PharmaSources/Zhulikou431June 24, 2020

Tag: Inhalation Formulation , Budesonide Suspension , Chinese Market

As the inhalation formulation market is developing in China, the Chinese government has gradually introduced favorable policies to offer support, for example, the medical insurance policy continues to promote the Chinese-produced pharmaceutical products to substitute imported ones, and China has also provided a series of policy support for Chinese-produced pharmaceutical product innovation and medical device domestication. As a result, Chinese pharmaceutical enterprises that develop and produce inhalation formulations are rising. Chinese enterprises represented by Chiatai Tianqing, Joincare, CF PharmTech, and Hengrui Medicine, etc. are actively developing formulation varieties and compound formulation varieties such as budesonide, salmeterol and fluticasone, and tiotropium bromide; wherein, the first generics of many inhalation products have been approved, such as Joincare’s Compound Ipratropium Bromide Solution for Inhalation, and Chiatai Tianqing’s Budesonide Suspension for Inhalation. As Chinese-produced generic varieties are successively marketed, the share of respiratory system inhalation formulations of Chinese enterprises will continue to increase in the future, to gradually break the domination of imported pharmaceutical products.

Layout of Chinese enterprises

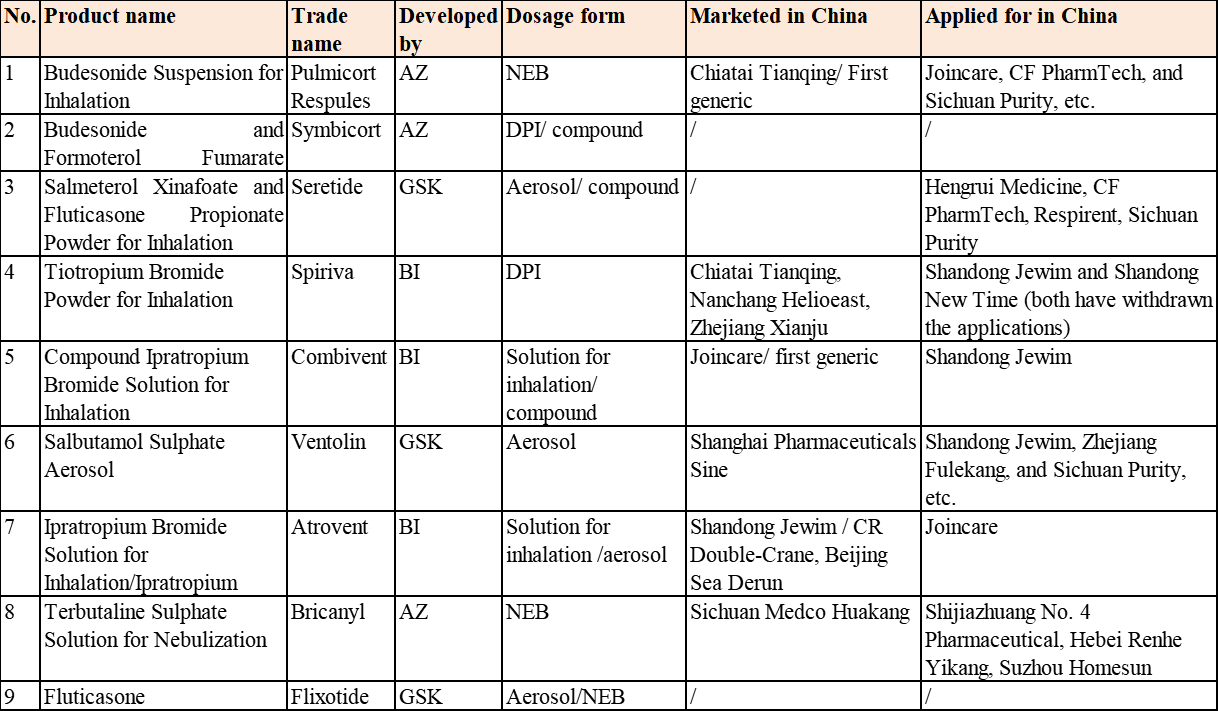

Inhalation formulations in China are mainly single formulations and nebulizer solutions (NEBs) (such as Budesonide Suspension for Inhalation), while compound formulations and aerosols/dry powder inhalers (DPIs) are used far more than NEBs in overseas markets. Take the respiratory system drugs, for instance, products commonly used in the current inhalation formulation market of China include Budesonide Suspension for Inhalation, Budesonide and Formoterol Fumarate Powder for Inhalation, Salmeterol Xinafoate and Fluticasone Propionate Powder for Inhalation (Seretide), Tiotropium Bromide Powder for Inhalation, Terbutaline Sulphate Solution for Nebulization, Salbutamol Sulphate Aerosol, Ipratropium Bromide Solution for Inhalation, Compound Ipratropium Bromide Solution for Inhalation, betamethasone, and fluticasone, etc. (see Table 1 for the details)

Table 1 Common Inhalation Formulations for Respiratory System and Registration Situation in China

