XiaoyaowanMay 20, 2020

According to the epidemic announcement on Mar. 29, the number of confirmed cases worldwide has exceeded 650,000, with the number exceeding 10,000 in many countries in Europe, North America, and Asia. Globally, the R&D of therapeutic drugs and prophylactic vaccines still needs time, and each country can only rely on the prevention and control method of early diagnosis and early isolation.

Pharmaceutical product shortage and imbalance between supply and demand of global APIs

The global API supply industry chain has been affected since the outbreak of the COVID-19 epidemic. Countries such as India and the U.S. have experienced pharmaceutical product shortage to varying degrees; in particular, the capacity and supply of epidemic-related drugs are insufficient. The Indian government announced on Mar. 3 that the export of 26 APIs and drugs prepared therefrom, including paracetamol, etc., would be restricted and first supplied to meet the domestic demands of India due to the serious damage caused to the supply chain by the novel coronavirus; on Mar. 6, Trump required all the production of all medical protective articles and antibiotics, etc. to return to the U.S.

In the meantime, the COVID-19 epidemic has been raging in the world. To meet the anti-epidemic needs, countries and regions all over the world are urgently purchasing and reserving necessary supplies, and the demands for urgent anti-epidemic supplies including antiviral and anti-infectious APIs, etc. have increased largely.

The demands for pharmaceuticals, a special product, are relatively rigid. With interruptions in the supply chains of pharmaceutical intermediates and APIs, etc. overseas, the API supply-demand structure has become unbalanced under the global anti-epidemic background.

Global API supply pattern

According to the data of the U.S. consulting company Markets and Markets, the global API market size was about USD180 billion in 2019 and is estimated to reach USD245 billion in 2024, with a compound annual growth rate of 6.1%.

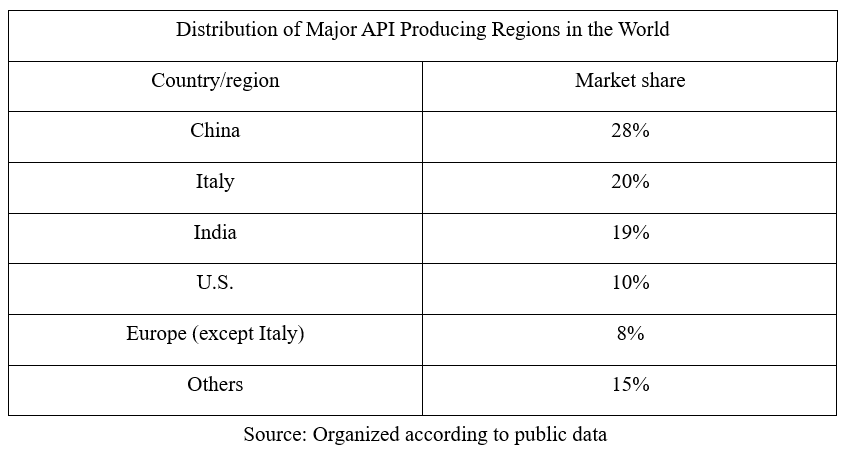

Before the epidemic, major API producing regions in the world included North America, Western Europe, and China, India and Japan in Asia; wherein, North America was based on import, most of the supply in Japan was to local formulation enterprises, while Western Europe, China and India were major export bases of APIs.

In this epidemic, Italy has become the hardest-hit country in Europe and has expanded the lockdown to the entire country on Mar. 10, directly affecting the daily supply of the related API production bases; the domestic supply is insufficient in India and the U.S. As a result, the supply of overseas APIs has been facing a challenge.

API capacity gradually recovering in China

The API industry chain in China was interrupted temporarily after the outbreak of the COVID-19 epidemic, and global related anti-epidemic drugs including antibiotics and antiviral drugs, etc. were in short supply, especially antibiotics and vitamins. The 26 APIs and drugs restricted by the Indian government for export are mainly antibiotics, vitamins, and antiviral and antipyretic and analgesic drugs of which the APIs or core intermediates are from China; Trump has required the production of anti-epidemic drugs and articles to return to the U.S., however, reestablishing production bases in Europe and U.S. is not realistic or in compliance with the commercial rule of law.

Benefiting from the effective control over the COVID-19 epidemic in China, the number of newly confirmed cases in major producing areas of APIs in China such as Zhejiang, Shandong, Jiangsu, and Hebei has been zero for days, API enterprises have started to resume work and production orderly, and the logistics system has gradually recovered.

In the medium and long term, the orders of related antibiotic and intermediate manufacturers in China will largely increase.

Importance of Chinese API industry's position becoming prominent

After years of development, the Chinese API industry has now been supported by complete upstream basic chemical raw materials and in possession of complete API varieties and categories, occupying the leading position in the markets of bulk APIs including antibiotics, vitamins, and antipyretic and analgesic APIs, etc. And China is gradually catching up with and surpassing India in characteristic APIs. Chinese API manufacturers have been improving their process, technology, cGMP quality system, and EHS capabilities, etc. after years of development and accumulation, and their product structures have continued to be optimized from the front-end intermediates to back-end finished APIs and their target markets have shifted from low-end, non-regulated markets to high-end, regulated markets to improve product value-added and enterprise profitability. China is the biggest supplier and even the world only supplier of APIs of some important drugs, such as the APIs of drugs against breast cancer and lung cancer, and the antibiotic vancomycin, and China also controls the global supply of heparin. China, an important supplier of global APIs, has not only effectively met the domestic demands for APIs but also sold them in a large number to the international market.

Register as Visitor to CPhI China 2020!

-----------------------------------------------------------------------

Editor's Note:

PharmaSources.com is a vertical B2B online trade platform serving the pharmaceutical industry,

for any copyright disputes involved in the articles,

please email: Julia.Zhang@imsinoexpo.com to motify or remove the content.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025