-small cell lung cancer (NSCLC), small cell lung cancer (SCLC) and soft tissue sarcoma, plus thatthe thyroid cancer indication is in development, etc. This shows that a multiple-indication layout is a right way for an oncology drug to sell well.

Top Ten Best-Selling Oncology Drugs in the U.S. in 2019

(Source: Forward Industry Research Institute; statistics according to the pharmaceutical generic names; pomalidomide still not marketed in China)

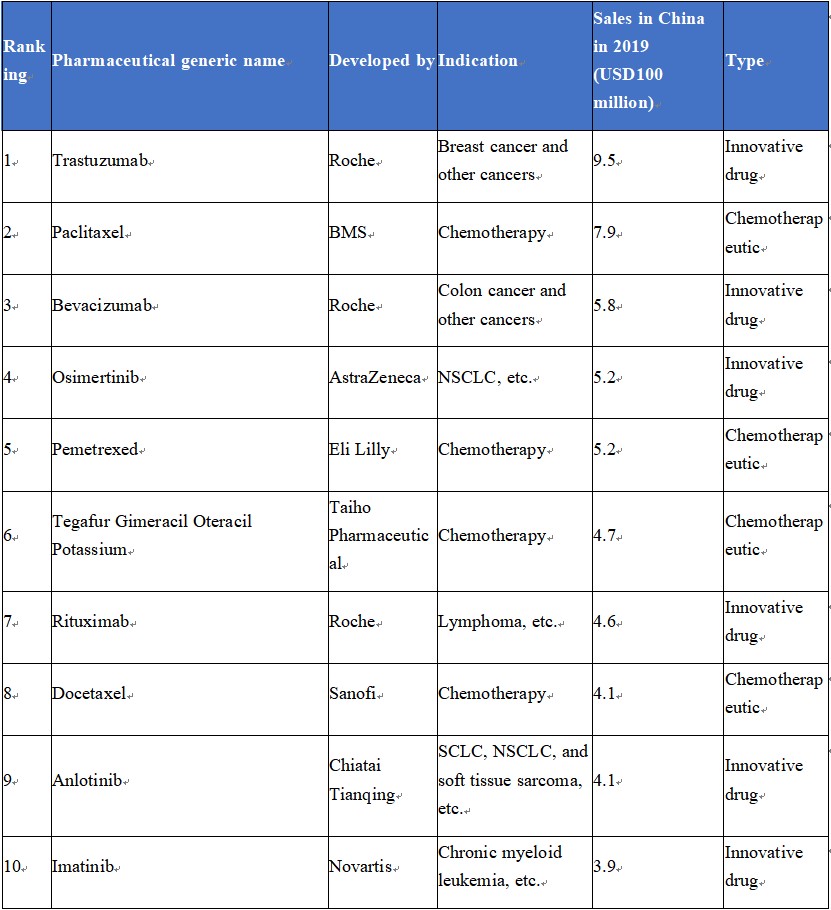

Top Ten Best-Selling Oncology Drugs in China in 2019

(Source: Forward Industry Research Institute; statistics according to the pharmaceutical generic names)

According to the data of Frost & Sullivan, the global drug market is expected to have a CAGR of about 5% from 2019 to 2023 to reach about USD1.6 trillion in 2023; the global oncology drug market is expected to have a CAGR of about 11% to reach USD250 billion in 2023, accounting for 16% of the global drug market, with growth significantly higher than that of the global drug market.

The growth of the Chinese market will be even faster than that of the fast-growing global oncology drug market. The medical care supplies market in China is expected to have a CAGR of about 7% from 2019 to 2023 to reach USD322 billion in 2023; the oncology drug market of China is expected to have a CAGR of 14% to reach USD45 billion in 2023, accounting for 14% of the drug market in China, significantly higher than the growth of the global oncology drug market.

The oncology drug market of China may further grow in the future mainly for three reasons:

1. Demands for oncology drugs are growing and the market size is expanding in China. According to the statistics of the National Cancer Center of China, the incidence of tumors in China was 235.23/100,000 persons in 2010 and 285.83/100,000 persons in 2015, with a CAGR in the five years reaching 3.97%, and the CAGR of new patients with malignant tumors is high in China.

Furthermore, the five-year survival of Chinese cancer patients was 37.20% and that of American patients was 67% in 2015. There is big room for the improvement of the five-year survival of Chinese cancer patients. The number of tumor patients who require drugs in China is projected to maintain growth in the future.

2. The penetration of immunotherapies and targeted therapies that have better effects will increase because the treatment method for malignant tumors is mainly chemotherapy in China at present. Furthermore, the popularization of immunotherapies and targeted therapies is expected to prolong tumor patients’ survival, therefore, the demand for stock drugs may expand.

3. Innovative oncology drugs are encouraged by the related policy to be involved in the NRDL (National Reimbursement Drug List of China) negotiation, therefore, the accessibility of innovative oncology drugs is expected to greatly increase in the future.

To sum up, the top ten best-selling oncology drugs in China may upgrade in the future, more and more innovative drugs will be on the list, and the list in China will be more and more aligned with that of the U.S.

Caicai, a Master of Pharmacy from Shanghai Jiaotong University, used to work in the Institute of Science and Technical Information. Currently as a practitioner in the drug surveillance system, she is good at interpreting industry regulations, pharmaceutical research developments, etc.

-----------------------------------------------------------------------

Editor's Note:

To become a freelance writer of PharmaSources.com,

welcome to send your CV and sample works to us,

Email: Julia.Zhang@imsinoexpo.com.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025