Most of the inhalation formulations approved in China years ago were applied for registration according to the old Class 6 registration. Approved for production, they still need to go through again the generic drug consistency evaluations or confirmatory clinical trials as required by the latest policy. Inhalation formulations produced by Chinese enterprises have rapidly risen in the market in recent one year, with multiple first generics approved for marketing, for example, the first generic “Compound Ipratropium Bromide Solution for Inhalation” of Joincare was marketed on Apr. 9, 2019, which started a new pattern of the Chinese inhalation formulation market; it is the first inhalation formulation approved according to the new Class 4 registration, the second inhalation formulation passing the generic drug consistency evaluation, and the first drug passing the generic drug consistency evaluation among all respiratory inhalation formulations in China. Following this, there has been continuous good news of Chinese enterprises, for example, Joincare’s Levosalbutamol Hydrochloride Nebuliser Solution was approved for marketing on Sep. 29, 2019; Hebei Renhe Yikang’s Salbutamol Sulfate Solution for Inhalation was approved for marketing on Feb. 5, 2020; Budesonide Suspension for Inhalation, the first generic of the original drug with the biggest sales in the respiratory system field in China, was approved for Chiatai Tianqing on Feb. 25, 2020.

From the perspective of the grasped information on the marketed varieties and R&D layout, more than ten Chinese enterprises are actively developing inhalation formulations, including Joincare, Hengrui Medicine, Chiatai Tianqing, CF PharmTech, Shandong Jewim, Zhejiang Xianju, Hebei Renhe Yikang, Lunan Better, Shanghai Pharmaceuticals Sine, CR Double-Crane, Beijing Sea Derun, Nanchang Helioeast, Respirent, Sichuan Purity, and Sichuan Medco Huakang, etc.; wherein, Chiatai Tianqing, Joincare, Hengrui Medicine, and CF PharmTech are leading among those enterprises. Key pharmaceutical enterprises of the above will be introduced below.

Chiatai Tianqing

As the core subsidiary of Sino Biopharmaceutical, Chiatai Tianqing is the Chinese pharmaceutical enterprise with the most comprehensive layout in the respiratory inhalation formulation field; it has rich R&D pipelines and fast R&D progress, with main respiratory drugs including Tiotropium Bromide Powder for Inhalation, and Formoterol Fumarate Powder for Inhalation, etc.; and its first generic of the big variety: Budesonide Suspension for Inhalation has been approved for marketing in Feb. 2020. As a result, respiratory inhalation formulations are expected to become important incremental business of Chiatai Tianqing in the next years.

