PharmaSources/XiaoyaowanOctober 24, 2019

Tag: Monoclonal Antibodies , toripalimab , Sintilimab

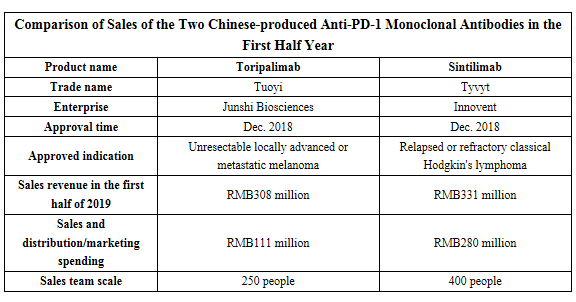

Junshi Biosciences's toripalimab and Innovent's sintilimab were successively approved in Dec. 2018, to become the first Chinese-produced anti-PD-1 monoclonal antibodies marketed. Innovent and Junshi Biosciences have recently released their 2019 semiannual reports in succession, according to which, sales of toripalimab and sintilimab both exceeded RMB300 million, which are noteworthy.

Source: Semiannual reports of the companies, and public data

Sales of Innovent’s sintilimab reached RMB331 million in the first half year

According to the report of Innovent on Aug. 28, the company achieved operating income of RMB440 million in the first half of 2019. Innovent’s first commercialized drug product: Sintilimab Injection was commenced sales on Mar. 9, 2019 with the trade name of Tyvyt; its sales income reached RMB331 million in the first half year, accounting for about 79% of the total income of the company. The sales team of Innovent has 400 people, and the selling and marketing expenses of Tyvyt reached about RMB280 million in the first half year.

R&D expenses of Innovent reached RMB671 million in the first half of 2019. Its R&D pipeline reserves 21 innovative drugs in the fields of oncology, metabolic diseases and other therapeutic areas, wherein, the marketing applications for the 3 biosimilars (IBI-301/IBI-303/IBI-305) have been successively accepted by the NMPA and included in the priority review, and its 16 drugs in development have entered the clinical development stages.

Sales of Junshi Biosciences’ toripalimab reached RMB308 million in the first half year

According to the report released by Junshi Biosciences on Aug. 29, the company achieved operating income of RMB309 million in the first half of 2019. Toripalimab has been for sale in China since the end of Feb. 2019 and been established with a sales network that covers major large and medium-sized cities in China; its total income reached RMB308 million in the first half year, making it the main source of income of Junshi Biosciences at present. The sales team of Junshi Biosciences has 250 people, and the selling and marketing expenses of Tuoyi reached about RMB111 million in the first half year.

R&D expenses of Junshi Biosciences reached RMB369 million in the first half of 2019. Its R&D pipeline reserves 19 pharmaceutical products in development, including 17 innovative drugs and 2 biosimilar varieties, covering fields of pharmaceutical products for oncology, metabolic diseases, inflammatory or autoimmune diseases, and neurogenic diseases.

Production capacity situations

Innovent’s Phase I sintilimab production line includes three 1,000L bioreactors, and in Phase II production line, Innovent’s new six 3,000L stainless steel bioreactors have completed GMP commissioning and validation, and the total production capacity will increase to 21,000L in the future.

Junshi Biosciences has the capacity to produce 1,500L monoclonal antibodies at present. In the first half of 2019, Junshi Suzhou Zhonghe production base completed the technical transformation and upgrading to increase three 500L fermenters to expand the production capacity to 3,000L. The increased production capacity has been filed with the government medical product regulator and will be put into commercial production.

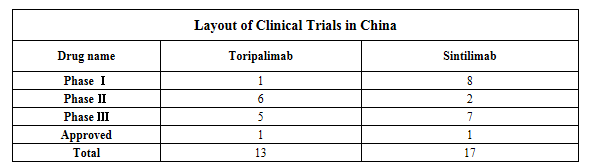

Clinical layout of indications in development in China

From the perspective of the clinical layout, Innovent’s sintilimab has been registered 17 clinical trials in China, including 7 Phase III clinical trials. Those clinical trials focus on indications of sintilimab for lung cancer treatment: the clinical trials using it to treat non-small cell lung cancer (NSCLC) as first-line and second-line therapies are in Phase III and the clinical trial using it in combination with bevacizumab/chemotherapy regimen to treat EGFR-positive NSCLC as a second-line therapy is also in Phase III. Drug combination therapeutic regimens of sintilimab are based on chemotherapeutics and use fewer targeted drugs.

Source: Drug Clinical Trial Registration and Information Publicity Platform

Junshi Biosciences’ toripalimab has been registered 13 clinical trials in China, including 5 Phase III clinical trials. Junshi Biosciences has given priority to the development of toripalimab’s indications for melanoma and nasopharyngeal cancer and also laid out indications not involved by Hengrui and Innovent such as triple negative breast cancer and neuroendocrine tumor. Its clinical development pattern has avoided the product’s fierce competition with similar products in China and is expected to have the first-mover advantage in the future upon the early layout in the niche market.

The variety with "dark horse" potential in the anti-PD-1 monoclonal antibody market in China

Hengrui Medicine announced the interim data of the Phase III study of treating NSCLC with camrelizumab in combination with carboplatin and pemetrexed as first-line therapy (name: NCT03134872) at the World Conference on Lung Cancer on Aug. 22. According to the results announced, the clinical effects of camrelizumab are comparable with MSD’s Keytruda to reach the international level. It is expected to become the first Chinese-produced anti-PD-1 monoclonal antibody approved for lung cancer treatment.

Drugs taking the lead in being approved the lung cancer indication have achieved rapid growth of sales, as seen from the competition pattern of Keytruda and Opdivo, the top 2 products in global anti-PD-1 monoclonal antibody sales. Take MSD’s Keytruda for example, Keytruda’s sales revenue reached USD4.9 billion in the first half of 2019, growing by nearly 57% than the same period last year; its sales revenue from the lung cancer indication exceeded USD3.1 billion in the U.S. market, which contributed to 65% of the total sales.

Hengrui’s camrelizumab is the third Chinese-produced anti-PD-1 monoclonal antibody approved for marketing. Its first indication approved is the classical Hodgkin's lymphoma, and its second indication: advanced hepatocellular carcinoma has been applied for. Camrelizumab has started to be marketed in July and it is expected to become the first Chinese-produced anti-PD-1 monoclonal antibody as first-line therapy for lung cancer if its relevant Phase III clinical trial is completed smoothly in the future.

Camrelizumab, a latecomer Chinese-produced anti-PD-1 monoclonal antibody, has the potential to surpass the formers to become a dark horse in the area of Chinese-produced anti-PD-1 monoclonal antibodies and rewrite the sales record of Chinese-produced products, based on its advantageous indications and upon the strong marketing capacity of Hengrui Medicine.

Xiaoyaowan, a pharmaceutical industry practitioner, a word carrier in the We-media era focusing on changes of the pharma industry.

-----------------------------------------------------------------------

Editor's Note:

To become a freelance writer of En-CPhI.CN,

welcome to send your CV and sample works to us,

Email: Julia.Zhang@ubmsinoexpo.com.

Contact Us

Tel: (+86) 400 610 1188

WhatsApp/Telegram/Wechat: +86 13621645194

Follow Us:

Pharma Sources Insight January 2025

Pharma Sources Insight January 2025