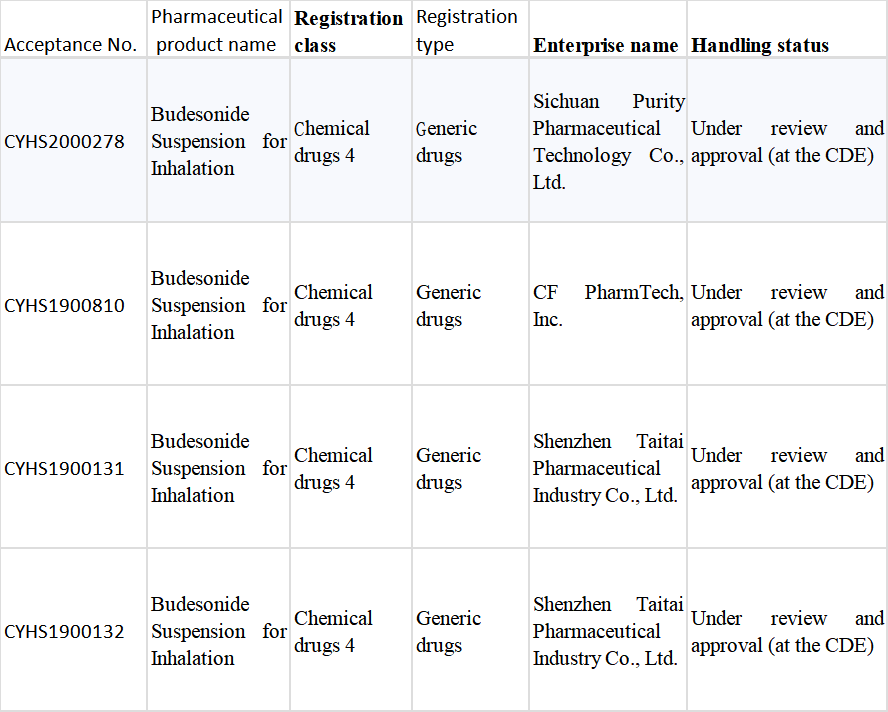

As the biggest inhalation formulation variety in China, the original drug: Budesonide Suspension for Inhalation had sales of more than RMB6 billion in China in 2019 and was an exclusive product of AstraZeneca (AZ) until Chiatai Tianqing took the lead in breaking the situation. With the marketing of the first Chinese-produced generic of this “super” big variety, the pattern of the original drug’s market monopoly for up to 20 years will be broken, and Chiatai Tianqing will become the new navigator of this “blue ocean”. Besides the approval for marketing of Chiatai Tianqing’s “Tianqing Shuchang”, Joincare’s Taitai Pharmaceutical Industry, CF PharmTech, and Sichuan Purity have all applied for the production of the generic drug (Table 2). Four Chinese manufacturers are expected to compete for the main market with AZ in the future.

Table 2 Registration Situation of Budesonide Suspension for Inhalation in China

Joincare

As an enterprise that has the potential of leading in respiratory inhalation formulations in China, Joincare has delved into and been focused on the layout in this field since 2013 and now has possessed strong technical R&D strength. Its Shulintan® (Compound Ipratropium Bromide Solution for Inhalation) and Lishutong® (Levosalbutamol Hydrochloride Nebuliser Solution) approved for marketing in 2019 opened a new chapter of generic drugs of inhalation formulations in China. Wherein, Shulintan® is the first generic of Boehringer Ingelheim (BI)’s original drug: Compound Ipratropium Bromide Solution for Inhalation (Combivent), while Lishutong® (Levosalbutamol Hydrochloride Nebuliser Solution) is the first NEB registered and approved according to the new registration Class 3 in China and the first levosalbutamol solution for inhalation marketed in China. According to the annual report of the company in 2019, its Compound Ipratropium Bromide Solution for Inhalation participated in the tender and online procurement of 21 provinces and municipalities, and Levosalbutamol Hydrochloride Nebuliser Solution participated in the tender and online procurement of 14 provinces and municipalities by the end of 2019.

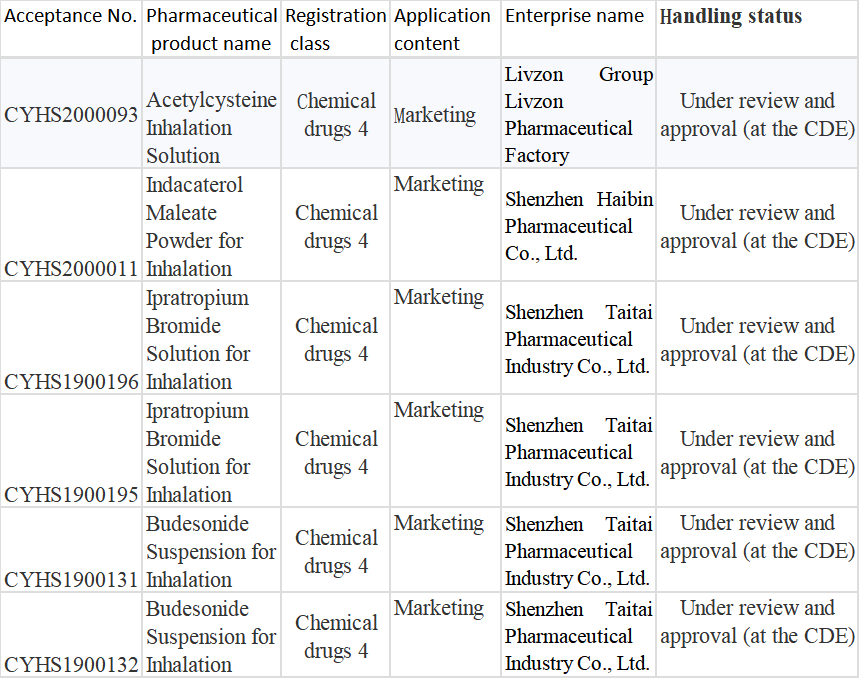

The respiratory system field is the R&D field Joincare focuses on. Under it, Shenzhen Taitai Pharmaceutical Industry, Shenzhen Haibin Pharmaceutical, and Livzon Pharmaceutical Factory have all got involved in inhalation formulations, with over 20 products in development. In addition to the 2 approved for production, those being applied for marketing include Acetylcysteine Inhalation Solution, Indacaterol Maleate Powder for Inhalation, Ipratropium Bromide Solution for Inhalation, and Budesonide Suspension for Inhalation; wherein, the company is expected to receive marketing approval for the generic drug of the original drug: Budesonide Suspension for Inhalation, a big variety with 2019 sales of more than RMB6 billion, by the middle of this year, which will be something to watch of the company.

Table 3 Registration Situation of Inhalation Formulations of Joincare

Hengrui Medicine

Hengrui Medicine is a pharmaceutical and healthcare enterprise engaging in pharmaceutical innovation and high-quality pharmaceutical R&D, production and promotion. Founded in 1970, it leads the Chinese market in the market shares of oncology drugs, surgical anesthesia drugs, specialized infusions, and contrast agents. A part of the company’s inhalation formulations are surgical anesthesia drugs, for example, its Sevoflurane Inhalation received an ANDA number of the U.S. FDA in Nov. 2015; its Desflurane, Liquid for Inhalation received an ANDA number of the U.S. FDA in Feb. 2018, the product passed the generic drug consistency evaluation in the same year, with the production approval issued by the CFDA for “Desflurane, Liquid for Inhalation”, and the product is also the first inhalation formulation passing the generic drug consistency evaluation in China.

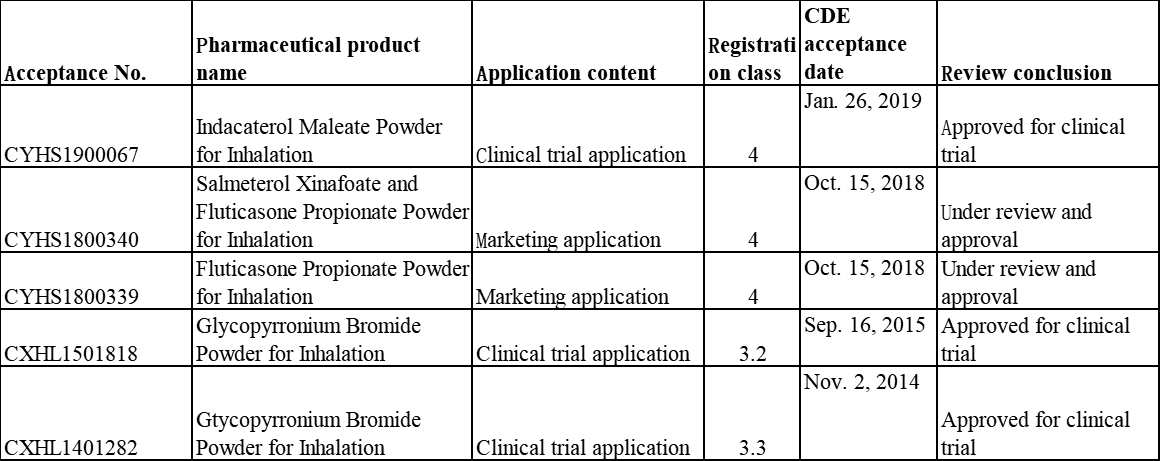

Furthermore, Hengrui Medicine has a rich inhalation formulation product pipeline. According to the inquiry results from Insight database, its Indacaterol Maleate Powder for Inhalation, Indacaterol Maleate and Glycopyrronium Bromide Powder for Inhalation and Gtycopyrronium Bromide Powder for Inhalation have been approved for clinical trials, and its Salmeterol Xinafoate and Fluticasone Propionate Powder for Inhalation has been applied for marketing and is now under review and approval.

Table 4 Registration Situation of Inhalation Formulations of Hengrui Medicine

CF PharmTech

Founded in 2007, CF PharmTech is a comprehensive pharmaceutical enterprise committed to providing global patients with high-quality respiratory system drugs. Since founded, the company has been focused on the development of therapeutic drugs for global respiratory diseases and has now established an advanced inhalation formulation R&D base as well as production facilities oriented for global high-end markets. Its product lines in development cover a full range of respiratory system products, involving therapeutic fields with large clinical demands such as asthma, COPD, allergic rhinitis, etc. The company has an R&D and production platform for the four major inhalation formulations: metered-dose inhaler (MDI), dry powder inhaler (DPI), nebulizer, and nasal spray and aims to become a leading enterprise in the drug R&D and production of the field.

The company has more than 20 programs in development that have been applied for registration in the Chinese market and overseas markets including the U.S. and Europe, etc., and those programs involve several blockbuster drugs for respiratory diseases.

CF PharmTech successfully completed Series E funding of RMB630 million in Jan. 2020, with a total of 5 series completed so far and the investment institutions including well-known CCB International, SDIC, GTJA, CMB International, and GP Capital, etc.

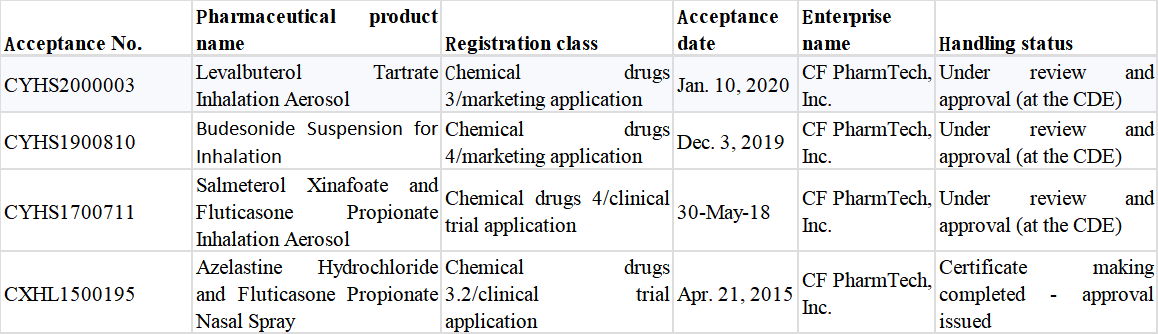

Multiple products of CF PharmTech have entered the in vivo bioequivalence studies; wherein, Budesonide Suspension for Inhalation and Levalbuterol Tartrate Inhalation Aerosol have been applied for marketing and are under review and approval.

Table 5 Registration Situation of Inhalation Formulations of CF PharmTech

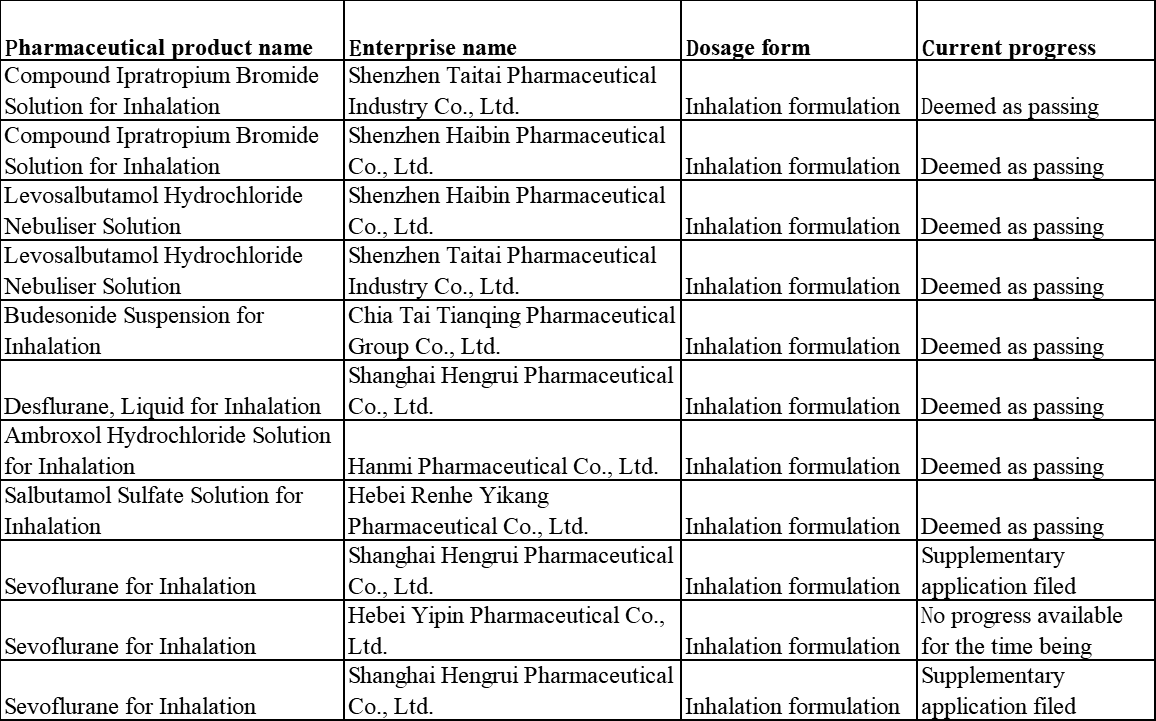

Condition of the generic drug consistency evaluation of related Chinese products

According to information queried from the DXY Insight database, the number of product varieties that have passed the generic drug consistency evaluation was 274 by May 28, including only 8 inhalation formulations (all deemed as passing the evaluation).

Table 6 Statistics of the Situation of Inhalation Formulations Passing the Consistency

Note: This article does not constitute any value judgement or investment advice.

References:

1. NMPA website

2. Insight database

3. db.yaozhi.com

4. CDE website information

5. Joincare, CF PharmTech, Chiatai Tianqing and Hengrui Medicine websites

6. Chinese Pharmacopoeia Commission website

Read More:

The Layout of Inhalation Formulations in the Chinese Market (I)

Zhulikou431, as a senior engineer, PDA member, ISPE member, ECA member, PQRI member, senior aseptic GMP expert, has deep knowledge in aseptic process development and verification, drug development and registration, CTD document writing and review, regulatory audit, international certification, international registration , quality system construction and maintenance, as well as sterile inspection, environmental monitoring and other fields. In recent years, he has focused on the analysis of trends in the macro pharmaceutical field and the risk management of pharmaceutical enterprise mergers and acquisitions projects.

-----------------------------------------------------------------------

Editor's Note:

To become a freelance writer of PharmaSources.com,

welcome to send your CV and sample works to us,

Email: Julia.Zhang@imsinoexpo.com.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025